- NEWSLETTER, GLOBAL

- November 13, 2024

Generative AI has been a game-changer in various industries, and finance is no exception. As global businesses struggle with more complex data and stricter regulations, the GenAI technology has proven to be a revolutionary inclusion in the realm of finance and accounting processes. Leading accounting professionals deploy AI-powered tools to optimize their daily tasks and improve efficiency. They are enhancing data analytics to benefit from smart insights like never before.

Established companies providing AI consulting services are streamlining operations using these technologies. Thus, they can simplify their financial reporting and deliver better services to their clients.

In this edition, we will explore how GenAI works and how it is transforming financial services. Read on to know why accounting firms are adopting this sophisticated technology to optimize their operations.

What is Generative AI, and How Does It Work for Finance and Accounting?

Generative AI is an advanced form of artificial intelligence. It is a form of AI capable of creating new content and generating insights. It completes tasks based on data provided. The technology goes beyond the role of traditional AI in automating specific actions to actively creating valuable content including text, images, data visualizations, and even personalized reports.

Generative AI streamlines several critical tasks for finance teams like predictive forecasting, data analysis, and reporting. For instance, it can be used to generate real-time financial reports or provide data-driven insights to optimize tax planning and consolidation processes. The technology processes large datasets quickly to understand queries related to natural language. GenAI transforms data into meaningful and actionable insights.

With the rise of AI in accounting automation, top accounting firms are adopting these tools to augment their services. These tools also enhance client reporting capabilities and minimize human error in complex financial tasks.

The Perfect Time for Generative AI to Transform Finance Processes

Generative AI is no longer a futuristic concept. It’s already transforming the finance industry. LLMs that power Generative AI have significantly matured and become reliable tools that can handle complex financial tasks. With improvements in technology like Retrieval Augmented Generation (RAG), GenAI assistants can now produce high-quality outputs backed by real information that can be verified. This reduces the risk of inaccurate or misleading data.

Moreover, GenAI can be seamlessly integrated into existing financial software like cloud-based accounting systems. This makes it easier for finance professionals to adopt and scale. This presents a tremendous opportunity for accounting firms to enhance their services while maintaining the accuracy and transparency that their clients require.

Five Key Ways Generative AI Assists Finance Teams

1. Boosting Efficiency in Data Handling

Gen AI significantly enhances the efficiency of accounting teams. The technology automates routine tasks that would generally take hours. Rather than manually sifting through massive datasets or performing repetitive calculations, accountants can ask the AI to carry out the tedious tasks.

For instance, AI assistants can instantly process vast amounts of transactional data and generate reports or visualize financial trends. This reduces the time accounting firms spend on manual data entry.

2. Generating Accurate Financial Visualizations

One of the key strengths of GenAI is its ability to create high-quality and visually appealing charts and graphs from raw data. Accounting teams often struggle to interpret complex financial data and present it to stakeholders. GenAI simplifies this process as it produces high-quality visualizations that communicate the KPIs and trends.

Accounting firms use tools powered by GenAI to instantly create graphs, heatmaps, and dashboards. Thus, they transform raw data into meaningful visual insights. Thus, companies can communicate their financial performance clearly and confidently which facilitates better decision-making for both internal stakeholders and external clients.

3. Enhancing Data Analysis and Insights

GenAI provides advanced analytical features and eliminates human bias, along with the limitations of manual calculations. It can analyze massive datasets with greater accuracy and identify patterns, weaknesses, or opportunities that are often overlooked by human analysts.

For accounting firms, these financial reports are more precise and insightful. Leading accounting firms are using these tools to provide their clients with deeper insights into their financial health. This helps them make more informed and data-driven decisions like saving tax.

4. Streamlining Actuals Reporting

5. Simplifying Narrative Reporting

Professional AI Consulting Services to Maximize its Potential in Accounting

- NEWSLETTER,U.A.E

- November 13, 2024

As global companies continue investing in the UAE, the importance of compliance comes to the spotlight. During the UAE Growth and Investment Forum, the panel discussion on Corporate Tax highlighted the importance for business owners to shift their mindset towards robust accounting and compliance practices. This is essential to optimize tax benefits amidst the evolving tax regulations in the country.

With new regulations shaping the corporate tax environment in the UAE, the importance of maintaining accurate financial records cannot be overstated. Naturally, forward-thinking businesses are consulting reputed teams of professionals for accounting services in Dubai. According to experts in the field, conscious effort towards internal discipline and proper financial practices is vital to ensure that businesses remain compliant. With the right guidance from tax consultants, they can also optimize their tax structures.

The Need for a Shift in Mindset

An expert speaking at the Forum pointed out that the tax environment in the UAE has significantly changed. He explained that businesses here never had any compliance for so long in the country. However, the need for a conscious shift in their mindset is evident. The days of operation without any structured tax laws are over. Therefore, businesses in the UAE need to adapt with proper accounting procedures in place. They must meticulously follow International Financial Reporting Standards (IFRS) to ensure adherence to standards and optimize their tax obligations.

