- Newsletter, Saudi Arabia

- February 8, 2022

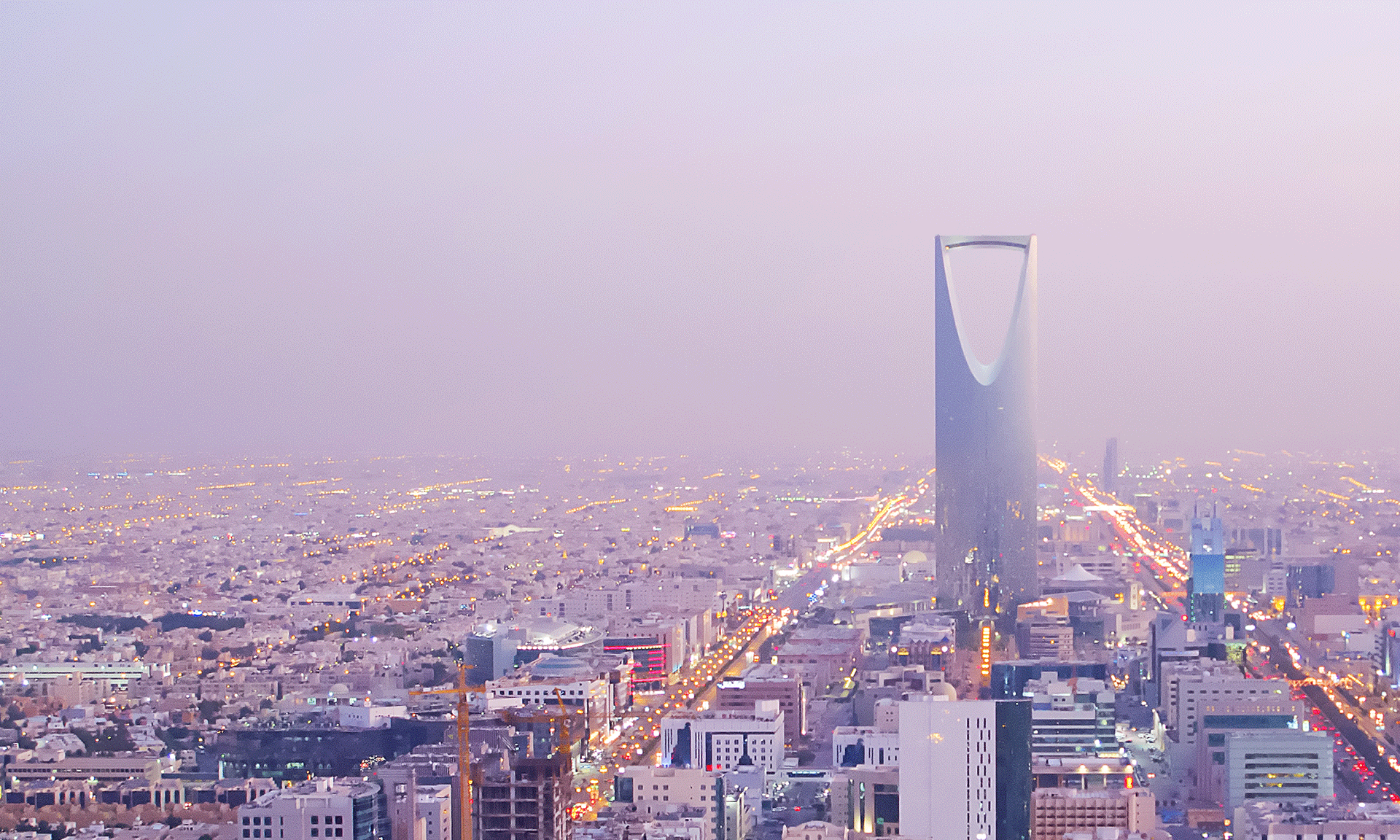

Saudi Arabia is planning to attract $3 trillion of investment into the country’s economy over the next nine years as part of the National Investment Strategy (NIS) to drive economic growth and sustainable development. The Public Investment Fund including other global and local firms will play the most valuable role. The investment minister recently remarked.

In his address during Riyadh Future Minerals Forum on 13th January 2022, Investment Minister Khalid Al Falih said, “The kingdom is striving to be ‘the most investor-friendly destination and increase the participation of the private sector to ‘our large and growing economy, to 65 per cent.”

To promote investment contribution to the GDP, the Kingdom is planning for a global best in class investment law to attract more domestic and foreign investors for doing business in Saudi Arabia. The new law shall address the needs of both local and foreign investors. “It will be a global best-in-class law, it will be enacted this year, sooner than later,” the Minister highlighted.

Commenting on the crucial role the international investors play to support the country’s economic growth by establishing their business setup in Saudi Arabia, Mr Al Falih emphasized, “not only bring in the capital but bring in that know-how and best practices which benefit Saudi partners and the economy.”

To complement Saudi Vision 2030, the Kingdom of Saudi Arabia, the largest economy in the Arab world is steadily diversifying from an oil-based to the non-oil economy and is developing projects across key priority sectors including real estate, petrochemicals, manufacturing, transport and hospitality to drive investment and enhance demand and employment generation.

