- Article, Global

- October 21, 2024

Commercial Due Diligence (CDD) refers to an evaluation process where a prospective buyer audits the commercial viability, market position, and growth potential of a target company. This is a comprehensive analysis of business operations, along with crucial aspects like market demand, revenue streams, and competitive dynamics. Particularly, CDD is essential in M&A since it forms the basis of any deal.

In this article, we are going to help you understand the different types of due diligence services, their process, and why CDD matters in M&A.

- What is Commercial Due Diligence?

- Types of Commercial Due Diligence

- The Process of Commercial Due Diligence

- What Should a Commercial Due Diligence Report Include?

- Commercial Due Diligence Checklist

- Why is due diligence important during M&A Transactions?

- Impact of CDD

- Professional Due Diligence Consultancy Services

What is Commercial Due Diligence?

CDD involves evaluating the market positioning and future growth potential of a company. This is different from other forms of due diligence like financial, legal, and operational ones. CDD primarily evaluates the commercial feasibility of the acquisition.

If you’re buying another company, it’s essential to evaluate the commercial feasibility of the acquisition. Thus, as a buyer, your firm needs to evaluate factors like market trends, competitive positioning, and the sustainability of the business model. This informed and data-driven approach elicits a positive outcome of the deal.

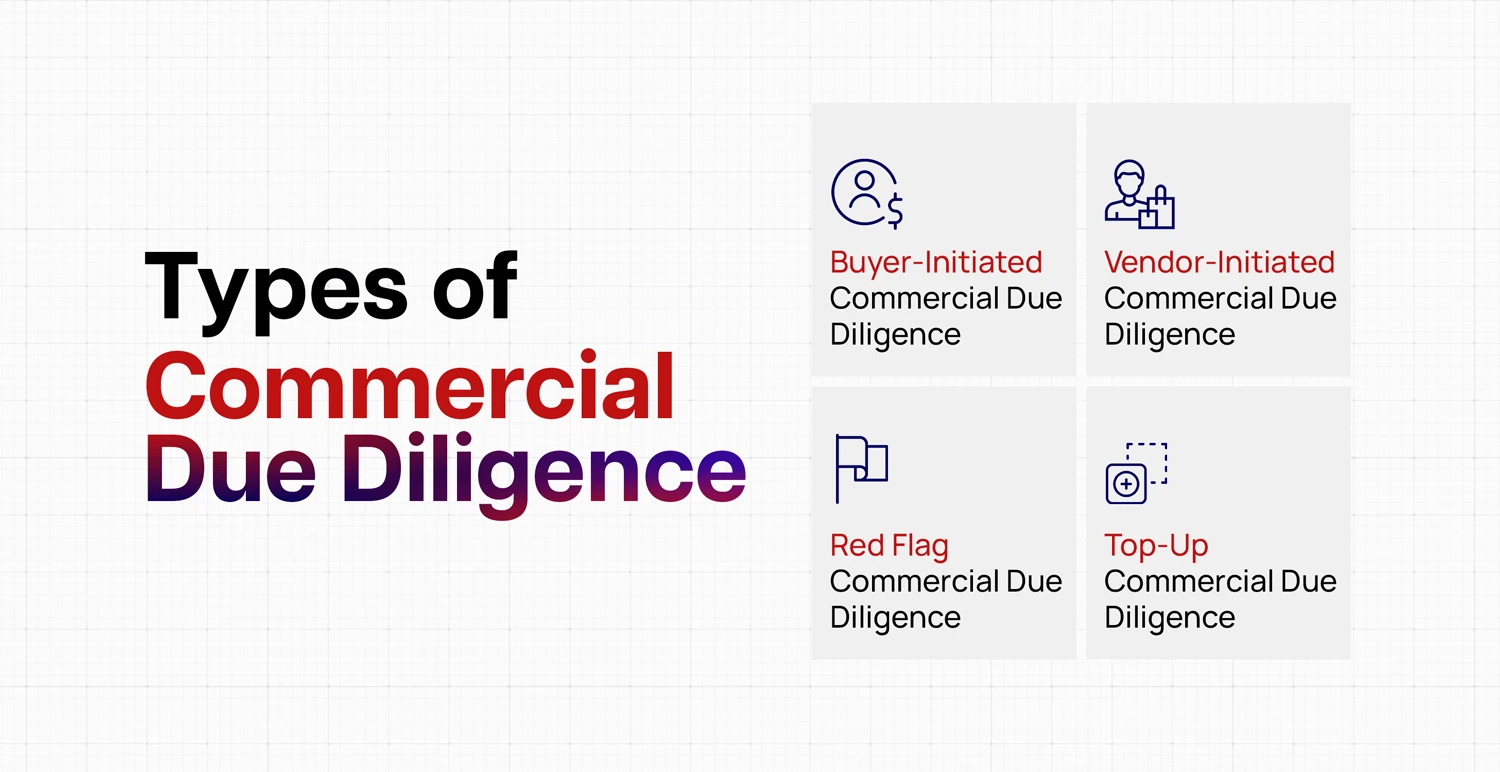

Types of Commercial Due Diligence

1. Buyer-Initiated Commercial Due Diligence

2. Vendor-Initiated CDD

3. Red Flag CDD

4. Top-Up CDD

| Type of CDD | Who Initiates | Purpose/Focus | Key Benefits |

| Buyer-Initiated CDD | Buyer | Comprehensive assessment of business operations, financials, and market positioning | Informed decision-making for the buyer |

| Vendor-Initiated CDD | Seller | Identifies and addresses potential risks before buyer’s evaluation | Increases marketability and value of business |

| Red Flag CDD | Buyer/Seller | Quick, high-level review to spot major risks or deal-breakers | Saves time and resources, early risk detection |

| Top-Up CDD | Buyer/Seller | Supplements existing due diligence, focuses on specific areas | Fills information gaps, ensures thorough evaluation |

The Process of Commercial Due Diligence

1. Liaising Process

2. Preparing the Commercial Due Diligence Report

3. Commercial Due Diligence Report Review

Finally, the buyer reviews the report to determine whether or not the initial investment thesis remains valid. They evaluate factors like revenue margins, competitive landscape, and growth potential. Accordingly, the buyer decides whether they should proceed with the transaction.

What Should a Commercial Due Diligence Report Include?

A thorough CDD report provides a holistic view of the target company. Key components in the report include:

- Company overview: A summary of the history, mission, and operations of the company.

- Management structure: Details about the leadership team and employee agreements.

- Legal matters: A review of contracts, litigation, and compliance issues.

- Products and services: An overview of the offerings and market strategy of the company.

- Financial model: Historical and projected financial performance and sustainability.

- Marketing analysis: Insights into the marketing strategy, customer base, and competitive advantages of the company.

- Competition: A comparison of the position of a target company to that of its competitors.

Commercial Due Diligence Checklist

A commercial due diligence checklist typically includes the following:

- An analysis of the growth drivers and sustainability of the target company, including market size

- Competitive landscape, which evaluates the strengths and weaknesses of the competition

- Business plan review, which includes the revenue growth potential of the company

- Understanding customer demographics, retention, and churn rates

- Reviewing the sales strategy and customer acquisition costs of the company

- Examining profitability, revenue growth, and cost structure as a part of financial health

Why is due diligence important during M&A Transactions?

The benefits of commercial due diligence during M&A transactions are many.

- Firstly, the buyer can carry out informed negotiations from a point of strategic strength as the company is armed with detailed insights about the target firm.

- Secondly, due diligence ensures that the buyer makes a good investment. CDD provides the confidence that the business is promising.

- CDD helps predict the future performance of the company in the respective market.

- It provides a detailed understanding of competitors and helps in understanding the growth potential of the company.

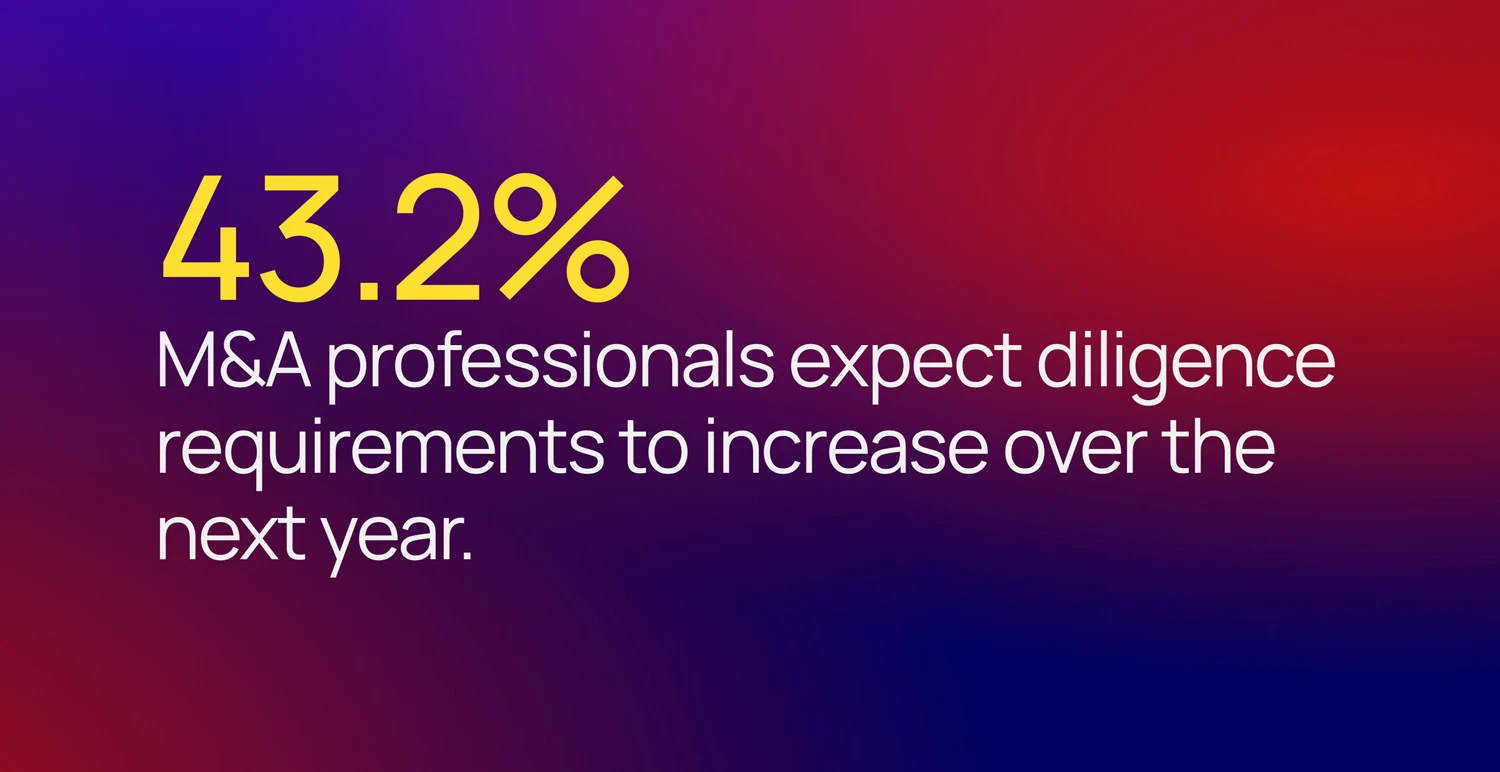

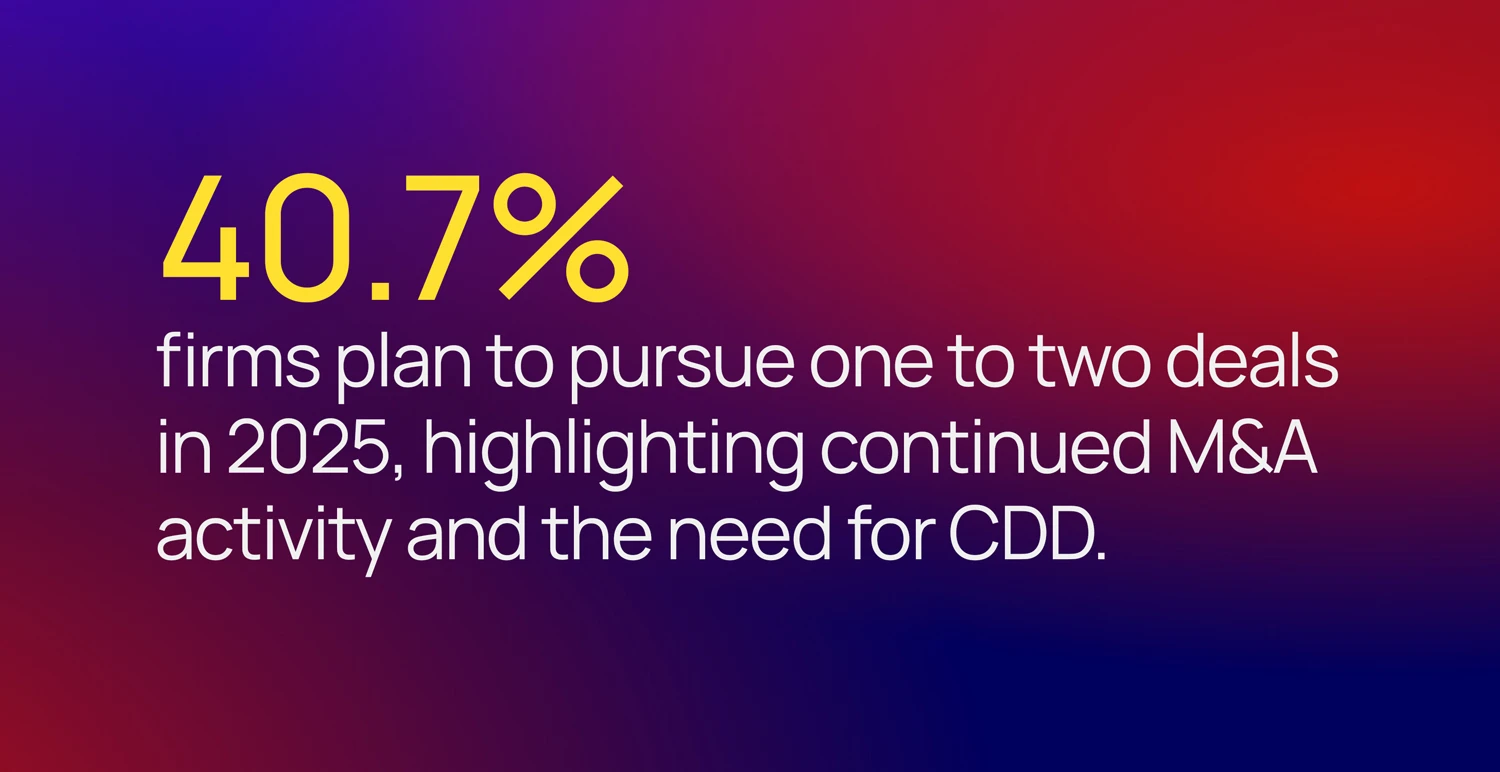

Impact of CDD

The impact of commercial due diligence has grown significantly with the use of AI and machine learning. These technologies help analyze large volumes of data more quickly, identify patterns that may go unnoticed manually, and offer sharper assessments of market risks and opportunities. This results in faster decisions and more reliable evaluations during transactions.

CDD goes beyond checking for risks—it confirms the business’s actual worth, examines its market standing and competition, and supports better decision-making during acquisitions.

Professional Due Diligence Consultancy Services

FAQs

1. Why do businesses conduct commercial due diligence?

2. What does the commercial due diligence process involve?

3. What is commercial due diligence?

4. When is commercial due diligence required?

5. Who conducts commercial due diligence?

6. What areas are covered in commercial due diligence?

- Article, Singapore

- October 18, 2024

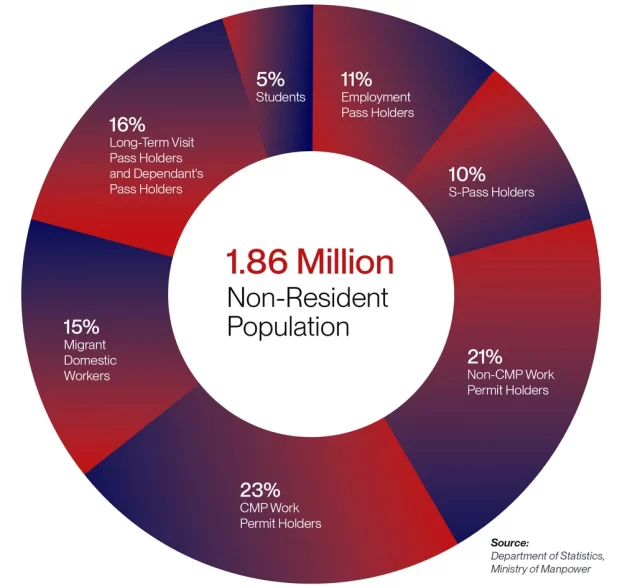

In order to keep up with the evolving dynamic workforce, Singapore has brought in new rules to their Employment Pass. The adjustments to employment pass in Singapore has been made to encourage foreign talent while also bringing transparency and fairness in the hiring process.

Some of the major modifications across the employment pass here include increasing the EP qualifying salary, strict rules of job advertisement is. The newer changes also bring about the introduction of Complementarity Assessment Framework (COMPASS). This blog explores some of the major changes in Singapore Employment Pass in 2024.

- Major Changes in Singapore Employment Pass

- Employment Pass (EP)

- Increase in Salary Threshold

- Strict Job Advertisement Policy

- Introduction of COMPASS

- Educational Verification

- What is the EP application process in Singapore?

- Singapore Employment Pass for Corporates

- Get Singapore Employment Pass Help with Us

Major Changes in Singapore Employment Pass

Who is eligible

To qualify for EP applications, candidates will need to pass a 2-stage eligibility framework:

- Earn at least the EP qualifying salary, which is benchmarked to the top 1/3 of local PMET salaries by age.

- Unless exempted, pass the points-based Complementarity Assessment Framework (COMPASS).

Note: Employers and employment agents can use the enhanced Self-Assessment Tool (SAT) to check a candidate’s eligibility before they apply.

Employment Pass (EP)

Qualifying Salary (Stage 1)

- Non-Financial Sector:

- Minimum monthly salary of SGD 5,500 for applicants under 45 years old.

- SGD 10,500 for applicants aged 45 and above.

- Financial Sector:

- Minimum monthly salary of SGD 6,000 for applicants under 45 years old.

- SGD 11,500 for applicants aged 45 and above.

Increase in Salary Threshold

- The minimum qualifying corporate salary for Singapore Employment Pass was increased effective from September 1, 2023.

- The latest salary requirements for the EP have been updated. Earlier it was $5,000 per month with a slightly higher minimum of SGD 5500 for roles in the financial service sector. For professionals in their 40s, the minimum salary increased up to 10,500 and 11, 500 for financial services for those whose age is beyond 45 years.

- Starting from January 1, 2025, the minimum wage will rise and go up to SGD 5600 and SGD 6200 for finance. So, this update will be applicable to new applicants and renewals from January 1, 2026.

- The salary requirement will be different depending on their age in the finance sector.

Strict Job Advertisement Policy

- Employers who want to hire international talent as per EP policy must have the position enlisted in MyCareersFuture for around 14 consecutive days.

- This requirement will be applicable for positions that have more than ten employees.It helps to bring fairness in the job sector for locals, giving them enough opportunity to apply for the same.

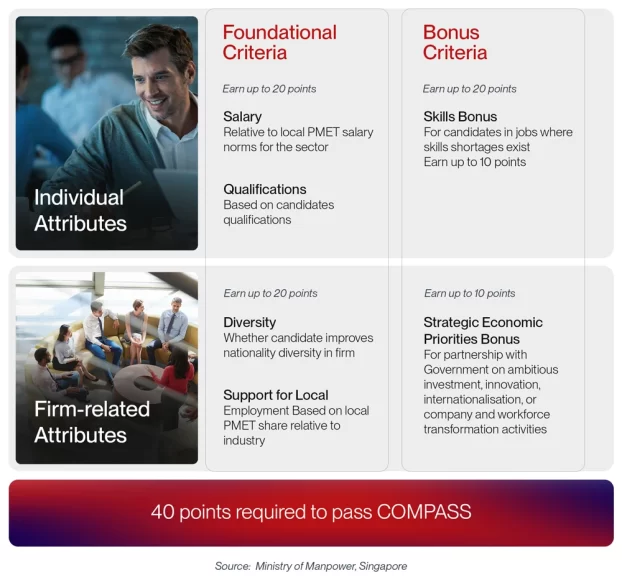

Introduction of COMPASS

- Complementarity Assessment Framework (COMPASS) became valid on September 1, 2023.

- It will evaluate different factors for the individuals such as work experience, qualifications and salary to determine that the candidate is eligible for EP.

All the candidates must earn 40 points to pass the COMPASS.

- Individual characteristics: Includes education and compensation up to 20 points.

- Qualifications: Based on the shortage occupation list and S Pass quota of your firm, you will get a maximum of 20 points.

- Firm-related attributes: Firm’s diversity and support to local employment, for a total of up to 20 points.

- Economic contribution: The industry your company is in and the strategic economic value. Up to 20 points.

Exemptions from COMPASS

Candidates are exempted from COMPASS if they meet any of these conditions:

- Have a fixed monthly salary of at least $22,500 (similar to the prevailing Fair Consideration Framework (FCF) job advertising exemption from 1 September 2023)

- Are applying as an overseas intra-corporate transferee

- Are filling the role for 1 month or less

Educational Verification

- All the Singapore Employment Pass applicants must provide proof for their educational qualifications. They must also show that they are accredited with any educational institution.

- The verification should have been completed by the leading screening companies (https://www.mom.gov.sg/passes-and-permits/employment-pass/documents-required#verification-proof-requirements)

What is the EP application process in Singapore?

- You need to submit the pass for the EP.

- Once that is approved, the authorities will provide the In-Principle Approval Letter.

- The E-pass will be provided by the Ministry of Manpower, upon raising the request.

- After that is processed, you will receive a notification letter.

- Then, you must register fingerprints and a photo to complete the identification process.

- After the process is complete, you will receive the Employment Pass card.

Singapore Employment Pass for Corporates

Get Singapore Employment Pass Help with Us

At IMC, we are dedicated to offering you the best assistance in achieving the Singapore Employment Pass for Corporates. If you have any queries or doubts about the procedure, we can help you. We have a streamlined process, and our experts can help you understand the process and fee.

We’re committed to making the process easy and smooth for you. So, if you’re struggling, contact us today to know more!

- Newsletter, Singapore

- October 15, 2024

Singapore stands out as a prime destination for entrepreneurs and investors in today’s evolving global landscape. While countries like the U.S., Canada, and the U.K. have tightened their immigration policies, Singapore has embraced a more welcoming approach!

Singapore offers robust company incorporation processes and a range of innovative immigration schemes that will take your business to the next level.

Choosing the Right Immigration Program

Global Investor Program (GIP)

Family Office Route

Self-Employment EP for Business Owners

Diverse Talent Attraction Schemes

Singapore also offers visa options designed for specialized talents, including:

- One Pass: For professionals earning over 30,000 SGD monthly.

- Personalized Employment Pass (PEP): For those earning above 22,500 SGD with no employer sponsorship needed.

- EntrePass and Tech Pass: For innovative entrepreneurs and tech leaders in high-growth industries.

Why Singapore?

How IMC Can Support Your Immigration Journey

If you’re ready to take the next step, IMC is here to guide you every step of the way. From selecting the most suitable immigration program to handling all the necessary paperwork, we provide tailored solutions to fit your specific needs. Our team of experienced consultants will help you navigate the application process, ensuring compliance with all local regulations and maximizing your chances of approval.

Additionally, we’ll assist with company incorporation, finding the best investment opportunities, and advising on tax benefits. Whether you’re applying for the Global Investor Program, establishing a Family Office, or pursuing a Self-Employment EP, we ensure a seamless and hassle-free experience.

- Newsletter, U.A.E

- October 15, 2024

For international businesses looking to expand their operations in the Middle East, Dubai has emerged as one of the most lucrative destinations. Dubai has even surpassed leading cities like Paris, Miami, and New York, standing out with its strategic location. The advanced infrastructure and political stability in Dubai make it a business-friendly avenue.

As the UAE emerges as a key global financial hub, it appeals to entrepreneurs, professionals, and academicians. Obtaining the Golden Visa UAE brings a host of benefits as businesses and entrepreneurs look to expand to the country.

Progressive Visa Policies in the UAE Driving Investments

The progressive immigration policies of the UAE have been instrumental in driving international investments. The Golden Visa was introduced by the government of the UAE in 2019. This was a major initiative designed to attract global talent and retain investors in the country.

This is a long-term residency visa, which makes a tactical shift in immigration from temporary expatriate labour to ensure a more stable and permanent pool of talent. With the Golden Visa UAE, individuals can live, work, or invest in any of the seven emirates of the UAE. These include Dubai, Abu Dhabi, Sharjah, Umm Al Quwain, Ras Al Khaimah, Fujairah, and Ajman.

Key Benefits of the UAE Golden Visa

With the Golden Visa, skilled and wealthy individuals enjoy a host of benefits in the UAE. This long-term residency visa is issue for five to ten years and can be renewed automatically. It supports the diversification strategy of the UAE, reducing its dependency on oil and diversifying the economy to sectors like education, technology, and healthcare. This initiative aligns with the vision of the UAE to establish itself as a global leader in business and talent.

Check out the key benefits of the UAE Golden Visa.

- Longer residency period: The Golden visa allows foreign individuals to reside for a longer period in the UAE without any local sponsor.

- Travelling made easy: With this visa, one can travel to the UAE and outside the country with minimal restrictions. You can also sponsor your immediate family members and as many domestic workers as required.

- Professional freedom: One of the best features of the visa is that it allows individuals to enjoy full ownership of their business in the UAE. They can also choose their employees which nurtures a conducive entrepreneurial environment for growth.

Eligibility of the UAE Golden Visa

The Golden Visa is ideal for individuals from various categories, including scientists, doctors, professionals, investors, executive directors, creative individuals, and those specializing in science and engineering. It is also beneficial to brilliant students, real estate investors, entrepreneurs, and those making public investments.

Applicants need to fulfil certain criteria to obtain the visa, which varies from one profession to another.

- Scientists and doctors need to seek approval from the Ministry of Health and Scientific Councils.

- Creative professionals need to get approval from the Department of Culture and Arts.

- Executive Directors should have five years of experience, a degree, and a minimum salary of AED 30,000.

- Investors should own a business, deposit AED 2 million, or pay a tax worth AED 250,000.

- For entrepreneurs, it’s imperative to have a project with a valuation of at least AED 500,000 and relevant endorsements.

With professional assistance from companies specializing in PRO services in Dubai, obtaining the UAE Golden Visa will be easy.

Seek Professional Assistance While Immigrating to the UAE

Whether you are an individual or an entrepreneur looking to immigrate to the UAE, professional support from seasoned advisors can be valuable. International businesses expanding to the country often seek global mobility services in UAE from established companies like the IMC Group to streamline the process. With experts on the side, businesses and individuals can seamlessly fulfil the eligibility criteria and confidently apply for a visa to immigrate to the UAE.

- Newsletter, U.A.E

- October 15, 2024

The UAE has emerged as a formidable player in the global wealth management sector, attracting HNWIs and family offices from around the world. The strategic location of the country, along with its progressive regulatory framework and favorable tax environment makes it a lucrative destination for structuring and preserving wealth. Established advisory companies provide comprehensive support to single family office in Dubai and high-net-worth individuals manage their wealth.

Traditionally, the UAE has been perceived primarily as a transactional market. Assets have been traditionally booked in offshore financial centres like Hong Kong, Singapore, and Switzerland. However, the proactive approach of the UAE to regulatory reforms and the introduction of legal frameworks like the UAE foundations law have transformed the landscape. With these developments, individuals can now structure their assets onshore more effectively. This makes the UAE a viable alternative to traditional wealth management hubs.

Dubai’s Position as Family Office Hub

Competition and Collaboration

Although the UAE has made significant strides in attracting wealth management clients, it faces stiff competition from established financial centers like Singapore and Hong Kong. These regions have a long-standing reputation as wealth management hubs. They offer robust regulatory frameworks and a deep pool of experienced professionals.

However, the UAE has some unique advantages like its strategic location and growing financial ecosystems. This positions the country as a compelling alternative for certain segments of clients.

Regulatory Landscape and Challenges in the UAE

The regulatory environment in the UAE has a crucial role to play in its rise as a global destination for wealth management. The government has implemented several reforms to make the environment more conducive for businesses. This includes the introduction of foundations and the deregulation of single-family offices in the Dubai International Financial Centre (DIFC). These measures have significantly enhanced the appeal of the UAE to HNWIs and family offices.

However, there is still a small door for improvement where the regulatory framework in the UAE can be streamlined. The country has made significant progress in aligning its regulations with international standards. However, it remains to be seen whether the regulatory environment remains efficient and transparent. This will make it adaptable to evolving market trends, which is essential for the success of the UAE.

Talent and Infrastructure

Overcoming Perceptions of Sovereign Risk

In recent years, the UAE has faced certain challenges while trying to establish itself as a global wealth management hub, particularly while overcoming perceptions of sovereign risk. While the country has made significant progress in addressing these concerns, it’s important to continue building trust and confidence among international investors.

The emergence of the UAE as a global leader in wealth management reflects its strategic vision. The progressive regulatory framework in the country and attractive business environment make it a prime destination for wealth management firms. The IMC Group continues to be a leading advisory company, assisting single family office in Dubai and wealthy individuals manage their assets in the UAE. As the country adapts to the changing needs of its clients, it looks well-poised to strengthen its position as a global financial hub.

- Newsletter, Singapore

- October 9, 2024

In recent years, the family office ecosystem in Singapore has been on a phenomenal growth trajectory. While the country had only 400 single family offices in operation in 2020, the number has grown manifold to 1,650 in 2024. The second minister for finance and transport and deputy chairman of the Monetary Authority of Singapore (MAS), Chee Hong Tat, revealed these astounding figures while speaking at the Global-Asia Family Office Summit.

He also spoke about the strong financial norms and pro-business regulations in the country, demonstrating why the country continues to be a preferred destination for wealthy families in Asia and various other countries around the world. Interestingly, wealthy families are looking for a leading single family office in Singapore to manage their assets and maintain their legacy across generations.

Singapore’s Economy Booms with Economical Progress

The assets under management (AUM) in Singapore have recorded an overgrowth of 8% in 2023. The five-year compound annual growth rate stands at an impressive 10%. In 2025, the Asia-Pacific region is likely to grow by 4.9%. Thus, Singapore is all set to benefit as a prime financial focal point serving the region.

You might be wondering why Singapore is the ideal hub for your family office. Chee demonstrated the key role Singapore has been playing in wealth management. He highlighted the importance of local banks like DBS, UOB, and the Bank of Singapore, along with global financial institutions like HSBC and Citi.

A recent survey involving the leading private banks in the country revealed that in the first quarter of 2024, the assets of their clients increased by 9.5% compared to the same quarter in the previous year. The same trend was evident in the Global Wealth Report of the BCG. It revealed that, between 2023 and 2028, Singapore is projected to grow at 8.5% per annum, which is faster than any other wealth centre around the globe.

The Role of Single Family Offices in Singapore

Chee pointed out the role of single family offices in Singapore beyond wealth management. These firms generate jobs and invest in local ventures.

He also expressed his support for the growing interest of Singapore in philanthropy. This reveals the impact that single family offices can have, both through social and financial contributions. In Singapore, single family offices are supporting causes like educating autistic and dyslexic individuals, besides providing elderly care.

Chee stated that Singapore is enhancing philanthropic activities through various programmes like the 2021 Philanthropy Advisory Skills which was launched by MAS, and the professional certification on philanthropy from the Asia Centre for Changemakers in 2023.

With supportive policies from the government and initiatives for talent development, Singapore is poised to remain a leader in Asia as well as the world in family office services and wealth management. The IMC Group continues to be an experienced advisor for single family office in Singapore, helping wealthy families and HNWIs in Singapore manage their wealth.

- Newsletter, U.A.E

- October 9, 2024

Over the last couple of decades, Dubai has evolved into a lucrative global hub for businesses. In 2024, forward-thinking international companies are eyeing the most promising sectors in the country. For entrepreneurs, key sectors to invest in Dubai include renewable energy, personal finance management, Ed Tech, tourism and hospitality, and real estate.

Consulting established professionals for company formation in Dubai, foreign investors are keen to make the most of the opportunities in the country.

4 Key Sectors Global Firms Should Invest in Dubai

1. Renewable Energy

Why invest in renewable energy?

- Incentives from the government: The government offers several incentives for renewable energy projects, including funding and tax breaks. Moreover, the DEWA (Dubai Electricity and Water Authority) supports these initiatives through its Dubai Solar Energy Strategy.

- Technological advantage: Some of the largest solar parks in the world, including the Mohammed bin Rashid Al Maktoum Solar Park, are housed in Dubai. Besides generating clean energy, these projects reflect the commitment of Dubai to advanced technology to achieve sustainable goals.

- Increasing demand: With global awareness of climate change making an impact, the demand for green energy solutions is likely to rise. As Dubai is bracing up to be a green energy hub, it presents a favorable market for innovative solutions and new technologies.

Investment opportunities in the renewable energy sector include:

- Solar energy projects

- Energy storage solutions

- Startups working on renewable energy

2. EdTech

Why invest in EdTech?

- Increasing demand: The demand for sophisticated educational solutions in Dubai is on the rise to cater to the different learning needs of the tech-savvy populations. Corporate training institutions, universities, and schools are increasingly looking for intelligent solutions.

- Support from the government: The UAE government is heavily investing in educational reforms to foster digital transformation. This creates a supportive environment for companies working in the EdTech sector.

- International reach: The strategic location of Dubai and its international outlook makes it the perfect hub for EdTech companies to thrive.

Global firms can explore the following sectors in the EdTech domain.

- Online platforms for learning

- Developing AI tools for education

- EdTech Hardware and software development

3. Personal Finance Management

Why invest in Personal Finance Management?

- Rising wealth: The population in Dubai is rapidly accumulating wealth, which intensifies the demand for personal finance tools. These solutions help individuals in investment planning, getting financial advice, and budgeting.

- Digital transformation: In the digitized environment, the shift towards intelligent financial solutions and digital banking is on the rise. This trend is reshaping the way individuals manage wealth, creating opportunities for new platforms.

- Financial literacy: With financial education gaining the spotlight in Dubai, the need for financial literacy solutions is on the rise. This makes complex concepts related to finance understandable to a broader population.

- Wealth management solutions

- Innovations in Fintech

- Financial literacy programs

4. Hospitality and Tourism

Why invest in hospitality and tourism?

- Strong growth potential: The tourism sector in Dubai looks lucrative for investors and the city attracts millions of visitors from all around the globe annually.

- Innovation: The hospitality sector in Dubai is evolving as it embraces new technologies like AI.

- Entertainment and events: The city is known for hosting global exhibitions, events, and various festivals. This largely drives the growth of the tourism and hospitality industry.

- Tourism infrastructure

- Tech-oriented experiences

- Luxury hotels

Professional Consultation for Business Setup in Dubai

The investment landscape in Dubai looks more promising than ever. In this edition, we have presented the key sectors where foreign businesses can invest in the city.

However, amidst the competitive commercial environment, the business setup in Dubai process can be challenging for companies expanding to the country. The IMC Group continues to be a leading consultancy firm, providing comprehensive assistance to global firms eyeing the lucrative opportunities in Dubai.

- Newsletter, Singapore

- October 9, 2024

Singapore continues to be a favorable avenue for investment, particularly among global firms. Foreigners consider this country to be one of the best places to start their business. With its bustling environment and dynamic commercial environment, Singapore has emerged as a favourite destination for global investors and entrepreneurs.

The sound commercial infrastructure in the country and the easy access to regional markets make Singapore a great place to invest. The country has a transparent legal system that reduces investment risks. Thus, businesses from different verticals enjoy the ease of conducting commercial activities. Although the Singapore company formation process is relatively easy, successful firms seek professional support from experts to streamline their path.

Read on to understand why Singapore continues to be the favourite destination for establishing your business.

7 Reasons Why Foreign Investors Choose Singapore

1. Supportive business environment

2. Tactical location

Located centrally at the junction of the main sea routes in Southeast Asia, Singapore gives an easy access to foreign companies. The country is placed strategically in the heart of Asia and provides a unique gateway to its expanding market. This opens up the way to imports and exports.

Thus, foreign companies investing in Singapore can gain easy access to the new markets as well as the established ones in Asia. This helps them enhance their operations and grow inter-organizational networks.

3. Favorable Tax System

The tax system in Singapore is one of the most business-friendly ones across the world. This is one of the key factors attracting foreign investors. While corporate tax rates in Singapore are low, businesses operating in the country also receive various tax incentives and exemptions.

Moreover, Singapore has established double taxation treaty agreements with several nations. Thus, foreign companies investing in Singapore enjoy reduced tax liabilities.

4. Transparent Legal System

5. Skilled Workforce

Singapore boasts a highly skilled workforce that helps foreign companies pool talent. With professional training and education, the workforce in Singapore is teeming with skills needed to suit various fields.

The country is committed to develop talent, promoting professional learning to enhance the quality of skills. Thus, businesses expanding to the country can hire skilled professionals and remain competitive in the market.

6. Advanced Infrastructure

After Singapore company formation, foreign companies can take advantage of the world-class infrastructure in the country. The country has an effective telecommunication system, transportation facilities, and modern offices. With a strong transportation system and operational efficiency, businesses experience a favorable environment in the country.

From high-speed internet to world-class highways, Singapore offers all the facilities that help companies conduct business and relocate their employees.

7. Key Financial Hub

Over the years, Singapore has established itself as one of financial hubs in the world. Its banking market is robust, and offers different types of financial products.

In Singapore, investors can benefit from the presence of several multinational banks that open up tremendous prospects of financing, investments, and financial management. Thus, global firms can control their finances and seek funds for further expansion and seize opportunities.

Professional Consultancy Services to Start a Business in Singapore

In this edition, we have comprehensively covered why foreign investors are looking to expand their operations to Singapore. Ambitious international companies often wonder how to start a business in Singapore as a foreigner. The IMC Group is one of the most trusted teams of consultants to guide businesses at every step during their company formation in Singapore. With personalized service and professional insights, foreign companies can establish their businesses and embrace the growth trajectory in Singapore.

- Article, Singapore

- September 27, 2024

The business world in Singapore is changing at a rapid pace which proves this time to be the best for starting a business here. The company-friendly policies and business regulations can leverage the benefit of global EOR & PEO services. Considering the bustling economy of Singapore and convenient bordering policies, it is the central hub for businesses. In fact, Singapore happens to be the headquarters for several Asian companies.

Singapore PEO policies can act as a crucial intermediary that will help in handling all the legal and administrative requirements of your business. If you want to start a business in Singapore, it is essential to adopt an experienced workforce while also keeping up with these policies. The market is continually evolving, leading to fluctuating needs for emerging industries and services. To maintain a competitive edge, explore the top five sectors that can gain the most from PEO or EOR solutions during their growth.

Manufacturing and Construction

Big construction and manufacturing companies are outsourcing their employment processes to streamline their HR management and payroll tasks. As a result, these businesses will have sufficient time to finish their international projects, plan their resources, distribution, and more. Collaboration is extremely crucial across the manufacturing and construction industry.

Driving newer and better opportunities from abroad can help to streamline all business operations, across newer countries too. Therefore, with the help of EOR and PEO guidelines, they can get access to a wide pool of skilled talent.

Technology

The technical sector is constantly evolving with major developments across cyber security, network infrastructure, and data analytics. Therefore, for companies involved with PEO and EOR services, it is important to hire internationally. Sourcing professionals internationally can help in getting better resources.

Recruiting talent from around the world can drain valuable time and resources, which are better allocated elsewhere. By partnering with a PEO or EOR service, businesses can focus on their core operations without the burden of managing international hiring complexities.

Additionally, data management becomes more streamlined with the support of a PEO or EOR. Upgrading to new systems or managing employee information can often slow down operations. Outsourcing these tasks to a PEO or EOR allows for a smoother transition and ensures modernization efforts are efficient and hassle-free.

Service and Retail

EOR and PEO services are extremely crucial in the service and retail industry to form better relationships with international clients. Attracting skilled professionals to contribute their expertise is essential for the growth of any company in this sector. Businesses depend on their employees to drive success and sustain their competitive edge.

EORs connect businesses and clients worldwide, enabling companies to deliver their top-tier consulting, education, and customer services to diverse regions without facing the challenges of hiring and integrating new employees.

Pharmaceuticals

The pharmaceutical industry is one of the major industries leveraging the power of EOR & PEO services. The sector has grown massively post pandemic as people started prioritizing their health and safety. The pharmaceutical industry is constantly evolving even today, which is why it is important to collaborate with international companies for better growth opportunities.

The EOR services will help to guide these pharmaceutical businesses about the legal procedure. They can become more compliant with the terms and conditions. As a result, our EOR & PEO services will ensure that your business connects with reliable companies for better business growth.

Renewable and Non-Renewable Energy Generation

The energy sector is constantly evolving, with its impact not only on the real estate sector but also on the production of energy-related services. There’s an increased demand for a sustainable future, which is also one of the driving forces behind the growth of this sector.

Since it is an expensive procedure, it is important to get the right people to do the job. Having our EOR and PEO assistance will not only help you set up the business appropriately but also get the right individuals. Thus, we will help you manage the business while scaling your workload, thereby allowing you to make the most of it.

Choose the Best Global EOR & PEO Services

With IMC Group by your side, you will receive expert support in managing your global workforce through our specialized EOR & PEO services in Singapore. Our exclusive Global Mobility solutions help businesses expand internationally with ease, facilitating seamless growth and compliance across borders. We have successfully assisted numerous businesses over the years expand their operations internationally. Contact us to know more!

- NEWSLETTER, GLOBAL

- September 26, 2024

A transition from traditional finance to AI-enabled real-time operations

The strategic advantages of AI-driven real-time finance

Instant Data Analysis: One of the most powerful features of AI is its ability to process and analyze vast amounts of data in real time. Thus, businesses can monitor their cash flow, track expenses, and forecast financial performance instantly. Real-time insights, backed by AI, are crucial for maintaining a competitive edge.

Real-Time Financial Reporting: AI-driven systems can generate updated financial reports. This provides immediate insights into the financial health of a company. It marks a significant improvement over traditional models of outsourcing, where financial reports were often delayed. Businesses can make critical decisions with real-time reporting, having access to the latest data. This helps them remain agile and responsive.

AI Tools in Power BI (or) Tableau automatically compile and analyze financial data, creating real-time dashboards and reports. This helps accountants monitor financial performance on the go. And provide clients on management with up-to-date insights.

Detecting Fraud in T&E Reports: One of the notable use cases where generative AI is being used in accounting is the auditing of Travel and Expense (T&E) reports. Thanks to the automated systems backed by AI, it is easy to detect potential fraud and inconsistencies that go beyond out-of-policy expenses. This translates to a significant amount of savings for accounting firms.

AI also evaluates data related to consumption and average pricing in restaurants. In the process, it detects discrepancies and anomalies that may be included in reporting expenses in the T&E system. The smart process significantly reduces the dependency on manual review processes and pacifies the financial processes as accounting firms can quickly address potential issues.

How accounting firms use AI to automate functions and boost productivity?

Besides transforming internal financial operations, AI is also reshaping the way accounting firms operate. Successful outsourced accounting service providers have been proactive in adopting AI-driven tools. Thus, they automate key functions to enhance productivity and efficiency. Advanced AI applications are capable of handling tasks like tax preparation, bookkeeping, and financial auditing with remarkable speed and accuracy. This significantly reduces the workload on human accountants, besides minimizing the margin of errors.

Automation of Routine Accounting Tasks: AI algorithms are now capable of managing routine tasks. These include data entry, invoice processing, and expense tracking. As a result, accountants can free up their crucial hours and focus on more strategic activities like advising clients on financial planning and business growth strategies.

AI tools such as Expensify automatically scan receipts, categorize expenses, and generate reports. Employees can take photos of receipts. The AI extracts relevant data (e.g., Date, Amount, Merchant) for expense claims, streamlining the process.

Enhanced Financial Auditing: AI-powered tools are capable of analyzing large datasets to identify discrepancies, fraud, and compliance issues. Naturally, they are much faster compared to traditional methods. This significantly enhances the accuracy of audits and speeds up the process. Thus, accounting firms can deliver more timely and reliable results to their clients.

Scalable Solutions: As accounting firms grow, the ability to scale operations without proportionally increasing costs is crucial. AI provides scalable solutions that can handle an increasing volume of transactions and clients without a corresponding rise in overhead. Firms looking to expand their client base find this scalability essential, while maintaining high levels of quality in their service.

Business owners and accounting heads of organizations worldwide are looking to partner with AI-driven accounting firms. These outsourced service providers can significantly enhance their efficiency in accounting. Leading accounting firms using AI have already set benchmarks in the industry. Working with one of these service providers can help businesses reap the benefits of automation and more accurate services.

Responding to inquiries from vendors and customers: Generative AI can be trained to handle inquiries from vendors and clients more effectively. With sophisticated chatbots, accounting firms can draft quick and helpful responses to these queries. With natural language processing and vast amounts of data, smart systems are capable of generating innovative and original replies.

AI needs to be trained to answer simple questions, while connecting customers to vendors in the ERP system. However, human experts need to be appointed to take care of more complex inquiries. This strategic approach significantly streamlines the communication process, making it responsive.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group