Tax Regulations Growing Complex in the UAE

The rapid expansion of corporate tax regulations in the UAE is clear as businesses need to be well-informed and proactive. Another expert pointed out that the once concise 60 pages of corporate tax regulations have now grown to over 2,000 pages.

The FTA (Federal Tax Authority) has been actively releasing clarifications and updates, which makes it crucial for businesses to remain informed. The tax authority body has done a wonderful job in raising awareness through educational seminars. It has helped businesses understand the evolving corporate tax environment.

Smart businesses, particularly those operating in free zones, can potentially benefit from exemptions within this framework. However, it requires a clear understanding of the finer details of the law.

Striking the Right Balance

Businesses operating in the UAE need to understand the new corporate taxation laws accurately. The anti-abuse clause within the tax law is one of the major provisions. The FTA evaluates and identifies whether or not a transaction or arrangement contains any element to abuse tax norms. Therefore, businesses must make sure that their transactions are valid for commercial use and refrain from gaining undue tax advantages. Mistakes in this area can lead to serious legal or compliance issues. This demonstrates the need for meticulous tax planning and execution. Businesses must seek professional support from experts specializing in accounting and compliance services in Dubai to remain compliant.

Importance of Accurate Data Collection and Tax Planning

Businesses must allocate resources optimally to prevent potential pitfalls related to compliance. Top accounting firms use advanced tools and software to ensure compliance for their clients. For businesses, it’s crucial to restructure and classify their accounts correctly.

As the corporate tax environment in the UAE continues to evolve, robust accounting practices and compliance have gained unprecedented importance. The shift in mindset from informal to formal accounting and tax procedures, along with a deep understanding of the complex and growing regulations will help businesses optimize their tax benefits.

Established tax advisory professionals like the IMC Group provide reliable accounting and compliance services in Dubai to global businesses. With detailed tax planning and a disciplined approach to data collection, businesses can remain compliant with the new corporate tax norms in the UAE.

- NEWSLETTER, INDIA, U.A.E.

- November 13, 2024

In recent years, particularly after the pandemic of 2020, India and the UAE have entered into a strategic partnership that strengthened their ties beyond trade. These two nations share mutual business interests in key sectors like critical minerals, defence, and energy. The bilateral ties between India and the UAE have bolstered trade and fostered significant flow of investments. Currently, the UAE is positioned as one of the top ten investors in India. The Abu Dhabi Investment Authority (ADIA), which is among the largest sovereign wealth funds in the world, has diversified its portfolio in India. Currently, it spans sectors like aviation, telecommunications, and technology.

On the other hand, Indian firms are looking to capitalize on lucrative investment opportunities in UAE. With India on its side, the UAE has a reliable partner in both security and technology. This interdependence is maturing into a strategic partnership that extends from traditional trade and cooperation on energy to new sectors like defense, space exploration, education, and climate initiatives.

- Landmark Agreement on Civil Nuclear Cooperation

- Main Investment Avenues for India-UAE Collaboration

- The India-GCC Partnership – Boosting Regional Relations

- A Legacy of Trade Between the UAE and India

- Key Commodities: India’s Export and Import Profile

- Strengthening Trade in Local Currencies

- Conclusion

Landmark Agreement on Civil Nuclear Cooperation

The two countries reached a historic milestone when they signed an MoU for civil nuclear cooperation. The deal was signed between India’s Nuclear Power Corporation (NPCIL) and the Emirates Nuclear Energy Corporation (ENEC). In September 2024, this deal was formally signed, and its objective is to deepen collaboration in nuclear energy. It was signed during the visit of Sheikh Khalid bin Mohamed bin Zayed Al Nahyan, the Crown Prince of Abu Dhabi to India.

This partnership matured on the basis of previous discussions initiated back in 2015. Both the countries committed to use nuclear energy peacefully in fields like agriculture and safety. The UAE is expanding its investments in nuclear energy, which reflects a long-term vision for its shared scientific and technological advancements.

Main Investment Avenues for India-UAE Collaboration

1. Multilateral Initiatives and Economic Integration

2. Trilateral Engagements

3. New Agreements in Energy and Logistics

In 2024, India and the UAE signed additional some other to strengthen their energy ties. These include a long-term LNG supply arrangement between Abu Dhabi National Oil Company (ADNOC) and Indian Oil Corporation and a strategic partnership with India’s Petroleum Reserves.

Moreover, the UAE has shown significant interest in supporting India’s food infrastructure. As part of the I2U2 mission, they have made specific investments to develop food parks in Gujarat and Madhya Pradesh.

4. The Role of the UAE in Shaping India’s Energy Sector

The India-GCC Partnership – Boosting Regional Relations

A Legacy of Trade Between the UAE and India

Trade Statistics (in US$ Million)

| Year | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 |

| India’s Export to UAE | 28,853.59 | 16,679.54 | 28,044.88 | 31,608.79 | 35,625.02 |

| India’s Import from UAE | 30,256.65 | 26,622.99 | 44,833.48 | 53,231.55 | 48,025.58 |

| Year | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 |

| Total Trade Volume | 59,110.23 | 43,302.53 | 72,878.36 | 84,840.34 | 83,650.60 |

Key Commodities: India’s Export and Import Profile

Table showing Top Exports of India to the UAE

| India’s Top Exports to UAE | 2022-23 | 2023-24 |

| Mineral Fuels & Oils | 8,681.78 | 8,236.64 |

| Precious Stones & Metals | 5,772.47 | 8,043.08 |

| Electrical Machinery | 3,650.03 | 3,538.86 |

| Nuclear Reactors & Machinery | 1,074.13 | 1,363.65 |

Table showing Top Imports of India from the UAE

| Commodity | 2022-2023 (US$ Million) | 2023-2024 (US$ Million) |

| Natural or cultured pearls, precious stones, jewelry, coins | 14,788.04 | 20,109.77 |

| Mineral fuels, mineral oils, bituminous substances | 27,704.95 | 17,628.89 |

| Plastic and articles thereof | 1,700.46 | 1,664.70 |

| Aircraft, spacecraft, and parts | 1,881.98 | 1,175.53 |

| Salt, sulfur, earths, and stone | 948.23 | 993.94 |

| Iron and steel | 1,071.15 | 674.47 |

| Tanning or dyeing extracts, pigments, paints, inks | 22.81 | 659.31 |

| Ships, boats, and floating structures | 647.37 | 639.38 |

| Aluminum and articles thereof | 509.37 | 529.79 |

| Copper and articles thereof | 454.82 | 527.59 |

| Nuclear reactors, boilers, machinery | 306.88 | 481.48 |

| Electrical machinery, sound recorders, and parts | 479.60 | 323.11 |

| Fertilizers | 376.72 | 308.33 |

Strengthening Trade in Local Currencies

Conclusion

- NEWSLETTER,U.A.E

- November 12, 2024

The UAE incorporated a new corporate tax framework in 2024 amidst booming global business in the region. The new policies directly affect businesses operating in the country, impacting the corporate earnings of foreign companies. Moreover, the reform reshapes the field of auditing, as companies need to comply with new standards of corporate tax.

As tax professionals adopt these changes, there’s a visible shift in their approach to helping their clients ensure compliance and meet higher standards for accuracy.

Established corporate tax consultants in Dubai, are proactive on the latest norms and assist forward-thinking businesses ensure compliance in the evolving financial environment.

Overview of the Corporate Tax Structure in the UAE

The new corporate tax policy was introduced in the UAE to ensure economic diversification. The new policy levies a tax of 9% on businesses when their profits exceed AED 375,000. This taxation affects a wide range of businesses, and the new policy also presented tax professionals with greater responsibilities.

Currently, auditing bodies in Dubai need to integrate these regulations into the scope of their policies to ensure businesses adhere to their tax system. The process involves an in-depth review of financial records and accurate tax reporting. Under these new regulations, businesses must maintain clear profit and loss accounts. Auditors need to play a crucial role in verifying compliance, thereby minimizing associated risks.

As Dubai continues to impose corporate taxation norms, accuracy and transparency in financial reporting have become essential. Now, auditors must ensure that the reports are thorough and that they adhere to regulatory requirements.

Emphasis on Financial Documentation

The importance has now shifted to detailed financial documentation as per the new tax obligations in Dubai. For businesses operating in the city, it’s imperative to present statements that show taxable income as per the regulations. This has led to a higher demand for tax consultancy services in Dubai to ensure compliance with the new tax standards in the UAE.

Currently, tax professionals are channelling greater attention to verify that businesses in the UAE adhere to tax norms, scrutinizing all financial activities for accuracy. Naturally, the auditing process has grown more demanding as tax professionals aim to mitigate the risk of penalties arising from reporting discrepancies.

Moreover, companies now need to submit detailed financial reports like income statements. Transparency in these aspects is crucial to determining tax responsibilities. These financial documents detail revenue, expenditure, and net income, and need thorough scrutiny to prevent misreporting.

Shifts in Auditing Practices Following Tax Reform

With the introduction of stricter corporate tax norms in Dubai, auditing practices have undergone a visible shift. This shift also requires tax consultants to remain abreast with the latest regulatory updates as the corporate tax framework in Dubai continues to evolve.

With the introduction of stricter corporate tax norms in Dubai, auditing practices have undergone a visible shift. This shift also requires tax consultants to remain abreast with the latest regulatory updates as the corporate tax framework in Dubai continues to evolve.

The Role of Auditors in Supporting Compliance

The role of auditors is crucial in ensuring compliance with the tax environment in the UAE. They meticulously evaluate financial records to identify areas of potential non-compliance. Thankfully, leading tax professionals are aware of the latest norms on how to calculate corporate tax in Dubai, UAE. They assist companies in avoiding fines or other legal consequences.

Besides ensuring compliance, these consultants can also optimize tax reporting, which enables businesses to minimize their tax obligations lawfully. They analyze financial operations to facilitate accurate adjustments to tax liabilities. Thus, firms can shift to the new tax structure with professional support.

Professional Tax Consultancy Services from Industry Experts

With new corporate tax norms implemented in the UAE, tax professionals are serving international businesses operating in Dubai as strategic partners to ensure compliance. They provide the necessary guidance to ensure compliance with the new requirements. Thus, these experts go a long way in mitigating financial risks effectively.

The IMC Group continues to be one of the leading corporate tax consultants in Dubai. Seasoned tax professionals and accountants in this proficient team understand the latest tax norms in the UAE and ensure compliance with the same. Businesses, therefore, can maintain accurate financial records to adhere to the norms in the evolving regulatory environment in the country. With professional tax advisory consultation and support, companies expanding to the UAE can remain compliant with corporate tax laws.

- NEWSLETTER,U.A.E

- November 12, 2024

As global businesses boom in the Middle East, the UAE has solidified its regional standing as one of the most sought-after hubs for startups. Its favorable investment environment and attractive policies make it a key destination for international businesses. The strong legislation of the UAE further makes it a great destination for global firms.

Reports from leading international organizations position the UAE at the top, considering various global startup metrics. This is a result of its initiatives to create a favorable business environment that hails innovation. The ongoing efforts have also boosted the ranking of the UAE in global competitiveness reports.

According to recent data from Statista, the UAE continues to be a prominent player among the GCC nations. As many as 5,600 startups registered across the UAE by the end of Q2 2024.

UAE’s Dominance in Fintech Startups

Statistics also reveal the leadership role of the UAE in the fintech sector within the region. Currently, over 550 fintech startups are active in this sector. A reputed consulting and research firm released a report, which shows the rapid rise of the USE in global startup rankings. It is currently the fastest-growing entrepreneurial ecosystem in the GCC.

Between the second half of 2021 and the end of 2023, the value of the startup ecosystem in the country was $4.2 billion. Forward-thinking firms from all around the globe are looking for new company formation in Dubai with professional advisory solutions from seasoned experts like the IMC Group.

Several emirates, including Abu Dhabi, Dubai, and Sharjah witnessed this growth trajectory. Each of these cities has fostered an environment of continuous and sustainable growth, offering support and incentives for the development of startups in crucial sectors.

The Growth of Abu Dhabi in the Startup Sector

Abu Dhabi has retained its position as the fastest-growing startup ecosystem in the Middle East and North Africa. Between the second half of 2021 and the end of 2023 Abu Dhabi secured $224 million in initial funding. The overall venture capital investments from mid-2021 to 2023 surpassed $1 billion. This boost in investments has been driven partly by Hub71, the global tech ecosystem in Abu Dhabi.

An expert stated that the tech ecosystem is experiencing growth interest from tech-based startups that tackle global issues. It is striving to create economic value and provide the emirate with new job prospects.

Dubai and Sharjah Continue to Lead Entrepreneurial Ecosystems

Meanwhile, Dubai has bolstered its efforts to develop a vibrant startup ecosystem. Currently, it ranks at the top among Gulf nations and second in the region based on its startup ecosystem valuation. The startup ecosystem of Dubai was valued at over $23 billion at the end of 2023.

On the other hand, Sharjah has also made a significant impact on the startup ecosystem in the UAE. The city currently hosts around 60,000 small, medium, and startup enterprises across its six free zones and 33 industrial zones. The startup ecosystem in Sharjah was valued at valued at $424 million, with $39 million in early-stage funding by the end of last year.

The UAE Drives Economic Diversification through Innovation

Abu Dhabi, Dubai, and Sharjah are collectively strengthening the position of the UAE as a prime tech hub for entrepreneurship and innovation. Naturally, the UAE appeals to global investors looking for expansion in the Middle East.

Foreign companies looking to capitalize on the dynamic commercial environment can seek holistic support from reputed business set up consultants in Dubai, like the IMC Group. These professionals provide comprehensive assistance to establish a business in Dubai, paving the path to compliance and success in the Middle East.

- NEWSLETTER,SINGAPORE

- November 12, 2024

Singapore continues to strengthen its position as a global hub for family offices as a major economy in Southeast Asia. Recent updates to its tax incentives demonstrate a shift towards transparency, philanthropic impact, and local investment. As the Monetary Authority of Singapore (MAS) introduced new regulations in 2023, single family offices in Singapore now need to adhere to more rigorous standards under the major tax exemptions in the country. These include the Enhanced Tier Tax Incentive Scheme (13U), Offshore Fund Exemption Scheme (13D), and Onshore Fund Incentive Scheme (13O).

In this edition, we have explored the eligibility requirements in-depth, along with the evolving role of family offices within the financial landscape in Singapore.

Overview of Key Tax Incentives for Family Offices in Singapore

| Tax Incentive | Tax Incentive | Key Requirements | Minimum Assets Under Management (AUM) |

| 13D Offshore Fund Exemption Scheme | Non-Singapore residents managed by a Singapore-based fund manager | Non-resident in Singapore – No full ownership by Singaporean entities | No minimum AUM required |

| 13O Onshore Fund Incentive Scheme | Companies incorporated in Singapore | 100% Singapore investors – S$200,000 minimum annual spending – Employ at least two investment professionals (IPs) | S$20 million |

| 13U Enhanced Tier Tax Incentive Scheme | Offshore and onshore entities | Open to foreign investors – S$500,000 minimum annual spending – Employ at least three IPs | S$50 million |

Detailed Evaluation of Tax Schemes For Single Family Offices in Singapore

Now, let’s take a look at the detailed breakdown of tax schemes for single family offices in Singapore.

Offshore Fund Exemption Scheme (13D)

Under the 13D scheme, funds managed by Singapore-based managers on income derived from certain investments are subjected to certain tax exceptions. The eligibility for this exception depends on the non-resident status of the fund in Singapore and a structure prohibiting full ownership by Singaporean entities. However, this scheme doesn’t have any AUM or minimum local spending requirements. It is crucial for compliance and effective tax planning.

Onshore Fund Incentive Scheme (13O)

The 13O scheme encourages the establishment of fund vehicles within Singapore. It targets companies that are locally incorporated. The requirements of this scheme are as follows.

- Investors must be entirely from Singapore

- The minimum AUM should be $20 million

- To strengthen local economic contributions, the minimum annual spending should be S$200,000

- Professional staffing requirements involve two qualified investment professionals with a monthly income of at least S$3,500

Thus, MAS remains committed to foster local talent and developing various sectors.

Investment Allocation

Coming to investment allocation, at least 10% of AUM or S$10 million must be allocated to climate-related investments, local equities, or non-listed funds that are distributed by financial entities licensed in Singapore. Thus, the financial ecosystem will benefit from local investments, including non-listed Singapore companies with a notable presence.

Enhanced Tier Tax Incentive Scheme (13U)

The 13U is the most comprehensive scheme and applies to both onshore and offshore entities. Key components of this scheme are:

- Jurisdiction: Flexible residency requirements

- AUM: Minimum S$50 million to qualify

- Annual local spending: At least S$500,000 to promote consistent reinvestment within Singapore

- Professional staffing: There should be three investment professionals that support an advanced level of fund management and compliance oversight

In recent years the role of single family offices in Singapore in wealth management for affluent families has gained unprecedented prominence. Thus, it’s imperative to maximize tax incentives through this scheme. It allows family offices to use the tax treaties in Singapore and is applicable to Variable Capital Companies (VCCs).

Local Philanthropy and Contributions to ESG

The Philanthropy Tax Incentive Scheme of Singapore, designed in 2023, has been effective from January 2024. It provides incentives to family offices that allocate funds towards local and global philanthropic causes. This scheme includes a provision of up to 100% tax deduction, which is capped at 40% of the income of the donor.

With this scheme, Singapore demonstrates its strategic goal to allocate capital toward important social causes. The funds donated to charities in Singapore also qualify as business expenses under the regulations of MAS. Thus, philanthropy has been embedded as a component of compliance in Singapore.

Maximize Tax Incentives with Professional Consultation Services from Experts

The tax schemes in Singapore offer a clear pathway for single family offices to achieve tax efficiency while they support local economic and social initiatives. Established advisory professionals like the IMC Group work closely with single family offices in Singapore to help affluent families manage their wealth and maximize their tax savings through incentives. With expert assistance, single family offices can optimize the tax structure amidst the dynamic regulatory environment in Singapore.

- Article, Singapore

- October 22, 2024

- An Overview of Shelf Company in Singapore

- How Can You Purchase a Shelf Company in Singapore?

- Are Shelf Companies in Singapore Illegal?

- The Difference Between a Shelf and Shell Company

- Reasons for Buying a Shelf Company in Singapore

- Benefits of Buying a Shelf Company in Singapore

- Disadvantages of Purchasing a Shelf Company in Singapore

- Conclusion

An Overview of Shelf Company in Singapore

A shelf company, also known as a ready-made company or shelf corporation, is a pre-registered company that has little nor no recent activities. It provides entrepreneurs with the opportunity to acquire an established company without going through the complexities of starting from scratch.

So, if you do not wish to create the company from scratch single-handedly, then it is completely legal to buy a shelf company for sale in Singapore. You may call it a ‘readymade’ company. The main benefit of using Shelf Company is that you can quickly and easily penetrate the market. It is possible because you can avoid the lengthy and rather complex process of company formation.

How Can You Purchase a Shelf Company in Singapore?

The acquisition of ready-made shelf companies in Singapore is a good idea among business persons who wish to start their business as soon as possible. It enables one to avoid undertaking the procedures to start a company as it can be carried out instantly.

Below, you will discover how you can find, acquire, and incorporate shelf companies easily in Singapore.

Step 1: Know the Pros and Cons of Buying a Shelf Company in Singapore

Step 2: Consult with a Professional

Step 3: Check Company Profile and Compliance

Step 4: Negotiate and Sign the Sale-Purchase Agreement

Ownership Structure: Foreigners can own 100% of shelf companies in Singapore, making them attractive for international entrepreneurs.

Step 5: Transferring Ownership

Step 6: Amend Constitution of the Company of Incorporation

Step 7: Register Current Updates of the Company

Step 8: Open Bank Account in Singapore

For the sake of convenient business running, all companies need to open a corporate bank account in Singapore. Therefore, open a corporate bank account when you already have the company and register it as yours.

If the company already has a bank account, you must update the authorized signatory and other related information, such as the company name, registered address, shareholder details, and directorship.

Are Shelf Companies in Singapore Illegal?

Absolutely, not. The shelf companies in Singapore are fully legal. This type of company is perfect for those who wish to skip the complicated and lengthy registration process. This is because shelf company registration is already done by its previous owner. You just have to check all the documentation and compliance in place.

Furthermore, if the current owner wishes to sell the company, it provides a favorable option for the existing owner.

The Difference Between a Shelf and Shell Company

Shelf Company: A dormant, legally registered entity that is intended for sale to someone who wants a company with a clean history and immediate business operability.

Shell Company: A non-operational entity often used to hold assets or facilitate transactions, but sometimes associated with fraud or tax evasion.

A shell company is a company that does not own or conduct any business at all. It only exists on paper, and that paper is intended only to be used for fraudulent or illicit activity. On the other hand, a Shelf company is a company that has gone through the registration process. It contains all legal means, and its directors are willing to commence the business processes.

Reasons for Buying a Shelf Company in Singapore

Double Taxation Avoidance Agreements

Intellectual Property (IP) Laws

Free Trade Agreements

Legal Compliance: Approximately 80% of shelf companies are compliant with ACRA regulations upon purchase, but thorough checks are still recommended.

Benefits of Buying a Shelf Company in Singapore

Shelf companies in Singapore offer multiple advantages to all business owners. Some of them are:

- Shelf companies are ready and formed already meaning that one will not have to go through the process of forming them.

- They have a pre-set structure and they are financed, reducing initial setup expenses.

- Some have established clientele bases and suppliers which can help in the preparations when entering the market.

- Shelf companies have more likelihood of getting business loans given that most lenders like to fund companies with at most 2-3 years of existence.

- Foreign shareholders are allowed to have 100% ownership.

- Another point is that every old shelf company for sale is considered to have higher credibility compared to newly developed businesses.

Disadvantages of Purchasing a Shelf Company in Singapore

Of course, there are some drawbacks to buying a shelf company in Singapore as well.

- The first one is that you are not in complete control of the company like the way you may have with a company starting from scratch.

- You may not know but if you buy aged shelf companies for sale in Singapore, it is more costly than the newly formed shelf companies.

Conclusion

- Article, Global

- October 21, 2024

Commercial Due Diligence (CDD) refers to an evaluation process where a prospective buyer audits the commercial viability, market position, and growth potential of a target company. This is a comprehensive analysis of business operations, along with crucial aspects like market demand, revenue streams, and competitive dynamics. Particularly, CDD is essential in M&A since it forms the basis of any deal.

In this article, we are going to help you understand the different types of due diligence services, their process, and why CDD matters in M&A.

- What is Commercial Due Diligence?

- Types of Commercial Due Diligence

- The Process of Commercial Due Diligence

- What Should a Commercial Due Diligence Report Include?

- Commercial Due Diligence Checklist

- Why is due diligence important during M&A Transactions?

- Impact of CDD

- Professional Due Diligence Consultancy Services

What is Commercial Due Diligence?

CDD involves evaluating the market positioning and future growth potential of a company. This is different from other forms of due diligence like financial, legal, and operational ones. CDD primarily evaluates the commercial feasibility of the acquisition.

If you’re buying another company, it’s essential to evaluate the commercial feasibility of the acquisition. Thus, as a buyer, your firm needs to evaluate factors like market trends, competitive positioning, and the sustainability of the business model. This informed and data-driven approach elicits a positive outcome of the deal.

Types of Commercial Due Diligence

1. Buyer-Initiated Commercial Due Diligence

2. Vendor-Initiated CDD

3. Red Flag CDD

4. Top-Up CDD

| Type of CDD | Who Initiates | Purpose/Focus | Key Benefits |

| Buyer-Initiated CDD | Buyer | Comprehensive assessment of business operations, financials, and market positioning | Informed decision-making for the buyer |

| Vendor-Initiated CDD | Seller | Identifies and addresses potential risks before buyer’s evaluation | Increases marketability and value of business |

| Red Flag CDD | Buyer/Seller | Quick, high-level review to spot major risks or deal-breakers | Saves time and resources, early risk detection |

| Top-Up CDD | Buyer/Seller | Supplements existing due diligence, focuses on specific areas | Fills information gaps, ensures thorough evaluation |

The Process of Commercial Due Diligence

1. Liaising Process

2. Preparing the Commercial Due Diligence Report

3. Commercial Due Diligence Report Review

What Should a Commercial Due Diligence Report Include?

A thorough CDD report provides a holistic view of the target company. Key components in the report include:

- Company overview: A summary of the history, mission, and operations of the company.

- Management structure: Details about the leadership team and employee agreements.

- Legal matters: A review of contracts, litigation, and compliance issues.

- Products and services: An overview of the offerings and market strategy of the company.

- Financial model: Historical and projected financial performance and sustainability.

- Marketing analysis: Insights into the marketing strategy, customer base, and competitive advantages of the company.

- Competition: A comparison of the position of a target company to that of its competitors.

Commercial Due Diligence Checklist

A commercial due diligence checklist typically includes the following:

- An analysis of the growth drivers and sustainability of the target company, including market size

- Competitive landscape, which evaluates the strengths and weaknesses of the competition

- Business plan review, which includes the revenue growth potential of the company

- Understanding customer demographics, retention, and churn rates

- Reviewing the sales strategy and customer acquisition costs of the company

- Examining profitability, revenue growth, and cost structure as a part of financial health

Why is due diligence important during M&A Transactions?

The benefits of commercial due diligence during M&A transactions are many.

- Firstly, the buyer can carry out informed negotiations from a point of strategic strength as the company is armed with detailed insights about the target firm.

- Secondly, due diligence ensures that the buyer makes a good investment. CDD provides the confidence that the business is promising.

- CDD helps predict the future performance of the company in the respective market.

- It provides a detailed understanding of competitors and helps in understanding the growth potential of the company.

Impact of CDD

The impact of commercial due diligence has grown significantly with the use of AI and machine learning. These technologies help analyze large volumes of data more quickly, identify patterns that may go unnoticed manually, and offer sharper assessments of market risks and opportunities. This results in faster decisions and more reliable evaluations during transactions.

CDD goes beyond checking for risks—it confirms the business’s actual worth, examines its market standing and competition, and supports better decision-making during acquisitions.

Professional Due Diligence Consultancy Services

FAQs

1. Why do businesses conduct commercial due diligence?

2. What does the commercial due diligence process involve?

3. What is commercial due diligence?

4. When is commercial due diligence required?

5. Who conducts commercial due diligence?

6. What areas are covered in commercial due diligence?

- Article, Singapore

- October 18, 2024

In order to keep up with the evolving dynamic workforce, Singapore has brought in new rules to their Employment Pass. The adjustments to employment pass in Singapore has been made to encourage foreign talent while also bringing transparency and fairness in the hiring process.

Some of the major modifications across the employment pass here include increasing the EP qualifying salary, strict rules of job advertisement is. The newer changes also bring about the introduction of Complementarity Assessment Framework (COMPASS). This blog explores some of the major changes in Singapore Employment Pass in 2024.

- Major Changes in Singapore Employment Pass

- Employment Pass (EP)

- Increase in Salary Threshold

- Strict Job Advertisement Policy

- Introduction of COMPASS

- Educational Verification

- What is the EP application process in Singapore?

- Singapore Employment Pass for Corporates

- Get Singapore Employment Pass Help with Us

Major Changes in Singapore Employment Pass

Who is eligible

To qualify for EP applications, candidates will need to pass a 2-stage eligibility framework:

- Earn at least the EP qualifying salary, which is benchmarked to the top 1/3 of local PMET salaries by age.

- Unless exempted, pass the points-based Complementarity Assessment Framework (COMPASS).

Note: Employers and employment agents can use the enhanced Self-Assessment Tool (SAT) to check a candidate’s eligibility before they apply.

Employment Pass (EP)

Qualifying Salary (Stage 1)

- Non-Financial Sector:

- Minimum monthly salary of SGD 5,500 for applicants under 45 years old.

- SGD 10,500 for applicants aged 45 and above.

- Financial Sector:

- Minimum monthly salary of SGD 6,000 for applicants under 45 years old.

- SGD 11,500 for applicants aged 45 and above.

Increase in Salary Threshold

- The minimum qualifying corporate salary for Singapore Employment Pass was increased effective from September 1, 2023.

- The latest salary requirements for the EP have been updated. Earlier it was $5,000 per month with a slightly higher minimum of SGD 5500 for roles in the financial service sector. For professionals in their 40s, the minimum salary increased up to 10,500 and 11, 500 for financial services for those whose age is beyond 45 years.

- Starting from January 1, 2025, the minimum wage will rise and go up to SGD 5600 and SGD 6200 for finance. So, this update will be applicable to new applicants and renewals from January 1, 2026.

- The salary requirement will be different depending on their age in the finance sector.

Strict Job Advertisement Policy

- Employers who want to hire international talent as per EP policy must have the position enlisted in MyCareersFuture for around 14 consecutive days.

- This requirement will be applicable for positions that have more than ten employees.It helps to bring fairness in the job sector for locals, giving them enough opportunity to apply for the same.

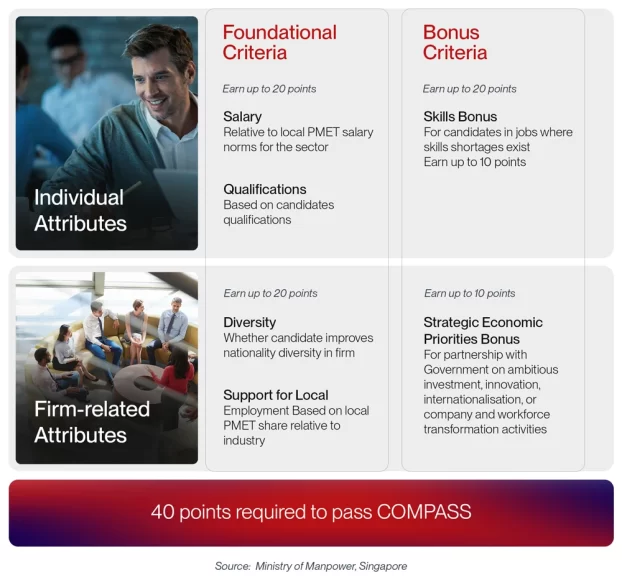

Introduction of COMPASS

- Complementarity Assessment Framework (COMPASS) became valid on September 1, 2023.

- It will evaluate different factors for the individuals such as work experience, qualifications and salary to determine that the candidate is eligible for EP.

All the candidates must earn 40 points to pass the COMPASS.

- Individual characteristics: Includes education and compensation up to 20 points.

- Qualifications: Based on the shortage occupation list and S Pass quota of your firm, you will get a maximum of 20 points.

- Firm-related attributes: Firm’s diversity and support to local employment, for a total of up to 20 points.

- Economic contribution: The industry your company is in and the strategic economic value. Up to 20 points.

Exemptions from COMPASS

Candidates are exempted from COMPASS if they meet any of these conditions:

- Have a fixed monthly salary of at least $22,500 (similar to the prevailing Fair Consideration Framework (FCF) job advertising exemption from 1 September 2023)

- Are applying as an overseas intra-corporate transferee

- Are filling the role for 1 month or less

Educational Verification

- All the Singapore Employment Pass applicants must provide proof for their educational qualifications. They must also show that they are accredited with any educational institution.

- The verification should have been completed by the leading screening companies (https://www.mom.gov.sg/passes-and-permits/employment-pass/documents-required#verification-proof-requirements)

What is the EP application process in Singapore?

- You need to submit the pass for the EP.

- Once that is approved, the authorities will provide the In-Principle Approval Letter.

- The E-pass will be provided by the Ministry of Manpower, upon raising the request.

- After that is processed, you will receive a notification letter.

- Then, you must register fingerprints and a photo to complete the identification process.

- After the process is complete, you will receive the Employment Pass card.

Singapore Employment Pass for Corporates

Get Singapore Employment Pass Help with Us

At IMC, we are dedicated to offering you the best assistance in achieving the Singapore Employment Pass for Corporates. If you have any queries or doubts about the procedure, we can help you. We have a streamlined process, and our experts can help you understand the process and fee.

We’re committed to making the process easy and smooth for you. So, if you’re struggling, contact us today to know more!

- Newsletter, Singapore

- October 15, 2024

Singapore stands out as a prime destination for entrepreneurs and investors in today’s evolving global landscape. While countries like the U.S., Canada, and the U.K. have tightened their immigration policies, Singapore has embraced a more welcoming approach!

Singapore offers robust company incorporation processes and a range of innovative immigration schemes that will take your business to the next level.

Choosing the Right Immigration Program

Global Investor Program (GIP)

Family Office Route

Self-Employment EP for Business Owners

Diverse Talent Attraction Schemes

Singapore also offers visa options designed for specialized talents, including:

- One Pass: For professionals earning over 30,000 SGD monthly.

- Personalized Employment Pass (PEP): For those earning above 22,500 SGD with no employer sponsorship needed.

- EntrePass and Tech Pass: For innovative entrepreneurs and tech leaders in high-growth industries.

Why Singapore?

How IMC Can Support Your Immigration Journey

If you’re ready to take the next step, IMC is here to guide you every step of the way. From selecting the most suitable immigration program to handling all the necessary paperwork, we provide tailored solutions to fit your specific needs. Our team of experienced consultants will help you navigate the application process, ensuring compliance with all local regulations and maximizing your chances of approval.

Additionally, we’ll assist with company incorporation, finding the best investment opportunities, and advising on tax benefits. Whether you’re applying for the Global Investor Program, establishing a Family Office, or pursuing a Self-Employment EP, we ensure a seamless and hassle-free experience.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners