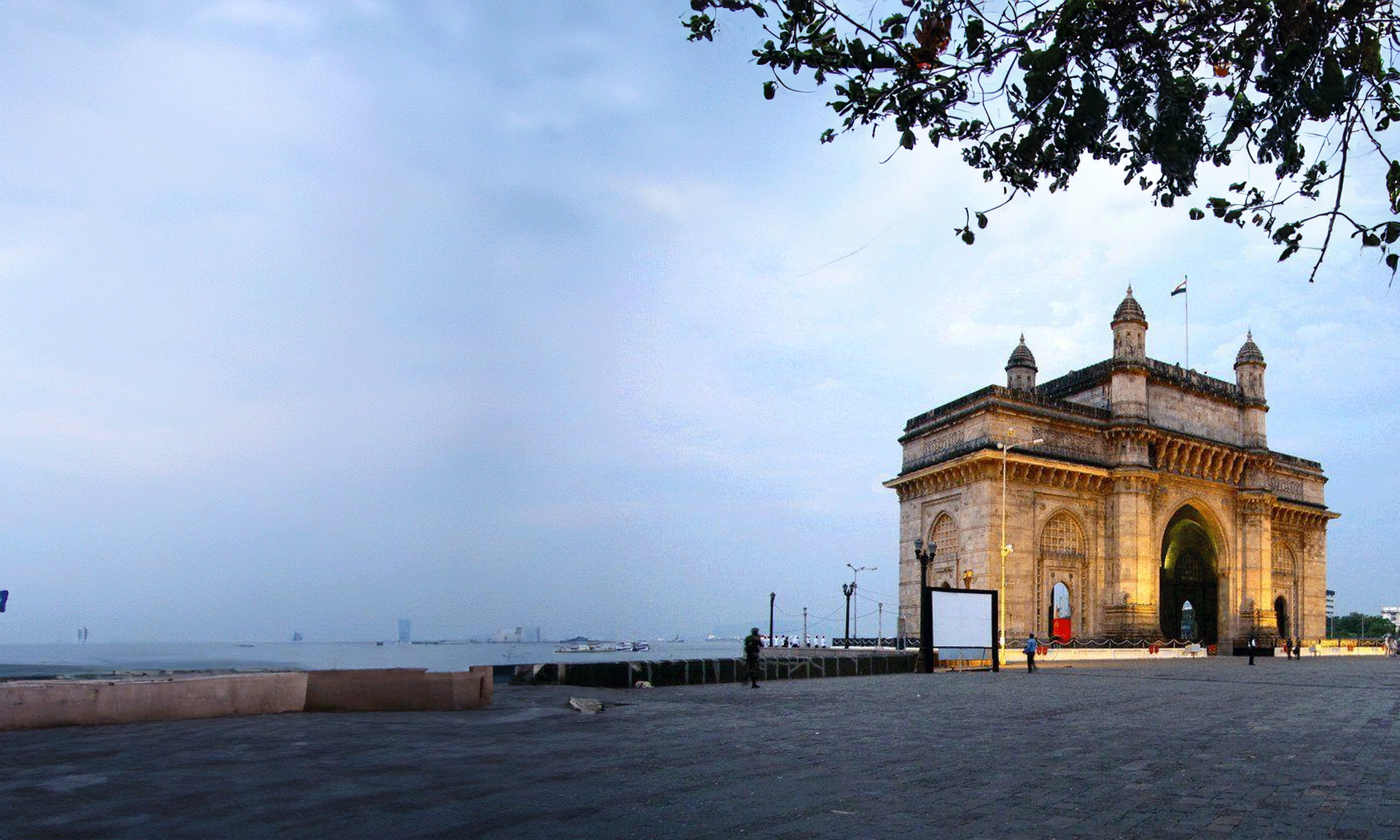

- Article, India

- February 13, 2019

India is the world’s fastest growing democracy that is also free-market and provides profitable business opportunities for everyone, especially the American companies that offer the right products or services. India’s future looks promising and it shows a potential for continued growth at the rate of 8-10% for the coming couple of years. Hence, this is the apt time for the U.S. companies to setup their businesses in the expanding Indian market and even for American companies doing business in India to make further growth plans.

But before that, you should answer these questions: Does your business possess a strategy suiting Indian market? Are you ready with a plan on how to enter and then do business in India? Do you know what corporate structure to follow and what entities are there for conducting business in India? Do you know the legal requirements of setting up a business in India?

How to do business in India?

India, being a diverse and complex as a country, one should take into consideration many factors such as language, regionalism, values, religion, etc when deciding to do business in India. Even one’s approach and behavior should be amended according to whom you are dealing with or addressing. Irrespective of the industry, all the investors and US companies doing business in India should be prepared to accept some differences in the way businesses operate in India and even the norms and regulations in which they function.

New opportunities for US companies

India announced comprehensive relaxations in January 2018 in foreign direct investment (FDI) regulations for single-brand retail and some other areas, along with permitting overseas carriers to obtain up to 49% of Air India to support speeding up its divestment. The objective was to eliminate barriers to global investment and aid the economy in faster development.

The cabinet committee on economic affairs (CCEA) has recently permitted 100% FDI in the sector of real estate broking and also permitted foreign institutional investors (FIIs) and foreign portfolio investors (FPIs) for investing in power exchanges via the primary market.

A lot of concentration being on infrastructure development, the government allocated Rs 5.97 lakh crore in 2018 budget for this sector with an objective to make over 80,000 km of roads till March 2022. India has taken many new initiatives in finance and the tax reforms are intended to bring in more investment, and also push the transformation towards a digital economy.

Points to consider for foreign investors and US companies doing business in India

Any global investor who is planning to start or set up a business in India should first opt for an apt business and corporate entity that is best-suited with its goals and also manages the liability and tax planning challenges. Foreign businesses planning to do business in India or American companies doing business in India should focus on various entry strategies in India and plan their corporate structuring so that they can save taxes as permitted by laws and also as per international tax treaties.

The global investors or shareholders should mandatorily seek proper government approvals before investing in India. As there are several steps to be performed before setting up a business in India, if you need assistance with company formation in India or foreign company registration in India, we at IMC, would be happy to help you in each step of the process.

- Article, U.A.E

- February 5, 2019

The Middle East has been growing at double-digit growth rate and is a region boasting of some most diverse and lucrative markets in the world. German companies, which are typically used to structured, single-digit expansion rates in mature markets, operating in the Middle East though would be fascinating, but a challenging prospect. Also, demographically, Dubai and Middle East consist of some of the richest consumer segments throughout the world, who also possess a strong global outlook. Another benefit is that the government is investing hugely in infrastructure and its corporate environment is supported by younger workforce, who is more educated and technically-advanced. There are ample opportunities for German companies to consider Dubai and other Middle East markets, because they have huge long-term potential.

Dubai’s DMCC has opened a new office to enhance German business ties

Dubai Multi Commodities Centre (DMCC), which was conferred the title of “the global free zone of the year” last year, has recently announced that it would open a new representative office in Dusseldorf, Germany. The opening of this new office in one of Germany’s financial and trade centers will surely get many more European clients to DMCC’s doorstep.

It will provide an easier option to German businesses to form a company without the need to travel to Dubai. Looking at some data, in 2017, the non-oil trade done between Dubai and Germany had touched about $11 billion.

This move has been taken as per DMCC’s plan to take advantage of growing interest shown by German companies to look at better trade relations with Dubai.

Felix Neugart, who is the CEO of the German Emirati Joint Council for Industry & Commerce (AHK) was of the view that over the last few years, a strong connection has been built between the German and UAE business communities. The free zones in Dubai play a major role in bringing in global businesses into the UAE. The opening of a new DMCC office in Duesseldorf is a move to enhance the relations amid German industry circuit and the DMCC with its global business community. The new office is going to improve trade and will foster newer investment opportunities.

DMCC and German Arabian Advisory have also signed a memorandum of understanding (MoU) in 2016 to explore establishing an advisory service in Düsseldorf. This is also a part of DMCC’s endeavor to draw German businesses to setup their offices and presence in Dubai and further enhance their ties.

Some examples of German companies looking at investing in Dubai

- Germany’s Meilenstein has entered UAE market with an investment of $327mn: Meilenstein is a German real estate developing company, which has announced its entry into the real estate market of the UAE as it is coming up with eight projects to be built in various locations in Dubai, totaling to $327mn (AED1.2b).

- Siemens is growing its reach in the Middle East with an investment of $500 million in Internet of Things (IoT): Siemens, a German multinational, is getting in the Middle East by investing almost $500 million in the digital space spread over the coming three years. Siemens is planning to build a couple of new IoT facilities in Dubai and Abu Dhabi.

If you think it is a good prospect for company formation in Dubai, but don’t know how to go about it, leave it on our experts. Get in touch with our professionals and we would assist you in each step.

- Article

- February 2, 2019

German companies are seeking to invest and do company formation in India in the High-Tech market, as per a study conducted by Federation of Indian Chambers of Commerce and Industry (FICCI), Embassy of India and Ernst & Young. This alliance will boost trade relations and augment investments between these two countries while anchoring Prime Minister, Narendra Modi’s ‘Make in India’ initiative.

Siddharth Birla, who was the Immediate Past President of FICCI and Chairman of Xpro India Limited was of the view that there was a requirement to expand India’s contribution of high-tech manufacturing and also orient R&D to achieve higher levels of economic growth.

Germany being a technology leader, it can very well complement India’s goals in the field of Hi-tech manufacturing. This collaboration would include sectors such as Electronic System Design and Manufacturing (ESDM), IT, automotive, photonics, civil aviation and airports, water, transportation infrastructure, heavy engineering, renewable energy, biotechnology, space and defense manufacturing and pharmaceuticals.

India and Germany’s partnership is expected to benefit both these countries while also improving their mutual growth. Germany’s high-tech features and know-how and India’s young and skilled manpower can get together to bring the best possible results.

The key highlights of the report were as follows:

- German businesses are showing inclination to invest in the Indian High-Tech market.

- India is now one of the highest performing nations among the BRIC markets.

- India has a huge market readiness for High-Tech products.

- The collaboration of India and Germany in the field of High-Tech manufacturing can augment the ‘Make in India’ initiative in a big way.

- Various challenges are affecting investment decisions of German organizations.

- There are seven High-Tech verticals that offer greatest opportunity for Indo-German partnership.

- German businesses can benefit from strong capabilities that India has in the IT and Space sector.

- Government of India has been taking various initiatives in FDI and streamlining regulations to set up businesses and infrastructure, and this can majorly influence the business especially in High-Tech sectors.

India is an alluring market for German start-ups and vice versa. To add to it, Invest India, which is Government of India’s investment promotion and facilitation agency, is sending the best 10 promising start-ups to CeBit (scheduled from June 11 to 15) this year.

Other programs aiming Indian and German start-ups

GINSEP: The German Start-ups Association launched the German Indian Start-up Exchange Program (GINSEP) in 2017 with an objective to promote a healthy exchange among the start-up ecosystem and encourage the Indian and German start-ups to get an easy access to the other nation.

Indo-German Young Leaders Forum (IGYLF): Indo-German Young Leaders Forum is a platform of bilateral exchange meant for exceptional minds from both countries. It aims to promote an exchange between young leaders of India and Germany – be it from politics, business, science, culture or media – thus establishing long-term networks.

StartUp AsiaBerlin: The StartUp AsiaBerlin platform was set up by the State of Berlin and has organized several workshops on how different ecosystem can collaborate, which was attended by stakeholders from both Asia and Germany.

- India, Newsletter

- January 18, 2019

RBI has recently announced a new regulation for all the foreign borrowings, thus permitting all the eligible companies to raise overseas funding under the regular route and remove the existing sectoral curbs. All the entitled borrowers would be now able to raise external commercial borrowings (ECB) up to the maximum limit of $750m per year under the regular route.

The “liberalization or rationalization” in the latest framework ECB and rupee-denominated bonds has been mainly done to simplify the process of doing any business, said the central bank. The RBI said that the Tracks I and II under the current framework have been combined as the ‘Foreign Currency denominated ECB’ and the Track III or the Rupee Denominated Bonds structure has been amalgamated as ‘Rupee Denominated ECB’ to replace the current four-tiered arrangement and the structure has now become instrument-neutral. Here, Track I, II, and III stands for the total amount and maturity of the funds that are raised.

In addition, all-in cost ceiling per year is quoted at ‘benchmark rate plus 450 bps spread’, where 100 basis points are equal to 1 percentage point. The minimum average maturity period (MAMP) is decided at three years, which is applicable for all the ECBs, whatever may be the borrowing amount in lieu of different layers of MAMPs currently, with an exception of the borrowers who are especially allowed in the circular to borrow only for a short period, the RBI norms said.

The list of qualified or eligible borrowers now includes all businesses eligible to get FDI. In addition, all the port trusts, businesses in SEZ, SIDBI, all registered companies involved in micro-finance activities, EXIM Bank, registered trusts, societies, cooperatives, and NGOs could also borrow as per the new framework. But, lending or borrowing as per the ECB framework conducted by Indian banks and their foreign branches would be subject to the prudential regulations, said the RBI.

ECBs are basically commercial loans that are raised by qualified resident organizations from recognized non-resident businesses or organizations and must comply with all the usual parameters like minimum maturity, permissible and not permissible end-uses, and also highest allowed all-in-cost ceiling.

However, there is also a negative list, where the ECB proceeds are not permitted to be utilized, and those include real-estate activities, equity, and capital market investment, purposes of working capital barring foreign equity holder, and repayments of Rupee loans barring foreign equity holder.

- Article, U.A.E

- January 17, 2019

Tax domicile certificate or the tax residency certificate is typically a certificate or official document that is issued by the respective authority for the government entities, companies and individuals who are eligible to enjoy the benefit of agreements of double taxation avoidance on the income and is signed by the UAE.

In case of UAE, this tax residency or the tax domicile certificate is issued by the UAE’s Ministry of Finance of UAE. The certificate can be obtained by a company or business that is registered in the UAE and also by individuals who have acquired the residency visa or they already permanently live in the UAE. This tax residency certificate is typically valid for one year from the date it is issued.

Please note that only onshore UAE companies are eligible to receive a tax residency certificate. Offshore companies that are also called as International Business Companies are not permitted to get such a tax residency or a domicile certificate. But that is different from a tax residency certificate and doesn’t offer the usual advantages of double tax treaties. In case of UAE onshore companies, the tax domicile or residency certificate is a necessary document which allows them to fully take benefit of the wide-ranging network of double tax treaties that the UAE has signed along with so many countries located in various parts of the world.

The main condition for being considered a resident in the UAE is that one has to obtain a residence permit. A foreign individual should have a sponsor as a rule, so as to apply for a residence permit in the UAE. In many cases, the company that employs the expatriates usually acts as their sponsor and gets them their residence visa. The best way for the people, who do not come in the jurisdiction on an employment contract, is to incorporate or set up a company in the UAE.

Establish a corporate structure to act as sponsor

The usual and preferred method of getting residency is by a corporate structure. However, for foreigners, incorporating an FTZ company is the best way of getting sponsorship. This company should necessarily have physical presence in the kingdom and for that the most cost-effective options are suggested by the free zones that are located in the northern emirates with likelihood to have “flexi offices” or “flexi desks”.

Benefits of getting a Tax Domicile Certificate

Tax domicile certificate provides the advantage to fully utilize the benefits of the widespread double tax treaties network that the UAE has signed with various countries in so many parts of the world.

DTAA or double tax treaty (DTT) is actually a bilateral agreement signed between UAE and other nations that uphold the welfare of global investors and businesses from other jurisdictions in an attempt to invest in the UAE. Due to this treaty, any global firm that is already paying taxes overseas for the profits they have earned from the business can also mitigate the possible tax burden in the country.

This not only applies to companies, but also to individuals who are fiscal citizens in the UAE for over 180 days and are able to provide the documents needed by the Ministry of Finance, will be eligible to use the benefits.

Necessary Documents for getting a Tax Domicile Certificate

In case of individuals

- A valid passport copy

- A valid residence copy

- Certified bank statement for a minimum of 6 months during the required year

- Source of income or a salary certificate in case of a job

- Certified tenancy contract or a title deed

- Immigration report of the residency, that is, Exit and Entry report

In case of corporate

- A valid trade license

- A copy of identity card for all the company owners/partners/directors

- Certified articles of establishment; founding; incorporation; institutionalizing or Memorandum of association

- Copy of the residence visa for the company owners/partners/directors

- Copy of valid passport for the company owners/partners/directors

- Certified audited report

- Certified tenancy contract or title deed

- Certified bank statement for a minimum of 6 months during the required year

Need a TRC in the UAE?

We at IMC offer an array of business services to our clients and are especially known for our quick turnaround and reliable services. If you are looking for a Tax Residency Certificate in Dubai or PRO services in Dubai, get in touch with our team of professionals who will assist you according to your specific needs.

- Bahrain, Newsletter

- January 17, 2019

The Bahrain Ministry of Finance or the MoF recently said that the VAT registration will be divided into three phases and launched separately, completely depending on the total value of the annual supplies of various businesses. The three registration phases are as follows:

| Annual Supplies | VAT Registration Deadline | Effective Registration Date |

| Over and above BHD 5 million | 20 Dec 2018 | 1 Jan 2019 |

| Over and above BHD 500,000 but less than BHD 5 million | 20 June 2019 | 1 July 2019 |

| Over and above BHD 37,500 but less than BHD 500,000 | 20 Dec 2019 | 1 Jan 2020 |

This announcement has come after the MoF’s earlier announcement that the VAT registration’s first phase would be restricted to companies who have at least BHD 5 million annual sales.

Businesses which have an annual taxable turnover above the voluntary registration limit of BHD 18,750 could register for VAT but on a voluntary basis.

However, at a meeting conducted by the MoF with tax advisors regarding VAT implementation recently, the MoF has given its confirmation that the VAT regulations would be issued before the end of January. The MoF also provided additional details on the issues such as:

- How frequently can be VAT returns filed;

- How are the VAT groups divided;

- What is the VAT treatment for the supply of buildings, food items, financial services, electricity, oil, gas and imports and also government entities;

- What would be the content and prerequisites for tax invoices; and lastly

- Who will be the tax representatives and agents.

Next steps

Companies should ideally consider the VAT treatment of their business transactions to establish if they are required to go for VAT registration or not. Though postponing the process of VAT registration for some firms would offer additional time to the businesses, the company should decide whether they should go for VAT registration so as to recover the VAT incurred on their procurement or not.

Need professional assistance?

If you are looking for professional VAT consultants in Bahrain who can advice you if you need to register for VAT or not and also need help for getting a VAT impact assessment done or conduct a second review to find out the VAT treatment of your business transactions, do get in touch with us.

Our team of experienced professionals at IMC will help you at every step in case you require any advice or assistance.

- Newsletter, Qatar

- January 17, 2019

Do you know that the $2.2tn worth Indian economy has been growing at more than 7.5 percent? The Indian ambassador, P Kumaran shared the good news that India is now offering many investment opportunities to Qatar. He shared this at a recent annual networking event that was organized by the Qatar Financial Center (QFC) along with the Indian Business and Professional Council (IBPC).

Kumaran also said that India has a nominal gross domestic product of over $2tn (which is over $7tn on purchasing power parity basis) and a growth rate of over 7.5 percent, and it now ranks as one of the most rapidly-growing large economies of the world. India is now opening its doors and offering many opportunities to Qatar with regards to investment options, a highly-trained and educated workforce, and a market showing potential for business alliances.

He also said that the Indian embassy would continue to give its support to the QFC in promoting business and also form new commercial links. Yousuf Mohamed al-Jaida, who is the QFC chief executive, said that Qatar and India have always shared good and stable bilateral ties, and the QFC would continue to play its role in supporting the flourishing Indian business community located in Qatar, which influences further development of these relations.

There are about 24 fully-owned Indian companies based and operating in Qatar as of now. There is a forecasted 6,000 Qatar-India joint ventures functioning in the field of infrastructure, energy sector, ICT, and other areas, and the contribution that the Indian businesses play in the local economy is really huge and irrefutable.

QFC also houses 31 Indian businesses that include Tech Mahindra, a fintech firm named Goals101, and many others. K M Varghese, who is the President of IBPC said that IBPC feels that the QFC should be partnering with them in Qatar to fulfill their aim of attracting more and more Indian businesses and organizations into Qatar by using the very unique QFC platform.

Thinking of setting up your business, opening a branch office or company formation in Qatar? Just get in touch with our professionals and let us assist you in having a hassle-free experience.

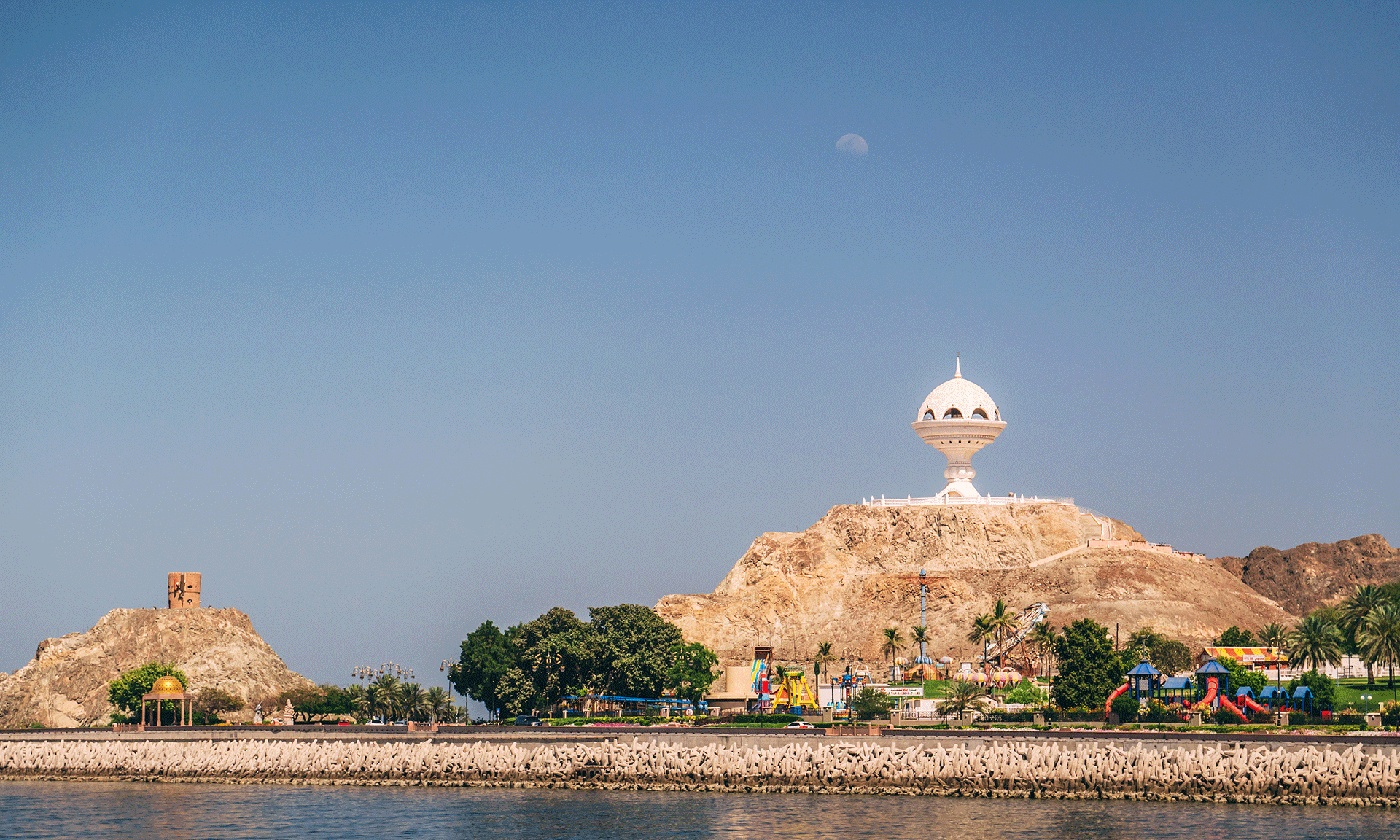

- Newsletter, Oman

- January 17, 2019

New doors are opening for more and more investments for the Al Mazunah Free Zone in Oman, which comes under the purview of the Public Establishment for Industrial Estates – Madayn, as various operating projects reached a number of 197 by the end of November 2018, stated Said bin Abdullah Al Balushi, who is the supervisor of business processes in this free zone.

Al Balushi said that Al Mazunah Free Zone has been fortunate to get 46 fresh investment applications with professionals wanting to do company formation in Al Mazunah Free Zone, which are now under the process of review. This free zone has been very instrumental in the establishment of many Small and also Medium Enterprises for the residents in the wilayat of Al Mazyunah. Approximately 14 SMEs were set up in the areas of import and export, shipping and unloading, hospitality, construction, and also in public services. What’s more? The free zone also provided 60 new job opportunities especially for the national cadres in the operating body of this free zone, some investing companies and the developer named Golden Hala Company.

Al Balushi also shared that Madayn is working on various projects as of now, which include developing the free zone in phase one (second package), and in phase two, the aim would be transmitting electricity to the various leased companies such as cables and transformers, and the broadband project.

According to the electronic system taken up by Al Mazunah Free Zone for managing the transfer of exported and imported products, the volume of imported products into the free zone has reached 155,666 tonnes by November 2018. In addition, the total number of imported vehicles, equipment, and machinery added to about 7,739 during this period.

Al Balushi also said that Madayn keeps making continuous efforts for promoting the Al Mazunah Free Zone among various investors by organizing events that focus on the new investment opportunities available in the free zone and how its strategic location contributes to the local and global trade and investment movement.

These efforts have been planned as per Madayn’s vision to further improve Oman’s status as a top regional hub of manufacturing, ICT, entrepreneurship excellence, innovation and its goal to bring in more industrial investments and keep on giving continued support by making locally and internationally competitive strategies, providing stable infrastructure and value-adding services, and simple governmental processes. These efforts also are in line with the Madayn’s key objectives such as luring fresh foreign investments into the Sultanate and localizing the national capital, while continuing to encourage the private sector to attain sustainable financial and social development, accomplishing environmental sustainability, and also contributing to adding new job opportunities for the national cadres.

Al Mazunah Free Zone was set up under Royal Decree no. 103/2005 to function under the administration of the Public Establishment for Industrial Estates. Its strategic location, which is on the border of the Sultanate and Yemen makes it the perfect Gulf gateway for transit trade especially to Yemen and Eastern parts of Africa. The free zone has a goal to bring in more domestic and international investments for enhancing the trade exchange, get more advanced technologies, and open for new job opportunities. Various incentives are given to investors, which include customs’ exemptions, full or 100 percent foreign ownership, no capital requirements at all, and the Omanisation rate at 10 percent.

So if you are planning of company formation in Oman in near future, get in touch with us at IMC and we will be happy to assist you.

- Newsletter, U.A.E

- January 17, 2019

Do you know that the DIFC was the first-ever financial Free Zone in the UAE? It is one of two free zones in the country and is also internationally-known for its world-class facilities and services. The initial set up was done in 2004, and today, it has expanded and developed into one of the most recognizable and successful free zones in the kingdom.

It provides all the benefits of a free zone like 100 percent foreign ownership along with no income or profit tax at all. In addition, DIFC especially caters to all the financial companies and is governed by the Dubai Financial Service Authority (DFSA).

It does not actually rely on the rules and legislation found on the UAE or Dubai mainland, because the DFSA makes provisions that are specific to the particular free zone.

The New Version of the DIFC Companies Law

The new law was announced and enacted by the DIFC President, who also happens to be the Vice President of the UAE, His Highness Sheikh Mohammed bin Rashid Al Maktoum.

The amendments include:

- There are two new company forms that can be established in the DIFC;

- New duties can be added, or changes can be made to the current responsibilities of the directors of companies;

- New ultimate beneficial ownership registration information has been added, which all the companies should provide to the DIFC authorities.

Now, the new company types introduced would actually replace LLCs and share limited companies and are PLC’s, which are typically public companies; LTD’s which are basically private companies; and other recognized company forms like branch companies.

The director duties and roles were not so clear earlier, but now, an expansion of the same has been provided. There are some new responsibilities, which involve the promotion of a company’s achievements, avoiding conflicts of interest, and also applying their knowledge and experience in helping their business to grow.

The general changes though are not on a large scale but aim to work upon the already built foundation provided by the DIFC. The amendments are expected to be received well, especially because it would not require too much effort from current companies and would ensure a more regulated and controlled environment in the free zone.

In case you need to know more about new company regulations, any information about how to set up a company in the free zones, or professional assistance for company formation in Dubai, do get in touch with us and we would be happy to help.

- Newsletter, U.A.E

- January 17, 2019

Compulsory health insurance, some new life rules and enforcement of new regulations will be the top agenda.

Yes, this New Year is going to be a buzzing one for the insurance market in the Middle East and there are three major developments that we can forecast.

The first one is that an obligatory health insurance will continue to be rolled out in the GCC region. Recently, a new law has been announced in Bahrain and Oman which will be implemented in 2019, according to which all the employers need to necessarily offer health insurance to their staff members. However, with compulsory health insurance being a major factor of growth and upsurge in markets like the Kingdom of Saudi Arabia, Abu Dhabi, and Dubai, many others are surely going to follow suit.

Secondly, the UAE is soon going to put into practice the much-awaited Life Insurance Regulations. This step was announced back in 2016 end, but the Insurance Authority needs to still publish and announce the final draft of these regulations before its implementation. These regulations will surely have a very positive effect on the industry. It is also predicted that they will put a cap on the total fee and commission that is to be paid by policyholders, limit the usage of indemnity commission, and execute some obligatory disclosures and Pro-forma product illustrations. In all probability, the regulations would also help in short to a medium-level reduction in the total number of life insurance intermediaries and will further drive more consolidation.

Thirdly, all the regulators in the market will get tougher. In 2018, there were a lot of proactive steps taken by insurance sector regulators, be it in terms of the issuing of new regulations or better level of enforcement. Many official bodies in the KSA and UAE have suspended insurers and other intermediaries from doing business which is pending the investigation process and remediation of several regulatory breaches. It seems that these authorities and regional regulators would continue the same thing in this year too, as the regulators want to push further compliance and augment consumer protection.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners