The UAE has always been among the first nations to apply modern technologies to increase government efficiency. The ICP Smart Services is one of these projects that stands out. This tool has changed how locals, foreigners, and companies use government services. It makes processes easier to get to, faster, and more user-friendly. Whether your goal is to launch a new company or obtain a Golden Visa, knowledge of ICP Smart Services is vital. Let’s go over these offerings and how they could benefit you.

ICP Smart Services is a tool with many features meant to make many government tasks in the UAE easier. People can get a lot of different kinds of services on this platform, which makes it easy and quick to use. Take a closer look at the services they offer:

ICP Smart Services makes getting and updating different types of cards easier. The service makes applying for a tourist, residence, or work visa online simple. It also includes applying for long-term cards like the Golden Visa, which lets investors, business owners, and skilled workers stay in the country longer.

Note: The total times above assume no delays or missing paperwork. They may be extended by: Public holidays, Incomplete or unreliable documentation, Delays in biometric appointments or medical tests.

The tool makes it simple for UAE residents to update, replace, and apply for Emirates ID cards, necessary documentation. Users may also use their Emirates ID to alter their personal data on the online platform. It keeps their information current so they don’t have to go to government places in person.

People from the UAE can use ICP Smart Services to apply for, update, or change their cards online. This service ensures that people can easily and quickly handle their travel papers.

ICP Smart Services makes it easy to keep track of residency cards. Users can get new residency cards, renew old ones, or remove them if needed. It is also possible to move residency cards from one sponsor to another through the app. It speeds up the process for both companies and expats.

It would be best if you had specific security clearances and licenses in the UAE to do certain jobs and actions. Users can apply for these licenses and clearances online through ICP Smart Services. As a result, all the necessary permissions are easily and quickly acquired.

Use either the ICP Smart Services website or the mobile app available on Google Play and Apple App Store.

Services are clearly grouped — Emirates ID, visa, passport, and other government processes — for easy selection.

Fill out the digital form, upload your documents, and pay online. The system guides you through each step.

Most services can be completed fully online, saving time and reducing paperwork.

