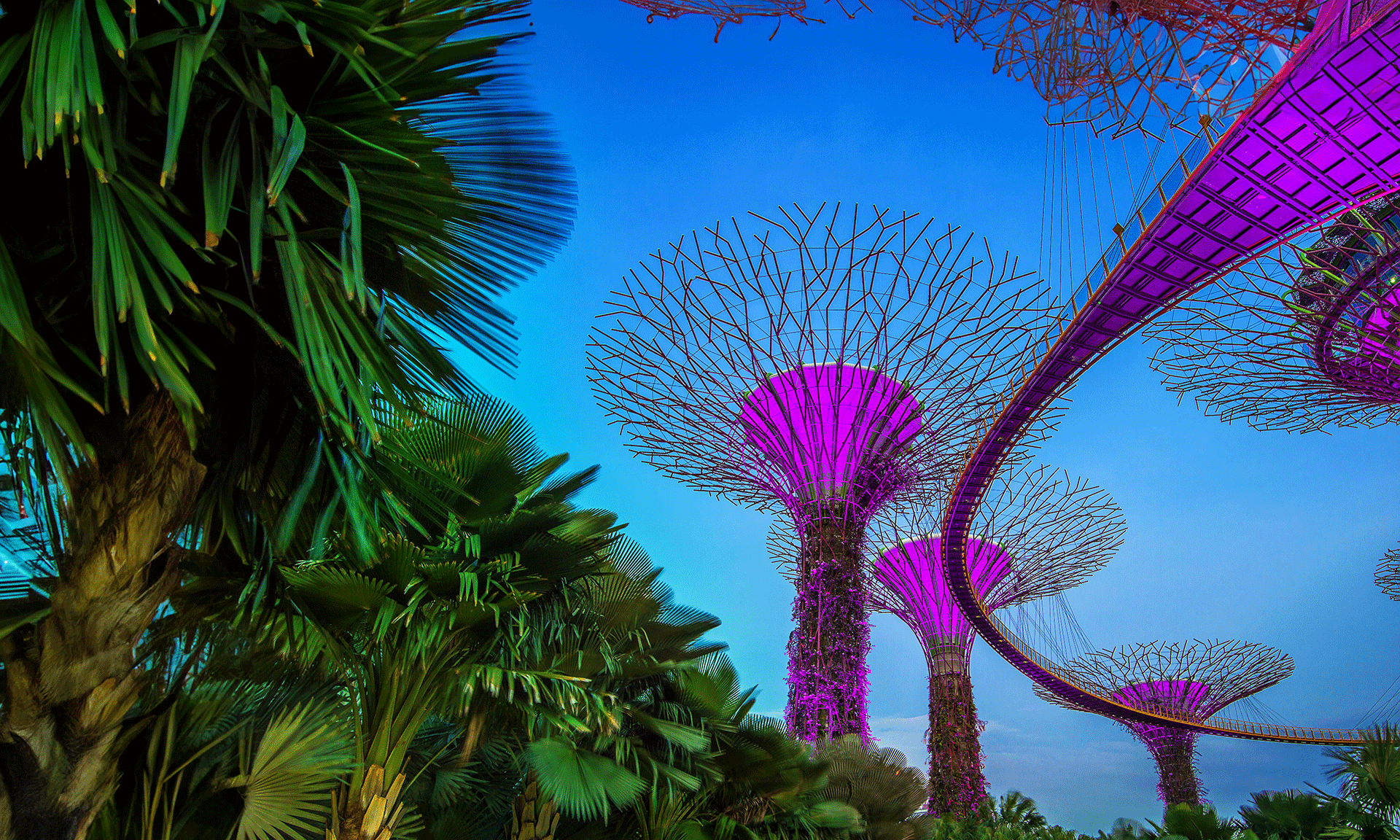

During the second quarter of 2020, we saw investments in Southeast Asian startups nearly double despite the damage to the global economy caused by the COVID-19 pandemic. Most of this surge of investments was driven by e-commerce and FinTech (financial technology) companies. According to DealStreetAsia, the Singapore-based startup information platform, the value of fundraising in southeastern Asia rose 91% to nearly $3 billion during the second quarter (April – June, 2020). At the same time, the number of transactions rose 59% for the same period.

Interestingly enough, many countries were under a strict lockdown during the second quarter of the year. To say the least, this hampered deal-making opportunities while economic uncertainty discouraged many investors. However, a number of different venture capital funds raised a significant amount of investment funds. According to an interview with Monk’s Hill Ventures’ co-founder and managing partner Kuo-Yi Lim, most deals had been in the pipeline since earlier in the year.

During the past 5 or 6 years, two largest ride-hailing businesses in the region (Gojek in Indonesia and Grab in Singapore) have led the way in the startup funding boom. During the first quarter, these two businesses were responsible for raising 70% of the regions’ revenues. This equates to over$2 billion. We witnessed a different picture in the 2nd quarter as the e-commerce sector raised $691 million while the FinTech sector raised $496 million and logistics raised $360 million.

Furthermore, a considerable amount of funds were raised by a number of other local companies as well. As a result, Southeast Asian economic experts contend that this is an indication that the COVID-19 pandemic has generated an increase in Singapore company incorporation. The 2nd quarter’s biggest fund raiser was Tokopedia, an Indonesian-based e-commerce company. According to DealStreetAsia, Tokopedia secured $500 million from Temasek Holdings, a Singapore-based investment firm.

Furthermore, the Vietnamese e-commerce company Tiki secured $130 million from the private equity firm Northstar Group. According to Tiki Vice President Ngo Hoang Gia Khanh, the company witnessed a dramatic increase in consumer shopping needs where face masks, hand sanitizers, and other necessities were concerned. As competition continues heating up in Vietnam’s local and regional business sectors, Tiki offers unique services in order to differentiate itself from other companies doing business in Vietnam.

With a network of fulfillment centers operating nationwide, the company provides an express delivery service known as TikiNow for shipping packages to customers within 2 hours from the time their order is received which is faster than their competitors. They also offer free, on-the-spot installation of bulky and heavy items. As Southeast Asia’s demand for online shopping venues continues to increase, delivery and logistic startups have also enjoyed increased revenues. For example, Kargo Technologies of Indonesia raised $39 million while Ninja Van of Singapore raised a whopping $279 million.

The FinTech sector has also seen some significant fundraising in several companies. For example, Voyager Innovations, the parent company of mobile payment app Paymara of the Philippines raised $120 million this past April from Tencent Holdings of China and KKR, a US private equity fund – two of their current shareholders. As the first funding round the company has had since 2018, Voyager Innovations was able to compete with their in-country rival Mynt.

Other notables in the fundraising deals arena included:

- Cleantech Solar of Singapore (energy sector) $75 million

- Kopi Kenangan of Indonesia (food and beverages sector) $109 million

- RWDC Industries of Singapore (biotech sector) $133 million

- Synqa of Thailand (FinTech sector) $80 million

- Traveloka of Indonesia (online travel agent) $100 million

IMC Group

IMC Group