- Article, Singapore

- November 6, 2019

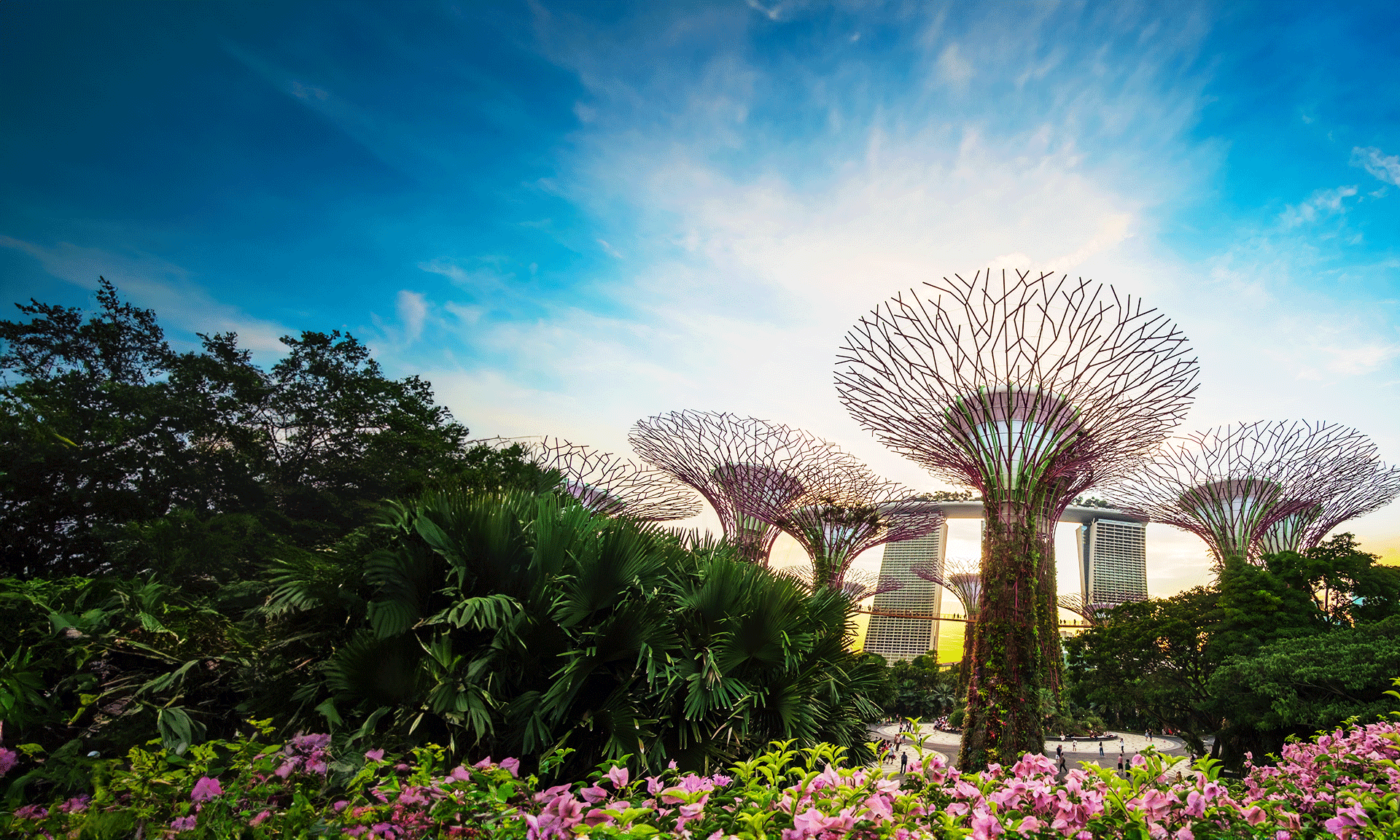

While the world’s economy is facing downtrend and going through a bumpy ride, Singapore has been ranked as the world’s most competitive economy. As per an updated global league table, Singapore has beaten the top economies across the globe to become the most competitive economy. The Global Competitiveness Report series provides an annual assessment of long term economic growth and drivers of productivity.

Singapore beats the United States of America to emerge at the top spot in the ranking of 141 economies. The last time the country took the top spot in the rankings was in the year 1999. Singapore scored 84.8 out of 100 and secured the top spot. The US scored 83.7 in comparison to last year’s score of 85.6. The US lost the top spot due to uncertainties and effects of trade war

Current Year Ranking | Economy | Last Year Ranking |

| 1 | Singapore | 2 |

| 2 | United States Of America | 1 |

| 3 | Hong Kong | 7 |

| 4 | Netherland | 6 |

| 5 | Switzerland | 4 |

| 6 | Japan | 5 |

| 7 | Germany | 3 |

| 8 | Sweden | 9 |

| 9 | United Kingdom | 8 |

| 10 | Denmark | – |

As per the report, the performance of Hong Kong improved and it rose four spots to claim the third place. This report is prepared on the basis of responses received in the first quarter of the year i.e. before the political turmoil began in the country. The report appreciated Hong Kong’s macroeconomic stability and financial system. The Netherlands jumped two spots to fourth place and Switzerland fell by one place.