His Royal Highness Crown Prince Mohammed bin Salman noted last year that the Public Investment Fund is making huge investments infusing billions of dollars into the country’s economy to drive growth. USD 40 billion fund injection has been planned yearly during 2021 and 2022, HRH Crown Prince highlighted.

The Investment Minister added, “The kingdom will be – in terms of its regulatory system and judicial system – one of the best places to do business. We are already good by the way international investors and domestic investors have been finding investing in the kingdom to be stable, predictable and secure, but we are not happy with being very good and we want to be the best. And we believe that our regulations and reforms are taking us in that direction.”

The Kingdom witnessed higher FDI flow into its economy in recent times as also revealed by the issuance of new foreign investor license data registering the highest number of 478 new licenses during the first quarter of the previous year since 2005.

The NIS includes many initiatives including the expansion of the country’s railway network and plans to increase it with 8000 Kms of the new track thus tripling the sizing of the existing network. The investment minister informed.

“New rail will criss-cross the Kingdom and add to the network we already have,” Khalid Al-Falih told the Future Minerals Forum in Riyadh.

There is approximately 3,650 km of track on the Saudi rail network presently and it also plans to build more internal railway networks to jump-start its investment in the infrastructure sector, highlighted the Minister.

To realize Saudi Vision 2030 several socio-economic structural reforms have been rolled out in the Kingdom and approval of new privatisation and agriculture laws including a new mining law in January 2021 feature amongst them.

- Newsletter, Singapore

- February 8, 2022

Family businesses play the most pivotal role in the Asian economy and almost 85% of the companies in the Asia Pacific region are owned by family groups. Moreover, more than 20% of the top 750 global family businesses ranked by revenue are based in Asia with total revenue of approximately USD 2 trillion.

Trusts, unlike companies and not being a legal entity, have provided an effective structure for holding valuable assets for the beneficiaries and transitioning from the settlor to the trustee like a family business, for a long time. The absence of rigid formal requirements for the creation and operation of trusts, and the high flexibility of trust structures, make them particularly useful for estate and succession planning.

Trusts are being used for holding and passing on family wealth for centuries and providing great advantages of asset protection and disposal of family assets without lengthy probate procedure. Such trusts when combined with a Singapore Private Trust Company (PTC) provide a structure for enabling founders to take continued rapid commercial decisions about their business effectively without sacrificing the validity of the trusts. These private trust companies commonly known as family trust companies form the foundation of the Singapore family office.

If the settlor is willing the board of the PTC can consist of the settlor, members of his family and professional trusted advisors and the settlor and his family members have direct involvement in the decision making processes. A Singapore PTC vehicle thus allows members of succeeding generations of the family to be involved in the management of the PTC providing Management succession planning.

To avoid personal ownership issues, a Purpose Trust is often used to create an entity with no individual owning the structure. Typically, a separate non-charitable purpose trust is used, with the purpose of the trust being to hold the shares of the PTC and especially when control and confidentiality are concerned. The benefit offered is that the Trust can then be used to ensure the board of the PTC is properly controlled. This trust type is formed to hold assets for a purpose and without providing a benefit to any specific individual.

Though Singapore does not have legislation allowing non-charitable purpose trusts, it is possible for the shares in a Singapore PTC to be held by a trust in another jurisdiction with appropriate provisions for the non-charitable purpose trusts formation.

PTC can also hold other assets, such as real estate, private equity and hedge funds appropriate for the family and diversify to optimize assets as and when necessary. As PTCs have no motive for profit-making with no conflicts of interest, the entity can reduce costs of trust administration while ensuring the needed risk management as per the risk appetite of the family. PTC structure with high liquid assets can also invest in and facilitate the best Singapore company incorporation.

There is often slowness or reluctance on the part of the Independent professional trustees in approving certain assets for holding or entering into major transactions or Singapore PTC however provides greater choice to determine investments to be made with the trust fund based on knowledge of family members acting as members of the board.

Continuity of business is assured with a Singapore PTC because even if the administrator changes, PTC remains as a trustee.

In Singapore, the ownership of Singapore companies and PTCs are publicly available on the company register. However, certain confidentiality is maintained and ownership information about trusts is generally not available. A Singapore PTC owned by a purpose trust in a jurisdiction allowing a non-charitable purpose trust structure will maintain confidentiality about the owners of the PTC and the asset holdings of the trust.

As several family businesses in Singapore are focusing on leadership succession, besides wealth succession, a Singapore PTC structure can be beneficial as it familiarizes the family members with the wealth and business interests owned by the trust and provides appropriate instructions to the members in managing such assets.

The island nation with its current trust law and trusted legal system, world-class infrastructure, high level of digitization, openness to foreign talent, attractive tax regime and political stability has come up as a global hub for corporate and financial services activities. The city-state now has become home to many sophisticated wealth management entities including the Single Family Office in Singapore.

- India, Newsletter

- February 8, 2022

Narrating the recent Omicron surge as “a flash flood than a wave”, the Reserve Bank of India’s (RBI) report claimed the country’s economy to be on strong footing despite the rapid surge of new and more transmissible covid 19 cases. The near term economic prospects remain unaffected, reported RBI.

