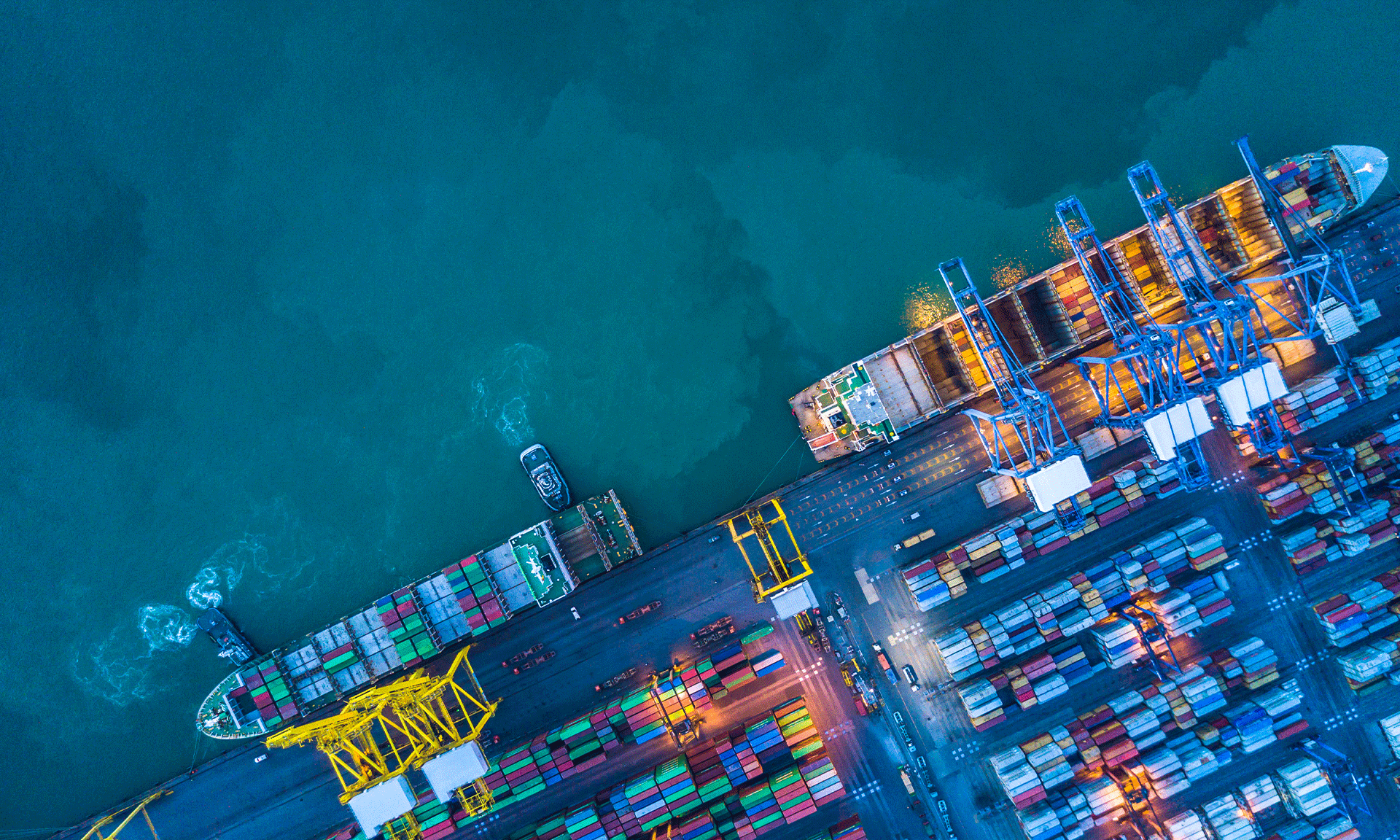

With an upsurge of the expansion rates in terms of output and even new orders in the middle of reports of a bigger market demand in 2019, all the non-oil businesses operating in the UAE felt that this year had a very positive start.