According to the statement from the World Economic Forum, “Singapore improves from an already high base. The country is ranked first for infrastructure – one of the index’s 12 assessment pillars.” The country is also ranked number one for two other index pillars; labour markets and citizen’s healthy life expectancy years.

The Minister for Trade and Industry Chan Chun Sing said that the top rankings of the country reflect the strong fundamentals of Singapore’s economy which keeps it ahead of its competitors. He also added that even after topping the rankings charts, the success shall not be taken for granted. He said that the country must persevere to remain ahead in the world that is full of economic uncertainties and equip the country’s workers with right set of skills to remain competitive.

According to the report, Singapore ranks third when it comes to skillsets for the current workforce and 28th when it comes to skills of the future workforce. When it comes to market efficiency, financial stability and financial system, the country scores really well. The report further stated that Singapore is behind only Finland when it comes to the quality of public institutions. The report said that the country lacks commitment to sustainability and ranks 124th on the Freedom of the Press Index.

The report highlighted that if Singapore aims to become a global innovation hub it needs to promote entrepreneurship. The country ranks 93rd when it comes to hiring foreign labour and it needs to be improved.

CIMB Private Banking economist Song Seng Wun gave a statement that the number one ranking in terms of world’s most competitive economy showcases the will power of the policymakers in Singapore who aim to make the country the most preferred place to do business. However, he further added that Singapore needs to learn to work with the constraints that surround it.

Mr. Song gave the example that a small population of 5.6 million in Singapore has attracted top technology companies like LinkedIn, Facebook, Google, etc. to set up their offices in the country. But the local talent of the country may not provide them enough expertise which they require. This is the gap that needs to be filled between the current and future workforce through learning.

Lawrence Loh, National University of Singapore Business School’s Associate Professor said that Singapore is a global investment hub and it helped the economy get the top rank.

Another reason for the rise of Singapore as the most competitive economy is the slide in the performance of US. The report stated that “even after the weaker performance by US this year, it is still the most competitive economy of the world. US is still the top place for business dynamism and second in terms of innovation capability pillar”.

There is absolutely no doubt that Singapore is the top country to set up the business. If you are looking for company formation in Singapore, you can contact IMC Group. We provide expert assistance in setting up various types of companies in Singapore. In addition, we assist every registered company by providing them accounting services in Singapore. For more information, you can get in touch with IMC Group.

- Article, India

- November 5, 2019

Goods and Services Tax (GST) came into effect in 2017 and since then it is mandatory for all the businesses in India to create GST-compliant invoices; both on paper and electronically. It is an integrated system of buyers and sellers, wherein one person’s supply must match another person’s purchase.

Issuing a proper GST invoice is of paramount importance for successful return filing. Therefore, in this article, we will tell you everything about the GST rate, GST invoice and how to raise GST-compliant invoices to consumers.

Before we get into technicalities, some basic concepts must be understood well.

Who should issue GST Invoice?

Every GST registered business needs to provide GST-complaint invoices to its customers for the sale of goods and/or services.

GST Rates

GST came into effect with a five-tier tax slab in order to demarcate the essential and luxury goods. The slab rates are as follows:

- NIL – No GST is imposed on commodities like sanitary napkins, colouring books and drawing books for children, salt, cereal grains like wheat, oats, etc.

- 5% – Imposed on items like biogas, natural cork, cashew nuts, kites, etc.

- 12% – Imposed on items like notebooks, ketchup, pickles, diagnostic kits, plastic beads, etc.

- 18% – Imposed on items like sports goods, aluminium foil, set up boxes for televisions, computer monitors (not exceeding 17 inches), headgears, power banks, etc.

- 28%. – Imposed on items like aerated waters containing added sugar, non-alcoholic beverages, cigars and other tobacco products, paints and varnishes, granite, perfumes, cosmetics, etc.

You can easily find the GST rates on various goods and services on the GST website. Below mentioned are steps to find the GST rates.

- Log on to the official page of Central Board of Indirect taxes and Customs i.e. https://cbic-gst.gov.in/index.html

- From the top menu bar, click on the “Service” From the drop-down, select “GST Rates”option.

- Once the page opens, you can use the search bar to find the GST rates of the required goods and services. You can also find the pdf file for the rates on the right-hand corner of the page.

Based on the GST tax rate, the business needs to prepare GST-compliant invoice. For every business having a valid GSTIN (GST identification number), an invoice must be issued by the supplier to its customers at the time of sale of goods or services. In order to claim Input Tax Credit and refunds, supplier must produce a valid invoice mentioning appropriate details.

What are the mandatory fields a GST Invoice should have?

- Name, address and GSTIN of the supplier.

- Tax invoice number and date (Tax invoice will have a unique number for a financial year).

