- Newsletter, U.A.E

- September 10, 2020

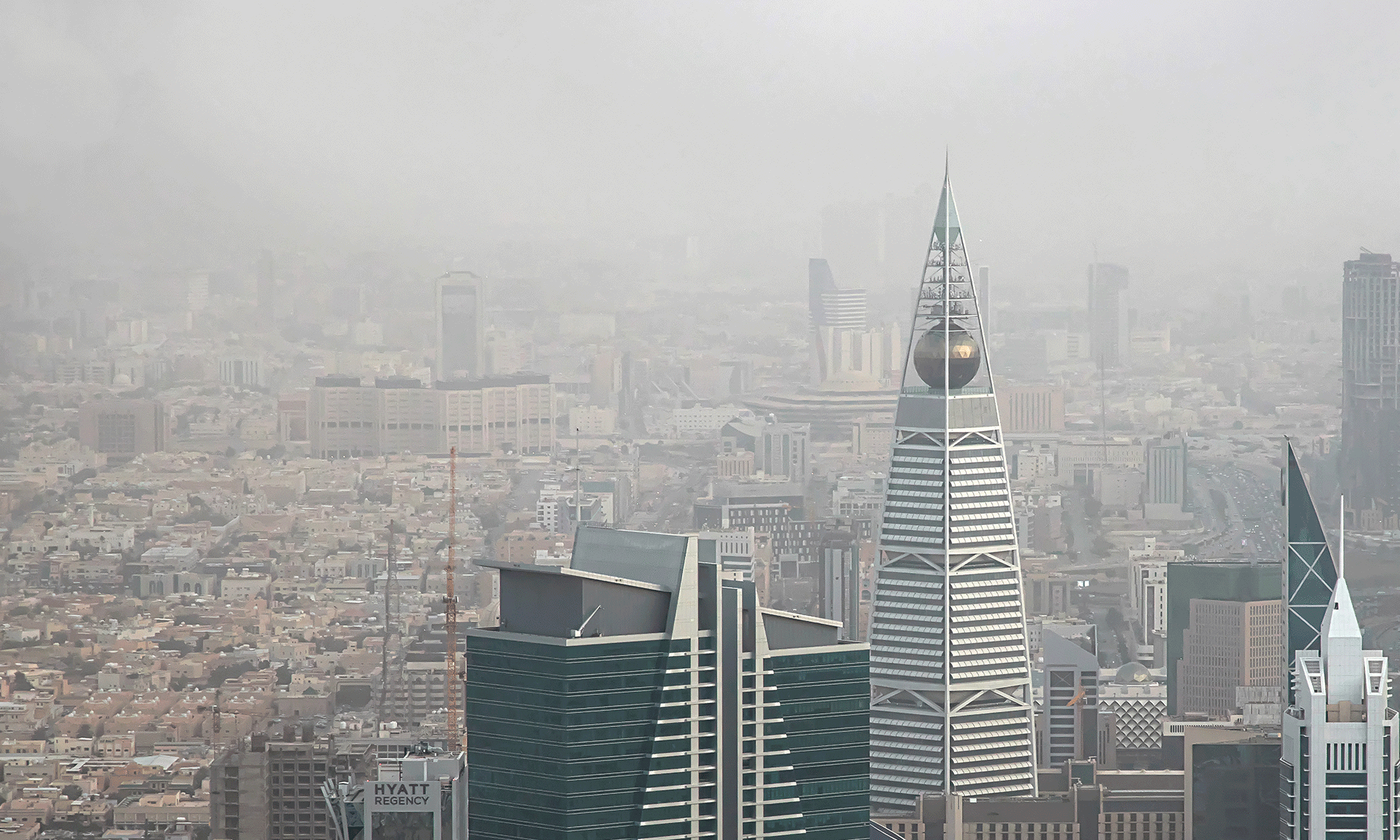

With the recent signing of the historic peace agreement, Israel and the UAE have taken steps in normalizing the ties between the 2 countries and formalizing a combined effort to research the COVID-19 pandemic. This could open ties between such industries as air travel, investment, security, telecommunications, and tourism. The world could soon be seeing cross-border ventures for doing business in UAE as well as Israel. All of this resulted from a landmark call that took place between Israel’s Minister of Foreign Affairs Gabi Ashkenazi and UAE Foreign Minister Sheikh Abdullah bin Zayed al Nahyan.

Company Alliances being formed

With the announcement of the peace agreement on August 13th, decades of hostility and opposition were finally set aside while promises were made to open ties in the industries above. For example, Etisalat (Emirates Telecommunications Corp,), the UAE’s largest phone company is in advanced talks with Partner Communications, the wireless operator of Israel. In addition to this, Israir Airlines Ltd. has applied for landing permits in the UAE. Finally, Israel’s TeraGroup has agreed to join forces with UAE-based APEX National Investment and research the Coronavirus.

Recent Stock Gains and other News

In other noteworthy news, the peace agreement has continued to reverberate through stock markets in the Middle East. For instance, Israel’s TA-35 was up as much as 2% while the indexes in Abu Dhabi and Dubai rose 0.6% and 1.3% respectively. Additionally, Stock indexes were up in other countries including Bahrain, Egypt, Kuwait, Qatar, and Saudi Arabia.

According to the Times of Israel, a recent phone call took place between Bahrain’s Prime Minister and the chief of Israel’s spy agency Mossad. An Arabic-language news reporter for Israel tweeted that a future meeting between the two has been planned and may lead to a peace agreement between those two countries as well. Interestingly enough, Bahrain has denied that the phone call occurred while there was no comment from Israel’s Office of the Prime Minister.

- India, Newsletter

- September 10, 2020

India celebrated their independence from the British Empire for the 74th time this past August 15th. It was also the day Prime Minister Modi announced the launching of three Digital India projects that could result in new company formation in India:

- the National Digital Health Mission

- a new cyber security policy

- the promise of optical fiber connectivity to 600,000 villages over the next 1,000 days.

The following is a breakdown of these three monumental projects.

National Digital Health Mission

The beginning of India’s new digital health infrastructure took place in 2017 when the National Health Policy was implemented. It proposed a National Digital Health Authority and released the blueprint for it two years later (July, 2019). This past August 7th was the release date of the NHDM’s (National Digital Health Mission’s) which outlined the digital registration of:

- doctors

- hospitals

- digital clinical decision systems

- digital personal health records

- pharmacies

- insurance companies

As a result, patients can now share their information between doctors and hospitals in a digital format by simply creating a Health ID. Furthermore, they can choose the specific documents they want to share with whom for as long as they want. To get the government benefits, people will need to connect their health IDs with the Aadhaar cards. In early weeks of July, NDHM began consultation and collaborations with insurance companies, large hospitals, laboratories and licensing authorities to ensure smooth functioning when the scheme is implemented. Other key features would include tele-medicine, data analytics tools and online pharmacy.

New Cyber Security Policy

The existing cyber security policy was born when whistleblower Edward Snowden said that India’s domestic issues were being monitored by the US National Security Agency. The scope and sophistication of cyber attacks and intrusions has increased dramatically over the past decade and are now targeting critical information infrastructure as well as sensitive business and personal data. Consequently, this poses a serious threat to the national economy and security. Due to a number of technological developments, there are significant challenges to contend with in the cyber environment such as:

- access to overseas data

- cyberspace law enforcement

- data privacy and protection

- global cooperation regarding cybercrimes and cyber terrorists

- misuse of Facebook, Twitter, and other social media platforms

Additionally, this will likely require the revamping and revitalization of existing structures. This may also have an impact on the passage of data protection legislation by a Joint Select Committee in India’s Parliament when attracting new companies in India.

Optical Fiber Connectivity

The Indian Government is referring to this as the “largest connectivity project in the world today.” BharatNet (Bharat Broadband Network Limited) which is governed by the Government of India’s Department of Telecommunications, is the country’s telecom infrastructure provider. Under this project, roughly 800,000 kilometers or nearly 500 miles of OFC or optical fiber cable to cover more than 2,50,000-gram panchayats with an estimated cost of the project to be over $6.2 billion. Although it was unable to meet its original deadline of March 2020, the project is still on track to be completed in the ensuing year. It has encountered multiple snags over the deadline and the most prominent issue that is cropping up is the lack of bidders for maintenance. This is partly due to keeping Chinese vendors out of the tender ambit.

- Newsletter, U.A.E

- September 1, 2020

Dubai International Financial Centre (DIFC) has recently unveiled a new license for tech companies, entrepreneurs and start-ups. With the license, DIFC company formation has now been made more efficient. The new license, dubbed “Innovation License,” is expected to attract different types of enterprises and businesses to the center. As per a recent press release by the DIFC, the new license is also an important initiative towards the Dubai Future District plan, which was announced back in January this year by His Highness Sheikh Mohammed bin Rashid Al Maktoum, the Vice President and the Prime Minister of the UAE.

Innovation License is designed to support entrepreneurship, innovation and creativity in the Middle East, Africa and South Asia (MEASA) region. Business organizations will expand and scale their operations using the Dubai International Financial Centre’s independent English Common Law-based data protection regime as well as legal and regulatory framework. Holders of the Innovation License will join the network of tech companies in the region’s largest financial free zone that consists of more than 2500 enterprises and 25,000 professional individuals.

The Innovation License costs $1,500 and provides business organizations with access to co-working spaces at Dubai International Financial Center. License holders also get access DIFC co-working spaces at subsidized, attractive prices. A top executive at DIFC Authority, Salmaan Jaffery, mentioned that the new Dubai Innovation License provides a prominent opportunity for future business aspirants to start, upscale and secure their enterprise within the framework of a global financial centre.

The license has indeed incentivized business setup in Dubai. Jaffery added that he hopes the new license will attract technology-focused enterprises that will transform the financial sector. In his opinion, these entities can shape the economic future that UAE holds.

With an aim of becoming a leading fintech hotspot, the DIFC has been working on and launching various initiatives and policies in order to attract foreign firms. It also intends to build a nurturing environment for businesses to thrive and succeed. The center is a proud home to over 730 active financial companies in addition to 120+ fintech firms.

Intuit Management Consultancy (IMC Group) can help businesses with DIFC licensing processes in a hassle-free manner owing to their experience and hands-on expertise.

- Article, Singapore

- August 28, 2020

Any registered business organization that isn’t actively trading or doesn’t have any income is referred to as a dormant company in Singapore. A firm can be deemed dormant if it no longer: sells or purchases anything, employs people, receive income or pay dividends. While the concept of a dormant company in Singapore is not new, the Accounting and Corporate Regulatory Authority (ACRA) and the IRAS (Inland Revenue Authority of Singapore) define a dormant company differently.

ACRA’s definition of a private dormant relevant company

- Pays penalties, fines or fees to Accounting and Corporate Regulatory Authority

- Employs a new secretary

- Maintains registers or books

- Initiates payment of any composition amount

- Appoints auditors

How To Obtain Tax Residence Certificate In Singapore? READ MORE

IRAS’s definition of a dormant company

All Singapore company incorporations must be in compliance with the ACRA and the IRAS. In order to enjoy the benefits of a dormant company, it is ACRA that should identify a firm as formant. ACRA exempts a dormant company from preparing financial statements, whereas IRAS releases it from the tax filing obligations.

How to get your company classified as officially dormant?

Filing requirements for a dormant company in Singapore

1. Filing annual returns with Accounting and Corporate Regulatory Authority (ACRA)

The company does not have accounting transactions

The company isn’t a listed firm or a subsidiary company of a listed organization

The company’s total assets at any time in the financial year does not surpass $500,000 in value or such other amount as may be prescribed in substitution by the Minister.

Please note that a dormant firm that’s exempted from preparing its annual financial statements must still prepare a management accounts to receive approval at the firm’s AGM.

2. Filing your taxes with the Inland Revenue Authority of Singapore (IRAS)

The firm must not own any investments (for instance, shares, properties etc). If you hold investments, you should not use it to generate any income for the firm.

The firm must declare that it will not start any sort of business transactions in the next two years.

The company must have filed all the financial statements and tax computations up until the firm stopped trading.

The firm should have de-registered for Goods and Services Tax (GST).

These processes are easier to implement when you seek professional aid from accounting services in Singapore.

What’s the procedure to recommence a dormant business?

Subject heading: “Recommencement of business and request for Income Tax Return”

Name and the Unique Entity Number of the firm

Date of recommencement of business and new principal activity (if applicable).

Date of receipt of other source(s) of income e.g. interest, dividend, rent, etc. (if applicable).

How to close a dormant company in Singapore?

If you have decided to close your current dormant company, then you must submit an application to ACRA affirming your desire to have your company’s name removed from the register of companies. The application has to be filed by your company secretary, the director or your registered filing agent. It can also be e-submitted through Biz File Portal.

Corporate secretarial services in Singapore is no easy job. However, with some external professional help, it’s a cakewalk. Reach out to the experts at Intuit Consultancy to know more.

- Article, India

- August 19, 2020

If a person wishes to avail of tax relief under Double Tax Avoidance Agreements, then they need to have a document called Tax Residence Certificate. The document is issued by the country of which you are a resident and is furnished only to those foreign countries with whom the home country has a DTAA agreement.

In India, the authority for issuing the certificate rests with the Income Tax Department. For understanding the criteria of being a resident in India you can go through the following points. An individual is said to be a resident:

- If they stay in India for 182 days or more in the previous year.

- If they stay in India for 60 days or more in the current financial year and have stayed in India for 365 days or more in the preceding four years.

Such an assessee should make an application in Form No. 10FA to the assessing officer, for meeting the agreement requirements referred to in section 90 and 90A. On the receipt of the application by the assessing officer as referred to in sub-rule (3), he shall satisfy himself by scrutiny of documents submitted. On complete compliance, the officer will issue the certificate for the assessee.

Tax residence certificate for non-resident Indians.

An assessee who is a non-resident in India should obtain the Tax Registration Certificate from the Government of the country or the territory of which he/she is a legal resident. This certificate shall contain the following information.

- Name of assessee

- Status (Individual/ HUF/Company)

- Nationality (in case of an individual)

- The country or the specific territory of registration

- Residential status for tax purposes

- The period till which the certificate is applicable

- The specified address for the validity of the certificate

- The Tax Identification Number in the specified country or noted territory, or a unique identification number by the government of such territory, in case of unavailability of TIN.

All the above information should be provided in Form 10F by the assessee.

The certificate mentioned in sub-rule (1) must be verified by the government of the country or noted territory for verifying the genuineness of assessee in the tax payment system.

Subject to the provisions of sub-rule (2), for sub-section (5) of section 90A and sub-section (5) of section 90, the below-mentioned information should be provided by an assessee in Form 10F

- Status (HUF/ Individual/ Company)

- Nationality, in case of an individual or the country or area of registration, in case of any person other than an individual.

- The residential status period.

- Address of assessee in India or the territory outside India, during the time for which the certificate is applicable.

- The TIN of assessee in the country or the territory of residence. If the TIN is not available then the unique number used for verifying the identity of the person in the specified region.

There is no requirement of providing the information or any such part thereof if it is already mentioned in the certificate referred to in sub-section (4) of section 90A or 90.

The assessee should keep the documents that are necessary to substantiate the provided rule under sub-section (1) and the Income-Tax authorities necessitate providing of said documents about the claims for any kind of relief under an agreement referred to in the sub-section (1) of section 90A and section 90.

Step-wise Procedure.

- Find your assessing officer (AO) on the web through the official website by entering the registered mobile number and PAN.

- Prepare a document that explains your in and out movement through the stamped passport. If your check-in or check-out is made online, then the air tickets should be retained for providing proof to the assessing officer.

- Download the Form 10FA and then submit it physically to the assessing officer. It is necessary to disclose the reason for the tax resident certificate. You also need to attach a copy of the Passport with all the stamps of departure and arrival.

- After all the submissions, the officer may ask you to visit him to discuss the documents. After complete satisfaction, the assessing officer will finally issue the TRC in Form 10FB.

The certificate will help you avoid double taxation on your income as per the above-mentioned DTAA agreement.

- Article

- August 14, 2020

It goes without saying that establishing a firm feels incomplete if the pillars of organizational trust and entrepreneurial foundation aren’t taken care of. At IMC, we believe that the company culture and its global outreach depend on the trust level it builds with the contemporaries. A trustworthy company gets noticed more than any other firm in the global landscape and this is what we aim to achieve for our diversified clientele.

