- Newsletter

- July 17, 2018

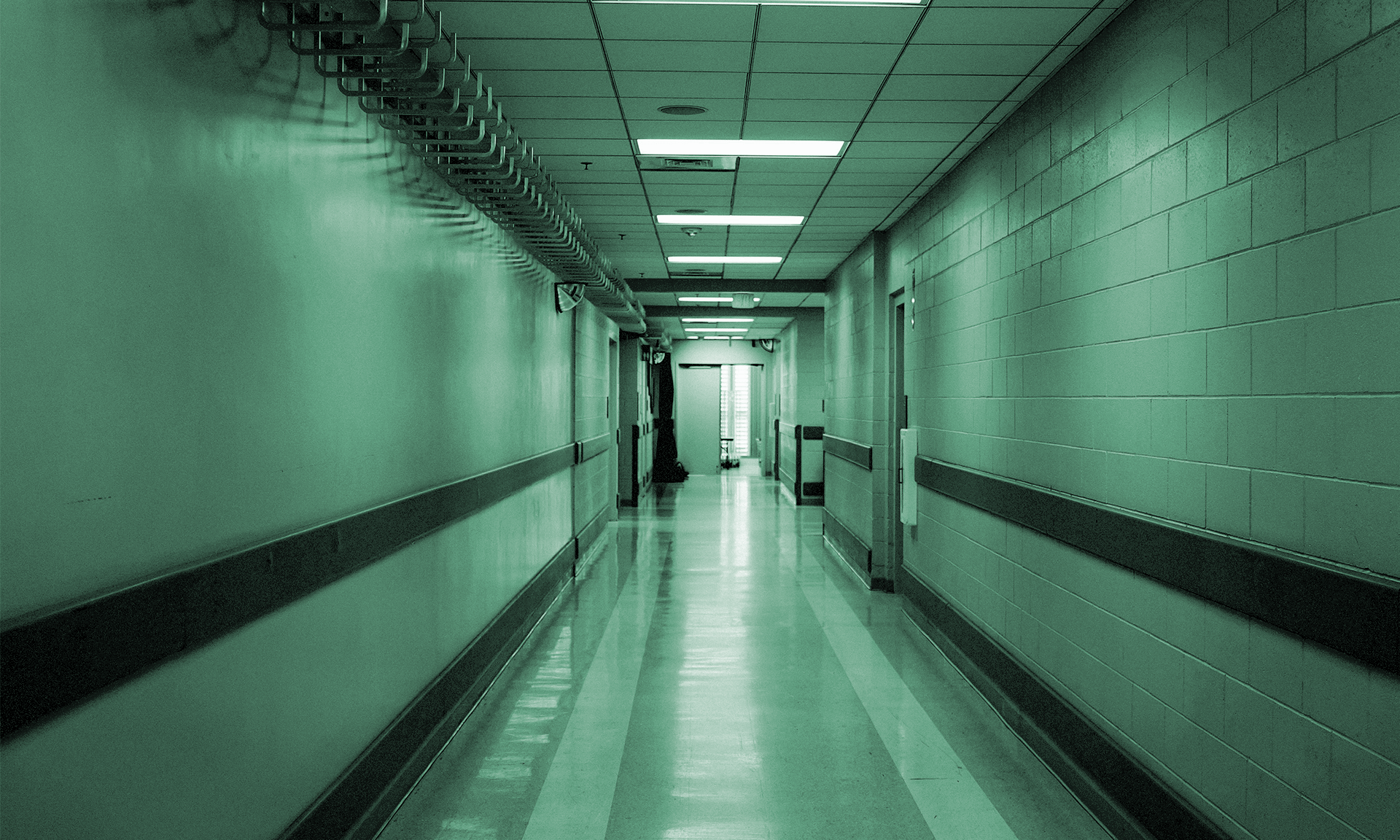

The Department of Health in Abu Dhabi (“DOH”) has come up with a fresh policy and guidelines around using Artificial Intelligence (“AI”) in the healthcare sector, with the objective of urging its implementation in a safe and secure manner.

As per the policy AI is defined as “the mimicking of human thought and cognitive processes to solve complex problems automatically”… “such as machine learning, distributed intelligent systems, [and] expert systems”.

Though the policy still doesn’t address many key points, most of the vital requirements of an effective AI in healthcare framework are taken care of. The DOH has developed guidelines and a regulatory framework, which will be able to administer the following elements of AI implementation in healthcare:

- Making sure of the safety of its usage and implementation with responsibility;

- Maintaining privacy and security;

- Ensuring transparency and also oversight;

- Making sure that the implications are ethical.

The new policy would be applicable to:

- All of the licensed healthcare professionals and providers in Abu Dhabi

- National and those international end-users who are locally based and who use, or want to use, Abu Dhabi-based residents or patient (both clinical and non-clinical) data in AI field, directly or indirectly;

- Pharmaceutical manufacturing companies based in UAE;

- All the healthcare insurers based in Abu Dhabi;

- All the licensed healthcare researchers in Abu Dhabi who are doing some form of human subject research; and

- All patients in Abu Dhabi.