- Buyer’s or recipient’s GSTIN, name and address, if he is registered. If the buyer or recipient is not registered and the value of taxable supply is more than Rs. 50,000 then the invoice should have the following details:

- Name and address of the recipient

- Address of the place where the goods or services are to be delivered

- State name and state code

- Details of the goods and services supplied in terms of description, quantity (number), unit (meter, kg, etc.) and the total value.

- The taxable value of the goods or services supplied after adjusting the discount, if any.

- HSN code of goods or Accounting Code of services.

- Applicable rate and amount of GST based on the transaction made i.e. CGST, IGST, SGST, UTGST and cess.

- Details of place of supply along with the name of the state, in case of inter-state trade or commerce.

- Details of the delivery address where the place of delivery is different from the place of supply.

- Clear mention on the invoice, if GST is to be paid on the reverse charge basis.

- Signature of the supplier or his authorized representative.

The supplier has to raise 3 copies of invoices at the time of supply of goods. The supplier will keep the original copy while the duplicate copies will be with the transporter and recipient of goods. In the case of supply of services, 2 copies will be issued; one for the supplier and other for the recipient.

What are the other types of invoices?

- Bill of Supply – Bill of supply is just like the GST invoice except that it does not contain any tax amount as the seller cannot charge GST to the buyer because the goods or services provided by the registered businesses are exempted or the registered person has opted for composition scheme.

- Consolidated Tax invoice – This type of invoice is issued when the value of goods or services supplied is less than Rs. 200. A consolidated tax invoice is also issued in situations where the registered person does not issue an invoice.

- Receipt Voucher – This type of invoice is issued when the GST registered supplier receives the value of goods or services in advance from the customers for future supply.

Apart from the above-mentioned scenarios, a proper invoice should be issued. Failure to raise a correct invoice is an offence and would attract penalties under the GST law

- Article

- November 1, 2019

[vc_row][vc_column][vc_single_image image=”29569″ img_size=”full”][/vc_column][/vc_row]

- Article

- October 29, 2019

About Australia

Australia crowns to be the largest country in Oceania and also boasts of being the world’s sixth largest country with an area of approximately 7.7 million square kilometres. The country comprises six states and two territories namely, the Australian Capital Territory (which includes Canberra, the political capital of Australia), New South Wales, Northern Territory, South Australia, Queensland, Victoria, Tasmania, and Western Australia. Australia shares close neighbourhood with Indonesia, Papua New Guinea and East Timor.

The country is known to have one of the strongest, open, flexible and most competitive economies in the world. In fact, it is one of the largest economies in the Asia Pacific region following China, Japan and Korea. Along with the strong economic growth, Australia also enjoys low inflation, which makes it all the more attractive for investors for doing business in the country.

Australia ranks 18th in the World Bank’s, Ease of Doing Business Report 2019. This is a testament to the country’s forward-thinking approach to business, protection of intellectual property rights, sound business regulatory environment and openness to global commerce.

This article covers everything you need to know about doing business in Australia, right from understanding the country’s tax and legal compliances to knowing about the types of business entities that can be formed.

Doing Business in Australia

Australia ranks on 12th position in the world economy and enjoys the 6th highest per capita GDP. Major sectors that contribute to economic growth include mining-related exports, banking, manufacturing, telecommunications, tourism and agriculture.

MNCs consider Australia as the best place for setting up their regional headquarters as the country offers them an opportunity to easily target the dynamic Asia Pacific region. It is also a leading financial centre in the Asia Pacific region.

The corporate tax rate in Australia is 30% which is very competitive as compared to other major economies. Moreover, it offers cost advantages to businesses in terms of office space, industrial land, utilities, transport infrastructure, etc.

In addition, the Government in Australia welcomes and encourages foreign investment. Also, the legal framework and government policies are very liberal and transparent.

Types of Business Entities for Incorporation in Australia

You can incorporate the following types of business entities in Australia:

- Private Proprietary Company (Limited Liability Company)

- Limited Liability Partnership

- Australian Trading Trust

- Public Limited Company

- Branch

- Representative Office

Depending on the type of entity that you choose to incorporate, the timeframe for incorporation, rules and regulations vary. Every type has its own advantages and disadvantages. Therefore, one must analyse all the conditions before incorporating a business entity in Australia.

Benefits of Registering a Company in Australia

Some of the advantages of registering a company in Australia include:

- Quick business registration within a weeks’ time owing to simple and direct rules

- Multiple trade agreements with other nations

- World-class infrastructure

- Educated and skilled labour force

- Incentives offered by The Australian Trade Commissions (Austrade) helps international companies source goods and services in the country. It also aids in identifying potential investment projects and strategic business partners.