“On the vaccination front, India has made rapid strides. On the Omicron variant, the recent data from the UK and South Africa suggest that such infections are 66 to 80% less severe, with a lower need for hospitalisation,” the recently published RBI Bulletin noted.

Community Mobility indicators revealed that in January 2022, the public movement dropped in some cities but was higher compared to covid 2nd wave and remained above its pre-pandemic level. There has been an increase in electricity generation which reached pre-pandemic levels, RBI said.

As the new year 2022 arrived, covid recovery in India faced headwinds as in the rest of global economies due to a rapid surge of Omicron cases. However, business and consumer confidence haven’t been dented that severely and acted as the silver lining for the nation’s economy, RBI highlighted.

The RBI said that the trajectory of Omicron, the new Covid-19 variant, is on a declining mode and the average demand conditions look strong and resilient with consumer and business confidence remaining upbeat including an increase in aggregate bank credit levels for doing business in India.

“Nonetheless, amidst upbeat consumer and business confidence and an uptick in bank credit, aggregate demand conditions stay resilient, while on the supply front, rabi sowing has exceeded last year’s level and the normal acreage,” the RBI reported.

The RBI report mentioned that reduction in inflation may not fade away too quickly and it is being monitored closely. There are signs of improvement as supply chain disruptions are slowly easing and burgeoning shipping costs are steadily reducing, RBI said.

There are signs of recovery and expansion in manufacturing and several categories of service sectors, India’s Central Bank reported. It also highlighted saying, “Overall economic activity in India remains strong, with upbeat consumer and business confidence and upticks in several incoming high-frequency indicators.”

The RBI re-emphasized that the new covid variant caused much less hospitalization and sounded optimistic on the near-term economic prospects and financial markets. India’s digital payment ecosystem is also in rapid expansion mode as opposed to a clouded and uncertain global economic outlook. “Inflation continues to mount across geographies amidst disruptions in production, supply chains and transportation,” the report mentioned.

There are widening differences observed in monetary policy stances of different countries due to economic uncertainty caused by higher inflation, disruptions in production, supply chain and transportation, the RBI noted. On the positive side, this also opens a window of opportunity to mobilize all resources on enhancing the global recovery, it added.

As per the Commerce and Industry Ministry report, India has registered the highest-ever annual FDI inflow of USD 81.97 billion during FY21 as several foreign investors preferred company formation in India.

- Newsletter, Saudi Arabia

- February 8, 2022

As reported by the Saudi Press Agency (SPA), the board of directors of the Royal Commission for Riyadh City (RCRC) convened a board meeting on 27th December 2021 to review Riyadh Strategy 2030 in light of the preparedness for its launch and decided to delay the launch of the 2030 strategy for the Kingdom’s capital due to the mammoth work involved and some of the key elements remained to be addressed.

His Royal Highness Prince Mohammed bin Salman bin Abdulaziz, Crown Prince, Deputy Prime Minister, and Chairman of the Board of Directors of the RCRC chaired the meeting.

The strategy for the Kingdom’s capital is to be put in motion during 2022 and further announcements would be made accordingly, the report cited. The Riyadh strategy 2030 to transform Saudi’s capital into one of the world’s top city economies was seen entering the final phase of implementation as the Saudi Crown Prince directed government officials to keep working on the executive plans of the strategy and directed all national and city-level government institutions to conclude the implementation of plans of the strategy before its launch, reported SPA.

As per the report, all government entities would be working closely with the RCRC and would present detailed plans and documentation of the initiatives and projects relevant to their respective sectors. Before setting the strategy in motion, detailed budgets would be proposed and responsibilities defined for ensuring a robust, integrated and full proof governance framework for implementing the strategy. The Crown Prince deliberated unveiling of a more detailed strategy soon.

Businesses willing to expand their operations through company formation in Saudi Arabia need to be in close touch with the RCRC, the entity responsible for implementing the Riyadh strategy, to explore and unlock potential partnership deals.

Prince Mohammed noted during the recently held Future Investment Initiative (FII) conference from 27-28 January emphasizing that the Riyadh Strategy will transform the capital into one of the world’s top ten city economies that would double its population to 15–20 million people. The strategy will also increase the number of visitors to more than 40 million by 2030, he also highlighted.

Built on six main pillars, Riyadh Strategy 2030 includes national human capital development and attracting best foreign talents, economic growth across various sectors, improvement of quality of life of its citizens, word-class measures for improving spatial impacts on urbanisation, effective governance and best utilization of resources of the city, and global branding for improving the city’s competitiveness, the SPA report revealed.

26 sectoral programmes will take the strategy implementation to fruition and include over 100 initiatives and 700 pioneer projects across various sectors. The initiatives and projects will cover different parts of the city and help transform Riyadh into one of the best cities globally to live in.

During the implementation phase, RCRC will monitor and measure more than 50 performance benchmark indicators, based on global leading cities, the SPA report highlighted.

As Riyadh Vision solidifies, foreign companies considering doing business in Saudi Arabia need to get proactively associated with the RCRC that can help address any future regulatory issues.

- Newsletter, U.A.E

- February 3, 2022

On January 31, 2022, the Ministry of Finance announced that the United Arab Emirates (UAE) will introduce a Federal Corporate Tax on business profits effective from June 1, 2023. The new tax regime has been introduced with the aim to incorporate best practices globally and minimize the compliance burden on businesses.

The statement mentions that the tax will be levied on all corporations and commercial activities in the UAE with a few exceptions. The new regime implies a standard statutory tax rate of 9% for taxable income exceeding 375,000 UAE dirhams ($102,000). Furthermore, to promote the growth of small businesses and start-ups, there will be a 0% tax rate for taxable income up to 375,000 UAE dirhams ($102,107.50). Having said that, the legislation is yet to be issued and the details for the corporate tax regime are subject to finalization.

The announcement brings a significant shift for a nation that’s long attracted businesses from around the globe because of its status as a tax-free commerce hub.

IMC Group has summarised the key aspects of the announcement which are as follows:

Corporate tax will be payable on the profits of UAE businesses as reported in their financial statements prepared in accordance with international accounting standards, with minimal exceptions and adjustments. The corporate tax will be applicable to all persons including individuals and legal persons undertaking business activities under a commercial license in the UAE. It also includes entities operating in the banking sector.

Entities subject to corporate tax are allowed to carry forward excess losses and utilize them as of the effective date.

The corporate tax will be applicable to all businesses and commercial activities with the following two exceptions:

- Entities engaged in the extraction of natural resources will be exempt and will remain subject to taxation at the Emirate level.

- Entities operating in free zones without any business conduct with mainland UAE will continue to receive tax incentives on complying with all the regulatory requirements. However, they would be required to register and file a corporate tax return.

Other key elements of the announcement

Foreign investors who do not carry on business in the UAE will not be subject to corporate tax.

There are no withholding taxes on domestic and cross-border payments.

UAE businesses will be exempt from paying tax on capital gains and dividends received from their qualifying shareholdings.

Corporate tax will not apply to qualifying intra-group transactions and reorganizations.

In order to give relief from double taxation, foreign taxes will be allowed to be credited against UAE corporate tax payable.

The corporate tax regime provides generous loss utilization rules and will allow UAE groups to be taxed as a single entity provided certain conditions are met or to apply group relief in respect of losses and intragroup transactions and restructurings. Besides, businesses will not be required to make advance tax payments or prepare provisional tax returns.

Transfer pricing and documentation requirements will apply to UAE businesses with reference to the OECD Transfer Pricing Guidelines.

Key takeaways

The introduction of the new corporate tax regime is bound to help UAE achieve its strategic ambitions and incentivise businesses to establish and expand their activities in the country. The move is expected to bring UAE in line with other competitive economies around the world.

However, the potential implications can be far-reaching. But for now, the tax and finance teams need to focus on developing a roadmap to prepare for the implementation of corporate tax. For that, it is imperative to get a deeper and thorough understanding of the rule and laws pertaining to corporate tax in order to completely assess the implementation plan. This might require many structural and organizational changes such as a change in legal structure, tax function, business model, accounting, contracting and transfer pricing, etc. Our tax experts at IMC Group can help you assess the potential impact of corporate tax in the UAE and how it may affect your business. As a part of our services, we can assist you with the following:

- Access the qualitative impact and perform readiness assessment covering systems, governance and technical aspects

- Access the quantitative impact and perform modeling work

- Offer knowledge sharing and conduct training for your in-house tax and finance teams

- Offer implementation support with respect to tax, accounting and systems perspectives.

There will be further announcements from the Ministry of Finance toward the middle of the year to help businesses prepare for the introduction of corporate tax and become fully compliant.

Keep watching this space for more updates on corporate tax in the UAE.

- Article, Singapore

- January 19, 2022

If you have decided on a company setup in Singapore this year then it is undoubtedly one of the best decisions taken by you. Singapore is the most vibrant, promising and business-friendly country in Southeast Asia and despite the coronavirus pandemic taking a heavy toll on the world economy, Singapore could mobilize almost $17.2 billion in fixed asset investments in 2020 alone.

The FDI commitments in the pandemic year have surpassed the medium to long term target of the Economic Development Board (EDB) ranging from USD 8 to 10 billion and are at the highest since 2008. The electronics, chemicals, and research and development sectors received the majority of capital investments but will promote growth in other sectors as well.

The country’s priorities to keep the borders open for ensuring business continuity garnered the confidence of the global business community. This Asian nation has long been recognised for it’s business-friendly policies and secured top positions in several global rankings awarded by international organizations. Choosing the right type of business structure is primarily governed by the nature and size of the business, licensing requirements, bus taxes and other liabilities, documentation needs, fundraising potential, future growth and expansion prospects etc.

There are many types of business structures available for you in Singapore however we will limit our discussions on the two popular types, a Subsidiary or private limited company and sole proprietorship company amongst the foreigners. A Singapore subsidiary is a private limited company structure available in Singapore and the majority shareholder is a corporation either a local or a foreign company or an individual. It is the most common and preferred form of business structure for small to medium size foreign companies in Singapore.

The subsidiary structure allows the company to function as a separate legal entity from the parent company and provides several advantages including

- Protection of the parent company and individual assets from the liabilities of the subsidiary

- 100% foreign ownership in the subsidiary

- Similar tax exemptions and incentives as applicable to Singapore resident companies

- Easier and simpler regulatory compliance requirements such as no need for financial statements of the parent company

- Several types of Tax Incentives, Rebates and Credits

Guide to Incorporating Your Business in Singapore: Essential Checklist

A sole proprietorship is the simplest but the riskiest business structure in Singapore and can only be availed by Singapore permanent residents, entrePass holders or citizens. As it is not treated as a separate legal entity, it usually poses considerable disadvantages for small to medium-sized businesses. Annual registration renewal from ACRA is mandatory for this business structure.

If somebody sues a sole-proprietorship company and it is unable to pay the dues, the owner must make payments from his assets. This structure allows a single shareholder and new equity participation is not possible as the business grows and expands.

Business entities aspiring for future growth normally don’t go for a sole-proprietorship structure which is generally poorly perceived by the financial institutions and customers. Selling off a sole-proprietorship business is often difficult too.

The tax benefits enjoyed by other business structures are not available to sole proprietorships including a higher effective tax rate than that for a private limited company.

Sole proprietorship businesses however offer a few advantages including less documentation, fewer tax compliances and easier processes, straightforward banking, lower registration fees and freedom of taking business policy decisions. It is easy and convenient to set up a company in Singapore without any bureaucratic interference and corruption. If you are to choose between a sole proprietorship and a private limited company, it is usually recommended that you go for the latter unless you are willing to set up a trading business in Singapore as an individual.

A sole readership business for foreigners is allowed in Singapore if you are not residing in Singapore, you need to appoint a resident as an authorized representative.

Foreign individuals or corporations willing to set up a business in Singapore typically choose a private limited structure as this offers many benefits already discussed. The tax climate in Singapore is simple and aims at promoting investment in the country. Income tax to companies and individuals is levied on the income generated from the businesses.

The applicable tax rate for a sole proprietorship company varies between 2% to 22 & as the last amended Income Tax Act by Inland Revenue Authority of Singapore (IRAS) in 2017 with no tax exemption allowed for this business structure.

IRAS imposes a 17 % corporate tax rate on private limited companies in Singapore. From the assessment year 2020, two partial tax exemptions have been provided to the private limited companies and are as follows

- 75% tax exemption on the first SGD 100,000 of regular income and,

- 50% tax exemption on the next SGD 100,000 of regular income

Formation of a sole proprietorship company must be done online through the BizFile+ portal using personal access or SingPass. If you don’t have personal access, then you must appoint registered corporate services firm for filing your case.

Once you register for a sole proprietorship, you will have minimum compliance requirements. This business structure doesn’t need to get their accounts audited and file for annual returns separately as this is done in the tax return of the owner during an assessment.

A private limited company whereas must comply with more regulatory compliance compared to a sole proprietorship company. The private limited structure can have 1 to 50 shareholders but must appoint a minimum of one Singapore resident as Director with full legal capacity. A foreign company director can also take up this position if he has an employment pass but needs a letter of consent (LOC) from the Ministry of Manpower (MOM).

The owners or shareholders of a private limited company need to appoint a Company Secretary who is a resident in Singapore for company secretarial services including the filing of annual returns with ACRA.

Bottom line

- GCC, Newsletter

- January 11, 2022

On 20 December 2021, the OECD released detailed rules to help implement a landmark reform to the international tax system and ensure that the Multinational Enterprises (MNEs) are subjected to global minimum taxation of 15% tax rate from 2023. The rules also highlight some other salient new points, including deferred taxes for calculating jurisdictional Estimated Tax Rate (ETR), the importance of modelling in assessing the impact and a timeline for implementation.

The Model Global Anti-Base Erosion (GloBE) Rules was published just after the October 2021 announcement of political consensus between 137 countries; including UAE, Saudi Arabia Qatar, Bahrain and Oman on ensuring that the corporate profits of MNEs are taxed at a minimum global rate irrespective of where these MNEs are headquartered. The earlier broad BEPS framework is now given a shape of implementable Model Rules needing integration into the domestic tax laws of the countries. With this release of the Pillar Two model rules, the governments can now take forward the two-pillar solution for addressing the tax challenges resulting from digitalisation and globalisation of the economy.

MNEs with revenue above EUR 750 million will be subjected to the minimum tax applicable and is estimated to create an additional USD 150 billion global tax revenues per year. The OECD believes that even with a high annual revenue threshold of EUR 750 million, the framework will cover 90% of the global corporate income tax base.

Scope and Applicability

The GloBE rules will apply to all constituent entities of an MNE group that qualify the minimum revenue threshold in at least two of the four fiscal years immediately preceding the fiscal year under assessment.

International Organisations, Governmental entities, not-for-profit organisations, pension funds and investment funds or real estate investment businesses which are ultimate parent entities of an MNE group are excluded.

Mechanism of Taxation

The GloBE rules apply a system of top-up taxes that brings the total amount of taxes paid on an MNE’s excess profit in a jurisdiction up to the minimum effective rate.

Imposition of tax is based on “top-up tax” calculated and applied at a jurisdictional level and using a standardized base and definition of covered taxes for identifying those jurisdictions where an MNE is subject to an effective tax rate below 15%.

