The ‘Google for Singapore’ event was celebrated for the first time in Singapore on 23 August, Tuesday marking the 15th anniversary of this company. A large number of industry and government leaders, including Singapore’s Deputy Prime Minister and Minister for Finance Lawrence Wong (DPM Wong), attended this memorable event.

In Google’s 15th anniversary event, the search engine giant deliberated its plan towards empowering Singaporeans to further elevate the city state’s outstanding status as a regional and global technology innovation hub encompassing four principal pillars including investments, online safety, economic opportunities and sustainability.

DPM Wong, attending this event said, “In fact, Singapore will enhance its value as a hub for trade, technology and talent flow even as economic uncertainties prevail amid an increasingly divisive world.”

The Deputy Prime Minister, at this event, also adored Google saying that the tech giant has remained Singapore’s strong and steadfast partner since it set up its footprint in this country 15 years ago.

Drawing particular reference to the Covid 19 pandemic over the last two and half years, DPM Wong noted the praiseworthy work Google has been doing in close association with the Singapore government to help residents bridge the digital gap between studying and working from home and get connected.

DPM Wong forecasted trade and investments 15 years down the line and noted that friendship between nations will dictate and matter more in the present circumstances than in the past trade and investments.

“Increasingly, there is a new logic at work: Let us be friends first before we do business,” he highlighted, narrating the world at a turning point.

“Geo-politics is increasingly driving trade and investments. And if this trend were to continue, and it looks likely, then we are heading to a more bifurcated and decoupled world,” he said.

200 event attendees at Google’s Mapletree Business City II office on Pasir Panjang road were also reminded by DPM Wong that such challenges are not new to the Singaporeans who have dealt with such challenges since the country’s independence in 1965.

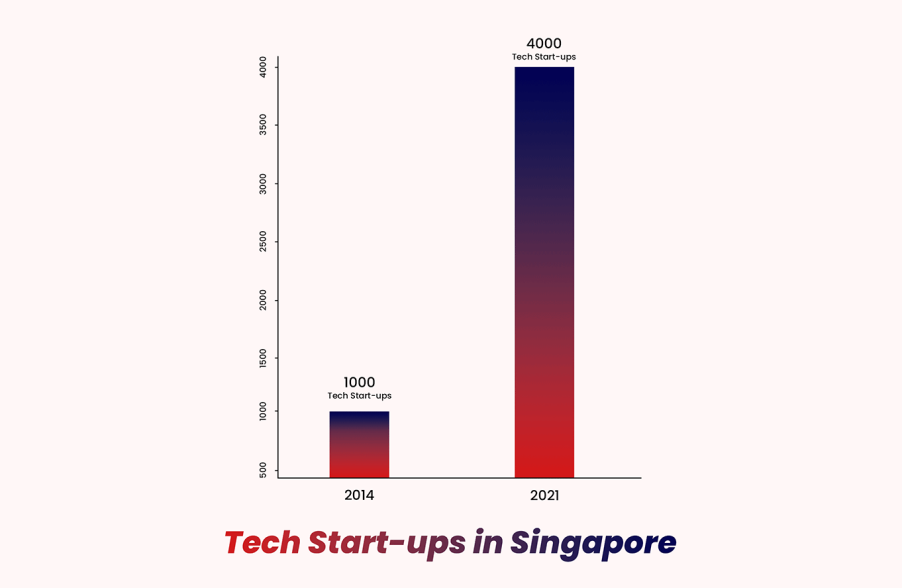

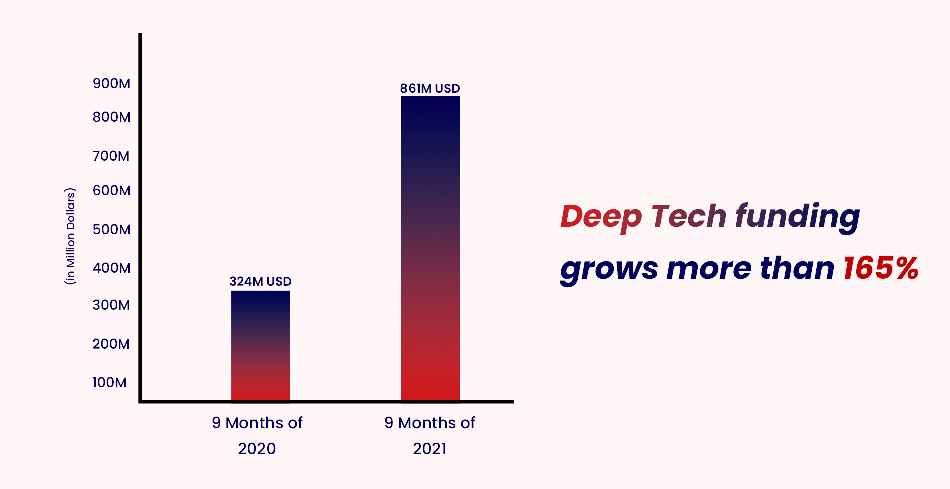

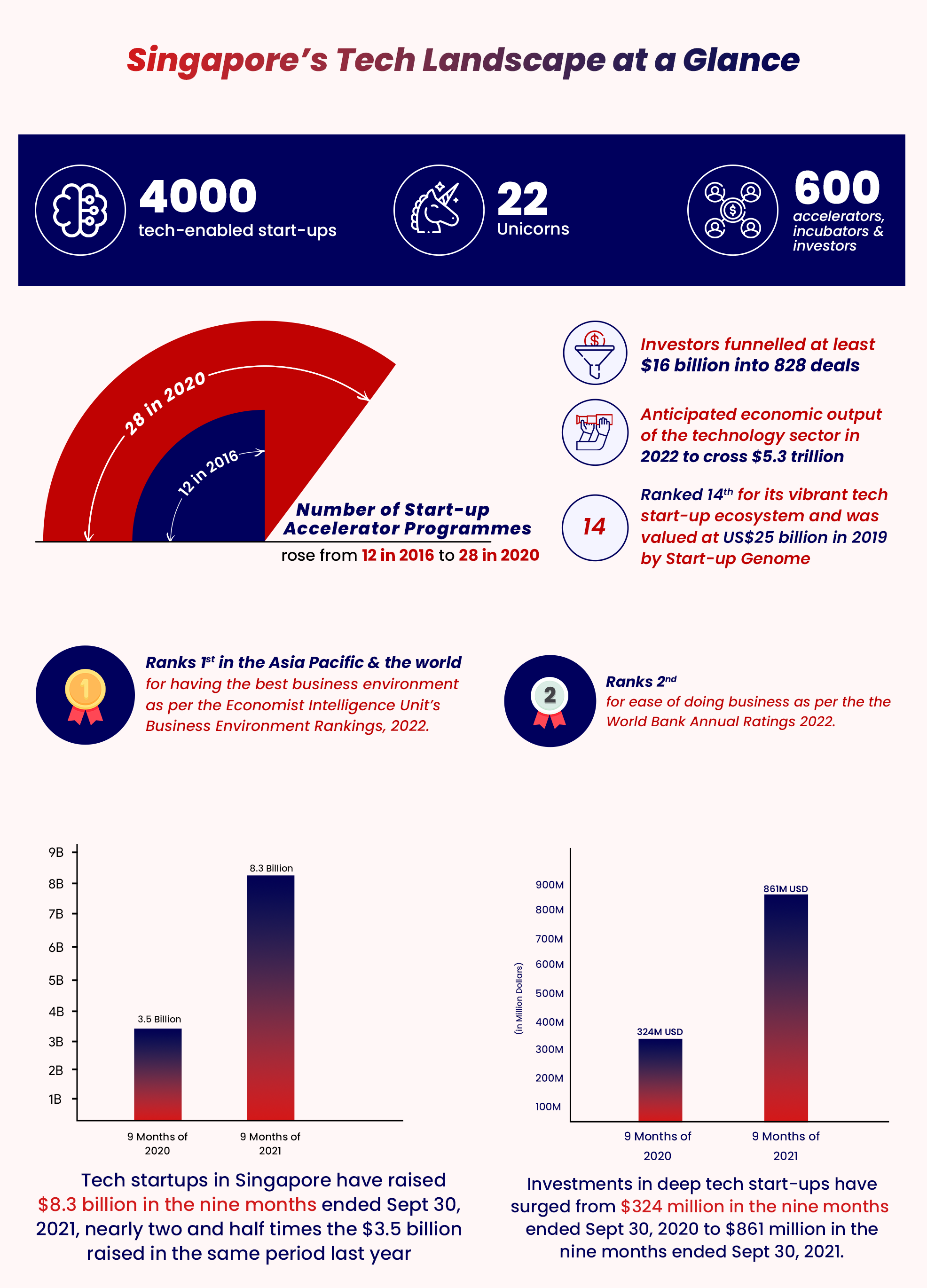

He also appraised the event attendees on investment and trade opportunities in Southeast Asia and Singapore, leading this continent in such matters.

“The digital economy in South-east Asia is only just getting started – fuelled by a huge, untapped but fast-growing digital consumer market,” he emphasized.

In light of increasing Asian wealth, a rising number of high net-worth families are consolidating their wealth in the city-state through formal structures and incorporating a Single Family Office in Singapore. This is how enhanced value creation is happening in Singapore as a trade and investment hub and as echoed by DPM Wong.

The Deputy PM also affirmed, “For its part, the Singapore Government will do everything it can to enhance its position as a hub for trade, technology and talent flow.”

Singapore is also striving hard to strike digital economy agreements with other countries to enhance trusted cross-border data flow to bring value through digital trade and innovation.

Singapore has recently entered into a Digital Economy Agreement with the UK. It also has similar pacts with Australia, Chile, New Zealand and South Korea. This new kind of trade agreement to boost digital trade is expected to attract more FDI through company formation in Singapore.

DPM Wong also stressed the importance of digitization in driving industrial growth and adding value as a tech hub. He added, “Of course, to be an effective hub, we also have to work with companies like Google to strengthen our tech ecosystem.”

Google officially launched its 3rd data centre in Singapore on Tuesday, Aug 23 and raised the company’s total investment in data and cloud facilities in the country to USD 850 million equivalent to SGD1.19 billion. Around 2.5 billion South Asian people will be able to access the services of this data centre.

Earlier an Oxford Economics report released by Google revealed that the company’s data centres in Singapore have contributed significantly to the country’s economy and generated around USD 216 million worth of economic activity in 2020.

Google Cloud and the Smart Nation and Digital Government Group (SNDGG) have secured a partnership deal to co-create innovative AI solutions for improving the work and lives of Singaporeans. The National AI Office of SNDGG has, for the first time, plans to enter into a public-private AI partnership with a renowned global technology company.

Google is also in the process of making a partnership with the IMDA and the Media Literacy Council for supporting the Digital for Life movement. This partnership will also ensure that 50,000 parents and children are trained on online safety. Be Internet Awesome (BIA) is a curriculum designed by the American tech giant to train primary school students which in turn will enhance the value of Singapore as a talent hub.

IMC Group

IMC Group