- Safe environment to conduct business and trade

- Advanced nation

- Suitable location in the Asia Pacific region for conducting research and development

Tax Registration and Filing in Australia

Australian domestic corporations have to pay corporate income tax on worldwide income, including income earned by their foreign branches. Some of the important things to consider in relation to taxation in Australia are:

Tax Structure | Percentage |

| Corporate Income Tax Rate | 30% |

| Capital Gains Tax Rate | 30% |

| Dividends | 30% |

| Interest paid by Australian Branch of Foreign Bank to Parent | 5% |

| Royalties | 30% |

| Construction and Related Activities | 5% |

| Goods and Services Tax | 10% |

| Fiscal Year in Australia | 1 July to 30 June |

| Companies with year-end of 30 June | To file returns by the following 15 January |

Australia’s Double Taxation Treaties

Australia has double taxation treaties with many countries throughout the world including Singapore, India, Canada, France, Germany, Indonesia, Malaysia, South Africa and the United Kingdom among others.

If you are a company in Australia and looking for company formation in Dubai or company formation in Singapore, you may get in touch with IMC Group.

Legal and Compliance Requirements in Australia

All incorporated entities in Australia are required to comply with the below mentioned laws:

- In order to form a limited liability company, the minimum requirement is 1 shareholder and 1 director. Non-resident investors have to appoint 1 director living in Australia.

- For trust to function as an alternative to a trading company, they have to get registered with the Australia Companies Registrar and tax authority.

- If all the trustees of a trust company are living outside the country, they have to appoint an Australian resident as a trustee or as a public officer.

- Limited liability partnerships must comprise of general partners whose liabilities extend up to their personal assets along with a limited partner whose liability only extends to their contribution. In addition, a minimum of 1 general partner must be an Australian resident.

- Public limited companies must have a minimum of 3 directors out of which 2 must be Australian residents.

- All branches in Australia are required to appoint a local agent who can accept services and notices on behalf of the foreign company. In addition, a branch is also required to have a registered address in Australia.

- Representative offices are restricted from engaging in activities that amount to carrying business.

Company Secretarial Compliance in Australia

Before starting a business in Australia, you need to comply with the below mentioned laws:

- All companies in Australia are required to keep minutes book that records the following:

- Resolutions passed by the members or directors without a meeting.

- Proceedings and resolutions of the members and directors of the company in meetings.

- In case the company is a proprietary company having only 1 director then the making of declarations of the director.

- The minutes of the company should be kept at the registered office or the principal place of business or any other place in this jurisdiction approved by ASIC.

- The chairman of the meeting should sign the minutes.

- Written consent must be taken from the director or secretary of the company for the appointment of such position as well as shareholders.

- All registered business entities in Australia should receive an Australian Company Number.

Accounting Services

All companies in Australia have to follow International Financial Reporting Standards (IFRS) for accounting. The responsibility of developing, issuing and maintaining accounting standards for entities in the public as well as the private sector is on the Australian Accounting Standards Board.

Auditing Services

As per the Australian law, large proprietary companies have to prepare annual financial reports and a directors’ report, get their annual financial statements audited and send these reports to the shareholders. The companies are also required to file the annual financial reports with ASIC unless a specific exemption applies to them. Even representative offices and branches are required to get their financials audited.

- India, Newsletter

- October 25, 2019

India has stepped up 14 places to take the 63rd position among 190 countries in the World Bank’s Ease of Doing Business ranking which was released on Thursday after the announcement of numerous economic reforms by the Narendra Modi-led government.

India was at the 77th place among a total of 190 countries in the last year’s ranking, which is a gain of 23 places. The report evaluates enhancement in the ease of doing business environment in cities like Delhi and Mumbai, which also shows that company formation in India is much simpler now.

“Sustained business reforms over the past several years has helped India jump 14 places to move to 63rd position in this year’s global ease of Doing Business rankings. India put in place four new business reforms during the past year and earned a place in among the world’s top ten improvers for the third consecutive year,” the World Bank Group’s Doing Business 2020 study said.

The newest reforms are in the Doing Business areas of Setting up a Business, Managing the Construction Permits, Handling the Trade Across Borders and also Resolving Insolvency.

In Doing Business 2020 report, India along with other top-gaining countries executed a total of 59 regulatory reforms in the years 2018/19—which accounted for almost one-fifth of the total reforms recorded globally.

Junaid Ahmad, World Bank’s Country Director in India said that India’s remarkable headway in the Doing Business rankings over the last few years is an incredible accomplishment, specifically for an economy which is so enormous and complex. Special attention given by the country’s top leadership, and the relentless attempts made to propel the business reforms agenda, both at the central and the state level, aided India to make such significant improvements. Now, the focus should be carrying on with this trend to maintain and further improve this ranking.

Doing Business recognises the 10 economies that have progressed the most on the ease of doing business after executing the regulatory reforms. In Doing Business 2020 report, the 10 top improving nations are Saudi Arabia, Togo, Jordan, Bahrain, Pakistan, Tajikistan, Kuwait, India, China, and Nigeria.

The founding of a modern insolvency regime in the year 2016 under the comprehensive policy to reorganise corporate law paved the path for steady upsurge in the number of reorganizations, in spite of some implementation-related challenges. Consequently, the overall rate of recovery for creditors moved up drastically from 26.5 to 71.6 cents on the dollar. “India now is by far the best performer in South Asia on this component and does better than the average for OECD high-income economies,” it said.

Concluding the procedures necessitated building a warehouse now costs only 4 percent of the total warehouse value. Creating quality control measures has also improved, and now only six economies globally have a score, which is more than India’s 14.5 out of 15 on this index.

Importing and exporting has become much simpler for companies for the fourth year in a row. With the newest reforms, India now stands at the 68th position worldwide on this indicator and does considerably better than the regional average. The time needed for the logistical processes such as exporting and importing goods is also now significantly reduced.

Doing business ranking is constructed on quantitative indicators on regulation for setting up a new business, handling construction permits, getting facilities like electricity, registering the property, protecting minority investors, getting credit, paying taxes, doing trade across borders, applying contracts and also resolving insolvency.

- Newsletter, U.A.E

- October 23, 2019

In the earlier part of 201, the Cabinet of Ministers in the UAE announced the release of Resolution No 31 of 2019 (Resolution), which was regarding the Economic Substance Regulations (ESR) that would be applicable with immediate effect.

ESR was introduced to make sure that all the companies that are conducting their business in the UAE, pursuant to the trade license gained from relevant authorities, comply with the Economic Substance Test. The resolution offers useful and important guidelines and parameters to perform any such substance tests.

This particular resolution is also a move to meet the EU’s obligation to remove UAE from the EU black list. EU has had a list of non-co-operative jurisdiction aimed for tax purposes. Consequently, on 10 October 2019, the EU has struck off UAE’s name from its black list.

Where is it applicable?

- ESR is applicable to all UAE companies who have gained a trade license or permit from relevant authorities to perform ‘Relevant Activity,’ which includes the Free Zone and also the Financial Free Zone.

- Nonetheless, this resolution would not be applicable to the companies that are owned by the Government of the state, other Government authority or body, or Emirate of the state directly or indirectly.

Relevant businesses and their core income-generating activity

| Relevant Business or Activity | Core Income-generating Activity |

| Shipping |

|

| Holding Company |

|

| Banking |

|

| Insurance |

|

| Investment Fund Management |

|

| Lease-Finance |

|

| Headquarter |

|

| Intellectual Property or IP (where IP is patent/non-trade intangible) and it is a High-Risk IP Licensee* |

|

| Distribution and Service Centre |

|

* High-Risk IP Licensee is defined as a licensee who:

- Did not create an IP that is held for business and acquired an IP from any related persons, in deliberation for funding any research and development activities carried out by another person located outside of the UAE and licenses such IP to related persons or generates any income

- Does not perform any research and development activity, or any marketing, branding, or distribution activities as part of main income-generating activity

What are the main parameters for the Economic Substance Test?

Licensee should mandatorily satisfy the below-mentioned criteria to be able to meet the Economic Substance Test in relation to the Relevant Activity:

- Perform the core or key income-generating activities in the UAE

- Licensee should be guided and managed in the UAE

- Required frequency of the Board of Directors meetings to be held in the UAE

- Directors should be having the required knowledge and expertise to carry out their duties

- To hire the required number of qualified and trained full-time employees, or satisfactory outsourcing expenditure spent for third party service providers

- To own the required amount of physical assets in the UAE

Requirement from the compliance point of view

- Notifications to be submitted

Licensee has to notify the authority on following every year:

- Whether or not it is performing the Relevant Activity

- If yes, then the gross income for the Relevant Activity depends on the tax outside the UAE

- If the financial year is followed by the licensee

- Reports to be submitted

If the licensee is performing the Relevant Activity, then it is needed to submit a detailed report every year within 12 months from the end of that Financial Year, detailing all the operations-related information, which includes but is not limited to employee details such as their experience, qualifications, type of contract, duration of employment, etc. and also detailed information on intangible details of the licensee.

What are the various offenses and penalties that are prescribed?

The resolution has recommended the following offenses and their penalties as mentioned here:

| Offenses | The related penalty |

|

Failure to comply with the Economic Substance Test | AED 10,000 – AED 50,000 (First Year) |

| AED 50,000 – AED 300,000 (Subsequent Year) | |

| Failure to give the required information or provide inaccurate information | AED 10,000 to AED 50,000 |

However, before a penalty is levied, the relevant authority should issue a notice (that is, giving an opportunity of being heard) to the licensee.

In addition, the authority can neither decide the economic substance test of the licensee nor levy any penalty after 6 years from the end of that financial year (an exception is only if there is deliberate misrepresentation or any fraudulent action done by the licensee or any other individual)

What lies ahead?

- The UAE has announced Country-by-Country-Reporting (CbCR) Regulations recently, which are in line with its commitment for implementing the Base Erosion and Profit Shifting (BEPS) standard for Action Plan 13. After the introduction of ESR, UAE has been able to send a positive signal to the rulers of its trade partners located in the other jurisdictions.

