Recent diplomatic breakthroughs between the UAE and Israel have come as a boon for the UAE and Israeli businesses, and also to the other business communities in the MENA and the MEASA regions.

The UAE and Israel signed an agreement in August, 2020 and as per this agreement, the UAE and Israel will establish full diplomatic relations and the UAE becoming the third Arab nations, besides Egypt and Jordan, to fully recognize Israel.

On 20th August 2020: the UAE President Sheikh Khalifa Bin Zayed Al Nahyan issued Federal Decree-Law Number 4 of 2020, abolishing a ban on business and trade dealings that was in force since 1972.

“Trade and investment prospects for the UAE and Israel are a ‘dividend of peace ‘ that will strengthen the newly forged ties between the region’s two most innovative economies,” said Abdulla Bin Touq, the UAE Minister of the economy.

“The prospects of trade and commerce between Israel and the UAE are exciting for both countries,” Mr Bin Touq said in an online seminar organized by the US-UAE Business Council. He also highlighted that the two most powerful economies now trading and working together will give rise to endless economic growth possibilities in the region.

The UAE has long diversified from the hydrocarbon-based economy prevailing in the Gulf region and despite having the 8th largest reserves of oil, only derives 30% of its economic output from oil and remaining 70% coming from fintech and financial services, innovation and technology, construction and real estate, and defence.

The UAE is also a strategically located nation connecting the East to the West with developed logistics support of free zone ports and two reputed Airlines, Etihad and Emirates. It is also a very progressive economy with high levels of foreign investments, extensive double taxation treaty arrangements and business digitalization, and has already established itself as a world-class hub for global businesses and commerce.

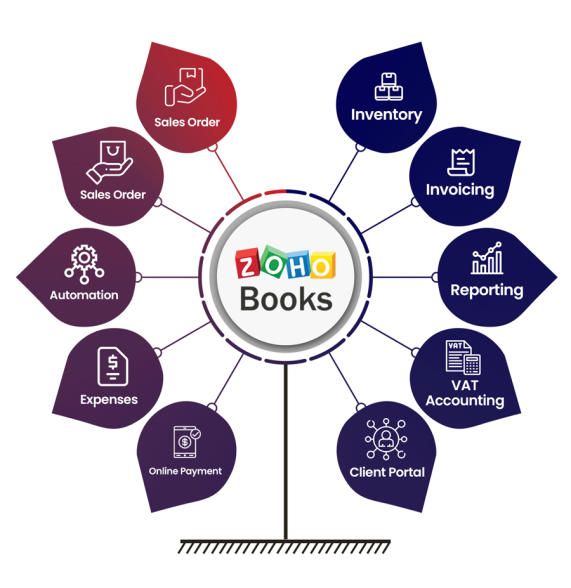

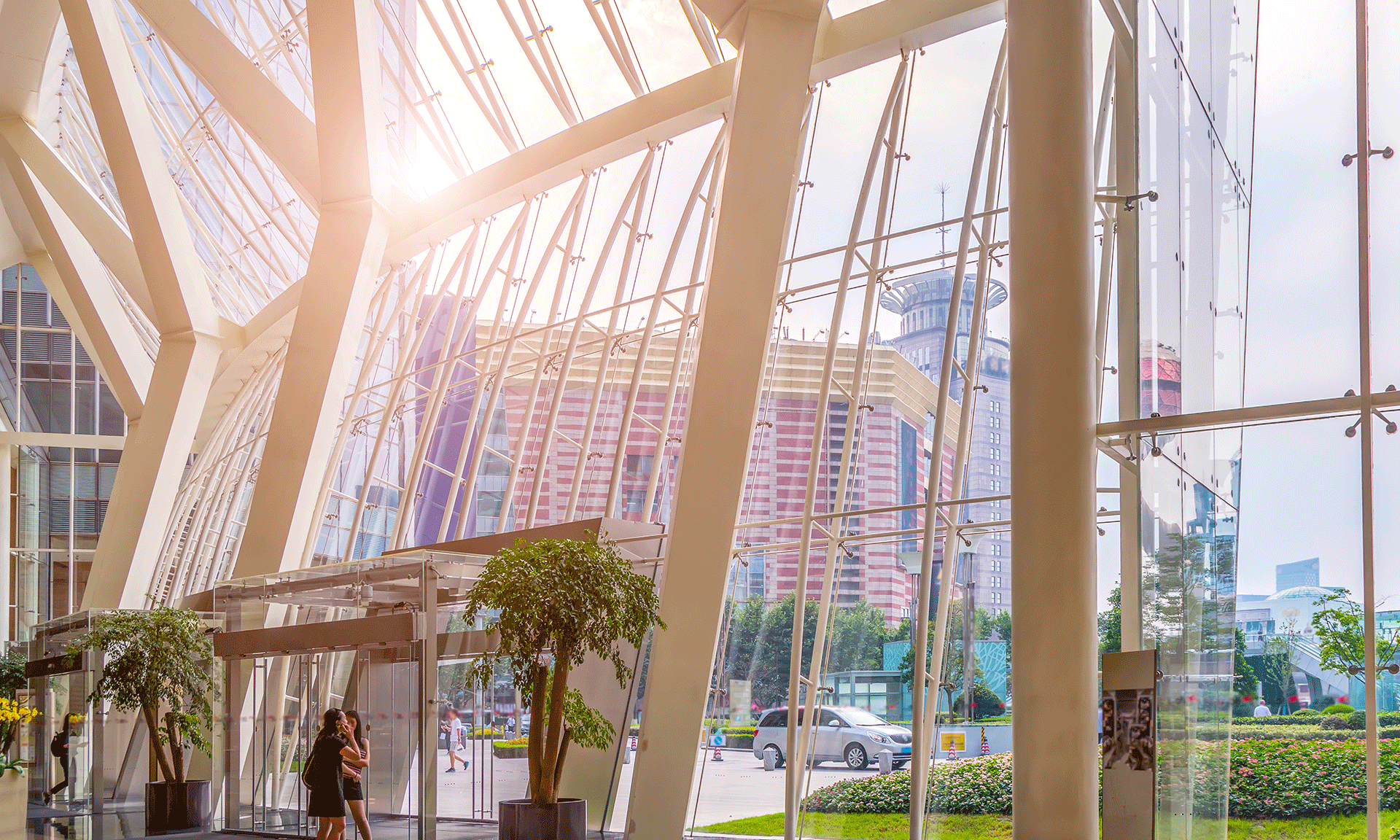

Dubai International Financial Centre (DIFC), the special economic free zone with its independent regulatory framework and judicial system, and 100% foreign ownership of companies have given the global economic prominence to the UAE. It is considered as one of the leading financial centres in the world and ranks 14th in the Global Financial Centres Index and higher than Frankfurt, Paris, Zurich, Chicago and Luxembourg.

DIFC, as a free zone is one of the most lucrative business destinations for foreign multinational business entities today and many startups, and established businesses are opting for DIFC company formation.

There are many special economic free zones in the UAE and especially in Dubai accommodating businesses from different sectors such as healthcare, media, technology, logistics and others. The UAE Government with a futuristic mindset also offers lots of incentives to prospective entrepreneurs for the business setup in Dubai.

Israel is an economically developed and technology-driven country with a free market economy. The country ranks first in the availability of scientists and engineers, the number of startups per capita, and venture capital investments per capita. It is considered a high-income country by the world bank.

There is immense potential for business opportunities and economic cooperation between the UAE and Israel in various sectors including logistics, aviation, Agri technologies, green and renewable energy, and food and water security.

The UAE was looking at eight trade and economic agreements with Israel including double taxation and free trade agreements before signing the Abraham Peace Accord in Washington.

Mr. Bin Touq said, “we are already seeing reports of Israeli firms signing deals with Emirati firms and we anticipate a host of joint ventures in almost all sectors.”

This diplomatic peace accord between the UAE and Israel has been an unprecedented and remarkable move in promoting business and humanitarian development in the Middle East region and the overall prosperity of mankind.

It was a memorable day when the first UAE Israel linked commercial flight landed in Abudhabi on 31st August.

Innumerable benefits in cross border trade and investment and in sectors related to health and pharma, tech and innovation, tourism and travel, and agricultural technologies exists between the two countries and will prosper with each passing day. Even Israel will benefit greatly from secure energy supplies from the UAE.

It is hoped that more Gulf countries follow suit and take the path of normalizing relations with Israel for a better cause of wealth creation, peace and harmony, and sustainable development of our world population.