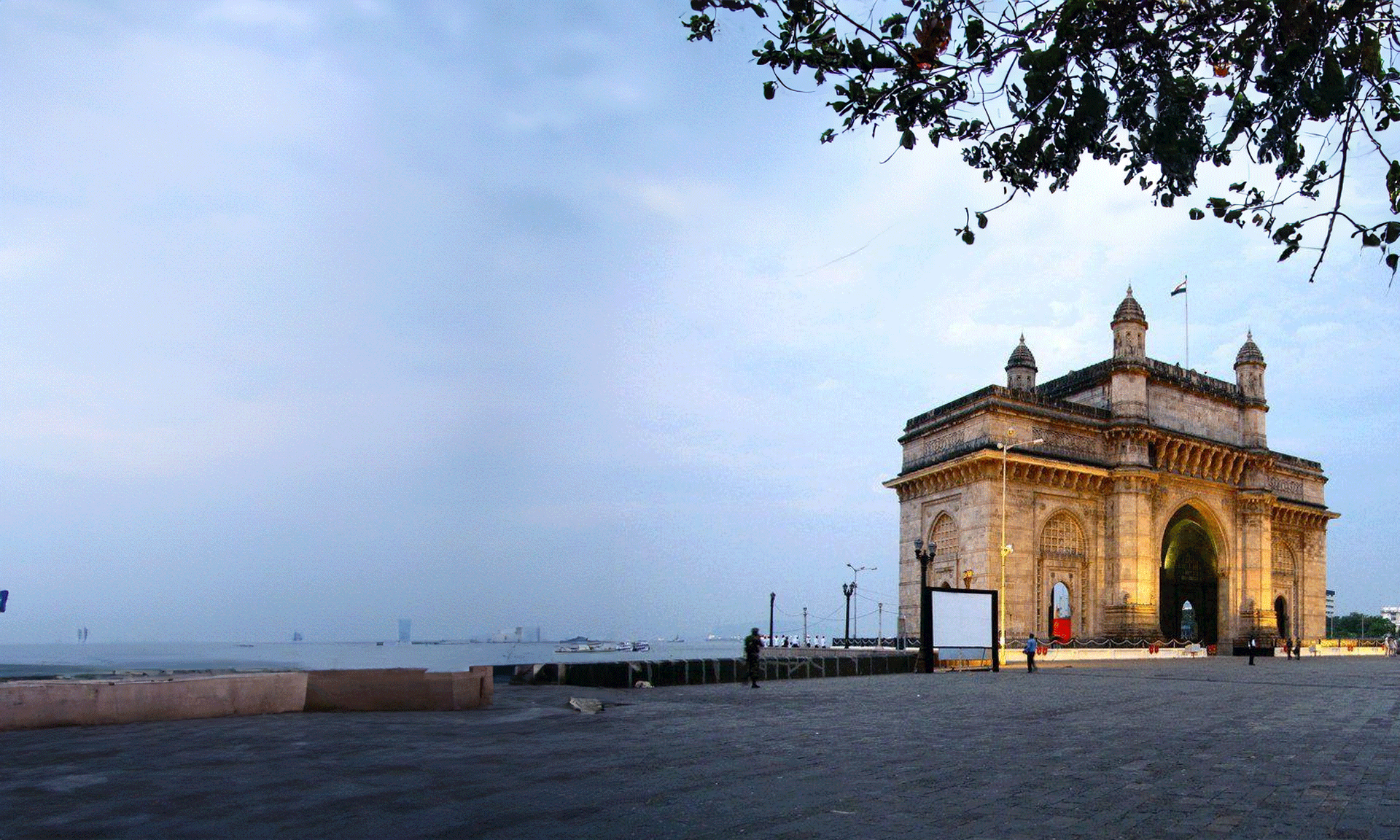

Mostly, the businesses remained confident about further progress in new orders resulting in growth of business activity in this year. Though some companies said that offering price discounts had enabled them to get bigger volumes in terms of new work, the output prices went down for the fourth consecutive month along with competitive pressures and comparatively feeble cost inflation.

As per surveys, the business activity expanded at the strongest rate since August, 2018. The rate of growth has also been faster than the series average. Where the output augmented, it was associated to higher number of new orders and also because of marketing and promotional activities.