- Additionally, announcement of these regulations have already aided the UAE in striking off their names from the EU blacklist. However, the execution and implementation process of these regulations in the UAE, could pose some challenges as it does not have any taxation related law till date.

- In spite of the regulations offering some very useful guidelines, the licensees will need a lot of judgment professionally to decipher if a particular activity meets the substance test or not.

- The above-mentioned regulations also bring out extra compliance requirements on part of the licensee and all the businesses operating in the UAE who are still struggling with the GST-related issues and compliances in the area.

Multinational companies are recommended to be pro-active and reconsider their current operational activities to alleviate and avoid any probable risk of non-compliance with regards to the above regulations.

- Newsletter, Saudi Arabia

- October 21, 2019

Saudi Arabia opened its doors to global tourists recently and announced a new visa regime, which will be applicable for 49 countries. The sultanate is also encouraging foreign companies to come and invest in a sector which hopefully would contribute almost 10% of the gross domestic product by the year 2030.

The kingdom, which was comparatively closed for decades, has recently, relaxed some of its severe social codes such as differentiating men and women in various public places and necessitating women to dress in all-covering black robes called abayas.

The tourism chief, Ahmed al-Khateeb mentioned before the official announcement that abayas would now not be compulsory; however, modest dress should be worn, which covers shoulders and knees, especially in public places and also at public beaches.

He also said that alcohol would remain banned. Visas, however, are now easily available online, either on arrival or at various Saudi diplomatic missions for a cost of about $120 which includes a health insurance fee. Outbound countries comprise of the United States, China, Russia, Japan and many European states as of now. More countries are slated to be added later.

Visas permit multiple entries and one could stays up to 3 months. There are no constraints for unaccompanied women, as was in the past, and Muslims can also do pilgrimage other than the Haj season.

Till now, any foreigners who were travelling to Saudi Arabia were majorly restricted to resident workers and their dependents, Muslim pilgrims who are allotted special visas to visit the holy cities like Mecca and Medina, and other business travellers.

The plans to welcome considerable numbers of tourists who come for leisure have been discussed for long, but was not accepted due to conservative views and bureaucracy. An added benefit was the e-visa meant for sporting events and concerts, which was announced last December.

This move comes as a part of the de facto ruler Crown Prince Mohammed bin Salman’s impressive plans to cultivate new industries to deter the world’s top oil exporter off crude and open up the country’s society by introducing formerly banned entertainment.

In quest of investments

In addition, the tensions with arch-enemy Iran have also flared up. Riyadh accuses Tehran for an assault earlier this month on Saudi oil facilities, which is denied by Iran.

However Khateeb, the chairperson of the Saudi Commission for Tourism and National Heritage, mentioned that the country is quite safe and this attack would not influence the plans to attract more tourists.

Tourism remains high on the crown prince’s memo or agenda, in spite of a shortage of infrastructure. To push further growth, Khateeb projected that almost 250 billion riyals ($67 billion) of investments are required, which includes 500,000 new hotel rooms by the year 2030 — half from government-supported mega projects and other half coming from private investors.

The government has also signed a memoranda of understanding which totalled to approximately 100 billion riyals with about regional and global investors like conglomerate Triple Five and UAE-based developer, Majid Al Futtaim. This of course signals that the next few years are going to be a perfect time for company formation in Saudi Arabia or foreign company registration in Saudi Arabia.

The government wishes to entice 100 million annual visits in the year 2030, which is up from about 40 million currently. The contribution to the country’s GDP is aimed to reach 10% from the current 3%.

This country, which shares its borders with Iraq in the north and Yemen in its south, claims of vast tracts of desert but also lush mountains, untouched beaches and heritage and historical sites that include five UNESCO World Heritage Sites.

This development drive has a purpose of adding almost 1 million tourism jobs. However, adding hundreds of thousands of Saudis into the workforce still remains as a key challenge for the crown prince, who has been able to manage making a dent in the official unemployment rate which is currently over 12%.

- Newsletter, Oman

- October 21, 2019

The Public Establishment for Industrial Estates (Madayn) arranged an Oman-India Investment Meet between September 29 to September 30 at Crowne Plaza in Muscat under the support of Yahya bin Said Al Jabri, who is the Chairman of the Special Economic Zone Authority at Duqm (Sezad) and Chairman of Ithraa.

The event falls within the endeavours of Madayn to pull in new foreign investments to the Sultanate and bolster affiliation with the private sector, specifically in the industrial sector. The meet hosted a very high-profile Indian business delegation comprising almost 35 businessmen who represented various sectors like food, logistics, telecommunications, information technology and renewable energy. Many business and investment officials who represented the public and private sectors in the Sultanate also came for the event.

This event also provided a perfect platform to highlight the investment opportunities available in Oman and Madayn’s industrial towns in particular. It also opened a great opportunity for exploring alliances between the Omani and Indian organizations and factories, which would ultimately add more value to the national economy, offer more job opportunities for the Omani groups in the industrial sector and allow business setup in Oman.

