- Article, Singapore

- October 6, 2021

Southeast Asia is one of the fastest-growing economies in the world today with nearly 10% of the world’s population residing in the ten member countries of the Association of Southeast Asian Nations (ASEAN) including Vietnam, Singapore, Brunei, Indonesia, Thailand, Cambodia, Philippines, Malaysia, Myanmar, Lao People’s Democratic Republic. Geographically, Southeast Asia is a tropical region favouring Solar energy as the best renewable.

Why Solar Energy Transition?

Rapid industrialisation in the ASEAN and the governments’ commitment to 100% electrification of households are transforming the economic and energy outlook in this region as policymakers across many of these countries are striving to meet the growing energy demand in a secure, affordable and sustainable manner for improving the quality of life of their citizens. Several incentives and support schemes have also been announced by the government of these countries to encourage the renewable energy sector.

As the rising energy demand in Southeast Asia has already outpaced the available energy supply within this region due to declining reserves of fossil fuel, the renewable energy sector is expected to take the driver’s seat with solar technology primarily fueling the growth of the regional renewable. Southeast Asia is presently working on a massive plan to take the renewable energy capacity from 517GW in 2020 to 815GW by 2025.

How is the Solar Energy Outlook in Singapore?

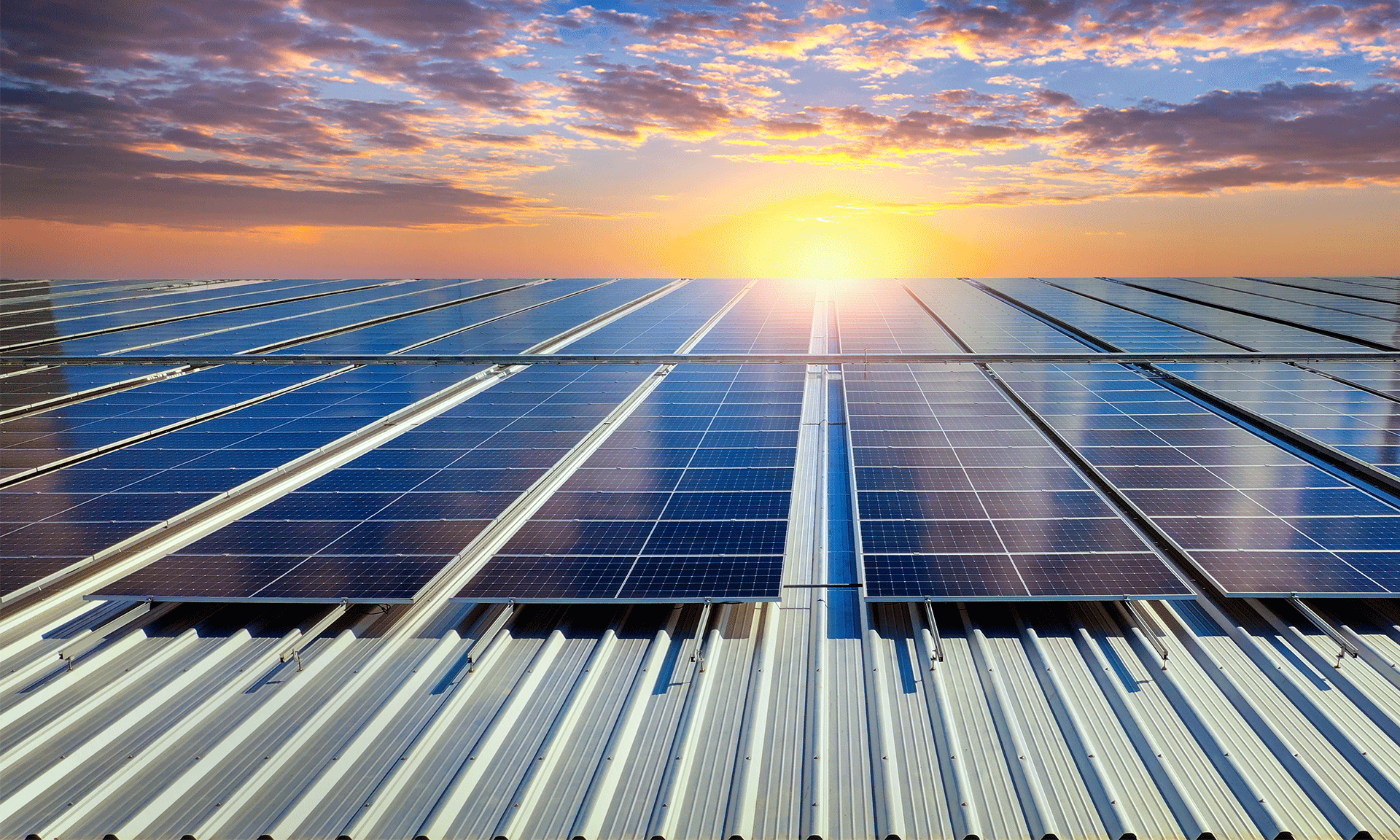

Singapore is intensifying its focus on solar PV installations due to shortage of land for wind energy and hydroelectricity installations and promoting the SolarNova program launched in 2014 by the Economic Development Board (EDB), the strategic measure for solar Photovoltaic (PV) growth.

The country added 296MW capacity over the last four phases spanning over 2015 to 2020 and another 60MW capacity has been installed this year. The rooftop solar PV installations on public housing are becoming most common.

