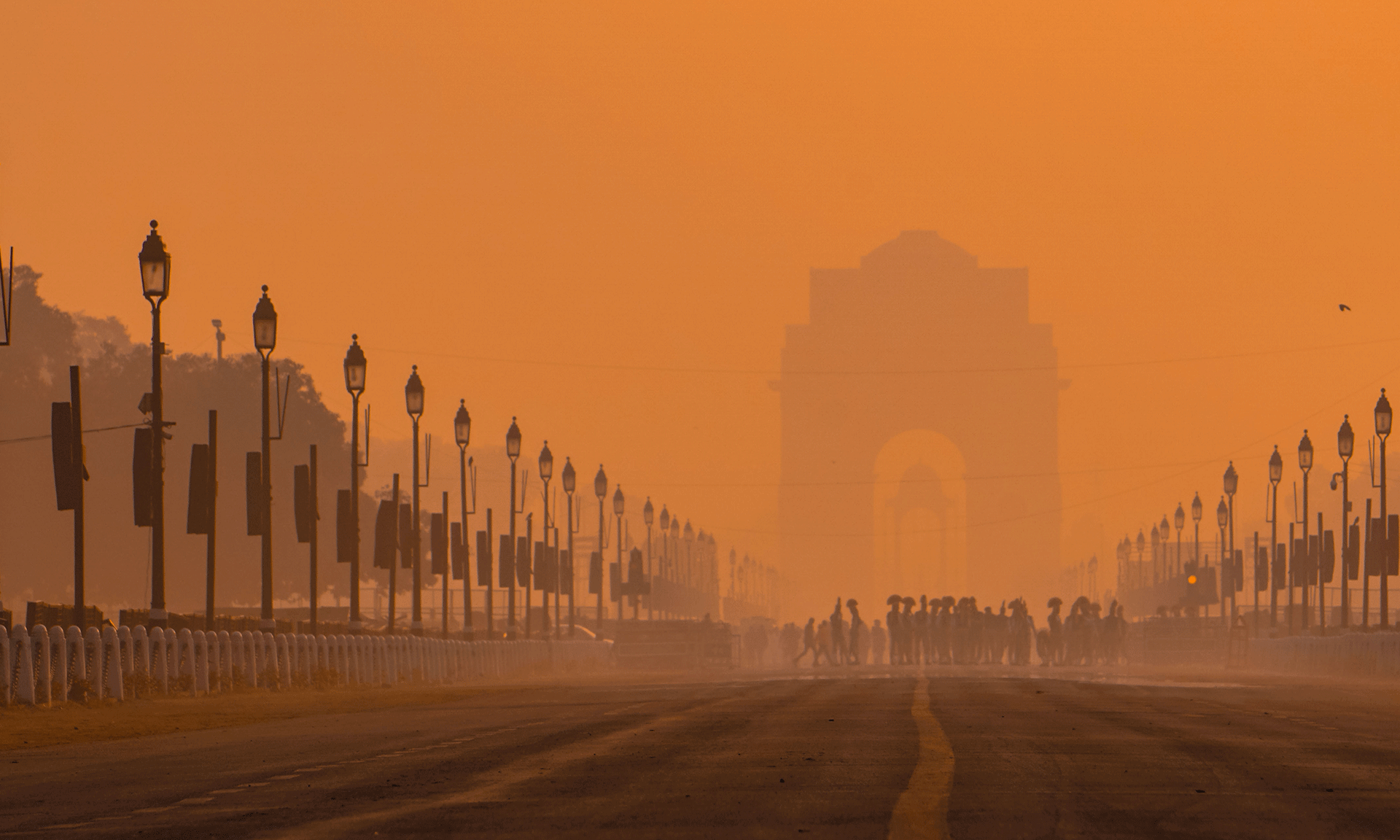

India’s market size is the biggest advantage for any successful enterprise. There is no dearth of customers or consumers and therefore, higher revenues. Considering this factor, opting to do your own business is any day a better choice than getting a job. You may think that getting the initial capital would be tough, but there are many such businesses in which you don’t need huge investments.

Your idea for a business doesn’t necessarily need to be a unique one. Even a small-scale business could be a good business if it’s does well on revenues and profits, along with bringing you goodwill and keeping up with some social obligations. So, we have collated a list of 10 business ideas which you could consider and begin your journey as an entrepreneur.

1. Desserts or Sweets Store:

Investment needed: Rs 50,000 – 60,000

ROI: 8-9 months

Who isn’t addicted to sweets? Especially in India, be it celebrating some special days like birthdays and anniversaries, festivals or victories in life, sweets are an important part of all Indian and South Asian culture. This makes getting into sweets business a great idea. Though it’s a mature market, if you think of a niche of specialty of desserts or sweets, there is a minimal chance of failure. What’s more? This business needs very small amount of capital and a small area to start with.

2. Gaming Center:

Investment: Rs 40,000-Rs 70,000

ROI: 6-7 Months

There’s a child hidden in all of us; and who doesn’t like playing video games, and other indoor and outdoor games? Yes, you can think of starting a gaming center. This surely will attract both children and adults. You could include video games, snooker, etc and if you don’t mind investing a bit more, then try virtual games, bowling alley etc.

3. Daily needs store:

Investment- Rs 100,000 – 150,000

ROI: 12 months

How about a all-in-one store where you get daily needs groceries, basic cosmetics and personal care products, household utilities and much more. You could strat such a store in a small space and with a small investment and may be think of expanding later after you start reaping profits. To expand your customer base, you could run festival discounts and other attractions.

4. Office Assistant:

Investment: Rs 30,000- 40,000

ROI: 4-5 months

Most of the MNCs and organizations usually have assistants who handle their day to day tasks and operations. But wouldn’t that be a job? No, you could also have a consultancy service where you could serve as an assistant to some organization; or may be even serve multiple organizations in their daily tasks. These tasks include simple operations like fixing meetings, arranging and co-ordinating events, travel etc. This business requires good networking and communication skills and doesn’t need much investment.

5. Home Tuitions:

Investment: Rs- 20,000-25,000

ROI: 3-4 months

If you want to utilize your skills and education while not investing a big amount, then you could think of starting home tuitions. May be you start with just one or two students, but if you do well, the word of mouth will be a good form of advertising for you and within no time you will have a big group of students. Here too, you could focus on any one or two subjects that you have expertise on. If you have good networking skills, after some time, you can expand your business into a tuition institute. Then, you can hire good teachers and other administration staff and reap the benefits.

6. Yoga Classes:

Investment: Rs 10,000-15,000

ROI: 2-3 Months

The ancient art of Yoga is one of the most sought after practices in today’s times. This is one of the business ideas that needs minimal investment and can be started in your home or garden. Just start a yoga class with a few people in the morning or evening. When you have enough number of clients, you could think of hiring a hall or a bigger space for your classes.

7. Book Store:

Investment: Rs 50,000-70,000

ROI: 12 months

Reading is a hobby and passion for many people these days. Be it newspapers, magazines, books or novels, starting a book store is a good idea. You could stock up books as per the city and the taste, literacy rate etc of people dwelling there. It’s also a good idea to keep books as per the age group of your customers. You could advertise about your book store through various schools, colleges and universities.

8. Fast Food Joint:

Investment: Rs 40,000- 50,000

ROI: 4-5 months

Indians have special love for spicy and street food. You could think of starting your own fast food restaurant or small joint in some market where you would get lot of customers. If you choose the correct location, your fast food joint can cater to hundreds of consumers every day. This business is hence a good idea because you can break even within a few months and then start reaping benefits provided you maintain a good quality.

9. Human Resource Consultant:

Investment: Rs 20,000- 25,000

ROI: 4-5 Months

Many big manufacturing companies require a mix of laborers, people for management and also other skilled manpower. But finding and appointing employees of various profiles is not at all easy. So how about starting a recruitment or Human resources consultancy business? You need good networking skills to do well in this business as you need to deal with both job seekers and job providers or organizations.

10. Budgeting Manager:

Investment: Rs 30,000- 40,000

ROI: 4-5 Months

Mostly, people start some enterprise in the area of their expertise, but they do not have the know-how of investments and how to procure funds etc. If you think you have knowledge of finance, you can think of starting your business or consultancy service as a budgeting manager. Even if you start with one big client, you can expand your business later with experience. In this business, you assist the clients in making decisions regarding their capital structure and how they can invest in securities.

You can choose any of these ideas depending on your skill-set; but remember that all businesses need commitment, hard work and passion. Just add your special touch, create your niche and you are good to go.