This high level event also highlighted Madayn’s vision in improving the Sultanate’s rank as a leading regional hub of manufacturing, innovation and entrepreneurship excellence, information and communications technology (ICT), and its quest in enticing industrial investments and offering continued support, through regionally and internationally-competitive policies, strong infrastructure, newer value-adding services, and simple and easy-to-manage governmental processes.

The event came in line with Madayn’s attempts to attain its key objectives which include pulling in global investments into the Sultanate while localising the national capital; thus, encouraging the private sector to realise sustainable economic and social development; attaining environmental sustainability, and also help in creating new job opportunities for the national factions and encourage company registration in Oman.

- Newsletter, U.A.E

- October 21, 2019

Foreign ownership in UAE has been a topic of discussions, especially after the FDI Law. But somehow, most of the companies are not aware that retention of 100 percent foreign ownership in the UAE via alternative modes, especially through establishing a branch of a Foreign Company where the ownership of the branch company is vested fully or 100 percent with the Foreign Company.

Article 327 of the UAE Federal Law No (2) of 2015 on Commercial Companies (“UAE Commercial Companies Law”) provides Foreign Companies with the right to function in the UAE depending only upon the provision of the law. Article 328 explains that any Foreign Company setting up its principal office or branch in UAE mainland should get a relevant license first from the representative Emirate’s or State’s governing authority. Foreign companies might not perform any activity or set up their own branch or principal office in the State without getting a license from the relevant authority after the approval of the ministry. The license would decide the activity which can be performed or practiced by the company.

As specified by Article 330, sub-article (2) of the above Law, the branch or office of a foreign company in the State to be considered as the main office of its activity in the State, and this activity would be dependent on the law’s provision which is in force in the State. As per the law, a legal person cannot perform any economic activity or form a branch office to any activity prior to getting a license to perform any such activity provided by the relevant authorities in the Emirates. The Department of Economic Development (“DED”) determines the relevant license pursuant to which any individual or legal party can perform economic activities in the UAE.

It is important to note that the license that a company would get and the business form of such a company are two separate aspects; but both are administered independently by the DED, which is accountable to issue the apt license which is in accordance with the pertinent trading activity.

Basically, the aim of the branch office is to endorse and market the products and/or services of the Parent Company, conduct the same business as the Parent Company is conducting, perform the transactions and complete the agreements under the name of the Parent Company, and finally provide services to the customers located in the UAE. It is important to note that a branch company is not permitted to conduct in any activities which are different from its Parent Company, thus, no new or different activity than that of conducted by the Parent Company can be undertaken by the branch company. But, in case the Parent Company does 10 activities, then the branch company is allowed to either undertake all or pick any of those.

After taking the license from the Economic Department, for practicing permanent or temporary activities, the branch company needs to also get the Chamber of Commerce registration.

Article 1 of the Ministerial Decision No. 377 2010 says, ” The Manual of license procedures for branches and offices of firms incorporated abroad and free zones in the UAE attached to the Decision shall be adopted”, thus, before getting the initial approval for setting up a branch of a foreign company within UAE, the DED would need an approval of the Ministry of Economy as a precondition.

Companies that want to conduct business, go in for company formation in Dubai or open their office here would need to obtain a license from the relevant authority in the Emirate and also obtain a certificate of entry at the Ministry. Article 329 of the UAE Commercial Company Law permits foreign companies the right to set up their own offices or branches in the UAE as long as their agent is a UAE national. In case the agent is a company, then it should be a UAE company and all their partners should necessarily be UAE citizens.

To conclude, for opening a foreign branch within the UAE assures 100 percent foreign ownership. However, the branch company is only allowed to conduct similar activities as that of the Parent Company. Also, the parent company remains accountable for the branch’s obligations or debts and is needed to entitle a representative for managing the branch’s affairs.

- Newsletter, Singapore

- October 21, 2019

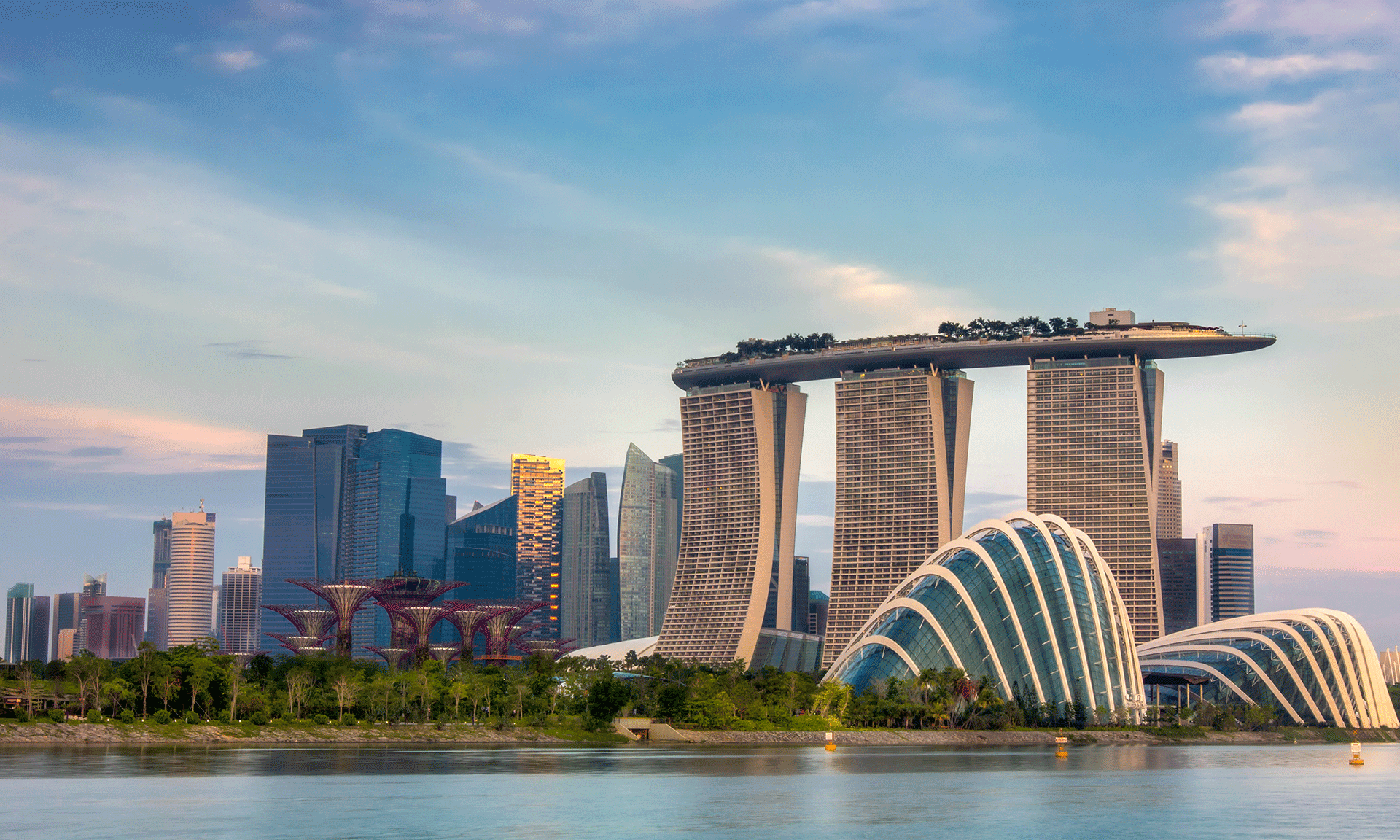

Singapore is a thriving market to set up a new business in; however you should ensure that you are aware of all the obstacles you might face in this process and know minute details of how to start a business in Singapore.

For companies who are wanting to expand their operations in the Asia Pacific region, Singapore happens to be an attractive and top choice. It is known for the ease of doing any business, attractive tax rates and related incentives, availability of skilled workforce, country’s stability and steady economic growth. So, if you are thinking of setting up your company there, the first step should be to get the incorporation process right from the start, thus, avoiding any delays that could cost a lot.

The key steps to incorporate a company in Singapore

There are three key steps for company formation in Singapore.

1.Name reservation: This can be done in just an hour or so, if you have an approved name reserved for four months starting from the application date (please note that no extension to this time period is allowed). To avoid any chance of rejection, it’s best to check the Accounting and Corporate Regulatory Authority’s (ACRA) database first to avoid identical names to any existing companies. In case your company is a part of some group, then a letter of appeal has to be submitted for using a similar naming to the other group companies, though the appeals process can end in a delay of up to two months. Same kind of delays could be incurred in case the name has certain words like ‘bank’, ‘law’, ‘finance’, ‘school’ and ‘media’ as other government authorities would be required to approve the use of the term. You would then need to submit all the details of the directors and shareholders when you apply for a name, so you should have already decided this.

2.Appointment of a minimum of one resident director:The director should be at least 18 years of age, of full legal capacity and must be a permanent resident, a Singapore citizen, and an Employment Pass holder (EP) or Entry pass holder, though an EP has to first get a letter of consent from the Ministry of Manpower prior to becoming a company director. This individual should also not have been disqualified anytime previously from acting as a director.

Company registration process: The application can be submitted through the ACRA online filing system. After submission of your registration documents, an instant approval from ACRA would be given to you through an email and the incorporation procedure would usually be effective on the same date. In some exceptional cases, ACRA might perform random background checks specifically on the information submitted during company registration process, which could further delay the registration by around two months. A company might opt for a preferred registration number out of a list of reserved registration numbers, which comes for a fee. This can be done during the company’s incorporation or registration. ACRA would offer a complimentary business profile after they incorporate the company.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group