The policy also lays the guidelines for the minimum acceptable requirements for AI (and its tools) introduced in Abu Dhabi. This includes all the certifications done by recognized international agencies, auditable validation statements and compliance with ADSSSA guidelines.

In addition, all the users of AI except the patients need to ensure the following:

- Have clear governance on implementation and usage of AI

- Lay guidelines and clear boundaries around the sharing and access of patient information so as to safeguard privacy and ownership of this information

- Conduct timely audits to check the AI functionality and how is it being reported to DOH

- Comply with all the regulatory requirements listed by UAE and DOH, including the guidelines that govern e-health, data protection, exchanges regarding health information, information security, and also AI.

The policy also proves that DOH’s recognizes the important role of AI and the benefits it can give if it is properly used in the healthcare sector. To encourage the application of AI in the healthcare arena, there is a need to have a clear regulatory framework. By implementing such a framework, the organizations can develop compliance structures that are needed to ensure a compliant adoption of AI into the healthcare industry.

Our team will keep you posted about any new implementation frameworks that are expected from the DOH. If you have any queries or need any assistance regarding the new AI policy or UAE healthcare industry report, our professional experts would be more than happy to help.

- Newsletter

- July 17, 2018

The UAE has recently announced eight new changes with a goal to improve a nation’s competitiveness in terms of economy, enhance tourism and also retain talented students.

- The mandatory bank guarantee needed for labour recruitment is being abolished and now in its place, a new and more reasonable insurance system will be introduced.

- New visa facilitation guidelines and procedures for any visitors, families, residents, and also for people overstaying their visa.

- The transit passengers will be exempted from all the entry fees for the first 48 hours. Transit visa could be extended for up to 96 hours by paying a fee of Dh50.

- People who are overstaying their visa granted can leave the country willingly and freely without requiring a “no entry” stamp on their passport.

- A new visa, which will be applicable for 6 months is going to be introduced. It will be of great help to people looking for a job and who have stayed more than their visa, but still wish to work in the country. It’s a temporary visa to further improve UAE’s position in terms of job opportunities and offerings and make it more attractive for professionals.

- It’s also an opportunity for people who came in the country in an illegal manner to leave voluntarily with a ‘no entry’ stamp for at least two years, if they a present return ticket.

- For those who are willing to adjust and renew their existing visa, could now do so without leaving and re-entering the country.

- A resolution was also passed to empower ‘People of Determination’ so that they get an equal access to the job market.

Insurance scheme

A new insurance scheme was rolled out for employees of the private sector, which helped in reducing the cost of compulsory deposit of Dh3,000 per employee per year to Dh60. The UAE cabinet said that this new system will secure the employees’ rights especially in the private sector and it will also decrease their burden. Companies will be able to save around Dh14 billion in guarantee payments, which in turn could be invested in the further development and enhancement of their business.

The insurance policy also covers workers’ entitlements, which includes end of service benefits, overtime and holiday allowance, unpaid wages, employee’s return ticket and cases of injury at work, up to Dh20,000 per worker.

Visas

The new changes have also relaxed the penalties for people who have overstayed according to their visa and for individuals who have illegally come into the country. Earlier, these kinds of offences were handled with a re-entry ban; but now, people who overstay their visa would be offered to leave the country in a voluntary manner without a “no entry” passport stamp.

A new six-month visa is going to be introduced for people seeking a job and have stayed beyond their visa, but still want to work in the country. This temporary visa makes UAE a more attractive place for professionals and also improves opportunities and offerings it can provide.

As for people who came in UAE illegally, they also will be given a chance to leave the country voluntarily with a “no entry” stamp for about two years, provided they have a valid return ticket.

All the travellers who are going through any of the country’s airports will be exempted from the entry fees for the first 48 hours. Their transit visas could also be extended up to 96 hours by paying a cost of Dh50. The passport halls also have express counters at all airports, so that this process can be facilitated well.

Opportunities for individuals with disabilities

The UAE Cabinet also came up with a new resolution which empowered people with various disabilities, thus helping them to find jobs. This regulation gives them the required support to get equal employment opportunities in different sectors, which is in tandem with the Government’s social development programmes for all segments of the society.

The UAE Cabinet also decided to set up headquarters for the Asian Paralympic Committee in the UAE, which would serve as a sports hub in this region and also offer various training courses for people with disabilities.

So in case you are looking for PRO services in Dubai or Dubai residence visa services, do contact us. Our professionals at IMC can help you with all your queries and you are assured to get a hassle-free experience.

- Newsletter, Saudi Arabia, U.A.E

- July 17, 2018

The finance heads in UAE have forecasted a huge revival in the economy and plan to increase the level of their investments and funds in their businesses.

The companies in the Middle East are very positive about the upward economic development trend seen for the coming year. The leaders are keen to invest even more in their enterprises, as per a survey report by 2018 Global Business & Spending Outlook.

About 90 percent of the people who took the survey foresee sizeable financial expansion in the country’s economy, which is directly in line with world-wide trend or average of 85 percent. This means that company formation in UAE and company formation in Saudi Arabia is a viable option in this scenario.

The survey also proved that almost three-fourth of the region’s total finance heads are planning to enhance their spending and investment level by almost 6 percent or more. As per the statistics, there are five countries, which top the list in terms of growth of investment in the world; these are China (90 percent), Japan (87 percent), UAE (84 percent), Saudi Arabia (83 percent), and Russia (80 percent).

This survey was a study conducted by American Express and Institutional Investor and was based on an assessment of almost 870 senior executives like CFOs or senior management in the finance function of various companies from more than 21 nations, which had annual revenues of over $500 million (Dh1.83 billion). This study had respondents not only from the Middle East region (representing about 17 percent), but also from North America (about 18 percent), from Latin America (11 percent), from Europe (32 percent), and from the Asia Pacific (21 percent).

Findings proved that the uncertainty in the social, economic, and political environment is the new normal. However, about 73 percent of the survey respondents were of the view that the domestic risk or economy’s fluctuations did not affect their overall spending or investment plans.

But on the other hand, more than 77 percent of the respondents felt that they wanted to expand their business-level risk management procedures or bring in improvements in their processes. However, in case of any unexpected economic turns and turmoil, 80 percent of the executives would in most likelihood move their enterprise to some lower-risk location.

Focus on the customer

The study finds that a huge percentage of the business executives in the Middle East will chase goals that are linked directly to the core organic growth of their enterprise. About 77 percent of the respondents in the Middle East region thus gave top priority to meeting customer needs in a better way.

Most of them are planning deliberate moves like exploring and getting into newer markets (66 percent) and taking steps towards innovation and business transformation (44 percent). In fact, the data shows that the executives in Saudi Arabia are the most eager ones wanting to expand and penetrate into newer markets (83 percent). Some categories of high-priority spending in the region include mobile technology, transportation and logistics (31 percent), and entertainment and travel industry (30 percent).

Growth in the job market

This will also lead to a substantial increase in the job opportunities and workforce in the Middle East companies in the coming year. About 73 percent of the respondents expected at least a 6 per cent raise in the total number of employees in their companies. Though organisations plan on doing so, the respondents felt that administration, sales, and marketing were the functions, which were the most difficult to hire and also retain (47 percent in each category).

Companies in the region are forecasted to enhance using more of temporary or part-time workers (59 percent) and also on-shore employees (43 percent) by moving the overseas positions or roles to domestic locations, which was contrary to outsourcing and offshoring (just 19 percent).

- Newsletter

- July 17, 2018

This step has been taken to encourage foreign direct investment and therefore invigorate the economy.

Kuwait is going to issue some new laws which are aimed to loosen the tight grip on foreign investment and thus quicken the process for various projects. This will stimulate the influx of funds and capital and hence accelerate its economy, which is dependent on the oil industry.

All the officials and authorities in Kuwait, which is OPEC’s fifth largest oil exporting country, are getting ready to come up with new laws. The first draft of these laws would be proposed for approval in the parliament when the new session resumes in October post the summer break.

Not only are new laws being worked upon, the existing and currently applicable regulations are also being amended so that they are suitable to invite more and more foreign investment. The report also said that the purpose of the new laws is to appeal to the new investors and draw in more overseas assets and capital, motivate the citizens of Kuwait to also keep investing in their country, take measures to curb capital going out and simplify the procedures to set up new enterprises and projects in Kuwait.

Some official sources also confirmed that the new laws were required in the existing economic situation in Kuwait so as to enhance the scope of businesses for overseas investors and increase the ratio of foreign capital to overall investments in the country. This means that the process of company formation in Kuwait will become easier.

The report was coupled with government data that showed that the overseas capital in the country stood at only about 1 percent of the total investment in Kuwait in 2017 and the overseas direct investment flowing into the country was only around $301 million.

- Newsletter

- July 17, 2018

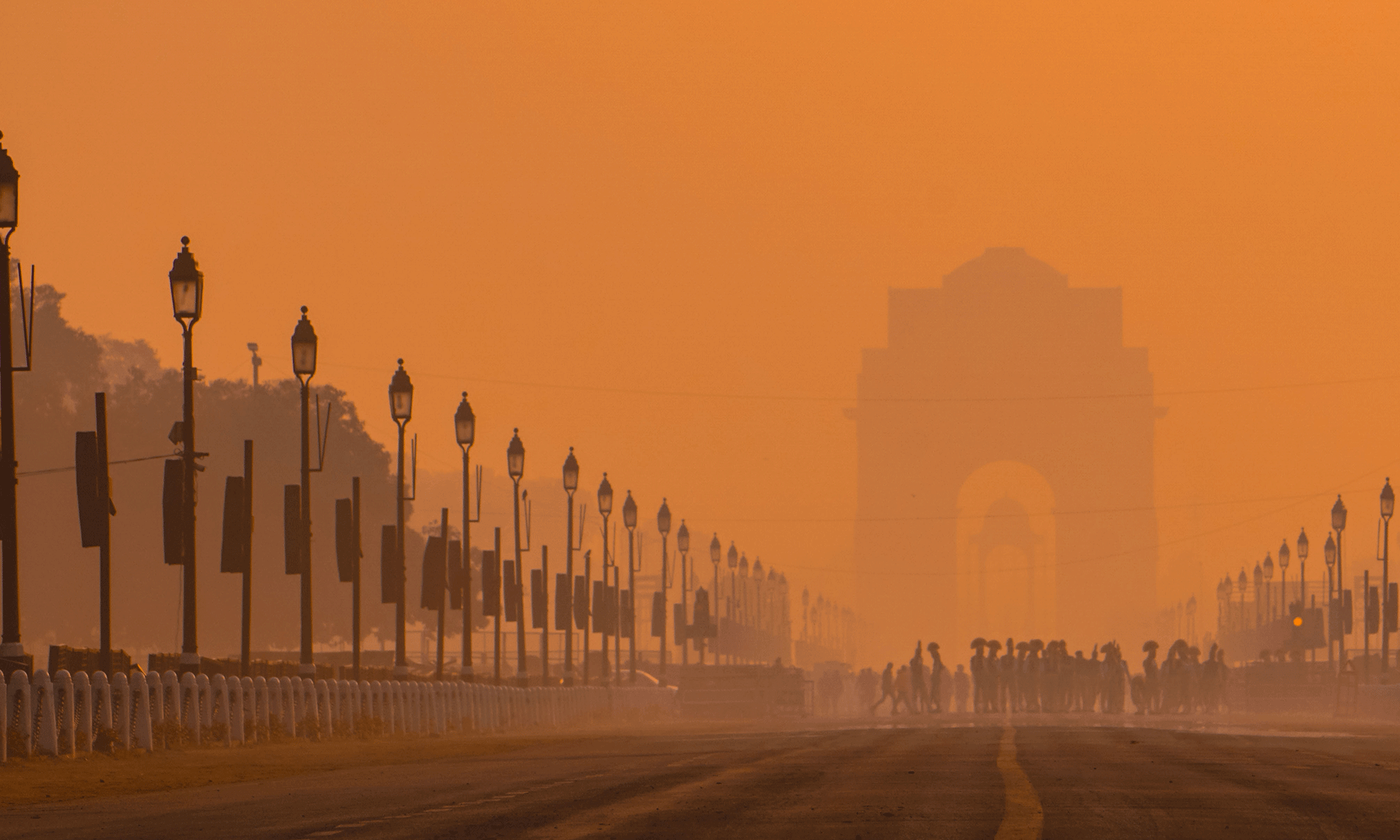

Do you know which is one of the fastest growing industry sectors in India? It’s the tourism industry. The hotels combined with travel industry went over $137 billion by 2016 end. However, the beginning of GST has impacted this industry in India in a big way. The Goods and Services Tax (GST) made its way in India on July 1, 2017, and since then all the experts and economists have been discussing the probable impacts of this new tax on the country’s economy and also on various businesses. But a deep-dive on the existing trends in the Indian tourism sector prove that there has been a positive impact and an upward turn after GST was implemented.

So let’s see how GST has helped this industry to further thrive. One reason why GST has shown a positive impact is that it has reduced the costs that customers have to bear and therefore, it makes their holidays more affordable. The main aim of GST has been to consolidate various taxes into one single tax amount, which in turn helps in decreasing the transaction costs related to tourism. The owners of various organisations and businesses earlier thought that GST would make things tougher for them. However, there surely are some challenges that come along the many positive consequences of implementing GST in the tourism industry.

The major benefit that GST brings is that the hospitality industry gets the benefit of homogeneous and uniform tax rates. Utilizing the input tax credit (ITC) has enhanced in a big way, thus simplifying and improving things. Many additional services such as complimentary food were also earlier being taxed under VAT. As per the new GST structure, these kinds of services would be taxed as bundled services. The hotels also gain because the end cost that the customers pay is going to come down. This works as a huge benefit for the hotels because they can attract more guests or tourists and hence grow their business. This in turn also increases the total revenue collection done by the government.

To do a reality check, major hotels in India follow a policy of dynamic pricing. Wondering what that means? The hotels basically fix the rates or tariffs manually depending on the total number of guests they are expecting in a particular season. Hence, we see fluctuating tariffs from in different seasons. The GST rates vary as per the tariff levels of various hotels, and thus, these hotels would need to ensure that the billing software they use, is updating the tax rates depending on the overall room tariff over the distribution channels including the travel agencies and the online aggregators. This helps the consumers in the long run and also maintains the transparency around hotel tariffs.

- Newsletter

- July 17, 2018

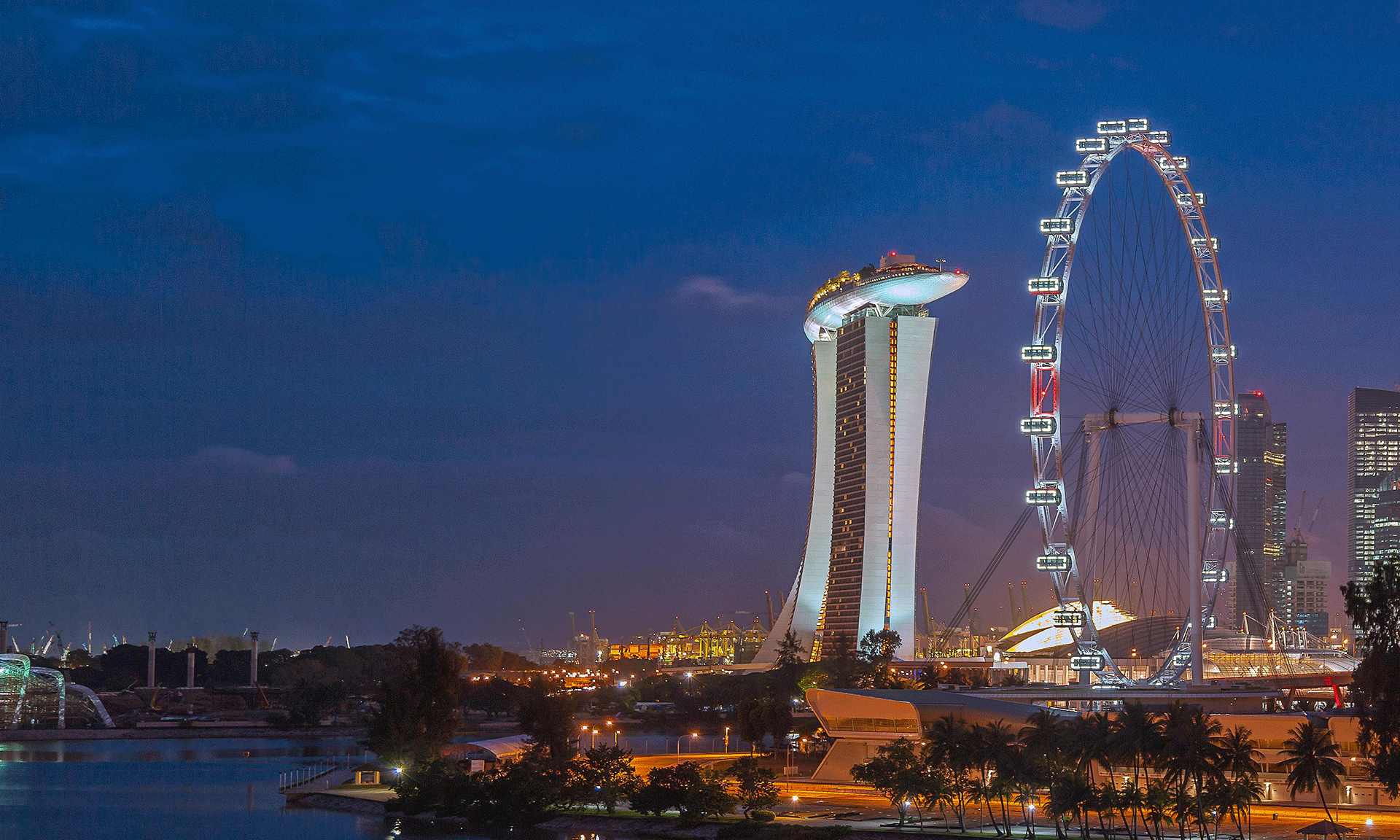

The experts of financial regulations are going to tackle issues like reform assessment, improving supervision and mitigating cyber risk in the coming decade, said the managing director of Monetary Authority of Singapore (MAS), Mr. Ravi Menon.

He was attending a Symposium on Asian Banking and Finance, which was organized by the Federal Reserve Bank of San Francisco recently. Mr. Menon’s speech was very futuristic and seemed like an address being delivered in 2028.

He pointed that the next few years till 2021 would be transformative because the regulators will be evaluating and estimating the effectiveness and influence of all the reforms, which were announced, post the global financial crisis of 2008.

Some sectors which are worth considering are infrastructure financing, trade financing and also small- and medium-sector business financing and market liquidity, where all the previous reforms have resulted in “sub-optimal social outcomes”, he said. The regulators who were focusing on the mentioned areas would want to regulate the adjustments so that the limitations could be eased out while keeping the risk at a nominal level.

Post that, the regulators could shift their attention towards improving the level of supervision and also aim on enhancing the cross-border collaboration and how they are managing various risks.

According to him, by 2028, maybe all the regulators get together and work out a “culture and conduct supervision” which would mean sharing best practices and also information on delinquent and those professionals who are not following the guidelines so as to discourage “rolling bad apples”.

Here, technology also plays an important role over the next few years. While handling operations, the supervisors probably would start to use the data analytics, assessment of the sentiments, and other various tools available in behavioral psychology to be able to learn more and get insights on the conduct and culture followed by different financial institutions.

However, there is an obstacle called cyber risk, which could gain prominence in terms of the regulatory schema followed by the central banks world-wide, said Mr. Menon. Hence the regulators might plan to set various standards for the distributed ledgers, and take efforts to make cloud computing services and dealing with artificial intelligence much safer.

The challenge, however, will be to stabilize the financial systems and also allow the financial sector to keep innovating and developing at the same time, so as to fulfill the requirements of the society and the economy on the whole.

- Newsletter

- July 13, 2018

Small enterprises and businesses give a huge push to not only a country’s economy but also to the world’s commerce scenario. Though it might sound easy, small enterprise owners are always on a roller-coaster ride, facing many ups and downs to sustain and reach the success they dream of. Though many entrepreneurs might aim high, they often miss one of the most important aspects, which is the proper maintenance of their finance and accounts books. Finance is like the major pillar of any business and not handling it effectively can give rise to major obstacles and problems, which could be very difficult to overcome. Any miss on the accounting and financial front could hinder the growth of the enterprise.

So let’s take a look at the main five ways in which small entities or businesses can deal with the finance and accounting challenges.

- Ensure to maintain proper accounts accurately:

It is imperative to maintain the books and records with accuracy for all the transactions done in the business. If the accounts are up-to-date and accurate, the day-to-day transactions and chores become simpler. Having said that, if the entrepreneurs are tracking their finances very carefully, it helps them to carefully tracking of the finances helps them to take a stalk to their enterprise’s financial status and also trace if there is any theft or fraud happening at any level. It also helps the business owner to know how many creditors and debtors they have and what are the impending expenses they can foresee in near future. This helps them to prepare their next steps and therefore resources and the budget they have. So business owners must take advantage of engaging professional accounting services in Saudi Arabia to avoid any stress related to financial planning or accounting.

- Spend on a good and latest accounting software:

Technology has advanced to a great extent and there are various softwares in the market, which can help a small business in financial planning, book-keeping and many other functions. These accounting softwares not only digitize the manual processes but also help entrepreneurs with accurate information about their businesses. It helps in accurately calculating the revenues, profits, expenses, and also making invoices and receipts. It also has a list of vendors and employees and hence the owners can focus on the bigger goals rather than worrying about accounting issues.

- Hire an expert and professional tax accountant

Usually smaller enterprises and entities do not have big budgets to spend and hence are not willing to shell out big amounts to hire a professional tax accountant. Most of such entrepreneurs try to take care of the taxation tasks and issues on their own to avoid hiring a tax expert. However, it’s important to know that an expert and professional accountant would have specialized experience and also the skills and knowledge needed to save tax for you and also plan your business finances accordingly. The tax experts are also up-to-date on the ever-changing laws on taxation and therefore they can easily handle the tax hikes and any hurdles that might crop up. Hence, it is imperative that all small businesses spend on hiring a trained and experienced tax accountant who can help organize and streamline your business accounts.

- Plan your financial projections and keep aside some cash reserves for any rough times

If you are an owner of a small business, it is important for you to get the financial projections done every year for at least three years. This will help in forecasting your revenues and profits that your business is expected to make and it also helps in tracking the expenses and budget and other smallest details like expenditure done on buying and maintaining machinery, other equipment, staff and all other resources. But at times, even if proper planning is done, there might be some unforeseen circumstances that a business owner is not prepared for. This happens only if the entrepreneurs are not maintaining proper and sufficient cash reserves. Therefore, it is always advisable to save and invest some portion of your profits as a cash reserve for future requirements that could arise. It is also advisable to keep an eye on these reserves and keep setting aside some part of your profits into these reserves on a regular basis.

- Demarcate your business and personal expenses:

At times, first-time entrepreneurs get confused and mix up their accounts. It is important to maintain separate accounts for one’s business and other personal expenses. If this is not done, it leads to a lot of chaos and the business won’t be able to calculate correct figures for their profits, expenses and taxes. Hence, the first thing any small business owner should do is to have a separate bank account for their business and personal use.

Effective planning and maintenance of business accounts and finances streamlines the business and helps in a big way. Our simple tips to do so will come handy for any small entities and also help them in times of financial challenges or crisis. So if you are looking for accounting services in Saudi Arabia, do contact us and our team of experts will assist you.

- Newsletter, U.A.E

- July 13, 2018

The Federal Tax Authority (FTA) revealed 20 designated free zones in the UAE that would be exempt from VAT which was recently introduced in the country. This move has brought a major relief and clarity for the companies operating in the free trade zones. With welcoming policies like these, UAE can expect increased growth as more organizations look for business setup in Dubai free zone.

VAT Free Designated Zones

As per the announcement, these 20 free trade zones would be generally considered to be outside of the UAE when it comes to the application of VAT. According to the UAE’s VAT law, the transfer of goods between these designated zones is now tax-free. However, such goods must not have been used or altered during the transfer process. Another point to consider is that such transfer must be according to the rules for customs suspension per GCC Common Customs Law. In a case where the conditions for transfer of goods are not met, the FTA may require a guarantee. This guarantee should be equivalent to the tax liability of the goods to be transferred.

The zone managers are required to follow internal procedures for keeping, storing, and processing of goods. The purchase of goods inside a free zone for incorporation into another unconsumed product within the same zone will not attract VAT. However, the movement of supply of goods into a zone from the rest of the country will not be covered under this rule and attract VAT.

There are total 45 free trade zones in UAE and out of these 27 are present in Dubai. From the 20 designated free trade zones, 7 are present in Dubai. This means 75% of the free zones will still have VAT applicable to them. Luckily, some of the most important free zones like JAFZA and DAFZA are included in the list of designated free zones. This relaxation has led to many newer businesses to consider company formation in JAFZA.

In addition to this, the Cabinet has also approved zero VAT on the supply of certain medications and medical equipment which are registered with the Ministry of Health (MoH). However, this does not include services related to medical equipment. Both these decisions will work retroactively from 1 January 2018.

List of Free Zones by FTA

Here is the complete list of Free Zones announced by the FTA as per the Annex to the Cabinet Decision No. (59) Of 2017:

- Abu Dhabi:

- Free Trade Zone of Khalifa Port

- Abu Dhabi Airport Free Zone

- Khalifa Industrial Zone

- Dubai:

- Jebel Ali Free Zone (North-South)

- Dubai Cars and Automotive Zone (DUCAMZ)

- Dubai Textile City

- Free Zone Area in Al Quoz

- Free Zone Area in Al Qusais

- Dubai Aviation City

- Dubai Airport Free Zone

- Sharjah:

- Hamriyah Free Zone

- Sharjah Airport International Free Zone

- Ajman:

- Ajman Free Zone

- Umm Al Quwain:

- Umm Al Quwain Free Trade Zone in Ahmed Bin Rashid Port

- Umm Al Quwain Free Trade Zone on Shaikh Mohammad Bin Zayed Road

- Ras Al Khaimah:

- RAK Free Trade Zone

- RAK Maritime City Free Zone

- RAK Airport Free Zone

- Fujairah:

- Fujairah Free Zone

- FOIZ (Fujairah Oil Industry Zone)

If you are looking for VAT registration service in Dubai, get in touch with us and we would be happy to schedule a consultation with you.

- Newsletter, U.A.E

- July 11, 2018

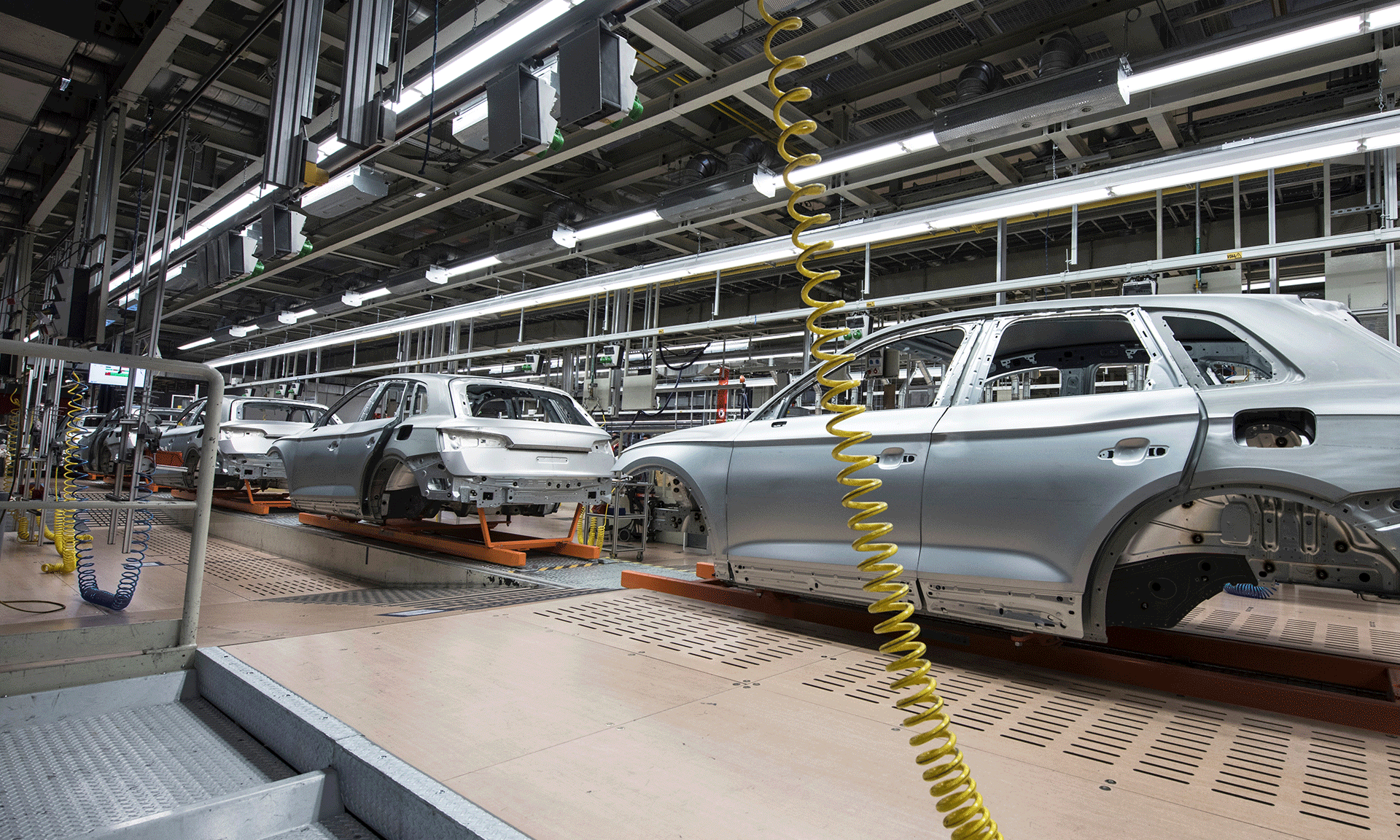

The vibrant automobile sector of Dubai is all set to witness a paradigm shift in the coming years. Starting with 2018, this multi-cultural hub has begun the year on an optimistic note and introduced many smart solutions in the automobile sector. The main focus of Dubai has not only been to climb the charts of a highly-advanced nation but also balance its economy with initiatives like green and a cleaner environment. The automobile industry in Dubai is also preparing for the grand event to be held in 2020 – the Expo 2020.

Given this backdrop, let us look at what kind of opportunities await the investors looking for business setup in Dubai free zone and mainland city.

- Car Rental Company: Starting your own car rental company is a great business prospect in Dubai. This is because the normal fare for travelling by cabs or taxis far exceeds the cost of just renting a car for the day. Dubai has other modes of transportation too, like the bus and the metros. But they don’t necessarily cover all the routes. So you stand to benefit a lot if you are the owner of a car rental company as there would always be foreign nationals, expats, businessmen, and other people looking to book your services.

- Parts and Accessories: In 2017, Dubai accessories and auto parts trade had hit DH 40 billion. For the previous year, it was 38.7 billion, resulting in a 3% hike. This goes on to show that the need for parts and accessories is ever increasing including for the purposes of exports and re-exports. Dealing in parts and accessories would be one of the most profitable ventures to carry out in Dubai.

- Truck Rental: Another great option to consider is getting a food truck license in Dubai. The street food culture of the USA and Europe is slowly making its way in Dubai too as the government of UAE started issuing licenses for food truck business. With the right business plan and all the necessary documentation and permits, this could turn out to be a great opportunity to invest in.

- Automobile Service: The Middle East is known for having the highest per capita spending on luxury vehicles worldwide. In the UAE alone, one in six cars sold is from a premium brand the likes of which include a BMW, Audi, Mercedes, etc. Additionally, the desert safaris serve as a bonus to add more demand for automobiles and SUVs. Needless to say, servicing for such high-end cars would always be a necessity.

- Automobile Insurance: All car owners are legally required to take out insurance of their cars if they are to stay in Dubai. So as long as there are people buying cars, there will always be insurance policies to be purchased for it. So you can study and compare the car insurance market in Dubai and consider becoming an insurance provider.

- Automobile Finance: Car financing is quite prevalent in the UAE. Almost 60 to 70 percent of the car buyers depends on a car loan to book their vehicle. Also, the interest rates are relatively low at 2 to 4 percent as compared to the outside markets where the interest rates are 5 percent. This makes automobile financing a lucrative business opportunity.

- Driving School: Driving in Dubai is more of a necessity than a choice or a luxury.If you have a driving license from any of the approved countries you can also convert your license to a UAE driver’s license without undergoing a road test. For other countries, you need to acquire your license after following the due process and clearing the tests.

- Newsletter

- July 10, 2018

Stunning infrastructure, high-quality lifestyle and liberal trade policies make Dubai company formation a lucrative option for investors. The economic diversity of this country draws many expatriates from all over the globe to explore the plethora of opportunities it offers. One of the most profitable ventures in Dubai is its Gold and Diamond industry. So, let’s have a look at how as an entrepreneur, you can start your gold trading business in Dubai.

There are three prominent areas in this thriving country where one can set up their gold trading business. They are:

1. DMCC Free Zone

Dubai Multi Commodities Centre (DMCC) has more than 13,000 companies and is one of the largest free zones in Dubai. With its key features like 100% business ownership, 50 years tax holiday and other freehold property options, many investors look forward to DMCC company formation.

Company Registration Process

-

Pre-Approval – This stage includes submission of a name reservation form to DMCC. This normally takes 5 to 7 working days. The authorities make a reservation of the name of the company while DMCC can carry out due diligence of the investors.

-

Company Registration – Once the preliminary due diligence is done by DMCC, the investor is required to submit the required documents necessary for registration within six weeks. These include pre-approval application form, passport copy, proof of residence, NOC certificate, and other such documents.

-

Company Licensing–In this final stage, once the registration is complete, the tenancy contract is required to be submitted. After that, you can receive your gold trading license and begin trading of gold within the DMCC free zone or even outside the country.

Reshaping Accounting Services in Dubai- Robotic Process Automation Read More

2. Gold & Diamond Park

This area is home to one manufacturing block (G+2) and a Retail Center (G only) and was established in 2011. It recently began leasing of office spaces for entrepreneurs looking to trade in gold.

Company Registration Process

-

After paying for the rent of the office space being leased, a contract agreement should be acquired from the Gold & Diamond Park.

-

Once you acquire the lease agreement, apply for a JAFZA license at the Jebel Ali Office.

-

On receipt of your application together with documents like agreement of partnership and copy of lease contract, the Jebel Ali Free Zone authority will grant you your license for gold trading.

3. The Mainland of Dubai

If you decide to set up your gold trading business in Dubai Mainland, the best location to opt for is the Gold Souk market. You can sell directly to the public here. This traditional gold market is in the center of the commercial district in Deira and is home to around 300 retailers. If you are interested in importing and exporting as well, the area around Port Rashid in Dubai is very popular.

Get in touch with us if you are looking to set up your gold trading business in Dubai. With decades of experience in establishing new companies in Dubai, we can take that stress off your shoulders.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group