Establishing and administering trust and foundation are our key areas of expertise. Our in-house professionals understand the stringent global guidelines and make sure companies avoid any conflict of professional interest while conducting business. Besides creating an aura of accountability, we also put efforts in maintaining the same for a significant timeframe.

Enlisting the Benefits of Trust and Foundation Formation

IMC believes that helping companies with trust and foundation building can have a host of positive effects on the credibility quotient and overall business presence. Trust formation helps with better tax savings as the company is then known to abide by all the regulatory guidelines in play. Moreover, asset protection is also possible with these strategies in play.

At IMC, we approach Trust and Foundation formation in a subtle manner by helping owners identify the trustee and initiate property transfers with ease. We understand that businesses like aggressive expansions but nothing fits them better than having a trustee hold organizational property for minimizing tax-based implications.

In regard to Foundation formation services, we follow a streamlined approach and help companies find a middle way between corporation establishment and a trust. Needless to say, companies can then protect and preserve their assets from the creditors.

Besides the obvious tax and asset-specific benefits, IMC makes it a case of extend the set of perks to the clientele. With us on-board, it becomes easier to experience unmatched organizational privacy, tax free transactions, inclusion of foreign owners into the firm, and even unquestioned confidentiality across diverse sources. Not just that, we assure privacy, competent relationship planning, and seamless property succession for simplifying business activities.

Why Trust and Foundation formation is necessary?

We understand that companies are mostly worried about asset protection and contingency planning. Therefore, we make sure that the concerned Trust and Foundation simplifies the legal and economic proceedings for each one of our clients.

Not just the professional setups, these services are compatible with family and personal businesses where property succession is a matter of concern. A company that gives attention to Trust and Foundation formation can avail the benefit of better estate planning, 100 percent ownership, and minimal to no taxation. However, the regulations and economic implications vary according to the region of interest.

Why Choose IMC?

Each one of our services is always in sync with the interest of the founders and concerned beneficiaries. Besides rendering extensive levels of professional support, we also cater to highly specific and discrete client requirements.

We ensure:

- Exclusive structure advice to companies for working in a highly efficient environment

- Provisioning of secretarial, trusteeship, and corporate services for members of the Trust and Foundation

- Error-free structuring, drafting, and establishment of the concerned setups

- Proper provisioning of the registered offices

- Seamless access to the general administration

- Efficient bookkeeping services

- Perfect tax filing, in accordance with relevant authorities

- Choosing the appropriate Trust and Foundation structure

- Provisioning for Due-Diligence

Connect with IMC for establishing Trust and Foundation which would help you with

- Better Financial Privacy

- Strongest Possible Asset Protection

- Tax Minimization

- Improved Succession Planning

- Financial Planning

- Newsletter

- August 12, 2020

During the second quarter of 2020, we saw investments in Southeast Asian startups nearly double despite the damage to the global economy caused by the COVID-19 pandemic. Most of this surge of investments was driven by e-commerce and FinTech (financial technology) companies. According to DealStreetAsia, the Singapore-based startup information platform, the value of fundraising in southeastern Asia rose 91% to nearly $3 billion during the second quarter (April – June, 2020). At the same time, the number of transactions rose 59% for the same period.

Interestingly enough, many countries were under a strict lockdown during the second quarter of the year. To say the least, this hampered deal-making opportunities while economic uncertainty discouraged many investors. However, a number of different venture capital funds raised a significant amount of investment funds. According to an interview with Monk’s Hill Ventures’ co-founder and managing partner Kuo-Yi Lim, most deals had been in the pipeline since earlier in the year.

During the past 5 or 6 years, two largest ride-hailing businesses in the region (Gojek in Indonesia and Grab in Singapore) have led the way in the startup funding boom. During the first quarter, these two businesses were responsible for raising 70% of the regions’ revenues. This equates to over$2 billion. We witnessed a different picture in the 2nd quarter as the e-commerce sector raised $691 million while the FinTech sector raised $496 million and logistics raised $360 million.

Furthermore, a considerable amount of funds were raised by a number of other local companies as well. As a result, Southeast Asian economic experts contend that this is an indication that the COVID-19 pandemic has generated an increase in Singapore company incorporation. The 2nd quarter’s biggest fund raiser was Tokopedia, an Indonesian-based e-commerce company. According to DealStreetAsia, Tokopedia secured $500 million from Temasek Holdings, a Singapore-based investment firm.

Furthermore, the Vietnamese e-commerce company Tiki secured $130 million from the private equity firm Northstar Group. According to Tiki Vice President Ngo Hoang Gia Khanh, the company witnessed a dramatic increase in consumer shopping needs where face masks, hand sanitizers, and other necessities were concerned. As competition continues heating up in Vietnam’s local and regional business sectors, Tiki offers unique services in order to differentiate itself from other companies doing business in Vietnam.

With a network of fulfillment centers operating nationwide, the company provides an express delivery service known as TikiNow for shipping packages to customers within 2 hours from the time their order is received which is faster than their competitors. They also offer free, on-the-spot installation of bulky and heavy items. As Southeast Asia’s demand for online shopping venues continues to increase, delivery and logistic startups have also enjoyed increased revenues. For example, Kargo Technologies of Indonesia raised $39 million while Ninja Van of Singapore raised a whopping $279 million.

The FinTech sector has also seen some significant fundraising in several companies. For example, Voyager Innovations, the parent company of mobile payment app Paymara of the Philippines raised $120 million this past April from Tencent Holdings of China and KKR, a US private equity fund – two of their current shareholders. As the first funding round the company has had since 2018, Voyager Innovations was able to compete with their in-country rival Mynt.

Other notables in the fundraising deals arena included:

- Cleantech Solar of Singapore (energy sector) $75 million

- Kopi Kenangan of Indonesia (food and beverages sector) $109 million

- RWDC Industries of Singapore (biotech sector) $133 million

- Synqa of Thailand (FinTech sector) $80 million

- Traveloka of Indonesia (online travel agent) $100 million

- India, Newsletter

- August 12, 2020

Although the first half of 2020 was supposed to be a banner financial period and witness accelerated growth throughout numerous sectors, the COVID-19 pandemic had other ideas. In every industry sector, we saw unprecedented economic challenges, especially among early-stage startups. It’s not about the industry sector that suffered the least or most amount of damage anymore, but rather the extent to which each sector was hurt, hence the decline in company formation in India.

From the standpoint of damage assessment, the hospitality and travel sectors suffered the most in the way of economic losses and realistically, these will most likely be the two sectors that have the longest recovery period under what is now the “new normal.” Furthermore, sectors such as logistics, manufacturing, transportation, and other areas that are classified as “people intensive” will be facing difficult challenges as well. However, there is hope that things will get better over the next few months.

How have Emerging Sectors been affected?

Emerging sectors such as the hygiene industry gained prominence as a result of the COVID-19 pandemic and good hygiene has been a hot topic of debate in India. Unfortunately, very little action has been taken over the years. However, this will likely change because of the global impact of widespread contamination risks. The Prime minister, Narendra Modi had been emphasizing and launching campaigns to improve hygiene and sanitation for the past few years. This has improved the situation but a lot still needs to be done.

Whether it’s a matter of community, personal, or surface area hygiene, the landscape has changed dramatically over the past several months. Even now, we’ve been seeing a dramatic increase in the number of India attract investment post-COVID-19 efforts among numerous early-stage startup companies.

Adversity – a significant Source of Opportunity

Ever heard the expression “War not only destroys, but also creates opportunities for those who are resilient and keen to rebuild.”? Well, the world has been at war with the Coronavirus and it has provided many difficult challenges yet amazing opportunities. We’ve seen numerous economic, financial, and physical challenges including:

- Cash flow impact attributed to lost sales

- Funding and investment plans being put on hold

- Growth setbacks for companies of all sizes

- Manpower shortages in labor-intensive industries including agriculture, construction, manufacturing, and so on)

Coincidently, this has given rise to numerous opportunities on a global scale such as increased online sales and product innovations. Indian companies are now focusing on delivering their products to the consumer’s residence. And guess who will benefit the most from all this? Those startups who figure out a method that meets these demands and fulfills the needs of the consumer will benefit the most.

The bottom line is simple. Indian startups that are capable of creating products that address the needs of the global marketplace will witness accelerated growth that surpasses pre-Coronavirus economic times. The future looks bright.