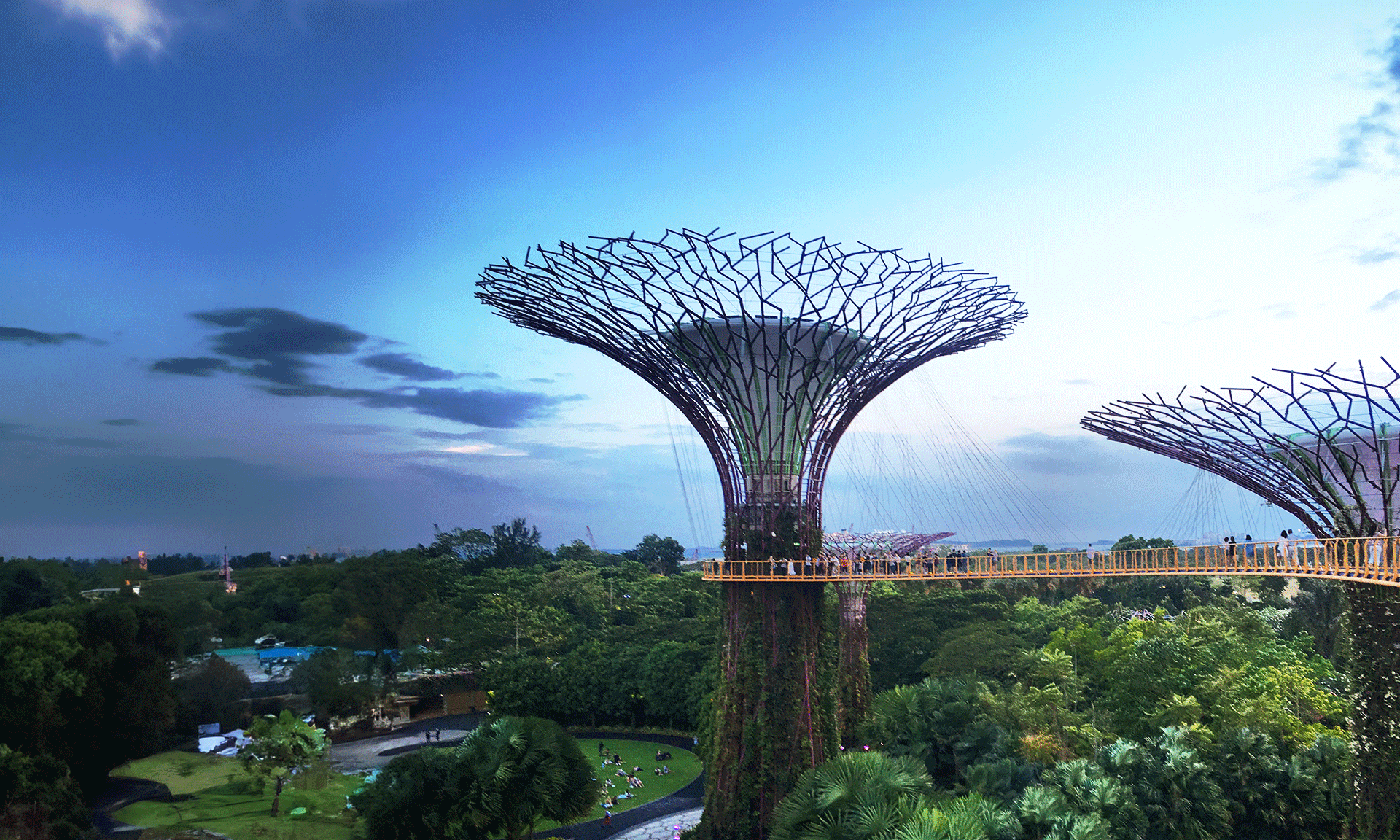

The survey’s results are in tandem with IMF’s observation that non-oil development in the UAE would go up further this year and in 2020 because of fiscal stimulus and also due to fast-track arrangements for the upcoming Expo 2020 Dubai.

The global financial institution has forecasted that UAE’s non-oil sector is all set to expand faster this year as compared to the oil sector in spite of some recovery in the crude prices and new company formation in Dubai is a good idea at this point of time.

The expansion in business activity was because of promotions partially and also because of huge price discounting done by various companies. The output price index continued to be below the neutral 50-level in January, 2019, indicating lower average selling prices in the country, although the percentage of price discounts in January was lesser. Selling prices have gone down for last eight out of nine months. However, the input costs went up modestly in the month of January.

Because of higher activity requirements, most of the firms had to hire extra staff during January. With companies acting as per higher order growth and bigger output, the purchasing activity was very strong in January. But the stock of pre-production inventories went down for the consecutive second month, proving that businesses are managing their inventories in a better manner and not building up stocks in expectation of the prospective demand.

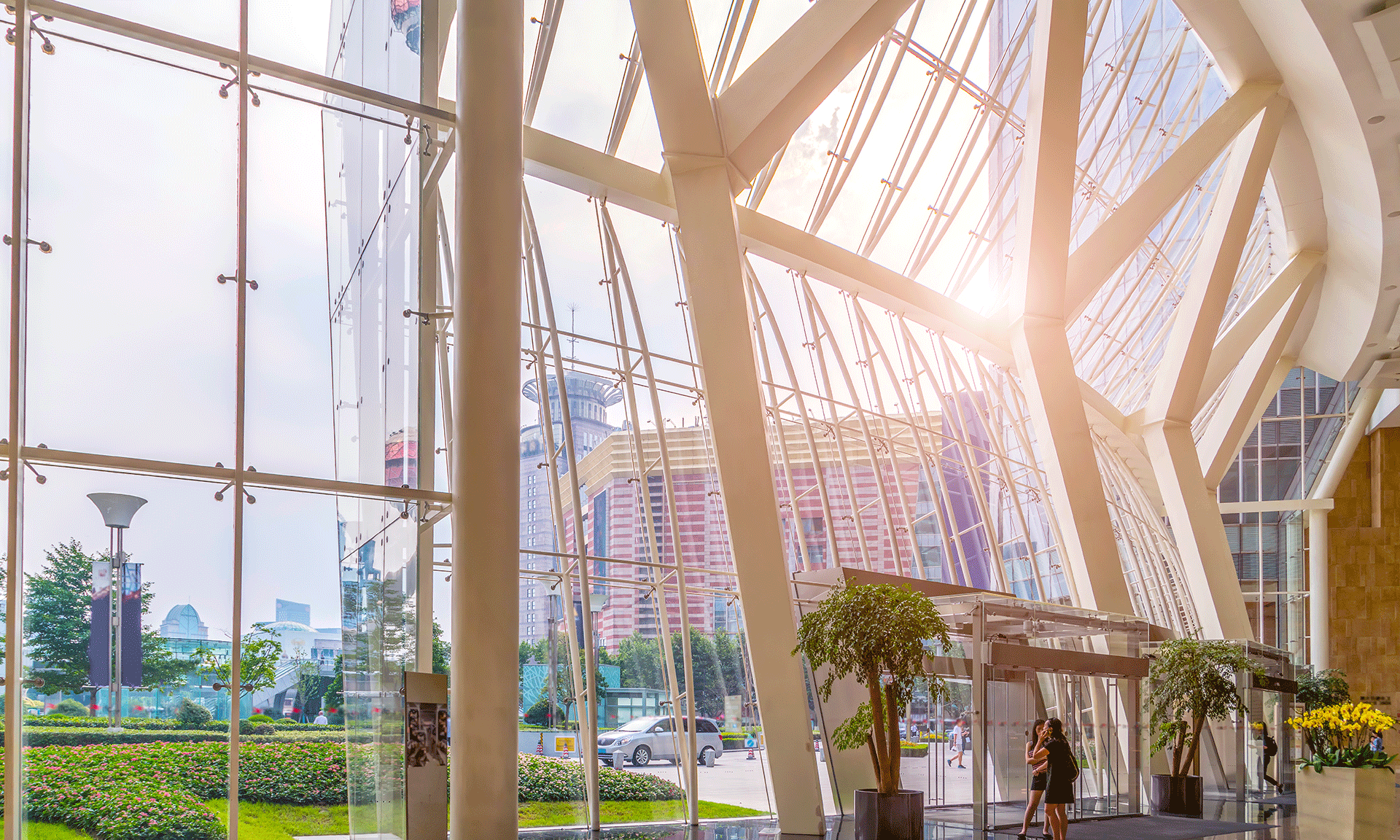

Over 68 percent of the companies expected their output to be higher within a year’s span. None of the companies that were surveyed predicted the output to be lower within a year’s time and optimism about the business in terms of future output stayed high in the month of January.

The business sentiment has been very high this year and has been strengthened as compared to that in December last year. The improvements in demand seen lately are expected to further go up, as all the marketing campaigns are forecasted to get positive results in 2019.

Another research shows that the investors in the UAE could be vulnerable to over-estimating the potential for the growth of investments in the near future. When the survey respondents were asked to guess their expected investment return in 2019, almost 24 percent people expected returns over 10 percent and just seven percent of the population expected returns to below two percent or in negative. Thus, this year seems to be a perfect time for business set up in Dubai free zone and if you have that as an agenda, but do not know how to go about it, please get in touch with us, and we would be happy to assist you.

IMC Group

IMC Group