- Article, India

- March 28, 2023

India is a great place to hire remote workers who speak English. But, because of complicated employment laws in India, companies need to know about employee benefits to follow the rules and stay competitive. This guide explains Indian employee benefits to help companies grow their business in India.

What are the Different Kinds of Employee Benefits Available in India?

In India, there are two types of employee benefits: statutory and supplemental. Statutory benefits are compulsory, and supplemental benefits are offered to attract and retain talent. The government enforces statutory benefits such as state insurance, gratuity payments, and provident funds. Supplemental benefits like personalized health insurance and disability coverage are additional.

Here are some detailed Statutory and Supplemental benefits.

- Mandatory Employee Statutory Benefits in India

- Understanding Social Security Benefits

- Employees’ State Insurance (ESI) Medical Insurance Benefits

- Employees’ Provident Fund (EPF) Retirement Fund Benefits

- Employees’ Pension Scheme (EPS) - Eligibility and Benefits

- Employees’ Deposit Linked Insurance Scheme (EDLI)

- Exploring the Benefits of Gratuity

- Supplemental Benefits for Employees in India

- Supplemental Medical Coverage for Employees Benefits

- Supplemental Life and Accidental Death & Dismemberment (AD&D) Coverage Benefits

- Providing Compliant and Competitive Employee Benefits Packages in India

Mandatory Employee Statutory Benefits in India

Statutory benefits are mandatory, legally required benefits that employers must provide to employees, such as medical insurance and paid time off. Employers can also offer supplemental benefits to enhance existing benefits, and fringe benefits to provide additional compensation. These benefits help attract and retain top talent.

Understanding Social Security Benefits

Indian employment law mandates two types of social security benefits – Employees’ State Insurance (ESI) and Employees’ Provident Fund (EPF). The EPF scheme covers retirement funds, pension, and life insurance and is a mandatory savings scheme for employees, requiring contributions from both employers and employees. The scheme aims to ensure financial security for retired employees. Understanding social security benefits is crucial for both employers and employees.

Employees’ State Insurance (ESI) Medical Insurance Benefits

The Employees’ State Insurance (ESI) Act in India applies to businesses with at least 10 employees earning less than INR 21,000 per month. Employers contribute 4.75% of their employee’s wages to the ESI fund, while employees contribute 1.75% of their wages. This entitles employees to medical benefits, including hospitalization, maternity, disability, and sickness benefits, among others. The ESI Act ensures that employees have access to medical benefits and financial support during challenging times. Employers must adhere to the ESI Act and contribute to their employees’ ESI fund to comply with Indian employment law. This ensures to cover the dependent family members of the employee.

Employees’ Provident Fund (EPF) Retirement Fund Benefits

The Employees’ Provident Fund (EPF) Act was established under The Employees’ Provident Fund and Miscellaneous Provisions Act of 1952. Employees working for companies with 20 or more employees and earning less than INR 15,000 per month must contribute 12% of their wages monthly, while employers contribute their part additionally. Upon retirement, employees receive a payout from the EPF, including interest.

Employees’ Pension Scheme (EPS) - Eligibility and Benefits

The Employees’ Pension Scheme (EPS) in India collects a percentage of an employee’s income to provide a pension after the age of 58. When employers contribute 12% of the employee’s salary to the Employees’ Provident Fund (EPF), 8.33% goes to the EPS. The scheme provides pension payments for life, and in case of the member’s demise, their nominee will receive the pension. The scheme carries no investment risks for employees as the Indian government sponsors the EPS and guarantees returns.

Employees’ Deposit Linked Insurance Scheme (EDLI)

Employees’ Deposit Linked Insurance Scheme (EDLI) in India: An automatic life insurance policy offered by the EPF scheme where the registered nominee receives a lump-sum payment in the event of the insured person’s death. The scheme is funded by 0.5% of the employer’s 12% salary contribution towards EPF.

Exploring the Benefits of Gratuity

Gratuity benefits are available to employees who have worked for their employer for over five years and retire, resign, or become disabled. The gratuity payment is equivalent to 15 days of wages for every year of employment. This scheme applies to employees working in establishments with 10 or more employees, including factories, mines, and ports.

Supplemental Benefits for Employees in India

Supplemental benefits are extra perks that employers provide to enhance the medical, retirement, and insurance coverage of their workers. These benefits often extend to the employees’ families and offer a higher level of coverage than the mandatory benefits. Examples of supplemental benefits include dental and vision insurance, retirement contributions, and extended leave. With workers worldwide seeking employers who prioritize their well-being and that of their families, a robust supplemental benefits package has become essential in attracting and retaining top talent. As such, employers are increasingly offering such packages to make their companies more attractive to prospective employees and keep their current workforce satisfied.

Supplemental Medical Coverage for Employees Benefits

Supplemental Medical Coverage is a common benefit offered by employers to their management-level employees, providing additional coverage beyond their basic medical insurance plans. This type of coverage often includes maternity care, cancer treatments, and fertility treatment, and may also extend to dependents and partners.

Supplemental Life and Accidental Death & Dismemberment (AD&D) Coverage Benefits

Employers often offer supplemental life and accidental death and dismemberment (AD&D) coverage to employees as an additional benefit. This type of coverage provides employees with peace of mind, knowing that their families will be taken care of in the event of an unexpected tragedy.

Supplemental life insurance typically covers an employee’s beneficiaries in the event of their death, with the payout amount determined by the employee’s salary and chosen coverage level. AD&D coverage provides additional benefits to an employee or their beneficiaries in the event of a serious injury or death resulting from an accident.

Offering supplemental life and AD&D coverage can set a company apart from other employers in the eyes of job seekers. It shows that the company values the well-being of its employees and their families and is willing to go above and beyond to provide them with additional protection and support.

Providing Compliant and Competitive Employee Benefits Packages in India

Global companies that want to hire employees in India attract and retain top talent by offering comprehensive and compliant benefits that exceed the market standard. Still, ensuring your benefits packages are competitive and legally sound is complicated. Instead, work with an experienced global partner like IMC Group to create market-specific rewards packages on your behalf.

Our Global Benefits solution helps employers gain a competitive edge in the hiring process by offering locally competitive benefits packages that go beyond statutory requirements and ensure your talent feels valued. Plus, you gain peace of mind knowing that your benefits offerings always comply with local labor laws.

If you’re looking to attract top-tier talent in India, IMC Group is your solution.

- Article, India

- March 28, 2023

If you’re looking to hire top-notch IT talent, India should be on your list of global destinations. Many companies around the world rely on Indian talent to thrive in today’s digital era. India’s abundant pool of skilled and educated professionals in the technology industry is a significant draw for companies seeking innovative solutions.

- 1: India's Talent Pool Continues to Grow as a Prime Destination for Hiring

- 2: India: The Top Destination for Sourcing Skilled Tech Talent

- 3: Leveraging India's Cost-Effective Workforce for Your Hiring Need

- 4: How Regulatory Changes are Making the Country a More Attractive Destination for International Companies

- Hiring Talents in India with an Employer of Record EOR Services provider

1: India's Talent Pool Continues to Grow as a Prime Destination for Hiring

India is an ideal location for a talent hunt, as it boasts a significant number of highly educated and skilled workers, and millions of students join the workforce every year. This talent pool makes India a prime destination for companies looking to hire skilled workers. The Indian Government’s vision to create a technologically advanced and digitally empowered society is being reinforced by the recent New Education Policy that emphasizes the integration of technology into education. This effort includes initiatives such as high-speed internet availability, seamlessly integrated services, mobile phone and bank account enablement, and universal digital literacy, among others.

With these strategies in place, the Indian government is recognizing the nation’s potential as a global technology leader and positioning it as a top talent market for companies looking to recruit top-tier workers.

2: India: The Top Destination for Sourcing Skilled Tech Talent

The demand for skilled workers in the technology sector is increasing rapidly. As a result, businesses are turning to India, which is recognized as the top global destination for sourcing tech talent by the India Brand Equity Foundation.

Indian IT & BPM have established over 1,000 delivery facilities in approximately 80 countries, and in the next five years, 40 percent of Indian developers are expected to enhance their skills. The IT sector’s export revenue is projected to increase by eight to nine percent annually.

To support this growth, the Indian Government is investing heavily in infrastructure. Additionally, India ranked second in the 2019 Agility Emerging Markets Logistics Index, with 48.1 percent of those surveyed expecting India’s e-commerce market to grow at the same pace as, or even faster than China.

3: Leveraging India's Cost-Effective Workforce for Your Hiring Need

Compared to other regions such as Asia, Latin America, Africa, and Eastern Europe, salaries for web developers in India are lower, making it an attractive option for companies seeking to minimize their hiring costs. Despite this, a report by NASSCOM indicates that 79% of HR leaders anticipate significant challenges in keeping up with the rapidly evolving technology landscape. This underscores the importance of hiring qualified professionals who are up to date with the latest trends and technologies, and India’s pool of skilled talent can be a valuable resource in meeting this need.

4: How Regulatory Changes are Making the Country a More Attractive Destination for International Companies

In 2019, the Indian government introduced the Personal Data Protection Bill in parliament, aimed at safeguarding individuals’ personal data and preventing companies from misusing it. However, the bill also has implications for international companies that are hiring in India, as it provides a framework to protect their data as well. This legislation is critical in ensuring that businesses are able to operate in a secure environment, which is essential for companies with sensitive data such as financial information, trade secrets, and proprietary data.

The Personal Data Protection Bill establishes guidelines for collecting, processing, and storing personal data, and mandates that companies obtain consent from individuals before collecting their data. This is a crucial safeguard that ensures individuals have control over their data and how it is used. The bill also stipulates that companies must implement reasonable security practices and procedures to protect personal data from unauthorized access, modification, disclosure, or destruction.

Overall, the Personal Data Protection Bill is a positive development for international companies looking to hire in India, as it demonstrates the government’s commitment to protecting their data and creating a secure business environment.

Hiring Talents in India with an Employer of Record EOR Services provider

Looking to expand your business overseas and hire top talent, but worried about the compliance and legal complexities of doing so? Look no further than an Employer of Record (EOR) solution!

An EOR takes care of all the legal and administrative details of hiring international employees, including payroll, taxes, benefits, and HR. With a locally compliant entity in place, you can avoid the red tape involved in registering with local authorities and rest easy knowing that your business is fully compliant with all relevant laws and regulations.

With an EOR, you can focus on what you do best – growing your business and tapping into the global talent pool. Contact us today to learn more about how an EOR can help you expand your business overseas and hire the best talent, hassle-free!

- NEWSLETTER,U.A.E

- March 14, 2023

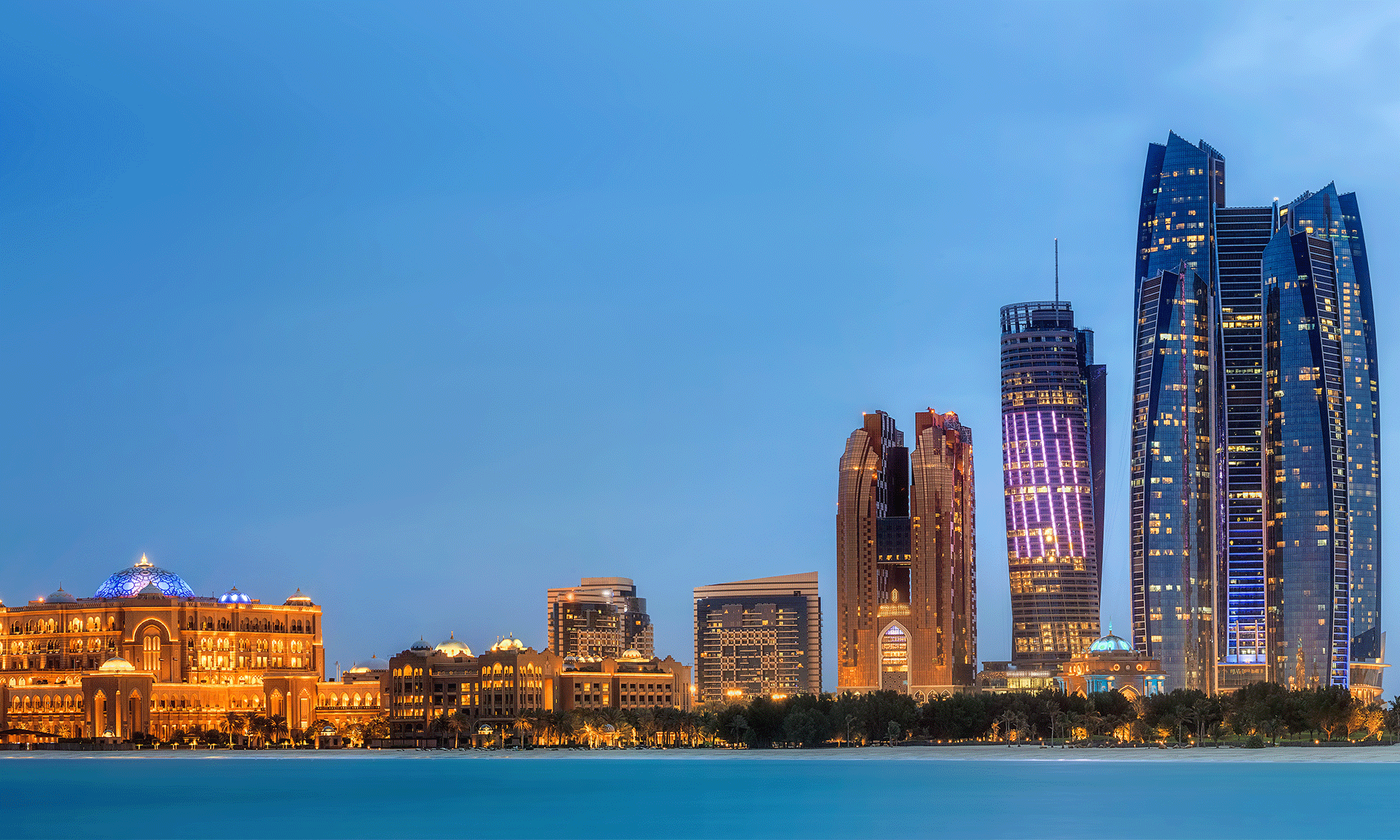

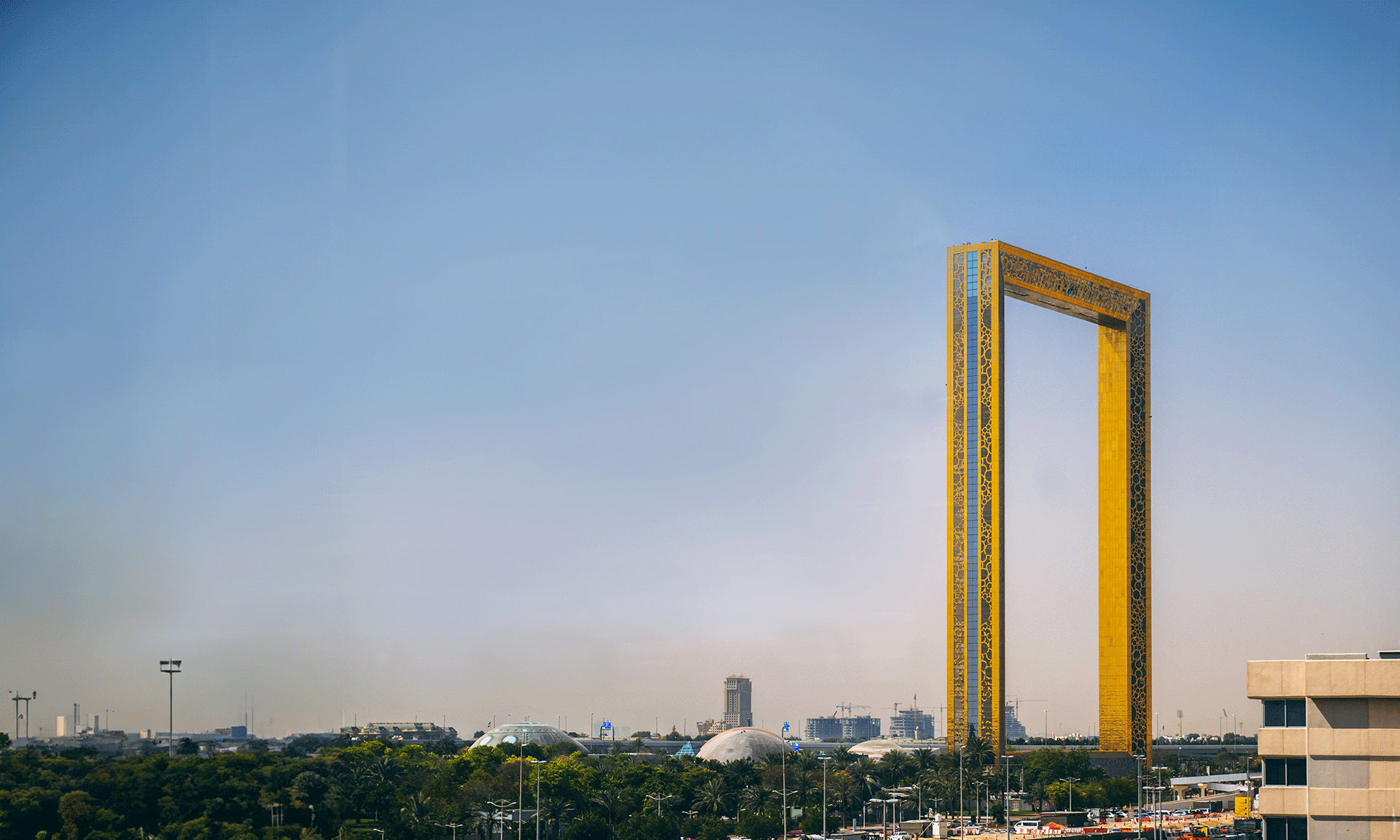

In preparation for the Dubai FinTech Summit scheduled for May 8th and 9th this year, under the patronage of His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, Deputy Ruler of Dubai, Deputy Prime Minister, Minister of Finance of the UAE, and President of the Dubai International Financial Centre, Dubai is further strengthening its global standing as a centre for FinTech and innovation.

The FinTech and innovation sector in the Middle East, Africa, and South Asia (MEASA) region is growing rapidly, and it is expected to double in market value from USD 135.9 billion in 2021 to USD 266.9 billion by 2027, according to the 2022 FinTech Report by DIFC FinTech Hive. In 2022, the investment in Dubai International Financial Center (DIFC) FC’s FinTech and innovation community surpassed USD 615 million. The number of active firms in the sector increased by 36 per cent, reaching 686. The Dubai FinTech Summit will be an ideal platform for start-ups, investors, and industry leaders to connect and tap into this opportunity as they move forward in the region and beyond.

The Summit, hosted by DIFC, the foremost international financial hub in the MEASA region, will convene 5,000 FinTech and technology experts from around the world to explore advancements and obstacles in the industry. It will also showcase all aspects affecting the future of finance, including Web 3.0, Metaverse, Blockchain, decentralised finance, regulation and policymaking, and the urgent requirement for more significant financial inclusivity. Attendees can also engage with over 100 FinTech exhibitors and participate in various panels and fireside chats.

Madinat Jumeirah in Dubai is the venue for the Dubai FinTech Summit, featuring distinguished local figures such as the UAE Minister of Economy, H.E. Abdullah Bin Touq Al Marri and H.E. Essa Kazim, Governor of DIFC. The summit’s line up of speakers comprises several notable personalities, including Bill Winters, Group Chief Executive of Standard Chartered PLC; Brad Garlinghouse, CEO of Ripple; Melissa Guzy, Co-Founder and Managing, among others; Michael Shaulov, CEO of Fireblocks, and partner at Arbor Ventures.

Dubai and DIFC are now considered global centers for innovation, recognised for their unique ecosystem and comprehensive approach to business, driving not only the future of finance but also the future economy. Currently, they are home to 60% of all FinTech companies based in the GCC. In 2021, the MENA region’s FinTech startups experienced a year-over-year funding growth of 183%, as reported by MAGNITT.

Mohammad Alblooshi, Head of DIFC Innovation Hub and FinTech Hive, highlighted the increasing impact of the FinTech sector in the region. He stated that the demand for FinTech services had grown significantly in recent years, fuelled by digital technologies and innovation across various sectors. He further emphasised that DIFC has solidified its position as the finance and innovation hub in the MEASA region by providing the most comprehensive FinTech and venture capital environments. DIFC’s vision to drive the future of finance has created attractive opportunities for start-ups, global players, and unicorns to establish a base in Dubai.

His statement continued with confidence, “The Dubai FinTech Summit, organised by DIFC, is poised to become the leading platform that captures the industry’s attention and realises our vision of positioning Dubai as the new hub for the future of FinTech and finance.”

According to Michael Shaulov, CEO of Fireblocks, a secure digital asset infrastructure company, Dubai’s accomplishments in the digital asset field in recent years have been impressive. The government’s collaborative strategy with the industry has attracted some of the most innovative and dynamic firms in the digital asset industry to the region, solidifying its position as a leading FinTech center and securing its economic future. Fireblocks is enthusiastic about participating in the Dubai FinTech Summit and discovering some of the world’s top FinTech solutions.

Luis Valdich, Managing Director at Citi Ventures, expressed his excitement about FinTech, stating that it is one of the most exciting industries in both tech and banking. The industry is being disrupted by various trends, such as digitisation, open banking, embedded finance, financial inclusion, the democratisation of investing, modernisation of the core banking stack, and the emergence of the creator and shared economies are driving economic progress globally. He looks forward to exploring these innovations further as part of the upcoming summit.

- NEWSLETTER,U.A.E

- March 14, 2023

In today’s changing global economy, Micro, Small, and Medium-scale enterprises play a vital role in driving economic growth and development. Indian MSMEs, which are often considered the backbone of the Indian economy, are now seeking to set up their businesses in Dubai beyond domestic markets. Dubai has emerged as their preferred destination for global expansion.

Due to its business-friendly operating environment, transparent taxation framework, high consumer adoption rate, low customer acquisition costs, and strategic location with access to a large customer base, Dubai has become the top choice for global expansion, attracting numerous micro, small, and medium enterprises from India.

Dubai’s stability, efficient governance, and dependability make it an ideal gateway to the Middle Eastern and North African markets (MENA), which comprise over 1 billion customers. This is a key factor motivating Indian MSMEs to expand their global presence through Dubai.

The trade links between African nations and the UAE have witnessed substantial growth over the last ten years, resulting in tremendous regional development with a vision for sustained progress. Moreover, the city has untapped potential to double its exports to African nations.

The Significance of Dubai's Strategic Location in International Trade

Being centrally located, Dubai serves as a gateway not just to the Middle East but also to Europe, Africa, and Asia, making importing and exporting through land, sea, and air more convenient.

With its long coastline and the world’s largest artificial port, Jebel Ali, Dubai has become the maritime hub of the region, providing unmatched trading opportunities.

Dr Thani bin Ahmed Al Zeyoudi, UAE Minister of State for Foreign Trade, stated at the World Green Economy Summit discussed the UAE’s plan to form Comprehensive Economic Partnership Agreements (CEPA) signed on February 18, 2022, with G7 countries.

From April to November 2022, the two countries witnessed a 27.5% growth in bilateral trade, with the trade value increasing to $57.8 billion from $45.3 billion in the corresponding period of the previous year. India’s exports to the UAE also saw a notable rise of $3.35 billion in value terms, showing a growth of 19.32% and reaching $20.8 billion from $17.45 billion during the same period.

Exploring the Future of Dubai-India Collaboration in the Digital Age

The launch of the Global India Collaborative (GIC) initiative at Dubai Expo 2020 aims to assist Indian MSMEs in discovering new markets and investment opportunities. Our businesses can only go global if we establish more connections between the Indian industry and the world.

Santosh Mangal, Global President of GIC, mentioned that this would aid in achieving the goal of making India a five trillion-dollar economy as Prime Minister Narendra Modi envisioned.

Business Opportunities for Start-ups in Dubai

Dubai’s visa offerings have emerged as a significant factor in attracting businesses to the city, with more relaxed laws and regulations than the other countries. The golden visa system provides long-term business visas. In contrast, the remote visa system offers additional opportunities for company formation in Dubai and operation in Dubai, even while working from outside the country. These visa options have made Dubai a desirable location for businesses, adding to the city’s reputation as a business-friendly destination.

Dubai’s appeal as an investment destination has been primarily driven by the visionary leadership of the Vice President and Prime Minister of the UAE and Ruler of Dubai, His Highness Sheikh Mohammed bin Rashid Al Maktoum, who envisions growth through innovation. This has attracted significant global players in industries that are driving the future of the global economy to invest in the city.

The Logistics Performance Index (LPI) by the World Bank, a global benchmarking tool that measures the effectiveness of a country’s trade logistics chain, ranks the UAE 11th globally and Ranked as the top destination in the Middle East and North Africa.

Dubai has established exclusive economic zones aimed at foreign enterprises, such as the well-known Dubai International Financial Centre (DIFC), where companies are granted complete ownership and an assurance of no corporate income tax or other levies for 50 years.

The prospects of Dubai as a global business destination

Presently, the city is a diverse cosmopolitan with a substantial Indian ex-pat community and is still enticing a skilled workforce with its worldwide standing and high salaries. Dubai is favoured by numerous businesses globally, including Indian MSMEs, who acknowledge its potential as a preferred destination to extend its global outreach.

- NEWSLETTER, U.A.E, INDIA

- March 14, 2023

Abdulnasser Jamal Alshaali, the UAE ambassador to India, informed that technical discussions between the UAE and India are underway to establish a trade arrangement with a finalized rupee-dirham exchange rate.

According to him, the technical discussion is still in progress, but they have already agreed to conduct a specific amount of trade between the UAE and India without relying on a third currency. He further added that both sides are collaborating on a remittance facility to make the transaction process more straightforward and convenient.

The fact “He added that the strategic oil reserve, which has been established and operational for quite some time, is quite beneficial and constructive, particularly considering the current state of affairs”.

Dubai, UAE is already a popular destination for Indian businesses looking to expand their operations overseas. With a business-friendly environment, world-class infrastructure, and a strategic location at the crossroads of Europe, Asia, and Africa, Dubai has become a hub for international trade and commerce. Dubai has become a popular option for Indian entrepreneurs and businesses looking to tap into the Middle Eastern market.

According to the ambassador, the UAE considers India a dependable partner in terms of its food security.

Alshaali highlighted the significance of food security for the UAE, stating that the country doesn’t produce much food and relies heavily on imports. Therefore, having a dependable partner like India is critical for the UAE’s food security.

Conclusion

The rupee-dirham trade deal is a significant step towards strengthening the economic ties between India and UAE. It is expected to create new opportunities for businesses in both countries and drive economic growth in the region. With company formation in Dubai and company formation in India becoming easier, more businesses are likely to explore opportunities in these markets, further boosting trade between the two countries.

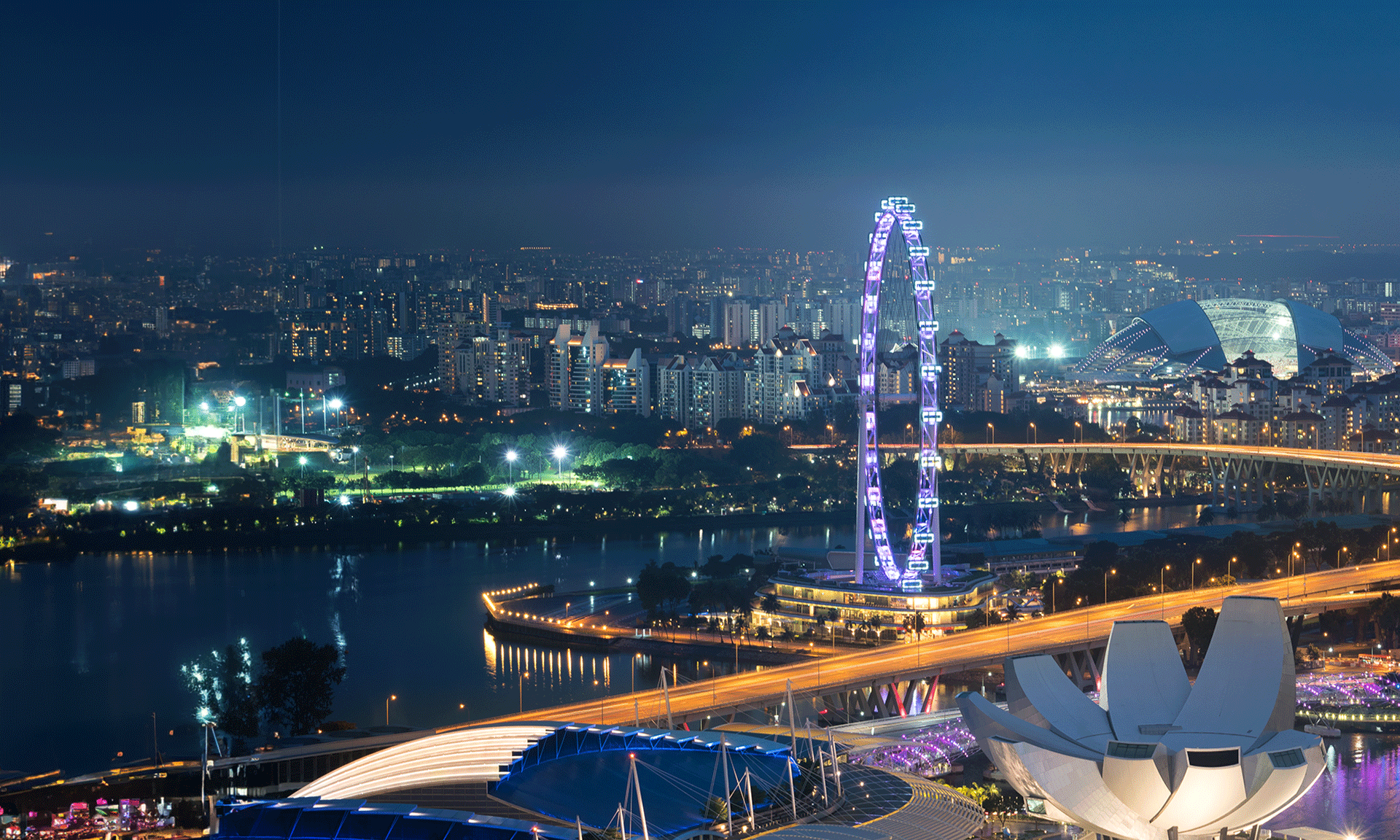

- NEWSLETTER,SINGAPORE

- March 14, 2023

The Singaporean government announced the country’s budget for 2023 on February 14th. The theme of the budget centres on enhancing Singaporeans’ abilities and taking advantage of new opportunities amid increasing global uncertainty.

In 2023, the government is expected to spend S$104.2 billion (US$78.1 billion), and the fiscal deficit is expected to be S$400 million (US$299 million), or 0.1 per cent of GDP. The range of 0.5 to 2.5 per cent is forecast for positive but sluggish economic growth. However, external factors like the protracted conflict between Russia and Ukraine and the deterioration of the US and Europe economies will significantly impact world trade. As a result, Singapore’s inflation is likely to continue to be high, particularly in the first half of 2023.

Support is provided for Singaporean businesses, including those looking to set up a new business in Singapore, as they adapt to life after COVID-19 and deal with high inflation and slow development. These include, among other things, tax deductions for invention and research and development (R&D).

BEPS 2.0

It was announced in Budget 2023 that Singapore will implement a minimum effective tax rate of 15 per cent for large multinational enterprises (MNEs) located in Singapore starting on January 1st, 2025.

Base Erosion and Profit Shifting (BEPS) has been a long-standing issue in global taxation, with companies exploiting loopholes in tax laws to avoid paying their fair share. The Organisation for Economic Co-operation and Development (OECD) has been working on a solution to this problem, known as BEPS 2.0, which is set to change the landscape of international taxation.

Starting in 2025, multinational enterprises (MNEs) with combined yearly revenues of EUR 750 million (US$797 million) or above will be required to pay a tax rate of 15 per cent on the profits they generate in the jurisdiction where they operate.

Innovation Enterprise Scheme

To promote innovation and R&D among businesses, the government has launched the Enterprise Innovation Scheme (EIS) in Budget 2023. The EIS offers tax incentives for eligible companies and introduces new measures to boost their innovative capabilities further.

Below are the Five Qualifying Activities Stated:

Maximising the Benefits of Singapore's Qualifying R&D Activities

At present, companies conducting R&D in Singapore can claim a 100 per cent tax deduction on all qualifying expenses related to R&D projects. Additionally, they can avail of an extra 150 per cent tax deduction for staff costs and consumables incurred for such tasks. The recent Budget 2023 has introduced a new incentive where companies can now claim a 400 per cent tax deduction on the first S$400,000 (US$298,000) of costs related to consumables and staff for qualifying R&D projects conducted in Singapore. This incentive will be effective from the year of assessment (YA) 2024 until the year of assessment (YA) 2028.

Boosting Innovation: Enhanced Tax Deductions for Intellectual Property Registration Costs

Currently, companies can avail of a 200 per cent tax deduction on the initial S$100,000 (US$74,600) of eligible costs for registering intellectual property, including patents, designs, trademarks, and other related expenses. With the introduction of Budget 2023, this incentive has been improved to a 400 per cent tax deduction for the first S$400,000 (US$298,000) of qualifying IP registration costs for each assessment year from 2024 to 2028.

Innovating with IP: A Guide to Acquisition and Licensing of IP Rights

Currently, businesses can claim a 100 per cent write-down allowance on capital expenses incurred on qualifying intellectual property (IP) rights, along with a 200 per cent tax deduction on the initial S$100,000 (US$74,600) of the costs related to licensing IP rights.

Under Budget 2023, this incentive has been improved further. Companies can now avail of a 400 per cent tax allowance/deduction on the first S$400,000 (US$298,000) of qualifying expenses incurred on acquiring and licensing eligible IP rights. This incentive is applicable for the years of assessment from 2024 to 2028.

Deductions on taxes for expenditure

Skills Future Singapore has authorised courses that are now eligible for a tax deduction of 400 per cent on the initial S$400,000 (US$298,000) of qualifying training expenses, which is an improvement from the earlier 100 per cent tax deduction.

Deductions on taxes for innovation projects conducted by qualified partners, including polytechnics

Budget 2023 has introduced a 400 per cent tax deduction program for qualifying innovation projects up to S$50,000 (US$37,300) of qualifying expenses for the years of assessment from 2024 to 2028. The initiative encourages companies to undertake innovation projects with local polytechnics, the Institute of Technical Innovation, or other eligible partners.

Enhanced Support for Business in the New Era

Enterprise Singapore, a statutory board under the Ministry of Trade and Industry that supports local SMEs in enhancing their capabilities, innovation, and internationalisation, will extend the current improvements provided by its Enterprise Financing Scheme, as announced by the government.

The Impact of the Enterprise Financing Scheme Trade Loan Extension

Starting April 1, 2023, and ending on March 31, 2024, the Enterprise Financing Scheme – Trade Loan (EFS-TL) will be available to enterprises. With the EFS-TL, borrowers can receive trade financing of up to S$10 million (US$7.3 million), and the government’s risk share on loan is set at 70 per cent, with a maximum repayment period of one year.

Extending the Enterprise Financing Scheme for Project Loans

The Enterprise Financing Scheme for Project Loans (EFS-PL) has been extended until March 31, 2024, to support eligible companies’ overseas and domestic projects. This program provides financing for various supportable loan types, including land/building/factory, working capital loans, machinery, equipment, other fixed assets, and guarantees. Borrowers can receive up to S$50 million (US$36.9 million) for overseas projects and up to S$30 million (US$22.1 million) for domestic projects. Additionally, borrower groups can receive up to S$50 million (US$36.9 million) for overseas projects and up to S$30 million (US$22.1 million) for domestic projects.

For fixed asset loans, the government will bear 50 per cent of the risk, and for young companies meeting specific criteria, the government’s risk share is 70 per cent. The maximum repayment period for fixed asset loans is up to 15 years, while working capital loans and guarantees have a maximum repayment period of up to five years.

Overview of the Enterprise Financing Scheme - Working Capital Loan

From April 1, 2023, to March 31, 2024, the Enterprise Financing Scheme – Working Capital Loan has been upgraded to provide an operating capital loan of up to S$500,000 (US$373,000).

Boosting Business Growth with Singapore Global Enterprises Initiative Top-Up

Boosting Business Efficiency: The Top-Up for National Productivity Fund

The National Productivity Fund (NPF), created in 2010 to enhance business productivity and employee training, will receive an additional S$4 billion (US$2.9 million) in funding under the new Budget of 2023. The NPF’s mission has also been expanded to support companies in developing new capabilities, upskilling their workforce, and contributing more to the domestic economy.

- NEWSLETTER,U.A.E

- March 14, 2023

The UAE government released the Cabinet Decision No. 85 of 2022 on September 2nd, 2022, to establish tax residency regulations in the country. These regulations determine when an individual or entity, such as a natural person or a juristic person like Limited Liability Companies, public joint stock companies, and foundations, may be recognized as a tax resident in the UAE. The regulations align with globally recognized standards and will be enforced from March 1, 2023.

According to Article 3 of the Cabinet Decision, a legal or juristic individual is a tax resident if:

It is founded, formed, or recognized under the country’s legislation (this does not apply to a branch registered by a foreign juristic person), or it is a tax resident under the country’s tax law.

Under Article 4, a natural person will also be deemed a tax resident if:

- Their primary place of residence and centre of financial and personal interests are in the UAE, or

If they have spent 183 days or more physically present in the UAE during a consecutive 12-month period, or

If they have spent 90 days or more physically present in the UAE during a consecutive 12-month period, and they are either a UAE national, hold a valid residence permit in the UAE, or are a GCC national, then they must also:

- Maintaining a permanent residence within the country

- Engaging in employment or business activities within the country

Under the new Corporate Tax regime, UAE Tax Resident certificate legal entities may be subject to the new Corporate Tax starting from June 1, 2023, as per Federal Decree-Law number 47 of 2022 concerning the taxation of corporations and businesses. Meanwhile, foreign legal entities may also be required to pay taxes, but only under the Corporate Tax regime.

According to Article 6 of the Cabinet Decision, if an international agreement such as a tax treaty outlines tax residency conditions for a UAE Tax Resident, those provisions will remain in effect. The Ministry of Finance will issue residency certificates in the prescribed form and method for such agreements.

If individuals fall under the definitions of tax residency mentioned above, they must obtain a Tax Domicile Certificate (TDC) by applying to the Federal Tax Authority (FTA), UAE, as per Article 5 of the Decision, to avail of the benefits and reliefs available.

The FTA is responsible for providing additional information and clarification on Cabinet Decision No. 85 of 2022. Additionally, it will establish regulations to gather the necessary information required for the implementation of the Decision’s provisions. UAE government entities are obligated to collaborate with the FTA to ensure the seamless execution of the Decision.

Previously, tax residency in the UAE was based solely on international treaties, with no domestic legislation in place. Introducing local tax residency criteria provides greater clarity and specific guidelines for those who fall under its jurisdiction.

- NEWSLETTER,U.A.E

- March 14, 2023

The United Arab Emirates (UAE) is a favoured investment destination for foreign investors. This is primarily due to its advantageous geographical location, economic and political stability, forward-thinking business regulations, and rich talent pool.

Nevertheless, the Free Zones, dedicated areas for business activities with specialized corporate and tax rules, play a crucial role in making the UAE a thriving business hub. The Free Zones offer an unparalleled opportunity for foreign investors to set up their businesses in Dubai, an environment conducive to growth and development.

The Benefits and Challenges of Corporate Tax in UAE Free Zones

UAE’s Ministry of Finance announced a CT regime on Jan 31, 2022, but assured that current tax incentives for Free Zone entities would still be honoured. After that, on April 28, 2022, a Public Consultation Document was made available. As per guidelines the free zone entities will continue to enjoy the tax benefits if they don’t carry out business with mainland UAE and fulfill relevant regulatory requirements.

The Free Zone Advantage: How the Final CT Law Protects Your Rights

The UAE MoF released the final version of the CT law on December 9, 2022, which includes Free Zone persons as taxable individuals. Additionally, the beneficial tax regime only applies to qualifying Free Zone individuals earning qualifying income.”

Article 18 of the final law defines a qualifying Free Zone person as an entity located in the Free Zone that:

- Must have sufficient substance

- Must generate qualifying income as specified

- Must comply with transfer pricing regulations under the law

- Must not have chosen to be subjected to Corporate Tax (CT)

- Must fulfil any additional requirements as prescribed

A Free Zone person’s qualifying income is taxed at 0%, while any other income is 9%. However, Free Zone persons may need access to the AED 3,75,000 income threshold. If eligible, a qualifying Free Zone person can apply to be taxed at the same rates as other taxable individuals.

Top Priorities for Free Zone Individuals in the UAE

Staying informed and complying with relevant regulations is essential for smooth and confident business operations. Free Zone individuals in UAE should consider key considerations to comply with regulations specific to their status. This includes visa requirements, employment restrictions, tax obligations, business licensing, banking, customs, and import/export regulations.

Maximizing Tax Benefits: A Guide for Free Zone Individuals in the UAE

A person in the Free Zone has the choice to opt for being taxed according to the regular provisions.

To comply with the arm’s length principle and disclose transactions with related parties and connected persons, Free Zone individuals must maintain sufficient transfer pricing documentation.

Free Zone individuals cannot join tax groups or receive tax relief on intra-group transfers and restructuring. Moreover, it is not allowed to transfer tax loss to or from a Free Zone person.

Free Zone companies, particularly those that belong to large groups, must assess the advantages and disadvantages of waiving the exemption since it is a one-time opportunity.

As Free Zone Companies’ revenue is divided into Qualified Income and other income, they must allocate expenses appropriately based on their earnings.

In addition, the Ministry of Finance’s FAQs have clarified that Free Zone entities that are part of a multinational group and meet the eligibility criteria will likely be subject to a distinct CT rate after implementing the Pillar Two rules in the UAE CT regime.

Conclusion

By staying informed and complying with these requirements, Dubai Free Zone Companies can maximize their success and grow their businesses confidently. Overall, the Free Zone model has proven successful. Choosing Dubai as a location for your company is likely to continue to be a key factor in the region’s long-term economic development.

In observation company formation in Dubai, as the UAE CT law becomes effective for the financial year beginning on or after 1 June 2023, companies must adjust their financial systems to ensure compliance. The upcoming cabinet notification regarding qualifying income will be closely watched to see if it aligns with the Public Consultation Document or presents any surprises.

- NEWSLETTER, GLOBAL

- March 1, 2023

We are pleased to announce the launch of the PayNow and India’s Unified Payments Interface (UPI) linkage, providing an instant, secure, and direct fund transfer service between the two countries. This milestone initiative was first proposed during PM Narendra Modi’s 2018 visit to Singapore, and the discussion of digital connectivity was further intensified at the India-Singapore Ministerial Roundtable held last year.

We extend our heartfelt congratulations to the Monetary Authority of Singapore (MAS), Reserve Bank of India (RBI), and all stakeholders involved for bringing this vision to fruition. This linkage will enable customers of participating financial institutions* in Singapore and India to send and receive funds between bank accounts or e-wallets across the two countries in real-time. They can do this using just the mobile phone number, UPI identity, or Virtual Payment Address (VPA). The linkage provides customers with a safe, simple, and cost-effective way to make cross-border fund transfers. This represents a significant step forward in strengthening the relationship between the two countries, as we explore and pursue new opportunities for collaboration and growth.

If you are an Indian company seeking to expand into Singapore, this is fantastic news! Incorporating a Singapore Company and establishing a presence in this dynamic and business-friendly city-state has never been easier. Take advantage of Singapore’s status as a regional hub for technology, finance, and business, and tap into the many opportunities available here.

Furthermore, if you are a single-family office, you will be pleased to know that Singapore is home to a thriving family office ecosystem. Singapore has established itself as a hub for wealth management and private banking, and it boasts a range of services that cater to family offices’ unique needs. With its excellent business infrastructure, low tax rates, and stable political environment, Singapore is an ideal location for Indian family offices looking to expand internationally.

We believe that this partnership between PayNow and UPI will continue to spawn innovative technology solutions, creating more cross-border opportunities for our digital economies. Don’t miss out on this chance to expand your business and take advantage of the growing digital economy in Singapore.

Get in touch with IMC today to learn more about incorporating a Singapore company or establishing a Single Family Office in Singapore.

*Singapore participants are DBS and Liquid Group. India participants are Axis Bank, DBS India, ICICI Bank, Indian Bank, Indian Overseas Bank and State Bank of India (more institutions will be added gradually).

- NEWSLETTER, GLOBAL

- February 28, 2023

In the context of a global economy, it is crucial for companies to attract and retain the best talent to stay competitive on the international stage. An effective strategy for gaining a competitive advantage is to provide a flexible workspace that caters to the requirements of the current distributed workforce. This article explores how flexible workspace solutions can assist global employers in attracting and retaining top talent across geographical borders.

What defines a flexible workspace?

A flexible workspace refers to a comprehensive workspace solution that offers employees and teams a range of work options based on their individual needs. Such options include open offices, hot desks, and coworking spaces.

Advantages of Offering Flexible Workspace Solutions to International Staff

Enhanced Employee Satisfaction:

The increase in remote work has resulted in a growing demand among employees to work from locations that align with their preferences and lifestyle. By availing a global network of flexible work desks, employees can easily locate a workspace that is convenient for them, irrespective of their location. This allows employees to have greater autonomy over their work environment, leading to an improved performance in a workspace that suits them best.

Heightened Efficiency and Teamwork:

Flexible workspaces not only offer convenience to employees but also provide them with fresh and distinct work environments that can stimulate creativity and innovation. This advantage is particularly evident in coworking spaces, where employees and businesses from diverse backgrounds and industries come together. The resulting diversity of perspectives can lead to the generation of novel ideas and innovative work methodologies.

Improved Harmony Between Work and Personal Life:

Offering employees greater flexibility in terms of when and where they work can help them manage their personal and professional lives effectively. Work flexibility is particularly crucial for employees who have family commitments, lengthy commutes, or inadequate access to stable and secure WiFi connectivity at home. When employers empower their teams to choose their work schedule and location, it promotes a better work-life balance, leading to increased productivity and job satisfaction while reducing stress and burnout levels among employees.

Enhanced Relationships and Involvement:

Providing employees with access to a worldwide network of flexible workspaces enhances their sense of connection with the company. When employees can work from a location that is convenient for them, it improves their level of engagement with the work. This advantage is especially relevant for international employees who may experience feelings of isolation or disconnection from their colleagues and the organization’s central office.

Enhanced Trustworthiness:

Empowering employees to select their preferred work schedule and location is a clear demonstration of trust from employers. This trust reflects respect for employees, which has a positive impact on their job performance. Additionally, when employers exhibit trust and respect towards their employees, it creates a mutual feeling of trust and respect, leading to elevated morale, improved teamwork, and increased innovation within the workforce.

Expense Reduction:

Employers can significantly reduce lease costs, as well as the expenditure on office furniture and equipment, by providing flexible workspace solutions. Most flexible workspaces come pre-equipped with all the essential amenities, resulting in cost savings for the employer. Moreover, through discounted global workspace access, employers can enjoy significant savings. These cost savings, along with those attained from using online collaboration tools, can be reinvested in building a better team.

Global Appeal and Talent Retention Through Adaptable Workspace Solutions

Organizations worldwide are recognizing the significance of creating a comfortable and productive workspace for their employees. Including flexible workspaces as part of an employee benefits package can offer a competitive advantage in attracting and retaining top talent internationally. With flexible workspace solutions, employers can reduce lease costs and office equipment expenses, enhance employee productivity, collaboration, and job satisfaction, promote work-life balance, and foster better engagement with the company. By empowering employees with the freedom and flexibility to work in an environment that suits them best, employers demonstrate trust and respect, leading to the creation of a more robust and innovative team.

In summary, a flexible workspace is a win-win situation for both employers and employees in the global economy, promoting a mutually beneficial work culture.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group