The sea city is gradually approaching the next target of a minimum of 2GW of solar energy by 2030 that can cater to the demand of 350,000 households. The country is also investing in the R&D of floating solar energy for future expansion.

Singapore has demonstrated its commitment towards becoming a low carbon economy with a proposal of USD 1.8 billion investment from its foreign reserves for green financing. Government-owned Temasek in partnership with Black Rock has already invested USD 600 million to lower its carbon footprint.

How is the Solar Energy Outlook shaping in other parts of Southeast Asia?

Countries leading the region’s renewable energy initiatives are Vietnam, Thailand, the Philippines, Malaysia and Indonesia amounting to almost 84% of the total installed renewable energy capacity and setting an ambitious target of a 23% renewable energy share in the total primary energy supply by 2025.

Recently Vietnam has overtaken Thailand in installed solar power generation with an increase in PV capacity from a mere 86 MW in 2018 to 16,500 MW at the end of 2020 having the largest installed capacity for solar power generation among members of the ASEAN mainly contributed by rooftop solar as space is scarce in the country. Amendments in the public-private partnership regulation have also been a contributing factor for the solar PV boom.

Thailand is the second country in the Solar energy race contributing to 17% of total installed capacity in the region and has set a target for 30% of the country’s total energy consumption from renewable sources by the year 2036. Rooftop solar is playing the most predominant role in advancing its energy transition.

Improving the share of renewables in the total energy requirement from 2% in 2019 to 20% by the end of 2025 is the target for Malaysia with an approximate investment of USD 7.9 billion mostly for the solar system infrastructure. The government has also floated a tender for 1GW of solar projects under the fourth round of its Large Scale Solar (LSS) procurement programme.

Indonesia too plans to enhance renewable energy percentage from 9% in 2020 to 23% by 2025 and can generate 640000000 GW of solar power placing the country on the strong ground for achieving 100% green electricity by 2050.

The Philippines in its National Renewable Energy Plan specifies targets for a minimum l34GW of renewable energy installations by 2040 and plans for 100% foreign ownership for attracting foreign investment in this sector.

Bottomline

It is believed that the renewable energy sector in ASEAN region after the covid pandemic would recover in 2021 driven by the resumption of economic activities and support policies of various governments.

- Article, Singapore

- September 30, 2021

These days, we live almost our entire lives online. It is therefore no wonder that businesses too feel the need to capitalise on this. Naturally, setting up an e-commerce business or service platform seems much more logical than establishing a brick-and-mortar shop. While the initial invested capital may be almost the same, the running costs will definitely be far lower.

If you too are an entrepreneur trying to set foot in the world of e-commerce, where better to start than in the economically flourishing city-state of Singapore. And if you’re looking for a guide for doing business in Singapore, you’ve come to the right place. Read on to discover quick tips on starting your own e-commerce business in the Lion City. While this guide is by no means exhaustive, it will help you gain important knowledge towards laying the foundation for your business plans. Let’s get started –

Research is everything

Why is research so important?

Firstly, research will tell you whether your e-commerce business has an audience or a market. It will also show you what the competition is doing and help you to identify any gaps in the market that your product or service can fill. This knowledge can prove to be immensely profitable for you.

While doing research, remember to dedicate time towards calculating how much business capital you will require to get started. While starting a new venture can be exciting, be careful of overspending. Even though your business is online, keep aside sufficient funds for contingencies.

Guide to Incorporating Your Business in Singapore: Essential Checklist

Learn local guidelines

Create an incorporated company

Create your website

When creating your website, you may either choose to go with ready templates online or make your very own. The second option is slightly harder but will give your e-commerce brand a truly unique online presence and design. Make sure to choose an appropriate domain name that resonates with your business and brand. Choose a good hosting service too – one that you can rely on 24/7. After all, an online store never closes its doors at night…it works round the clock. You want your e-commerce website to be accessible to your audience no matter what time of the day they choose to visit it.

Make sure that your website is user-friendly. All the major tabs for shopping, using filters to sort products, and customer support should be easily visible. Product pages should have good content with easy visibility of the different colours, designs or quantities for buyers. Try to also set up a proper customer support system for your e-commerce business. A number or 24/7 email or chat support can go a long way in creating loyal customers. It will help your buyers know that they can reach out to you at any time.

You also need to focus on setting up a secure payment gateway. Make sure to provide people with a wide variety of payment options, including credit cards, debit cards and Google Pay, among others.

Focus on good marketing

Set up delivery

The final step involves setting up a reliable delivery system that will ensure that your goods or services reach your buyers. You may choose to hire a third-party company to carry out delivery for you or even do it with your own manpower, depending on your needs and how far your buyers are. For instance, if you have buyers from overseas, you will have to tie-up with a third-party delivery platform.

We hope that this guide on beginning an e-commerce business in Singapore has been a great read for you today!

- Article, U.A.E

- September 22, 2021

The United Arab Emirates has a flourishing economy and is one of the most popular countries for investors and businessmen. If you too are looking forward to starting your own business in the UAE, you may be aware that you need professional PRO services. For instance, if your setup is in Dubai, you would need professional PRO services in Dubai. PRO stands for public relations officer. PRO services help your company stay compliant with all the local rules and regulations for a business to run smoothly.

Now, you can either hire your own PRO or choose to outsource your requirements. An increasingly large number of businesses are choosing to outsource their PRO services. Wondering why? In this article, we will take a look at 5 major benefits you gain if you choose to outsource your company’s PRO service needs.