- Newsletter, U.A.E

- August 12, 2020

FinTech Abu Dhabi recently announced that their Innovation and Startups team will be taking a virtual tour of 23 countries to solicit and correspond with founders of some of the most exciting early-stage financial technology sector startups from June through November of this year. The esteemed FinTech Abu Dhabi program will be inviting the top startups to join them during the 2020 FinTech Abu Dhabi Festival which runs from November 24th to 26th. The festival is co-hosted by the Central Bank of the UAE and the Abu Dhabi Global Market.

The global digital tour began in the UAE at the end of June and was kicked off with comments from such notables as:

- Lucy Liu, Airwallex co-founder and President

- Richard Teng, Abu Dhabi Global Market and Financial Regulatory Services Authority CEO

- Shu Pui Li, Governor of the Central Bank of The UAE (CBUAE) and Advisor to His Eminence

As the gateway to one of the most important portals and markets, FinTech100 offers a wealth of opportunities globally. The mutual topic of discussion between them was “FinTech – in the next decade.” It focused on company formation in Abu Dhabi and company formation in the UAE. This was followed by a 5-way pitching battle of FinTech startups. Mamo Pay and McLedger were the two companies that were crowned as champions of the match-up and will be a part of the FinTech 100 in Abu Dhabi at the festival this coming November. It will open new frontiers globally and help business network more.

The next virtual destinations in the FinTech Abu Dhabi Global Tour scheduled for the months of July and August include:

- Australia

- Canada

- India

- New Zealand

- Singapore

- Switzerland

- UK

- US

The FinTech 100 is the gateway to one of the most important markets in the world and is a high-level, by-invitation-only event that serves as a portal to a number of business opportunities. During the event, numerous startup founders who’ve traveled from many locations around the world to Abu Dhabi will be able to experience the renowned Abu Dhabi hospitality and have a chance to:

- be introduced to key corporate executives and major investors from the Middle East

- learn about numerous business and marketing opportunities

- network with their peers

- participate in the Innovation Challenge Awards

- India, Newsletter

- August 12, 2020

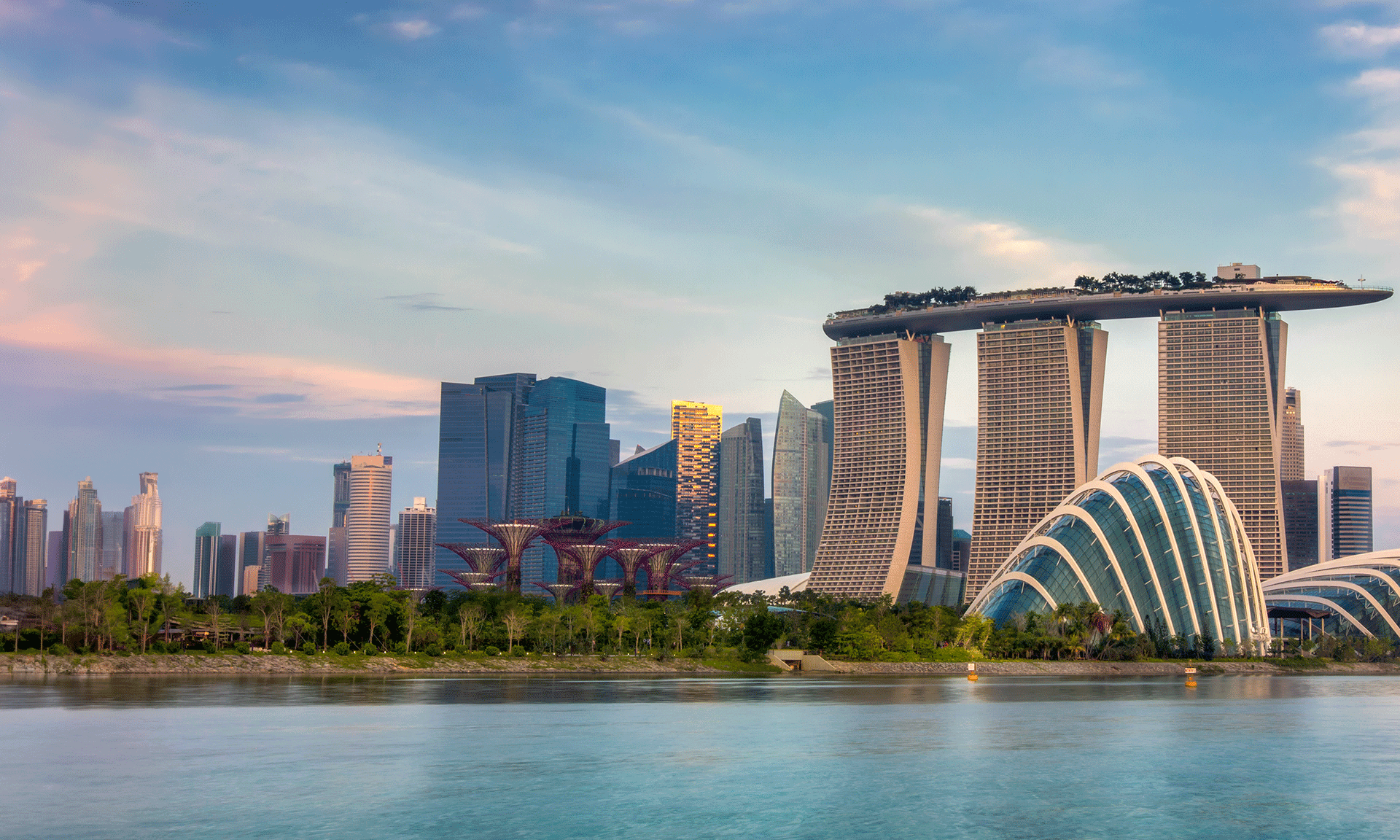

High net-worth individuals (or HNI’s as they are often called) have recently generated a surge of international investing as they urged Indian-owned family offices to develop partnerships with foreign investors in Singapore and Gulf countries. According to the Reserve Bank of India’s (RBI) liberalized remittance scheme (LRS), an Indian citizen is allowed to invest up to $250,000 abroad each year in bonds and stocks. Over the past 4 to 5 years, India has been outperformed by global markets. The fact that the Rupee has depreciated against the US dollar has made them more attractive to foreign investors.

Why should You consider investing Abroad?

Singapore has been putting its marketing efforts into attracting foreign investors from around the world. As a foreign investor, establishing a business is relatively easy. Singapore and UAE are cosmopolitan, multicultural sovereign countries that are well connected globally. Furthermore, their business environment is conducive to creative and knowledge-driven companies. Most importantly, these countries are strategically located at the main intersection of Europe and Southeast Asia and have excellent infrastructure.

Currently, even in the pandemic the governments of the Gulf Corporation have given rebates on taxes and other levies have been removed to ensure that family business in Gulf Cooperation with restricted liquidity and lower profits are able to maintain and thrive during these difficult times.

Compared to other countries, Singapore’s attractive tax system, sophisticated banking system, and strong legal framework have given it the competitive edge. Other positive factors that have helped this city-state attract foreign investors include:

- An educated workforce

- Ease of Singapore company incorporation

- Lower corporate taxes

- Numerous investment opportunities and incentives

- Strict enforcement of intellectual property laws

In addition to the above, Gulf countries and Singapore is an excellent place to live, learn, and work. These countries have long been recognized as some of the most competitive entities globally and are a frontrunner in several industry areas including:

- asset and wealth management

- insurance treasury operations

- international banking

- maritime finance

- trade finance

As a result, many international companies have established a base in Singapore and in the Middle Eastern countries and have taken advantage of what it has to offer foreign investors. They have utilized its diverse capital markets and their state-of-the-art financial investment services. The basic incentive for HNIs to invest in Gulf countries and Singapore is the tax advantage and investment policies that offer better growth prospects for their businesses.

What else makes Singapore attractive to foreign investors?

In recent years, Singapore has gained prominence as a favorable destination for the centralization of certain activities such as finance, IT, and logistics. This provides companies with certain benefits including enhanced productivity, lower operating costs, and superior customer service. Compared to other countries, company formation in Singapore is relatively easy. The city-state offers certain incentives that are targeted towards foreign investors from specific industries who can apply directly to the city-state government for them. For the foreign investor, Singapore offers one of the highest rated communications infrastructures when compared to Hong Kong and Malaysia.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group