The year 2020 celebrates India-Vietnam 42nd bilateral trade anniversary. India Vietnam relations have been steadily growing marked by economic, commercial and strategic engagements over the past four decades. India ranks 7th in the list of top trading partners of Vietnam while Vietnam has emerged as the 18th largest trading partner of India.

The increasing trade and investment ties between the two countries have prompted many Indian companies making investments in Vietnam in various sectors.

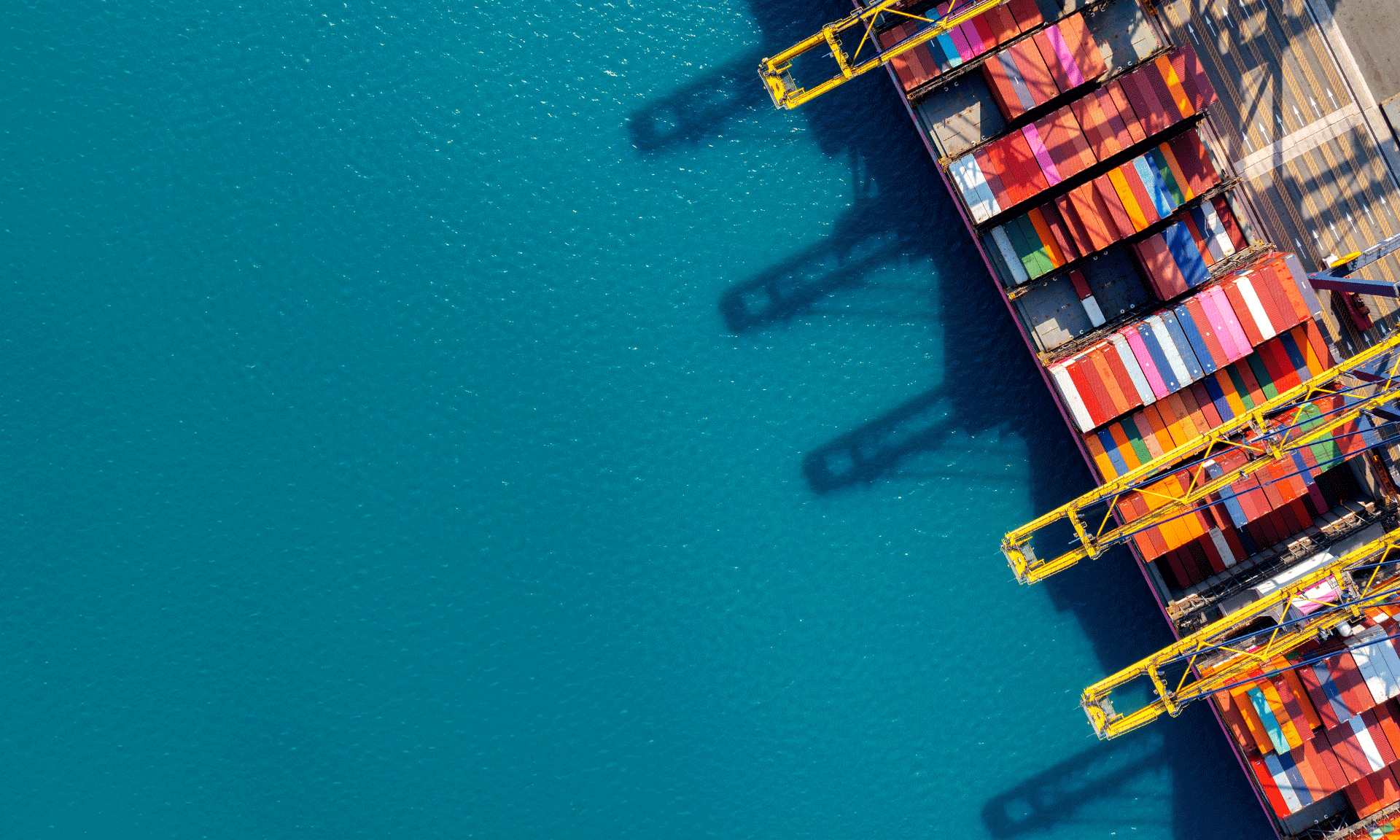

By 2020 both countries had aimed for a trade worth USD 15 billion with trade growing considerably from USD 5 billion to USD 13.7 billion between 2016 and 2019. Covid 19 pandemic, however, disrupted global economies and the India Vietnam trade volume shrunk by 9.9 per cent to almost USD 12.3 billion in the last financial year. The steady and rapid growth in trade between the two countries can only be understood by the fact that it was only USD 200 million in the year 2000.