1. Access to a professional PRO service

When you choose to outsource your PRO service requirements, you get to receive help and guidance from industry professionals who are familiar with local rules and regulations. This way, your documentation and other legal compliance work will always be on time. You will not face the risk of unnecessary fines either. We, at IMC Group, will take care of all your requirements from visa services to paralegal services and corporate bank opening for a hassle-free experience.

2. Cost-effective approach

Outsourcing your PRO services is indeed more cost-effective than hiring your own staff. If you were to hire dedicated staff, you not only pay a salary but also hand out benefits that can cost you a lot. A professional PRO service company only charges you for the services you need and no more. Thus, you end up saving on your expenses while getting access to some of the best minds in the market.

3. Access to exclusive and dedicated support

IMC Group will assign you your very own PRO expert who will take care of all your work. We offer doorstep assistance in which we send our representative to your office to pick up all the necessary paperwork. You are thus left free to focus on your business requirements while we handle all the technicalities like visa, permits, licences and so on. Handling all of these on your own in a foreign country can prove to be quite a task…a professional PRO service will get things done on time, the right way.

4. Transparency of service

At IMC Group, we value integrity in business. Therefore, we believe in a completely transparent system of operating. Even though we take charge of all the paperwork so that your work is lighter, we will still keep you informed every step of the way. We enjoy good credibility and reputation as a professional PRO service provider in the UAE. With a wide range of services and an experienced team, you are in good hands with us.

5. Extensive range of service offerings

If you were to hire your very own staff as PRO professionals, you may need to hire multiple roles. At IMC Group, you just need to get in touch with us for all your PRO service needs. We are your one-stop shop for a range of services including renewal and processing of visas, attestation of documents, local sponsor, trade licence, legal services, registration for rental and lease, share transfer services, and more.

We hope that this article has been an insightful read and has helped you understand why you need PRO services and better yet, why you must outsource this requirement. Get in touch with us at IMC Group today to know more.

- Newsletter, U.A.E

- September 14, 2021

Originally scheduled to be hosted from 20th October 2020 to 10 April 2021, the belated Dubai Expo is ultimately going to be held from October 1, 2021 and will continue till March 31, 2022. The postponement of this historic event was due to the outbreak of the Covid 19 pandemic which ravaged the entire world including the UAE.

The Dubai Expo 2020 is spanning between the two leading cities of the Emirates, Dubai and Abu Dhabi and will witness 60 exhibitions daily with pavilions from 191 countries. The 182-day event will attract more than 25 million visitors across the globe besides running more than 200 restaurants at the venue.

The master plan for Dubai Expo 2020 has been designed by HOK, an American firm around a central plaza with three thematic districts dedicated to the Mobility District, Opportunity District, and the Sustainability District

World Expos for many decades have been used as venues to showcase the greatest innovations that have helped transform our present-day world and the same tradition will continue in Dubai Expo 2020 with the latest innovative technologies around the world.

India enjoys long historic ties with the UAE and will be the largest participant in this major event with a new look of its Pavilion. The pavilion has been designed in a four-level structure with technology, culture, space and heritage as the defining themes. Once the biggest event of the world finally resumes in Dubai, the Indian Pavilion stretched over 4800 sqm will showcase the new technology, and its “5 Ts” resonating Talent, Trade, Tradition, Tourism and Technology.

Pavan Kapoor, Indian Ambassador to the UAE remarked, ” It is very clear that by sheer dint of our proportion of the population, by our connections that we have in India, we will be the largest participant at the Dubai Expo.”

The long history of trade and investment between India and the UAE has been further reinforced last year when the top leadership of the two countries convened regular virtual conferences to promote bilateral and trade investment cooperation during the post-pandemic.

Dubai Expo 2020 will showcase the robust India-UAE trade which has seen unprecedented growth over the years which was only valued at 180 million dollars per annum in the 1970s and has currently grown to 59 billion dollars in 2020. The UAE was the third-largest trading partner of India during 2019-20 after China and the US while India was the second-largest trading partner of UAE with an amount of 41.43 billion dollars of trade in non-oil sectors during 2019.

The UAE is a major exporter of crude oil and the Indian government has sought more investments from the UAE in Indian core economic sectors including infrastructure, logistics, defence, ports, highways, airports, renewable energy and food parks. In September 2020, the Consulate General of India, Dubai, and Tea Board India jointly organized a virtual B2B Meet for promoting Indian tea amongst the UAE consumers.

Besides enhancing trade and investment, the two countries also agreed to expand security cooperation and explore opportunities for mutual collaboration for fighting against the pandemic. Current geopolitical instability in many parts of the world has also forced the two countries to look for increased political and economic engagements. With millions of Indian workers employed in the UAE, India has been keen on protecting the interests of its citizens at the time of great economic turmoil.

While UAE scales up investments from India in healthcare, food security and fintech sectors and Dubai company incorporation by Indian investors, the Indian government announces major policy reforms to promote business and investments and attract foreign investors from the UAE. It is no wonder that Dubai Expo 2020 turns out as the perfect venue for enhanced bilateral trade and investment between the two countries.

Dubai Expo 2020 is the biggest event in the Middle East and North Africa (MENA) and will enhance and accelerate the country’s economy with foreign investments pouring in and new business set up in Dubai UAE.

The revival of the world’s economy is also intimately linked to the growth and economic prosperity of these two countries.

- Newsletter, Singapore

- September 14, 2021

Overview

Though Singapore has witnessed a more than fivefold jump in the number of Family offices over the last few years, this wealth and asset management space is still in a phase of infancy with enormous potential for future growth. Most of the family offices in Singapore belong to the first or second generation of Ultra High Net Worth (UHNW) families who are planning for their wealth transfer only for the first time and will keep doing so over many future generations promising a booming market for family office services.

Traditionally, family offices have been popular with well-established structures in Western developed countries viz the US and Europe. However, as the Asian continent has put its strong footprint in the global economy with a high concentration of individual wealth and private capital, there has been a surge of this financial business model in Asia, especially in Southeast Asian Singapore. As per data available with the Monetary Authority of Singapore, there are more than 400 family offices in Singapore, and only 200 of such offices manage an estimated value of assets exceeding 20 billion dollars, a whopping sum.

Family offices are private wealth management entities providing cost-effective financial solutions for UHNW families. Family offices employ financial advisors, investment analysts, legal and tax professionals for wealth and tax planning.

Family offices carry out financial and legal activities which are either carried out in-house or outsourced from external service providers. Activities performed by family offices include management and planning of private assets, wealth protection, succession planning, tax planning, lifestyle management, family governance, education, charities etc. While a Single family office in Singapore caters to one single family, multiple family offices can serve more than one family.

Why is Singapore considered attractive for Family Offices?

Multiple reasons are driving the ultra-rich families to flock to Singapore for establishing family offices post-pandemic. Singapore provides access to both Asian and global opportunities for investments and besides the Asian families, many US and European family offices are being attracted to the country with key family figures opting for residing and taking citizenship of Singapore. The main reasons for exponential growth can be attributed to the below-mentioned reasons.

- Reduced risks of regulatory changes ensuring the safety of assets

- A competitive corporate tax environment irrespective of residence status and tax incentives through Singapore Resident Fund Scheme, Enhanced Tier Fund Tax Exemption Scheme and Global Investor Programme

- Presence of investment and international banks planning to double their operations over next two to three years

- A Matured and Regulated financial market

- World-class Technology

- A recognized international hub for financial services and banking

- Newly introduced Variable Capital Company structures

- Easy settlement for super-rich families through Global Investor Programme

How do Global Pandemic and Geopolitical Uncertainty help flourish the Family Office Space in Singapore?

Global pandemic and geopolitical instability can be a big positive rather than negative for family offices in Singapore. The fear of morality of the pandemic has indeed made the super-wealthy families vulnerable but the uncertainties also instilled a sense of urgency amongst them. Singapore has one of the lowest death rates from the covid pandemic and many billionaires all over the world have been residing for longer in this city-state.

The pandemic has become an important wake-up call for wealthy families to mobilize resources and step up to bring in the positive changes needed in family offices for reviewing and updating protocols and practices within the family office space, investing more time and money for upgrading antiquated ineffective systems and assessing all forms of risk. The geopolitical instability has also raised safety issues of their assets and a need for relocation to a safer and more politically stable jurisdiction.

Covid pandemic has also triggered the possibility of higher tax regimes and stricter regulatory norms in the foreseeable future necessitating the need for wealthy families to explore better avenues for reducing the tax burden. Populist policies with several monetary stimuli introduced during early 2020 may not be viable for long due to inflationary pressure as already hinted by the Federal Reserve on Fed tapering.

In 2020, many billionaires across the world donated several billion dollars for vaccine development and many ultra-rich families were prompted to serve their communities in their countries of origin. This shift in social responsibility has spurred the growth of philanthropic trusts. Philanthropy helps in bringing people together and helps members of wealthy families do something meaningful by participating for a novel cause and reduce bureaucracy in organizations.

The pandemic also provided a big push in smart digital technologies and data securities providing wealthy families better comfort and safety in wealth management. As per recent surveys, more than 80% of family office respondents agree that artificial intelligence can be the biggest disruptive force in global business. More asset management and hedge fund professionals are joining family offices in Singapore and the technology stack is also growing more sophisticated.

Takeaway

The city-state has world-class technology, a transparent and non-bureaucratic regulatory system, a high standard of health infrastructure and a politically stable government and is attracting the super-wealthy families to set up a Singapore family office in preference to their home countries.

As there are plenty of alternatives available for family office structures and governance framework for addressing varying needs and circumstances, it is advisable for wealthy families to partner with a reputable and trusted partner with professional expertise and experience in providing advice on wealth management and implementing customized and appropriate family office structures.

IMC is led by a team of asset management and legal professionals and can help you set up your own family office in Singapore to provide independent and trusted advice on suitable structure, control and supervision keeping in view the long term needs for wealth management and administration.

- Newsletter

- September 14, 2021

OVERVIEW

Cash is oxygen for every organisation and no business can survive without cash in hand. Business expansion and growth are also impossible without a positive free cash flow. Even businesses with very high profitability can close down in absence of liquid cash. MSMEs and Startups suffer the most as they have limited access to finance and in the event of any stoppages in cash flow, the business operations are likely to come to a standstill forcing them to wound up their business either temporarily or permanently.

As any disruption in cash flow can seriously jeopardize the entire chain of business operations ranging from raw materials procurement to salary payment, Cash flow management becomes a matter of tremendous significance for businesses especially the smaller ones.

Cash flow management is a subset of finance and money management and effective implementation could be a serious issue for small businesses with limited professional skills and expertise. Several surveys conducted on MSMEs and Startups revealed that managing cash flow is the biggest of all challenges faced by small businesses during the business life cycle.

WHAT ARE THE REASONS FOR CASH FLOW CHALLENGES IN SMALL BUSINESSES?

Cash flow needs to be managed very prudently by small business owners and strict discipline must be maintained in terms of cash flow forecasting and budgeting. The main reasons for cash flow issues can be attributed to the following

- Unfavourable Payment Terms with Customers and Suppliers can adversely affect the cash flow, early disbursement of payment than that realized can dry up cash flow

- High Inventory especially for manufacturing MSMEs and Startups can block a considerable amount of cash

- High Fixed Costs in the form of debt & interest payment, high rent, high salary etc. can adversely affect the cash flow

- Unnecessary Expenses on non-value-added activities can cause reduced liquidity e.g., marketing expenses that can’t generate leads and grow customer base

- Seasonal effects as financial year-end time can be challenging for cash realization

WHAT ARE THE STRATEGIES FOR AN EFFECTIVE CASH FLOW MANAGEMENT OF MSMEs AND STARTUPS?

Following are the Roadmaps of MSMEs and Startups for an effective cash flow management system.

1. Planning and Forecasting Cash Flow

Cash flow planning and forecasting can lead to better management of working capital, reduced debt and high-interest cost and better evaluation of revenue requirements for handling expenses.

2. Financing of Expensive Purchases

Easy financing is available these days that can be used for expensive purchases and help avoid blocking of a large amount of funds. Instead of paying a lump sum, payment can be made instalments. Governments have also launched many credit facilities to finance capital expenditures of MSMEs and Startups.

3. Utilising Idle Assets and Outsourcing Machinery

MSMEs and Startups with assets e.g., land and machinery not being used for business purposes can rent out or sell such assets for mobilizing cash and address short term cash flow issues at hand. Many small businesses prefer to procure machinery on rent rather than spending on Capex for preserving cash and ensuring business sustainability. The cash generated from rent or sale can be put in a short term investment fund that can earn better interest than a fixed deposit and still be liquid.

4. Negotiating Payment Terms

Based on cash flow forecasting, MSMEs and startups can negotiate with their suppliers for temporarily delayed payments to address cash flow challenges. In many cases, vendors realize the situation and agree on deferring the payments. Similar arrangements can be made with the customers to speed up the realization of funds. Relationship management plays a big role and a lot of effort must go into this.

5. Expediting Recovery of Receivables

Sending invoices immediately after delivery of services and products needs to be the guiding policy of all SMEs and Startups. Fast billing and fast collection of receivables are a must for effectively address the cash flow. Tracking of receivables with continuous follow up on past dues is also extremely critical in ensuring liquidity and optimizing Days Sales Outstanding (DSO). DSO of 30 days or less with a Collection Effectiveness Index (CEI) of more than 80% is generally recommended for small businesses for healthy cash flow.

6. Claiming Advance from Customers

For executing big orders, MSMEs and Startups must negotiate on advance deposits and payments on part deliveries with their customers.

7. Reducing Unnecessary Expenses

Identifying and reducing unnecessary expenses should also be on the agenda of small businesses to effectively address cash flow challenges. They should continuously strive to reduce expenses, save cash, and make regular cash deposits to bank accounts for improving cash flow.

The fixed costs associated with your business must be reviewed critically and periodically to identify opportunities for cost reductions e.g., cosharing of office spaces, online marketing avenues for lead generations etc.

8. Negotiating Price

Though risky and non-viable at times, increasing the price of products and services can help small businesses garner more revenue. Similarly, price negotiations with suppliers can be initiated with strategies planned for a win-win situation. Implementing cost management and cost reduction incentives can also work well and can automatically translate into improved margins without entering into risky price increase with the customers.

9. Reducing Inventory

Reduced inventory can drastically improve liquidity within a system by unlocking a great deal of money. Reduced inventory also helps in reducing wastages and operating cost of the business. For manufacturing MSMEs and Startups, Just In Time (JIT) inventory management system has been hugely successful all over the world.

10. Technology

Last but not least, present-day technologies can help MSMEs and Startups to solve their cash flow puzzle to a great extent. Expense report software for expense management automation and credit card reconciliation. Time tracking software for optimizing staff, Inventory monitoring software for optimized inventory, online payment for speeding up receivables processing, automatic expense monitoring, etc., can help manage cash flow better.

Takeaway

More than 60% of small businesses fail to see the day of light due to imprudent working capital handling and poor cash flow management. In simple terms, delaying cash outlays as long as possible and collecting cash from customers as quickly as possible guarantee an efficient cash flow management system.

- Newsletter, U.A.E

- September 14, 2021

Overview

Trusts are most popular for estate and wealth planning and can be used as a planning tool for both tax and non-tax reasons. UAE is a no income tax jurisdiction and with the introduction of recently introduced onshore trust law may become the strongest competitor in establishing trust-based estate and wealth planning structures among the other no-tax jurisdictions. Foreign assets and foreign beneficiaries are allowed under the UAE Trusts Law. Trusts are also used as asset protection and succession tools.

What is UAE New Trust Law?

UAE witnessed a new Trust law during September last year to support the onshore wealth management sector when President Sheikh Khalifa bin Zayed enforced much needed Federal Law No.19 of 2020.

The undersecretary of the Ministry of Finance, Younis Haji Al Khouri announced in a press briefing noting, “The decree-law regarding trusts was an important addition to the UAE’s advanced legislative structure.” He also said, “The onshore Trust law supports the wealth management sector in the country and provides new mechanisms for managing companies and family funds. It also encourages the allocation of charitable trusts.”

It is noteworthy that two financial free zones in the country, the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM), already have trust laws based on English common law. Now for the first time, the UAE government recognised the country’s vast onshore private wealth and has allowed this financial model within the onshore wealth management system.

A ministry official remarked that this new trust law will allow both onshore companies and individuals to transfer their wealth to a trustee through a special document which is recorded electronically to reflect the assets if movable or property. The deed will mention the settlor, trustees and beneficiaries and document the responsibility and authority of the trustee and the details of the property.

As per the ministry the new initiative ‘was an important addition to the advanced legislative structure of the UAE’ and will help the financial sector to integrate with global financial industries and be more competitive with new avenues for managing funds.

The necessary tools for administering the new trust law are already being implemented by the UAE government. The trust registry for family businesses has been established and is currently being done for private trusts.

Why did the UAE Government Pass the New Trust Law?

Legal financial products including private family trusts, real estate investment trusts, securities, investments and mutual funds are already familiar to the UAE citizens and there was already a public demand for such a law. Although these products were available in the two financial free zones, the trust arrangements didn’t effectively deal with and establish ownership over UAE onshore assets such as cash, securities, land and moveable assets.

This new law will hugely benefit the family-owned company as this empowers the founders to do succession planning for securing the future of their businesses, assets and descendants in the long run.

Besides dealing with the securities for charitable and private trusts on financial markets, the new law will also include retirement funds to provide financial security to the beneficiaries in exchange for contributions to trust once they cease to work.

The law will help bridge some gaps in the onshore legal system in the country and will accelerate developments in onshore laws and practices. The country’s financial legislation will be stronger and more effective.

Preservation and investment of huge capital within the country will also be assured with the introduction of trust law.

The law has been aligned with the regulatory structure and best practices of the wealth management industries in advanced countries strongly emphasising investor protection and will help increase the confidence of the investing community.

What are Trusts?

A trust structure is established when the settlor, legal owner of assets transfers legal ownership of those assets known as the trust property to an individual or a company called the trustee and for the benefit of some persons as the beneficiaries. Once established, the legal ownership of the trust property will lie with the trustee with beneficial ownership vested upon the beneficiaries.

There are different types of trusts including public trusts, private or family trusts or public cum private trusts based on the types of beneficiaries. However, trusts can also be formed without any beneficiaries for charitable and non-charitable purposes.

What are Foundations?

A foundation is based on civil law and is an independent legal entity with characteristics of both a corporation and a trust. It doesn’t have shareholders and there is a Council that manages the foundation following its charter and regulations.

There are mainly three types of foundations viz Charitable foundations, Private foundations and Corporate foundations.

How are Trusts and Foundations Taxed?

Tax treatment of trusts can be quite complicated because it is a legal relationship and straightforward taxation doesn’t apply as an individual or business entity. Though the trustee is the legal custodian of the trust assets, they essentially belong to the beneficiaries of the trust.

Trusts are treated as individuals in many tax jurisdictions and the trustee needs to file a tax return for the trust besides filing their tax return.

As a no-tax jurisdiction, UAE doesn’t levy any income tax on trusts. However, if a UAE trust has settlers, trustees and beneficiaries who are residents of high tax jurisdictions in other countries, the trust can be considered as ‘ deemed tax resident’ and would be liable for payment of tax and filing tax returns. The settlors of a UAE trust may be liable for gift tax.

As the resident status of trust is primarily determined by the residence status of the trustees, a UAE trust with trustees who are UAE residents can enjoy tax-free status. If a DIFC trust has trustees with a tax residency certificate in Dubai, the trust can earn tax free income even when the beneficiaries of the trust are not UAE residents.

As the foundation is treated as a legal person, taxation is relatively easier. However, if a non-resident controls the foundation, the country of residence of the controller may be considered as the residence of the foundation.

Takeaway

Tax planning of a trust can be simple when both the trustees and beneficiaries are UAE residents. However, when they are residents of other tax jurisdictions, the trust deed must be documented and phrased very wisely and carefully for ensuring that the tax advantage is preserved. Similar measures must be followed for ADGM foundations as well.

Though UAE has reached DTAA agreements with many countries, most of these tax jurisdictions don’t mention taxation of trusts very clearly and comprehensively. Considering taxation of trusts as hugely complicated affairs, expert consultations are often recommended as a necessity.

- Newsletter, U.A.E

- September 14, 2021

One of the main objectives of the GCC is the gulf economic integration as per provisions of Article IV of the GCC’s set of laws for achieving coordination, integration and interdependence among member countries in all fields through similar economic regulations, joint ventures and strengthening ties with private sectors including technological and scientific progress.

Gulf economic integration focuses on the movement of products, removal of trade barriers including coordination and unification of economic policies. Work is also in progress to complete the requirements of the Monetary Union and the issuance of a GCC single currency.

The UAE has always been a forerunner in the area of GCC joint integration and all the country’s achievements are documented in the statistical reports of the Gulf Cooperation Council General Secretariat. UAE is the first member state to permit GCC citizens to own real estate (76%) in 2013 and grant licenses for economic activities and company formation in Dubai. It also allows GCC citizens to work in its government sector, grants admission to GCC students to public education, and achieves a high volume of intra-regional trade of GCC countries.

The Minister of State for Financial Affairs of the UAE, Obaid Humaid Al Tayer met Dr Nayef Falah Mubarak Al-Hajraf, Secretary-General of the Gulf Cooperation Council (GCC) on 2nd August 2021.

The agenda of the meeting was to discuss measures for enhancing economic and financial cooperation between GCC countries, ensuring better economic integration, accelerating trade and promoting outputs delivered by the GCC Customs Union Authority (GCCCUA, established in 2003) and the Gulf Market Committee (GMC, established in 2008).

The Minister of State for Financial Affairs emphasized the crucial role that UAE played in boosting the economic, trade and developmental integration, and widening the scope of cooperation amongst the GCC member countries and solidifying the role of GCC countries in the decision-making process of the world economy.

Al Tayer noted that the Gulf Council plays the desired and necessary role in strengthening economic ties and strategic partnerships between the member countries. He also stressed the intentions of the Ministry of Finance for promoting relations between the UAE and other GCC countries for achieving planned developmental goals.

The Unified Economic Agreement of the GCC countries and its implementation is looked after by the Ministry of Finance of the UAE including joint GCC economic action, associated projects, financial integration, and the implementation of plans of the GCCCUA and GMC.

“Department of the Cooperation Council for the Arab States of the Gulf Affairs”, a specialized wing of the Ministry of Finance has been established and assigned the responsibility to keep a follow up on the effective implementation of projects for economic integration.

Implementation of policy frameworks as a measure towards strengthening and boosting economic and investment ties with the GCC countries has been discussed by Dubai UAE with particular emphasis on the enhancement of trade exchange. The framework was also designed to support the sustainability of the gains accomplished by the GCCCU and the Gulf Common Market.

Discussions were held between Obaid Humaid Al Tayer and Dr Nayef Falah Al- Hajraf on potential frameworks and ways for strengthening and accelerating economic and investment cooperation with the GCC member states. The meeting convened on 2nd August 2021 was a result of efforts put by the Ministry of Finance for strengthening and extending support to joint GCC economic action and deciding on a common direction towards confronting international as well as regional changes in the economy.

Expanding on areas of co-operation and joint coordination among the GCC countries particularly in terms of the volume of trade exchanges that could confer the GCC region a distinguished position on the global economic decision-making map were also discussed during this meeting.

Al Tayer highlighted saying, “The Gulf Cooperation Council (GCC) plays a key role in consolidating the strong relations and strategic partnership between the member countries to enhance the Council’s march. The Ministry of Finance is keen to bolster the ties between the UAE and the GCC countries, to support the GCC joint action and meet its aspirations for development and prosperity.”

To strengthen and promote ways of economic and investment cooperation with various countries of the world, the UAE, represented by the Ministry of Finance (MoF) previously signed agreements with other countries as a GCC member state to strengthen its position across the world. As per the latest data and statistics, the total volume of the economy of all GCC countries is one of the biggest across the globe.

- Newsletter, U.A.E

- September 14, 2021

Overview

Universally recognised as overly complicated, Family Offices are run for many generations and greatly influenced by family dynamics and numerous business ventures, local and global investments, International business structures, trusts, foundations, real estate and other assets giving rise to a great number of complexities.

With time, family offices expand due to increasing numbers of beneficiaries through inheritances and the new and younger entrants bring in a plethora of conflicts of interests. Unless effective corporate governance is put in place, future decision making processes and maintaining harmony within the family becomes extremely difficult for a long and successful family business.

Corporate structures for family offices are often tailor-made as there is no single fit for the purpose that can control and manage these entities, ensure family unity in diversity and comply with all Family office regulations in UAE.

What is Corporate Governance?

Corporate governance is defined as a set of rules, regulations, policies and procedures that controls, directs and guides a business entity for balancing the interests of all the stakeholders including the community and the government as a whole. In the context of family offices, it governs every aspect of managing family affairs be it an investment, charity, business diversification, personal maintenance etc.

Though informal governance is sometimes practised for smaller family offices such as board meetings convened out of board rooms, well documented governing arrangements must be implemented for bigger family offices to effectively address the complex decision-making processes. As a family business grows, well-documented policies and procedures become inevitable to ward off family conflicts and navigate through unprecedented emergencies.

Why is good governance indispensable for UAE family offices?

Lack of transparent, ethical and well-accepted decisions can have serious consequences on a family business with growing conflicts and distrusts amongst family members and many lost business opportunities. A robust governing mechanism headed by a professionally credible board of directors can only make such decisions and steer clear of all family conflicts during major and bold moves in acquisitions, investments and other strategic issues.

A well established 4 P governing system encompassing people, process, performance and purpose can aid in achieving the following

Effective Conflict Resolution

Conflicts and disputes in family office environments emerge due to many reasons including differences in values, poor communications and interactions, poor performance, opposing interests, scarcity of resources, and personality differences and requires the management to timely and rapidly intervene before the conflicts can jeopardize the mission and objectives of UAE company incorporation.

A consensus-oriented responsive corporate governance with dispute resolution mechanisms and procedures can help the management eliminate conflicts to a great extent through improved communication, interaction and exchange of ideas and perspectives. The success of family offices is most often determined by the effectiveness of corporate governance and conflict management systems establishing a balance of interests of various stakeholders.

Smooth Succession Planning

For the preservation of family wealth, smooth and effective succession planning is crucial. However, it poses several challenges to family offices and is time-consuming considering the long time taken to strategize and formulate handing over the decision-making responsibility from a founder to the next generation. Most of the founders believe in short term fixes and prefer to keep the decision making process with themselves and are reluctant to transfer the power.

Good governance can instill business culture and promote values amongst the family members that help them understand the long term business goals and the necessity for the participation of the younger generation as early as possible facilitating smooth succession planning.

Reduced Risks of Fraudulent and Unethical Practices

Improved Financial Performance

Good governance promotes the financial performance of family offices as it encourages systematic and strategic investment plans depending on the need and preferences and avoids adhocism. Fundraising also becomes easier for a business set up in Dubai when well-governed and in compliance with every law and regulation of the Emirates.

Business Continuity

What are the attributes of well-governed family offices in the UAE?

Following are some attributes of well-governed family offices

- A shared vision, mission and goal are most important for family offices for implementing major decisions eliminating conflicts and randomly taken decisions by the founder.

- A tailor-made governing framework must be designed, developed and implemented as every family office is unique with varying objectives and scope.

- An environment of open and transparent communications comes first even when the best governance system is implemented as disputes and conflicts can not be ruled out completely. An accommodative and participative policy fosters easy and effective communication and helps avoid pent up ill feelings and personality clashes.

- A review mechanism must be in place to evaluate continuing suitability of the governance system for meeting the shared vision, mission and goal of family offices.

- A resilient and flexible governance structure can help family offices in times of unforeseen circumstances without any serious adverse effects on business performance and sustainability.

- A technology-driven governance structure can facilitate risk management, easy and interrupted communication amongst family members and fast decision making backed by information and data.

Takeaway

- Article, U.A.E

- September 13, 2021

Overview

COVID-19 pandemic has posed a global health crisis and turned out to be our greatest adversary since World War Two. Irrespective of the elderly and those suffering from health issues, all individuals are made to ponder over the systematic planning of distribution of their estate and wealth for rightful succession through a legal document declaring individual intentions for the division of their assets upon death.

To provide better living standards to the expatriate community who are in great numbers and both working and residing in the country, the government has put a lot of effort into introducing many crucial amendments to several laws and most important amendments to the issues of succession planning and inheritance. However, this being a complicated and sensitive subject needs careful handling and expert professional and legal advice.

Estate and Succession Planning in the UAE

The United Arab Emirates (UAE) has recently announced several legal and regulatory changes in the private wealth space.

The UAE is considered as an investment hub in the MENASA region and its regulatory environment plays an influential role in drafting the succession plan and division of wealth to the future generations of the Ultra High Net Worth Individuals (UHNWIs). As huge private wealth is concentrated in the Middle East mostly owned by family businesses, the successful transfer of such wealth is vital for the future economic development and growth in this region.

UAE’s inheritance provisions, long dictated by the Sharia provision, have recently been replaced with alternative measures for Expatriates and brought in amendments in the distribution of the estate of a non-Emirati individual. The estate planning can now be handled as per the rules of the home country of a non-Emirati when found different. In case of a divorce, similar provisions shall apply for the distribution of wealth and property.

The latest amendments demonstrate the country’s commitment to remain attractive to foreign expatriates and attract foreign direct investment into the country. The changes are made to address certain succession issues and facilitate the planning of transfer of wealth of many expatriate residents and private business owners in the country. Earlier Sharia dictated inheritance provisions applied even to the non-Muslims and for the distribution of assets of individuals on their demise unless a registered will was available with the Wills and Probate the Registry of the DIFC or the Abu Dhabi Judiciary.

The new regime mandates that the country’s rules and regulations shall determine the distribution of assets of the deceased citizen unless a registered will has been made with specific intentions. Similarly, the distribution of real estate in the UAE will continue to be distributed as per the rules prevailing in the country.

Vice President and Prime Minister of the UAE His Highness Sheikh Mohammed bin Rashid Al Maktoum as Ruler of Dubai issued Law No. 9 of 2020 for regulating family-owned businesses in Dubai. A transparent legal structure has been introduced in this legislation in an endeavour to secure and grow the wealth of individual families as well as promote contributions of the family businesses and private wealth for the social and economic development of the nation.

The new law has been made optional for new and existing family businesses including corporate equity securities and proprietorship. Family ownership in public joint-stock companies including movable and immovable properties however have been excluded from this regulation.

A legal framework for the internal business processes of family-owned entities has been provided in this new law regulating articles of family ownership contracts, organizational structure and management, responsibilities and authorities management with clearly defined delegation of power including the composition and structure of the board. The responsibilities of government entities towards the formation of family businesses have also been clearly outlined.

To make the family ownership contract legally binding, a few conditions have been put forth as under. Once the conditions are successfully met, the contract will require an attestation from a notary.

- All parties of the contract to be members of the same family with a single common interest

- Shares of each member to be clearly defined, and,

- The legal monetary rights including rights of assets must lie with the concerned parties under the purview of the contract

How can IMC help in your Estate and Succession Planning in the UAE?

We, at IMC, continually strive to offer families personalized services that can create maximum value. We are a UAE based professional services provider with an entire range of solutions fully compliant with UAE laws and regulations and backed by advanced technological infrastructure and systems.

We put our clients first and build a trusting relationship with a commitment to utmost confidentiality and help our clients for an effective and smooth transfer of family assets to their future generations.

We religiously coordinate with inheritance, tax and estate law experts and commit our most value-added services to establish and administer estate planning and succession structures to families across the globe. We also provide our services for asset management and protection, tax planning, trade transactions, business and family succession, and estate planning.

Takeaway

The succession planning process can be complex at times and especially when it involves establishing Company Structures, Foundations and Trusts at an international level. It usually calls for professional and expert consultations and can be outsourced to a local service provider for ensuring the continued security of assets and smooth succession.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group