Pillar 2 covers the Model rules that allow for a minimum effective tax rate on a jurisdictional basis through two GloBE rules:

Income inclusion rule (IIR) is the primary rule and stipulates that an ultimate parent entity of the MNE group or an intermediary holding company as in the case of a joint venture company shall need to pay a top-up tax in its residence country at the parent entity level in proportion to its ownership interest in subsidiaries with low taxed income. The tax obligation shifts to the lower parent entity in case the ultimate parent entity belongs to a jurisdiction where GloBE rules don’t apply or are not implemented. To avoid double taxation, an offset mechanism is put in place. There are also provisions for some special rules for partially owned parent entities.

Undertaxed payment rule (UTPR) is the second rule and applies as a residual top-up tax if the low taxed income is not completely brought into charge under the IIR due to local denial of deduction or adjustment of the low-taxed income. This rule does not apply to investment entities and the share of top-up tax is calculated by a formula based on assets and employees. Subject to meeting certain conditions, a tax exemption for five years is provided for MNE groups that are expanding in global markets as startups.

Effective tax rate (ETR) and top-up tax

Qualified MNEs need to calculate the ETR in each jurisdiction of their operations. GloBE rules refer to an effective tax rate (ETR) for determining the top-up tax to be paid. The ETR is calculated on a jurisdictional basis and for each country equal to the sum of the GloBE taxes of each entity excluding investment entities located in the jurisdiction, divided by the Net GloBE Income of the jurisdiction for the fiscal year.

GloBE rules start with the financial accounts and the consolidated financial accounting figure is the starting point for the GloBE taxes and Net GloBE Income per entity excluding adjustments. Importantly, besides the current tax expense, deferred taxes need to be accounted for under certain conditions. The GloBE rules provide for an exclusion of international shipping income.

If the jurisdictional ETR so determined comes below 15%, top-up tax payment becomes an obligation concerning the Net GloBE Income of that jurisdiction. For determining the amount of top-up tax; three main factors amongst others including the substance-based income exclusion, the de minimis profit exclusion and a potential domestic top-up tax need to be taken into account.

The substance-based income exclusion reduces the net GloBE income and is calculated as a specific return on the payroll costs and the tangible assets for each entity, except for investment entities in that jurisdiction. This is mainly important to MNE groups enjoying tax incentives.

There will be a transitional relief for the substance-based income exclusion and the excluded amount of income in the transition period of 10 years will be in the tune of 8% of the carrying value of tangible assets and 10% of payroll costs and will decline by 0.2% points every year for the first five years, and by 0.4% points for tangible assets and by 0.8% points for payroll for the last five years. A 5% reduction will apply for both payroll costs and the carrying value of tangible assets after 10 years.

Besides, a de minimis profit exclusion rule will be made available and no top-up tax will be due for jurisdictions where the average GloBE revenue based on three years, current year and past two years, is less than EUR 10 million and GloBE Income or Loss is less than EUR 1 million.

During the initial phase of international activities, the UTPR will not apply to MNE groups who are operating in no more than six jurisdictions and have a maximum of EUR 50 million tangible assets abroad. This is a limited time exclusion and valid for 5 years once an MNE comes within the scope of the GloBE rules for the first time. For those who are already within the scope, the period of 5 years will start when the UTPR rules come into effect.

Compliance Requirements

GloBE information return (GIR) becomes mandatory for MNE groups coming within the scope of GloBE Model rules.

The return must be filed within a maximum of 15 months after the closure of the accounting period and may be extended to 18 months for the first return.

Though a standard template will be provided by the OECD, the MNE Group may need to furnish information including group members, corporate structure, country-wise ETRs and top-up tax etc. Local tax laws will apply concerning penalties and the confidentiality of information.

What Comes Next

Releasing Commentary to the GloBE Rules for providing guidance and clarifications on GloBE Model rules implementation is next on the agenda of the OECD and may be released early 2022.

Public consultations will be organised during February and March on the Implementation Framework to provide support for the coordination and administration of the new rules. Safe harbours and the subject to tax rule (STTR) will also be included.

Pillar Two is expected to become law during 2022 and be effective in 2023. The UTPR rule is expected in 2024. A tax treaty policy provision may be developed by mid-2022 to address STTR.

Takeaway

There has been no mention of the scope of safe harbours in transfer pricing and may be available in the Implementation Framework during 2022. The recent publication of model rules is also silent on the design and implementation of the STTR.

The GloBE Model Rules signify a new tax regime that seeks to radically transform the international tax structure by according countries the right to tax an MNE headquartered in another no or low tax jurisdiction on its profits.

A Tax-benefit model will be crucial to understand the financial impact as certain elements of the GloBE Income calculation is left at the discretion of the taxpayer.

Compliance and data gathering will be equally vital along with the calculation of the jurisdictional ETR.

Outsourcing of a professional corporate service provider cum tax consultant is recommended at this point as input data may not always be readily available making it hugely burdensome for tax calculations and decision makings. Even when no top-up tax is due, the GloBE rules may cause specific compliance challenges during implementation.

- Newsletter, Singapore

- January 11, 2022

In an inaugural trade committee meeting on 7th December 2021 under the EU Singapore Free Trade Agreement (EUSFTA), the EU and Singapore agreed to strengthen bilateral partnerships on digital trade. The EUSFTA came into force on 21st November 2019.

The meeting was co-chaired by Valdis Dombrovskis, the Executive Vice-President of the European Commission and Trade Commissioner and S Iswaran, the Minister-in-charge of Trade Relations Singapore.

Discussions were held on the advancement of a comprehensive EU Singapore digital partnership and in a joint statement, the two deliberated on strengthening bilateral digital trade between EU and Singapore and assigned the EU and Singapore officials to resume technical discussions for identifying the digital trade elements.

It ushered in a strong bilateral trade partnership between the EU and Singapore into the digital future as a shared vision imprinted in the EUSFTA.

The partnership reached between the EU and Singapore is all set to enhance digital ties and promote bilateral trade and investments and provide benefits to the businesses and workers especially in the SME categories from opportunities in the world’s growing digital economy.

The joint announcement demonstrated the commitment of both the EU and Singapore to actively participate in digital economy partnerships. The recent EU strategy on Indo Pacific also highlighted its interest to explore and expand the Digital Partnership network with Singapore.

The Southeast Asian digital economy is projected to grow by more than 3 times between 2020 and 2025 and this agreement confirmed the undisputed leadership of Singapore in the technology and digital space that could pave the way for EU companies in the region’s fast-growing market.

EU Singapore digital partnership would also be supportive and complimentary for the continuing e-commerce negotiation initiatives of the WTO and help set digital trade rules in the world.

Strong bilateral trade relations between the EU and Singapore was reaffirmed by the Co-chairs as was evident from the annual goods and services trade figure exceeding €100 billion in 2020 between the EU and Singapore. Noteworthy, it happened at a time when the international trade suffered most due to the pandemic but EUSFTA generated business consistently.

Regional and global trade developments were discussed and the Co-Chairs also shared their views on measures to enhance economic recovery during the post-pandemic.

The latest EUSFTA implementation status was also reviewed including the Trade and Sustainable Development Board meeting that had successfully commenced earlier than scheduled. Issues on labour and fundamental ILO conventions were reviewed too. Green economy cooperation was also a matter of discussion and review in this meeting.

The Co-chairs recognizing the strong economic cooperation between the EU and Singapore in diverse areas also agreed to work together and provide support towards climate change and environmental protection initiatives.

- Newsletter, Saudi Arabia

- January 11, 2022

We have come a long way since Michael Aldrich invented electronic shopping in 1979 and with time, watched in disbelief how e-commerce transformed traditional retail business worldwide. The recent Covid pandemic and ease of access to innovative smart technology have further accelerated this transformation process as customers opted for increased safety and convenience.

E-commerce is sweeping across the world and Saudi Arabia is no exception. As the Kingdom advances towards realizing Saudi Vision 2030, new technologies and reforms are being implemented facilitating e-commerce adoption through enhanced mobile and internet usage. During covid 19, the country’s e-commerce market experienced a huge surge, about 60% as more and more customers preferred to go online for shopping with easier access to digital technology.

Market surveys conducted by global firms revealed a rapidly growing e-commerce sector in the Kingdom and as reported by Boston Consulting Group, the size of the country’s e-commerce space would exceed SAR 50 billion by 2025. E-commerce revenue would grow at a CAGR close to 19% between 2022 to 2025, forecasted Statista. The Kingdom witnessed a steady growth of online sales for the past couple of years and mostly in apparel, electronics, and appliances categories.

Mastercard Newsroom also echoed similar thoughts earlier and reported a higher percentage of online shoppers in the kingdom compared to the Middle East and Africa region.

Saudi Arabia made great progress in e-commerce infrastructure development and as reflected in its 49th position amongst 152 countries surveyed worldwide in the B2C e-commerce index on readiness to engage in online commerce published by the United Nations Conference on Trade and Development (UNCTAD).

Saudi Arabia is a country of youths as about 65% of the population falls in the 14 to 29 age bracket and exhibits a high level of familiarity and skill in online and digital environments and making the country one of the most social media savvy nations in the world. As per the survey conducted by Mastercard, Saudi youths also spend a significant amount of their time upskilling themselves in digital technology. The country also has a huge base of broadband internet subscribers with a high speed of internet. The country has the highest internet penetration in the region and is expected to reach around 93% by 2023. All together, makes the perfect ground for high online activities including banking and e-commerce.

Saudi E-Commerce Council is working on the country’s ‘e-commerce journey’ and besides developing infrastructure, also bringing in new legislation on imports of consumer products, enabling safe and secure payment systems for cashless transactions, providing supply and logistics services. The council also offers a package of services to prospective medium and small business establishments for setting up a company in Saudi Arabia.

The booming e-commerce sector in Saudi Arabia is all set to benefit its economy by developing other allied business sectors and generating employment. The supply chain and logistics sector should thrive and attract foreign investors for doing business in Saudi Arabia.

- Newsletter, U.A.E

- January 11, 2022

Overview

2021 remained a year of legislative reforms for the UAE and witnessed 40 decree-laws and amendments being rolled out for gaining a competitive advantage in the global economic landscape. One of the biggest additions is the recently introduced new Federal Trademarks Law No. 36 of 2021 (“New Law”), which has come into force on 2nd January 2022. The New Law has replaced the previous Trademark law, the Federal Law No. 37 of 1992. Though the amendments have been made keeping in perspective the GCC Unified Trademarks, some new provisions on different aspects and procedures have been introduced in the new law.

The New Law addressed various aspects of Trademark registration in UAE that were not fully covered earlier including the registration of non-traditional trademarks. Rules on infringement of trademarks have been made more stringent with increased sanctions and penalties. The new law also allowed multiclass application which was not included in the previous law. The registration of Geographical Indications is an innovative addition and newly introduced in UAE Trademark law.

The procedures outlined in the New Law are detailed in executive regulations.

What are the most important changes brought in the New Trademark Law?

Following are some of the most important changes brought in by the new trademark law 2021 in the UAE.

Enhancing the domain of Nontraditional Trademarks

Nontraditional visible and invisible trademarks have been included for registration in the new law such as holograms, single colour, 3D shapes, scents, sounds etc.

Trademark Registrability

Though the list of non-registrable trademarks remained more or less the same, the new law brought in an amendment to specifically prevent registration of trademarks which are translation, phonetic translation or transliteration of any well-known and already registered trademarks to reduce the risk of infringement.

The new law also made functional 3D trademarks non registrable.

Multiclass Trademark Registration

While the previous law only allowed single class applications, the new law now allows trademark applicants to include the multi-class in a single application.

Increased Penalties

UAE trademark office has raised penalties for trademark infringement in the new law enforcing AED100,000 to AED1,000,000 for counterfeiting, imitation, bad faith usage, possessing material for counterfeiting, engaging in export-import of counterfeit products. Owning a counterfeit product or selling it attracts a fine of AED 50,000 – 200,000. The fine used to be AED 5000 minimum in the previous trademark law.

More Elaborated Procedures on Infringement

The new law has provided more elaborated procedures on infringement including exhaustive reporting of infringement; withholding products, tools and equipment used in the infringement and legal proceedings; preventing suspected counterfeit products from entering commercial channels; preventing suspected counterfeits from being exported and preservation of evidence.

The new law seeks initiation of urgent proceedings in any matter of trademark infringement and within a maximum of 20 days.

Registration of Geographical Indications

Previously not regulated in the UAE, the addition of GIs in the new trademark law complies with the International Trademark registration system.

Geographical indications (GI) are signs used on products that have a specific geographical origin and possess qualities or a reputation that are due to that origin. To function as a GI, a sign must identify a product as originating in a given place and can be a sign or many signs in any form such as geographical names, personal names, numbers, colours and words.

In the new Law, UAE addresses the emergence of conflicts between geographical indication tags and trademarks with their rapidly increasing usage as forms of intellectual property rights and prevents the registration of a GI in the event of any confusion with a trademark application or any trademark registered and used in UAE in good faith.

Establishment of Complaints Committee

A committee has been established to hear all complaints and objections to the decisions issued by the UAE trademark office of trademark applications, cancellations and oppositions.

Challenging the Decisions of Complaint Committee

As per the new law, all decisions issued by the Complaint Committee can now be appealed before the Federal Court of Appeal instead of the Court of First Instance significantly reducing the litigation time with only two stages of court proceedings.

Request for Cancellation of a Trademark

The new trademark law stipulates that the Ministry of Economic Affairs should now receive the requests for the cancellation of trademarks. Earlier a competent court was supposed to receive such requests.

Prior Use for Cancellation

The new law regulates the rights of a prior user of a trademark for trademark cancellation.

Customs Seizure based on Trademark Rights

As per the new trademark law, UAE customs can now seize imported goods that infringe trademark rights and this provision was not covered in the previous law. Once a request is filed with the customs authorities for import seizure by someone being the owner of infringed trademark rights, goods that allegedly infringe trademark rights can be stopped from shipment clearance for 20 days. Certain exceptions are however provided in the new law.

Electronic Notification

The new trademark law specifies the requirements for electronic notification which was not included in the previous law.

Revised Timelines

The New Law revises the timelines for examination of trademark applications and stipulates it to be 90 days maximum from the date of application. It used to be 30 days as per the old law.

The time frame for appealing against the decision of the Trademark Committee regarding any rejection of trademark applications has been revised as 30 days in contrast to 60 days specified in the previous law.

Trademarks Registered in Bad Faith

Trademarks registered in bad faith can be excluded following the new law and complies with the Paris Convention.

Trademark Licenses

The new law stipulates that trademark licenses no longer need to be registered with the Ministry.

Conclusion

On 2021 September 28th, the UAE joined the Madrid System and became a signatory to the Madrid Protocol for international trademark registration alongside the national filing system.

The new trademark law has come into force after the UAE government received concrete and comprehensive feedback from trademark professionals and owners of well-established brands.

It is recommended that startups and SMEs willing to expand their businesses in UAE, MENA and international markets by promoting brands may look for a trusted partner and hire a professional and locally based corporate service provider for an easy and hassle-free Trademark Registration in Dubai.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners