- Newsletter

- November 12, 2018

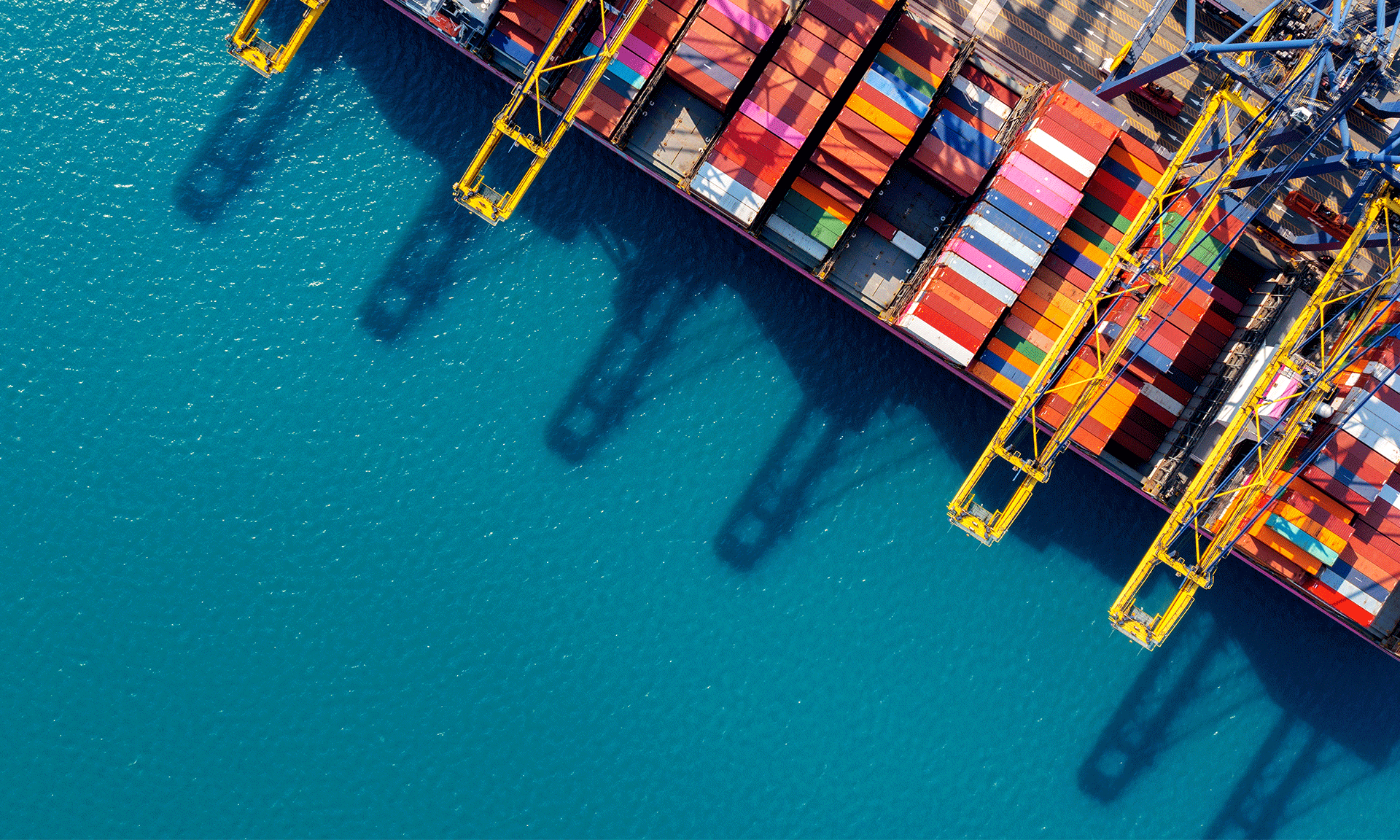

Situated on Oman’s northern coast, Sohar is a beautiful city reminiscent of a colorful past. This ancient city is steeped in history and is the largest in the northern areas of the nation. Having the fifth highest population in Oman, this town has always acted as a port for the country because of its strategic location. It also serves as a gateway between the east and west and currently, it is home to a deep sea port, allowing it to accommodate some of the largest ships, and thus becoming one of the rapidly growing free zones in the whole world.

Sohar free trade zone is one of the four operational free zones in Oman. Located in the Sultanate of Oman, situated 220 km away from Muscat – its capital, Sohar free Port and the free zone is mainly operating into areas such as Trade and Logistics, Steel Manufacturing and Processing, Petrochemicals, Oil and Gas, Minerals, Aggregate Industry, Ceramics, and Food logistics and processing. Oman’s Sohar free zone also has a one-stop-shop which acts as a window for all the customers to get whatever they need to establish and run their business seamlessly and efficiently.

Benefits of setting up a business or company in Sohar

- 100% foreign ownership but there should be a minimum of two shareholders;

- Exemption from the applicable corporate tax for at least 10 years. This period could be extended to up to 25 years or the duration of the lease in case the company meets specific Omanization targets;

- Availability of a ‘one-stop-shop’, which enables to easily get licenses, approvals or, permits they need for their business from a single place rather than running around to various government bodies;

- Very low capital requirements and encouragement to business start-ups;

- Omanization works as following regarding the corporate tax exemptions. The escalation system is as follows:

- The minimum level of Omanization is 15%;

- 25% Omanization after 10 years;

- 35% Omanization after 15 years; and

- 50% Omanization after 20 years and this is up till the final potential tax-free year (year 25);

The port was established in 2002, whereas the free zone came up in 2010.

Various possibilities in Sohar Port and Free Zone

The free zone is situated in Liwa and is on the coast. The location being close to many significant places, the free zone is within an easy reach of about 3 hours of Muscat. It is very near and well-connected to the UAE and Dubai. In addition, there are direct connections to highway which lead to Saudi Arabia, which is another significant economy in the region.

There are various types of licenses that can be obtained in this free zone. The types available are:

- Industrial License

- Light Manufacturing and Assembly License

- General Trade License

- Logistics License

- Service Provider License

These licenses permit doing these business activities and should be renewed annually. Third-party service providers must obtain a Service Provider license, although the services that are permitted to provide are specified. There’s another big advantage that the registration process for these service providers is not charged or is absolutely free of charge.

Also, there are some other permits which can be obtained, and the process is transparent and very simple. The permits are as follows:

- Plot Work Permit: This permit allows the Working Company to carry out the civil works within their plot. All the pertinent regulations on plot development and the required application process to get the Plot Work permit are in the Development Control Regulations;

- Common Area Work Permit: This permit allows the Working Company to carry out the works outside of the plot, but inside some of the common areas such as laying a pipeline or cable;

- Special Transport Permit: All businesses or companies would need an Environmental Permit. Which type of permit that would require depends on the type, scale of the work, and the complexity of the projects they intent to undertake. The permits are as follows:

- No environmental impact– In case there is going to be no environmental impact, there would be no application filling required and approval must be obtained within three working days.

- Limited environmental impact– In this case, the business needs to submit an environmental review form and the approval could take up to 30 days.

- Environmental Impact– In this case, the business should submit environmental impact assessment and the required approval could take up to 90 days.

The level of environmental impact is provided to the business or company during the assessment period so that the entities are prepared to give the needed review or assessment to make sure that the process is smooth and seamless.

The free zone does have its own rules and regulations known as the Sohar Free Zone Rules and Regulations, which are clearly distinguishable from the mainland laws.

Sohar Port and Free Zone is a very well-developed free zone, which is rapidly developing and growing and has large amounts of fixed investments flowing in. With so many advantages of a world-class deep sea port, proximity to various world-renowned business centers like Saudi Arabia and the UAE and the easy to use free zone facilities such as the one stop shop etc, Sohar Port and free zone offer very unique and promising opportunities for various businesses to set up themselves either on a regional or even on a global scale.

If you want to consider this promising prospect, do get in touch with the team of our professionals who will help you with new company formation in Oman or with foreign company registration in Oman.

- Article

- November 9, 2018

UAE has long been a hub for trade and business. The country has always been in the eye of global investors. The opportunities and profitability that UAE offers to the businesses attracts huge Foreign Direct Investment (FDI). UAE has now introduced a new investment law to attract more foreign investment and boost the economic growth of the country. The President, His Highness Sheikh Khalifa bin Zayed Al Nahyan, issued Decree No. (19) of 2018 on Foreign Direct Investment on 30th October 2018. The new law aims at making the country the first pick among global investors and promote country’s investment environment.

With the new law the UAE will be able to consolidate its position as the leader in attracting foreign direct investment not only at the regional level but also at the global level. The new law shall attract and encourage more foreign investment.

The introduction of the new law shall help UAE to expand and diversify its production base, attract latest and innovative technology, and enhance knowledge and training. The policy aims to increase the inflow for foreign direct investment to help in achieving sustainable and balanced development of the nation. It will help in generating job opportunities across different sectors of the economy, achieving the best returns of available resources and over all increased value to the country’s economy.

The law further states that, a “Foreign Direct Investment Unit” shall be established in the Ministry of Economy which will be responsible for framing and proposing the policies relating to FDI. Furthermore, the unit shall also determine the priorities and set up associated plans and programmes and work towards their implementation after they get approval from the cabinet of UAE. The FDI Unit shall also look into developing an attractive environment for FDI. They will ensure and facilitate the procedures for licensing and registering the FDI projects. In addition, the FDI Unit shall also monitor and evaluate their performance in the country.

As per the new law, the foreign companies shall be given a best investment environment. Moreover, the licensed foreign investment companies shall be treated like national companies within the limits that are permitted by the legislation of the state and international conventions to which UAE is a party.

The Article 10 of the Decree states that licensing authority and the other respective authority shall hold the power and responsibility to determine the conditions and procedures for licensing and establishing the FDI projects on the basis of listed documents of the Decree law and the law of the land. Furthermore, the FDI projects that were already in existence before the enforcement of the new law shall continue to retain the privileges that were given as per the former legislations, agreements and contracts within the specified period.

The announce of the new law comes as foreign direct investment flows in Dubai rose to $4.84 billion in first half of 2018 which is 26% up as compared to the last year. As per the reports from the Dubai Investment Development Agency (Dubai FDI), an agency of the Department of Economic Development (DED), the number of FDI projects in Dubai surged by 40 percent to 248 in 2018.

Sincere efforts by the government in the form of relaxed regulations, government diversification efforts and lower cost of doing business in Dubai has helped the city bag 10th rank globally for greenfield FDI.

We expect the UAE investment law to be a game-changer which will change country’s business landscape by attracting increased foreign direct investments. With increased FDI, more and more companies will aim to set up their business in UAE to grab this opportunity.

If you too are looking to set up a company in Dubai, it is ideal to seek professional help for the same. A professional and renowned company like IMC Group can help you with the entire process of company formation in Dubai. We take the complete charge of your business set up, right from conducting initial market survey to setting up your business and ensuring that it operates successfully. We come with an experienced team of skilled professionals who can guide you on every step of the way. To know more about our services, get in touch with us and we will be glad to assist you.

- Article

- November 8, 2018

UAE has always been among the top destinations for doing business. The country attracts local as well as foreign investors to invest in its numerous business sectors. One of the major reasons for this draw is the ease of setting up a business in UAE. Moreover, stable government, better political and social environment, booming economy, liberal laws and regulations for the business set up and many other factors contribute to attracting more and more investors. As a result, company formation in Dubai is on a rise.

With a package of reforms that were introduced in the past year, UAE has climbed up 10 positions to reach 11th position in the World Bank’s ease of doing business rankings. As per the report of the World Bank, the constant and focused efforts by the UAE government to keep the economy competitive and vigilant has led to the rise in the position.

Even though UAE has always led the Arab World for the past six years, the recent rankings have positioned its economy among world’s top 20 countries for the ease of doing business.

The World Bank’s ranking is determined after considering the scores of 190 countries on 10 factors that include dealing with construction permits, paying taxes, protecting minority interests, obtaining electricity, protecting minority interests, etc.

Factors contributing to UAEs better ranking

The four significant economic reforms that led to a better environment for doing business in UAE are:

- Ease of starting the business

- Getting electricity

- Smooth and easy registration of real estate

- Gaining access to easy credit

In terms of getting electricity, UAE has made it easier by getting electricity connections for commercial and industrial usage by eliminating the industrial and commercial cost of up to 150 kilo-volt-amperes (kVA). It is one of the few countries that received the top score in terms of electricity subcategory.

UAE has further made it easier for the entrepreneurs to start a business in the country by improving its online procedure for company registration. Moreover, government has made it simpler for new businesses to avail funds by strengthening the credit system by creating a register of moveable assets. This makes it safer for the banks to lend money to new businesses. UAE has further simplified the procedure to register a property by increasing the transparency of the land administration system.

The judiciary system of Dubai has also improved considerably. The measures like the modernization of the judiciary, better training of arbitrators and judges, setting up of commercial courts, implementation of new insolvency code, etc. have shown tremendous results for the economy of UAE. Furthermore, as per the new framework the secured creditors have priority to get their dues and have out of court settlements. This has strengthened the legal rights of the lenders and borrowers in the country.

All of these efforts have shown a positive impact on the judicial system of the country specifically on commercial litigations and insolvency proceedings. The Federal government and other local departments of UAE have made the country an ideal location for the investors to do business. The world class friendly environment of the country makes it an innovation hub. Furthermore, the commitment of the government to resolve the challenges remaining in its services and litigation matter ensures that UAE shall continue to remain committed towards rapid growth of its economy.

Investment Opportunities in UAE

With its attractive investment environment, UAE continues to be an investment friendly destination specially for international companies that are eyeing to set up their business in the Gulf region. The above factors along with world-class infrastructure in the form of top quality airports, public facilities, and economic zones leads to the evolution of UAE as an international business destination. Moreover, the relaxed and robust policies of the government further facilitate the business environment in UAE.

If you are keen on setting up a company in UAE, you can seek professional help to expedite and ease the entire process of company registration and operation. A professional and dedicated company like IMC Group can help you conduct initial market research, conduct feasibility studies, design entry strategies, make business development plan, register a company, obtain required business licenses and permissions and set up a company in a hassle-free manner. We have helped thousands of local and international companies to set up or expand businesses in Dubai and UAE. Feel free to reach out to us on [email protected].

- Article

- November 2, 2018

India is considered as a land of opportunities. Many businesses eye on establishing in India with the aim to generate a good profit. However, in the past, the lack of a supportive environment had led to closure and slow down of many businesses. But now the things are changing, India has climbed 23 spots in the ease of doing business index and is now at the 77th position. Now India ranks first in South Asia and third among BRICS nations for ease of doing business.

In the current year, there has been an improvement of 23 positions in the rank for doing business. In the last two years, India has climbed 53 positions, highest by any large country since 2011. Such performance has only been given previously by Bhutan. Removal of hurdles by the government in the construction permits led to India climbing to 52nd position from 129th position in that sector respectively.

Every year World Bank releases the ‘Doing Business Report’ by assessing the business regulations of total 190 economies of the world. The doing business report measures the countries performance on the basis of the distance to frontier (DTF). DTF measures the performance of an economy to the global best practice. India has improved to 67.23 from 60.76 during last year according to the DTF score. As per the report, India ranks among the top 25 countries of the world on three parameters – getting credit, protecting minority investors and getting electricity.

As per the World Bank report, India lists among the top 10 improvers for the second year in a row. This makes India the only country among the nine other countries of the world and only country among BRICS nations to have a place in the list. The six reforms that were the major reason for such improvement are;

- Trading across borders

- Starting a business

- Getting electricity

- Dealing with construction permits

- Paying taxes

- Getting credit

When it comes to dealing with construction permits, the single online window has given great results. The introduction of deemed approvals and reduced cost for obtaining the permits are other reasons for its improvement. Furthermore, in the electricity sector, the time taken to get a new electricity connection has reduced from 105 days to 55 days. In addition, the new Insolvency and Bankruptcy Code has led to systematic resolution of the corporate debtors.

Similar improvement was seen in the trading across borders. India has moved up to the 80th position from 146th position a year ago when it comes to trading across borders. This big leap in the rank is due to the reduction of time and cost to export and import goods. Various initiatives that further helped in easing trading across borders are:

- Implementation of electronic sealing of containers

- Upgrading of port infrastructure

- Allowing electronic submission of supporting documents with digital signatures under its National Trade Facilitation Action Plan 2017-2020.

Since setting up a business in India is on the rise, IMC Group assists in company formation in India. Our services include consultancy, secretarial service, company registration, accounting and payroll services, taxation services, mergers and acquisitions services in India, etc. With our team of expert and experienced professionals, we help companies to smoothly establish and operate. To know more about our services, you can visit our website.

- Article

- November 1, 2018

Whether you are looking for a global expansion of your existing business or are eyeing to set up a new business, there are several reasons to consider Singapore. It is an ideal location for companies all over the world to set up a new business or expand their market.

With highly efficient infrastructure, business-friendly atmosphere, stable socio-political environment, attractive tax regime, efficient regulatory systems, great market potential, fastest growing economy, open business policies, skilled workforce, enforcement of intellectual property rights and much more, Singapore provides the most conducive environment for companies looking to expand in the region.

Singapore is consistently acknowledged as a global business hub and an increasing number of companies are moving in this region. Moreover, Singapore ranks 2nd among 190 economies in ease of doing business as per the World Bank’s annual ratings, 2017. As of 2016, the World Bank ranked Singapore as the best country in the world for doing business for the last ten consecutive years. In addition, it is ranked number 1 out of 82 countries for the most efficient and open economies for seven consecutive years by The Economist Intelligence Unit. Not only this, Singapore is the 3rd wealthiest country based on the per capita GDP and is listed among the least bureaucratic countries in the world.

Let us see what all factors contribute to making Singapore an attractive location for entrepreneurs.

- Competitive Economy

Singapore has a sturdy economy with a very strong foundation. Its economy is rated AAA by S&P. It is also the world’s 3rd richest county based on its per-capita GDP. It has a very low unemployment rate while maintaining low inflation. Moreover, the county has no external public debt which contributes to a robust and well-managed economy.

- Transparent Government

Singapore has a transparent, stable and orderly government, whose vision is to take the nation to the progressive path. Its political system is very efficient where each law, policy and regulation is framed keeping in mind the rational and pro-business approach.

- Easy Infrastructure

Singapore has a world-class infrastructure with excellent road transport system and communication facilities. Not only does the country operate efficient air and seaports but also offers a good network of the highway system, subways, internet infrastructure, etc. Its technological infrastructure supports enormous growth and improves the productivity of the businesses located in the region.

- Strategic Location

Singapore is strategically located in the heart of South-east Asia and enjoys close proximity to emerging markets of India and China. Moreover, it enjoys the benefits of excellent connectivity to virtually all corners of the globe.

- Competent Labour Force

Singapore boasts of the best labour force in the entire world in terms of their productivity, skills, education, technical proficiency and hard work. Being a knowledge-based economy, its manpower is educated and professionally qualified. So, setting up a business in Singapore means you get access to the highly skilled talent pool.

- Efficient Tax System

Singapore offers one of the lowest corporate tax structures in the world. Apart from the attractive tax framework, the government has signed over 21 free trade agreements with 27 economies and 76 comprehensive avoidance of double tax agreements which facilitates smooth business across borders.

- Abundant Finance at Low Interest Rates

Singapore is home to over 128 commercial banks, 31 merchant banks, 365 fund managers and 604 capital markets services license holders. It is a primary hub for wealth management and investments in entire Asia which makes it easy for the businesses to have access to private as well as commercial banking services to fund their expansion and at very low interest rates. Moreover, the government in Singapore offers various tax incentives, financing schemes and cash grants to encourage businesses to set up in the country.

- Easy Company Incorporation Process

Setting up a business in Singapore is very easy and straightforward. You can easily set up a company here in just a few hours. The country welcomes with open arms investors, entrepreneurs and professionals who can complement its economy.

You can set up a company in Singapore in 5 simple steps.

1. Choose your business entity

2. Register your company by complying with the minimum setup requirements

3. Open a corporate bank account in Singapore

4. Get the necessary permits

5. Set up an office and hire well-trained and qualified employees

Bottom Line

Singapore enjoys an attractive position in the global economy and continues to be every entrepreneur’s heartland in Asia. The above-mentioned factors make Singapore the world’s top country when it comes to doing business.

Seeing an opportunity, we, at IMC Group have set up our own office in Singapore to cater to the growing needs of businesses. With a gamut of services including company incorporation, acquiring various business licences, conducting market survey, getting government approvals, facilitating accounting, tax and payroll, we support your business set up in Singapore. You can count on us to be your one-stop business solution.

- Newsletter

- October 15, 2018

UAE is known as a top international destination when it comes to technology transfer such as AI (artificial intelligence) and robotics.

Recently, Dubai has succeeded to pull in about $21.66 billion of FDI into high-technology transfer sector in a time frame of three years. As per the organizers of Hitec Dubai, 2018, this has pushed its position to the top-most slot as a global destination especially for Foreign Direct Investment in technology transfers such as robotics and artificial intelligence.

Dubai’s DTCM or Department of Tourism and Commerce Marketing is going to be the destination associate for Hitec Dubai 2018, which is slated to be held in the first week of December.

This two-day event, which is a business-to-business exhibition and is co-produced by the Hospitality Financial and Technology Professionals and Naseba will open the doors for all the buyers in the Middle East (worth about $75 billion), to top global IT solution-providers and leaders in the hospitality sector.

Frank Wolfe CAE, who is the CEO of HFTP, said that Though Dubai has already proven itself as one of the rapidly growing smart cities in the whole world, these visionary leaders will help Dubai gain the tag of ‘the smartest city of the world’.

Expo 2020 will attract a huge arrival of tourists and hence the hospitality sector will gain the limelight and position Dubai as ‘the smartest city of the world’. In addition, Hitec Dubai provides a prospect for all the hospitality buyers to pioneer most up-to-date technologies in their organizations.

- Newsletter

- October 15, 2018

The businesses in Saudi Arabia are more positive about the returns and future expansion opportunities as compared to last year. This is because of the Vision 2030 reforms put in place by HRH the Crown Prince Mohammed bin Salman aim to improve private sector participation. A survey data proves that about 33% of middle-market enterprises operating in Saudi Arabia foresee more than 10% growth in 2018, and about 6 out of 10 are aiming a growth of between 6-10%, which is a 24-% point increase as compared to the last year results.

This year, regulation has come up as a new factor in inspiring new innovations and thus pumping up revenue growth. About 35% of Saudi respondents consider regulations as the top-most motivator of innovation, up by almost 28% as compared to last year.

Though the top management is confident about the growth, the only apprehension is regarding the cash flow shortages, giving insufficient cash flow as the top-most obstacle to development this year. About 34% of companies based in Saudi that were surveyed recently said that they depend on bank finance for their funding, but as Saudi is looking at upgrading its stock exchange and opening it to global investors, they are finding funding options through capital markets. About 73% of top executives are thinking of an IPO, which is another proof of rapidly increasing business confidence.

Embracing the adoption of AI

The outlook towards new technologies has drastically changed over the last year. In 2017, approximately 94% of survey respondents said that they would not think of adopting robotic process automation. However, by the year 2020, about 82% are of the view that they would have surely adopted AI and also use or put robotic process automation in the application. Moreover, about 95% of the respondents said that they plan doing so within the coming five years.

Overseas expansion

The business leaders of Saudi Arabia now feel the requirement to step out of their comfort zone and expand their reach beyond their domestic borders if they aim to be the market leaders in their particular space. Overseas expansion is the topmost priority for about 29% of the survey respondents. This will improve the chances of company formation in Saudi Arabia and also foreign company registration in Saudi Arabia. Though about 18% of middle-market enterprises are thinking of expansions domestically and within borders only.

Hiring diverse and skilled talent key to growth ambitions

Motivated by the positive revenue growth targets, the Saudi Arabian corporate leaders have begun a hiring spree, and almost 58% of them are planning to engage more of full-time employees. The only thing they have to keep in mind to have more diversity while recruiting additional staff.

- Newsletter

- October 15, 2018

A recent study shows that about 53% of senior staff or executives who are based in the MENA region have artificial intelligence (AI) or Robotic Process Automation (RPA) on their mind when it comes to top technologies. Especially in the consumer sectors, the top technology focus in MENA is on automation.

The study says that the government services and the retail and financial services are the three main customer-facing areas, which are using AI and the efficiencies by automation drives, thus utilizing the resultant capacity to add new value, enhance the customer experience, and also enable more innovation in the products and services.

Governments are making way for the private sector

GCC Governments have instructed their departments to use more intelligent automation to further bring efficiency and encourage innovations, thereby enhancing the satisfaction levels of the residents and tourists by giving them quick and efficient public services. Dubai now stands as the most advanced city in the GCC, regarding automation of public services delivery.

This not only enhances the customer experience but also gives cost-cutting advantage due to automation. Governments should aim at creating in-house developed data science talent to increase service effectiveness and also promote innovations in the private sector.

Aiming to make the customer interactions smarter in the retail side

If used in the retail sector, RPA can build and strengthen the foundation for better digital customer experience; however, to make the customer interactions much smarter requires better predictive analytics which influence AI.

Financial services are leading the implementation of intelligent automation

The financial services sector is the most advanced when it comes to the application and usage of intelligent automation technologies. Many banks are using up-to-date storage of data to give wing-to-wing services to their customers while giving flawless connectivity between the channels, and partnerships with other service providers to facilitate fast payments and loan processing.

The extent to which intelligent automation is implemented currently could vary between and within various sectors, but the speed of transformation in this region has increased to a large extent this year as various organizations are aiming to find newer technologies and also collaborations, which could assist them in addressing the changes in their customer behavior.

Risks associated with digital transformations

As various organizations adopt fast-growing and emerging predictive technologies, they also need to evaluate and tackle information security, data privacy, and ethics.

Companies, be it public or private sector, will have to build their new models of data governance and create ethical guidelines regarding how the customer data is utilized to deal with reputational risk.

- Newsletter

- October 15, 2018

Data shows that there were investments worth US$1.6 billion in August 2018 across 50 deals, in which the buyout deals recorded a little over a double jump in the value as compared to August last year. Year-to-date, PE/VC investments done till August 2018, has shot up to US$18.7 billion, which is about 9% more when compared to the same month in 2017. August 2018 had US$830 million across 18 exits with over two US$200 million deals. While exits in 2018 (counted between January to August 2018) were at US$6.7 billion, with just the Walmart-Flipkart deal of US$16 billion, exits in this year are predicted to shoot up to two times of the total value of exits recorded in last year.

Investments

In August 2018, the deal value stood at US$1.6 billion, which was at par with the investments that were recorded one month earlier; however, it was almost a 71% decrease as compared to August 2017. The huge difference here is because of the two mega deals in August 2017 – first one of Softbank’s US$2.5 billion investment in Flipkart and the second one of GIC’s US$1.4 billion investment in DLF Cyber City. When we talk of deal volume, the investment activity in August 2018 was almost equal to the deals recorded in August 2017.

In August this year, there were four deals which valued more than US$100 million (and were cumulatively totaling up to US$1.1 billion), and accounted for almost 72% of the entire investments as against US$4.7 billion, which was recorded across six deals around the same time last year, which included a couple of the biggest PE deals (mentioned above) that happened in the Indian Market. The biggest deal in August 2018 was KKR’s buyout of 60% stake worth US$530 million in Ramky Enviro Engineers Limited.

When talking about the investment stages, buyouts topped the charts in terms of investment value, with four deals worth US$683 million, which is over two times the investments received in August last year. Expansion or growth deals, which mostly lead the way when it comes to investment value, totaled up to US$467 million in investments as compared to US$4.5 billion in August 2017. Start-ups were at the top when we talk about the number of deals (29 deals).

Power and utilities were at the top from a sector point-of-view, with US$532 million investments recorded just by two deals. The next in line was real estate which had US$360 million invested in two deals. Financial services recorded about US$42 million of investments with six deals. When talking about the number of deals, Technology was at the top with seven deals.

Exits

In August 2018, 18 exits were recorded with US$830 million, which was twice the value when compared to July 2018. But when compared to August 2017, exits have gone down by about 61% in terms of value, majorly because of some large exits that were recorded in August 2017 such as Tiger Global’s exit from Flipkart, which was worth US$800 million, IFC’s exit from Tikona Digital which was worth US$246 million and Bain Capital and GIC’s part exit from Genpact worth US$294 million.

The biggest exit in August this year valued at US$225 million, which was a part exit from Ola –a cab aggregator, by Helion Ventures, Accel India, Bessemer and others when a secondary sale was done to Temasek. Another huge exit in August 2018 was when Warburg Pincus sold 8.3% stake in AU Small Finance Bank Limited for a value of US$223 million in the open market. Then the lucrative conclusion of the US$16 billion Walmart-Flipkart deal, which happened in early September will be topping the lists of exits so far in the Indian PE/VC industry and also overshadow the dollar value of the exits that happened last year.

Open market exits were at the top with deals around US$480 million across eight exits, which was followed by three secondary exits which were valued at US$248 million. A PE backed IPO that came out in August 2018, saw Micro Ventures give up its stake in the Credit Access Grameen Limited for a value of US$71 million.

Financial services led from a sector perspective, as it recorded six deals worth US$381 million.

Fund raise

In July 2018, there were nine fund raises which were worth US$2 billion. In addition, fund raise plan was announced for about US$3 billion in August 2018. The hugest fund raise totaling US$695 million was done by Sequoia with an aim on investments during the early and growth stage especially in the sectors such as technology, healthcare, and consumer sectors.

- Newsletter

- October 15, 2018

The analysts say that AI and similar technologies like robots, drones and other autonomous vehicles will increase opportunities of employment in China by 12% in over the next 20 years, which would be approximately 90 million new job openings.

These technologies are set to not only boost China’s fiscal growth but also generate millions of new job opportunities, more than offsetting displacement of the current jobs. Though these new technologies could actually displace approximately 20% of the present UK jobs by 2037, but would also create an equally big number of new jobs by pumping economic growth.

As compared to the UK estimates, China is predicted to experience a bigger chunk of job displacement (26% vs. 20%) because of the more scope for automation in the manufacturing and agriculture sectors in China. But this is, in fact, more than offset by the huge anticipated boost to GDP in China by using AI and related technologies, which will eventually result into a much larger extent of job creation in the country (38%) as compared to the UK (20%).

The studies also noted that a lot of sectors will be benefiting from using AI and robotics and the major one will be healthcare. It is also important to understand that most of the additional jobs that will be created would have no direct link to AI or robots, but would be a resultant of a more affluent society, which in turn creates more demand of goods and services in general.

This also proves bigger opportunities for business in terms of investments in AI and similar technologies in China, which cover all domains of operations like marketing and product personalization, productive efficiency, R&D, human resource functions and also cybersecurity. However, there is a warning that a big disruption is likely to happen to all the present business models in every sector of the economy, as it is already noticed in media and entertainment and finance and retail.

As China is moving rapidly towards innovation and uniqueness, the industrial employment is expected to move from labour-intensive and low value production to more higher value, such as those used in manufacturing AI-enabled tools for both domestic market and export. Though the studies predict that the long-term consequence of AI on the job market is going to be optimistic for China, the transition phase towards an AI-based economy would cause some commotion to the existing labour markets because millions of workers would have to look for a change of career and maybe also locations. China has a grand Next Generation AI Plan, which aims hefty investments in the area of skill development. Having said that, this will also require some balancing by bringing in more refresher training and recruitment support for the displaced workers.

Therefore, any job which is at a “high risk” of going under automation does not necessarily mean that it’s going to be surely automated. This is because there are many financial, legal and other regulatory, and organizational roadblocks in the road to adopt AI and similar technologies. For China, it is estimated that though about 40% jobs could be considered for automation by 2037, only one-fourth of the current Chinese jobs will be displaced in reality around this period, as against 38% job creation.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group