Foreign companies expanding to Singapore often consider setting up a branch office in Singapore. A Branch Office is a great way for international organisations to establish a presence in the country while they continue operations under the same brand. However, it’s imperative to follow certain key regulations, requirements and steps involved in registering a branch in Singapore.

Read on to learn the process of Singapore company formation as a Branch Office. This guide explains the entire process of Singapore branch registration, detailing everything from eligibility and documentation to timelines and compliance.

- What is a Branch Office?

- Pre-Conditions to Establish a Branch Office in Singapore

- Key Things to Consider Before Company Registration

- How to Register a Singapore Branch Office?

- Documents Required for Singapore Branch Registration for a Foreign Company

- Timeframe for Registering a Business in Singapore

- Opening a Corporate Bank Account

- Annual Filing Requirements for a Singapore Branch Office

- Professional Consultation for Setting Up a Branch Office in Singapore

- Branch Office vs Subsidiary Company

What is a Branch Office?

When businesses setting up a Branch Office in Singapore, they establish it as an extension of a foreign parent company. It is, therefore, not a separate legal entity. A Branch Office operates under the name of the parent company. The primary goal of setting up such an entity is to help the parent company grow business activities and generate revenue in Singapore.

Now, businesses must understand that a Branch Office is a non-resident entity. Therefore, such a company does not qualify for the tax incentives that local companies in Singapore enjoy.

Pre-Conditions to Establish a Branch Office in Singapore

Before registering a branch in Singapore, businesses must meet the following requirements.

- Corporate shareholder: The parent company has to own 100% of the Branch Office

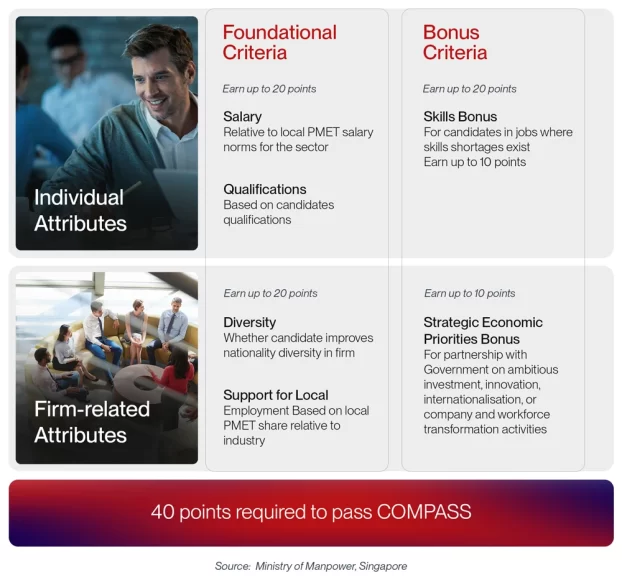

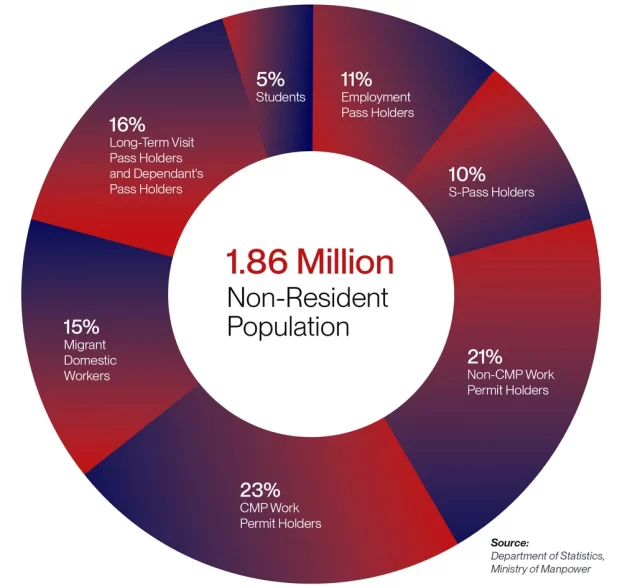

- Resident agent: At least one agent based in Singapore is required, who can be a citizen, permanent resident, or an Employment Pass or Dependant’s Pass holder.

- Registered office address: The Branch Office must have a physical office in Singapore. This implies that P.O. boxes are not allowed.

Since a Branch Office cannot be self-registered by foreign companies, they must work with a corporate service provider to register the company with the ACRA (Accounting and Corporate Regulatory Authority). The registration process takes a maximum of 24 hours if all the documents are in order. Generally, successful companies seek professional services from experts to streamline the process of setting up a Branch Office in Singapore and avoid delays.

Key Things to Consider Before Company Registration

Business Name

The name of the Branch Office must be the same as the parent company. The entity must obtain approval from the ACRA before registering itself. Here are certain conditions under which a name may be rejected.

- It is similar to an existing business in Singapore

- It is considered offensive or undesirable

- It resembles well-known trademarks of other companies

Resident Agents

At least one local resident agent needs to act as a legal representative at a Branch Office in Singapore. In case a foreign employee relocates to the country to manage a Branch Office, they need to obtain an Employment pass. This is the only way for foreign nationals to assume the role of an agent.

There’s no upper limit on the number of agents that can be appointed by a Branch Office. However, they need to be 18 years old at least, not bankrupt, and have no criminal record.

Company Secretary

Taxation for a Singapore Branch Office

For tax purposes, a branch office is classified as a non-resident entity, making it ineligible for tax incentives, grants, or exemptions. Additionally, it cannot benefit from tax relief on foreign-sourced income or claim double taxation relief under Singapore’s network of Avoidance of Double Taxation Agreements (DTAs).

Subsidiaries are treated as tax residents and can take advantage of the tax incentives of Singapore.

Employment Passes for Branch Office Staff

How to Register a Singapore Branch Office?

- Approval of the name: Submit the name of the company for approval by ACRA.

- Registering the branch office: Once approved, proceed with registering a branch in Singapore by submitting the required documentation.

Documents Required for Singapore Branch Registration for a Foreign Company

- Parent Company Details:

- Full legal name of the parent company

- Registered address of the parent company outside Singapore

- Corporate Documents:

- Certified copy of the parent company’s Certificate of Incorporation

- Certified copy of the parent company’s Constitution

- Register listing the Directors of the Parent Company

- Local Representative Information:

- Details of the appointed local representative

- Signed Statement of Consent from the local Singapore resident designated as the branch office representative

- Business Registration Notice:

- Foreign company’s registration number

- Description of the business activities carried out

- Legal structure of the foreign company

- Financial Documents:

- A copy of the parent company’s audited financial statement

These documents ensure compliance with Singapore’s regulatory requirements for foreign branch registration.

Timeframe for Registering a Business in Singapore

- Step 1: Firstly, businesses need to submit an online application with the necessary details, which takes around 10 minutes.

- Step 2: Next, they need to provide copies of their passport and details of the corporate shareholder, which can vary from applicant to applicant.

- Step 3: ACRA will process the application and completes Singapore branch registration within a few working days.

During Singapore company formation, foreign companies need not be physically present in the country. Corporate service providers handle the entire process remotely to get the business registered.

Opening a Corporate Bank Account

Annual Filing Requirements for a Singapore Branch Office

- Financial Statement Preparation

Branch offices must prepare financial statements in accordance with Singapore Financial Reporting Standards (FRS), which align closely with International Financial Reporting Standards (IFRS).

- Submission to ACRA

Audited financial statements must be filed with ACRA within 60 days of the parent company’s Annual General Meeting (AGM).

- Estimated Chargeable Income (ECI) Declaration

Within three months from the end of the financial year, branch offices must submit their Estimated Chargeable Income (ECI) to IRAS. ECI is determined after deducting non-taxable items such as capital gains and the sale of fixed assets from total revenue.

- Annual Income Tax Filing

Singapore follows a preceding-year taxation system, meaning taxes are assessed based on the previous year’s income. Branch offices must file their annual income tax returns with IRAS by November 30 (for paper submissions).

Meeting these requirements ensures compliance with Singapore’s corporate regulations and avoids potential penalties.

Professional Consultation for Setting Up a Branch Office in Singapore

Branch Office vs Subsidiary Company

| Feature | Branch Office | Subsidiary Company |

| Legal Entity | Extension of parent company (not separate) | Separate legal entity |

| Liability | Parent company liable for branch debts | Liability limited to subsidiary |

| Business Activities | Must be same as parent company | Can differ from parent company |

| Local Director Required | No | Yes |

| Company Secretary Required | Not mandatory but recommended | Mandatory |

| Tax Residency | Non-resident | Singapore tax resident |

| Corporate Tax Rate | 17% | 17% (with partial exemptions, e.g., 8.5% on first S$300,000) |

| Eligibility for Tax Incentives | Not eligible | Eligible for tax incentives and exemptions |

| Double Taxation Relief | Not eligible | Eligible under Singapore’s tax treaties |

| Filing Requirements | Audited financials of the branch and parent; ECI and tax returns to IRAS | Audited financials and tax returns for the subsidiary only |

| Withholding Tax | Generally exempt since 2014 on payments to branch | Subject to normal withholding tax rules |

IMC Group

IMC Group