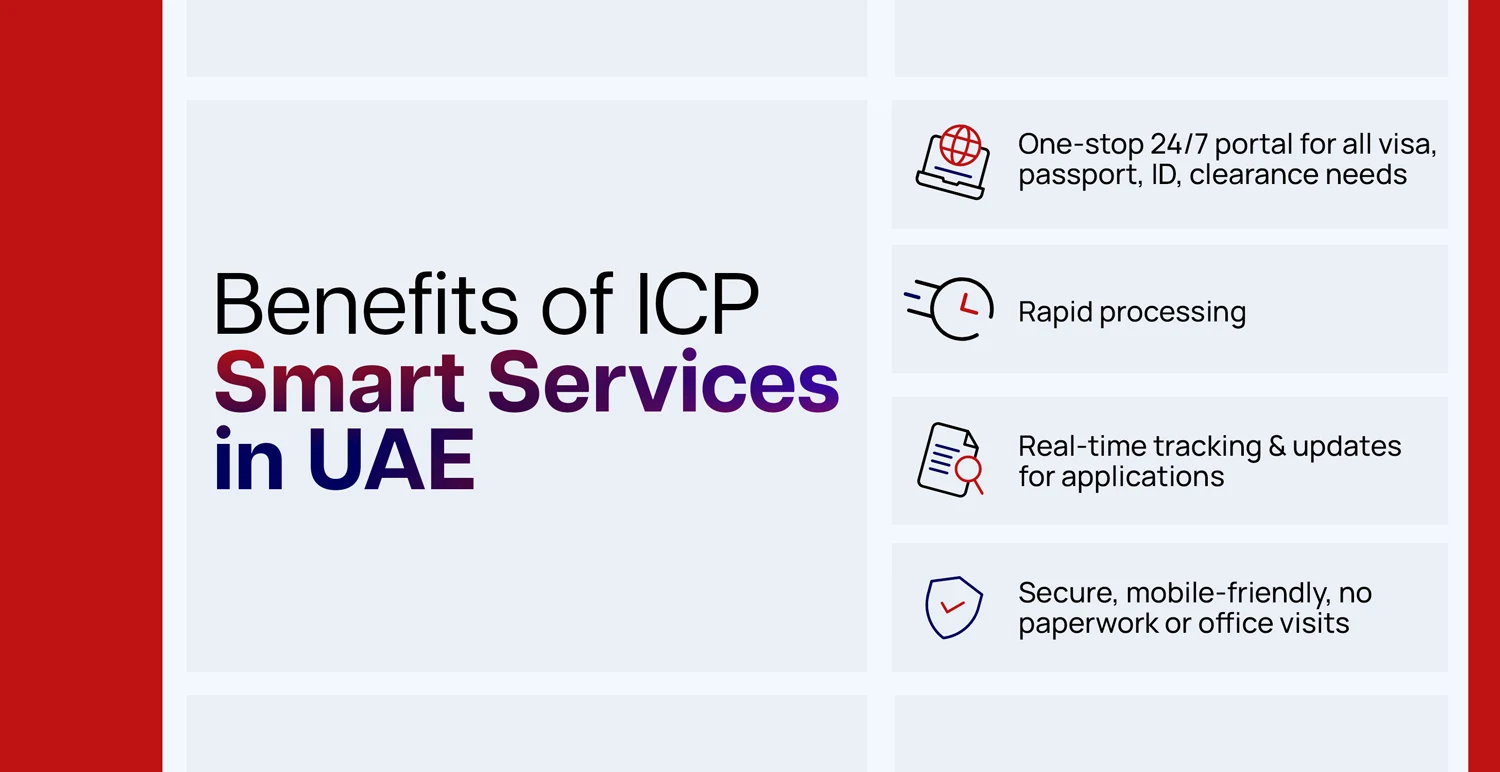

Using ICP Smart Services has many benefits that improve the experience. The platform is helpful for people who live, visit, or do business in the UAE. These are some of the main benefits:

One of the best things about ICP Smart Services is that it makes things easier. People can use many government services from their homes or workplaces. It eliminates the need to go to government buildings in person, which saves time and effort. The site is open 24*7, so users can fill out forms and do business whenever convenient.

ICP Smart Services simplifies many tasks, which makes application handling faster. Several government offices work together on the platform. It makes teamwork go more smoothly and lowers the chance of delays. Individuals and companies that need quick responses to their applications will benefit the most from this speed.

The platform provides alerts and information in real-time, letting people see where their apps are in the process. This openness ensures that users always know how their wishes are coming along. Users can also review their application records and past purchases through the online portal. It keeps a clear record of all encounters with government services.

The style of ICP Smart Services is simple and easy to use, so users can quickly find the services they need. During the application process, the site gives advice and help. It makes sure that people can finish their work without any problems. This design is straightforward, which is excellent for people who have never used online government services.

When you use ICP Smart Services, you can cut down on the costs of trips and paperwork. The online payment method makes it easier to pay all the fees. It makes sure that all deals are safe and quick. The app helps users save money and time by cutting down on the need for paper documents and in-person meetings.

Many different people and businesses in the UAE need ICP Smart Services. Here is a list of who needs to sign up for these services:

Registering for ICP Smart Services is quick and uncomplicated. Here is a detailed guide to assist in your starting process:

After signing up, it’s straightforward how to use ICP Smart Services. Take advantage of the platform in these ways:

Using ICP Smart Services to apply for visas speeds up the process and makes getting different types of visas easier. Here’s how to fill out the application:

ICP Smart Services makes it easy to keep track of your visa application through the ICP UAE visa tracking system. It makes sure you know how your application is going at all times. The steps are as follows:

ICP Smart Services is an online portal to manage visa, residency, Emirates ID, and other immigration-related requests without visiting service centers.

Delays may happen due to incomplete documents, technical errors, or pending approvals from relevant authorities. Check your dashboard for updates.

Typically, you need your passport copy, previous visa, Emirates ID, passport-size photo, and proof of residence. Requirements may vary by visa type.

Yes, even if a visa isn’t required, GCC nationals must register for residency and Emirates ID services while staying in the UAE.

Yes, individuals and companies must register an account to apply, renew, or cancel services.

Log in to your ICP account, go to the “My Services” or “Visa Services” section, and select “Check Visa Status.” Enter your application or passport number, submit, and view current visa validity dates and expiry information.

IMC Group

IMC Group