Unprecedented volatility has gripped the global investment and trade environment and forced businesses to diversify supply chains away from China and has made India Vietnam trade routes for international business more significant.

Major areas of focus in India Vietnam trade and investment include energy, food processing, sugar, tea, coffee, mineral exploration, manufacturing, IT, agrochemicals and automotive components.

India is one of the fastest-growing economies in the world today and ranks 5th globally in terms of GDP. The ASEAN-India Free Trade Area ( AIFTA), which Vietnam is also a part of, had come into effect in 2010 as a result of convergence in interests of all parties in enhancing their economic ties across the Asia Pacific. This Free Trade Agreement (FTA) exempts tariffs for more than 80 per cent of goods traded between ASEAN and India.

Vietnam has quickly emerged as a lucrative and highly effective location for the manufacturing industries in electronics and telecom segments who are relocating from China because of higher cost and US-China trade war. The country could successfully revive customer confidence by swift and efficient containment of the pandemic. Vietnam is increasingly recognized as a preferred manufacturing hub for companies to diversify their supply chains.

Vietnam has improved its global ranking in ease of doing business ranking 70 amongst 170 economies and has incentivized its business environment enabling Indian investors to establish their operations in its thriving economy.

India, on the other hand, has world-class expertise in IT services, pharmaceuticals, oil and gas and can greatly benefit Vietnam. There also exists export opportunities for iron and steel, zinc and man-made staple fibres from India to Vietnam.

India also has a large middle class in its 1.3 billion population and offers Vietnam a huge market. India’s customs duty exemption for ASEAN products also makes India an attractive destination for Vietnamese exports. There is a huge prospect in developing services related to wholesale and retail trade, business support, transportation and storage including trade opportunities in cotton and knitted clothing.

Exports from Vietnam to India include mobile phones, machinery, computer technology, electronic components, natural rubber, chemicals and coffee while Vietnamese imports from India essentially consists of meat and fishery products, corn, steel, pharmaceuticals, automobiles, cotton, textile and leather accessories and machinery.

Vietnam is strategically located offering access to other South Asian markets with proximity to manufacturing hubs and has a friendly and conducive investment climate which have helped it gain popularity as preferred manufacturing and sourcing location.

The increasing importance of Vietnam in global manufacturing and supply chain is potentially beneficial to India for its bilateral trade and investment ties with this nation. India’s business conglomerates have already invested close to USD 2 billion in Vietnam with more than 200 investment projects.

Several Indian business entities have already invested and shown interest in establishing operations in Vietnam including Tata, Adani, Mahindra and HCL Technologies to name a few.

Vietnam provides numerous attractive reasons to woo foreign investors such as favourable investment policies, increased access to markets, free trade agreements, political stability, economic growth, low labour cost and young workforce.

Indian Government has long initiated business and trade tie-ups with Vietnam as an impetus to promote textile trade and investment between the two countries and sanctioned USD 300 million Line of Credit to Vietnam in 2014.

Despite disruptions in the global economy, Vietnam remains resilient in its economic growth prospects in coming years and provides investment opportunities to Indian investors in Agriculture, Seafood, Information Technology, Automotive Components, Assembling and manufacturing of Agri Machineries and Infrastructure.

Vietnam has introduced several incentives to attract foreign direct investment to the country including preferential corporate income tax rates, import duty exemptions, exemption of taxes from royalties, reduction in land rental fees, and privileges awarded to build-operate-transfer (BOT), build-transfer-operate (BTO) and build-transfer (BT) projects and projects in Special Economic Zones.

The incentives offered are primarily focused for promoting FDI in high technology sectors, underprivileged regions, labour-intensive industries, and other priority sectors such as education and health where foreign entities receive red carpet welcome for company formation in Vietnam.

In the long term, Vietnam can increase its investments in India by taking advantage of the India Government’s policy reform of loosening up of FDI quota for foods and beverages sector and 100 per cent allowance of FDI in the e-commerce, and foods manufacturing space and explore the company registration in India.

The India-ASEAN FTA however may be reviewed and analyzed for trade loss after India announced its decision to opt-out of the Regional Comprehensive Economic Partnership (RCEP).

IMC Group

IMC Group