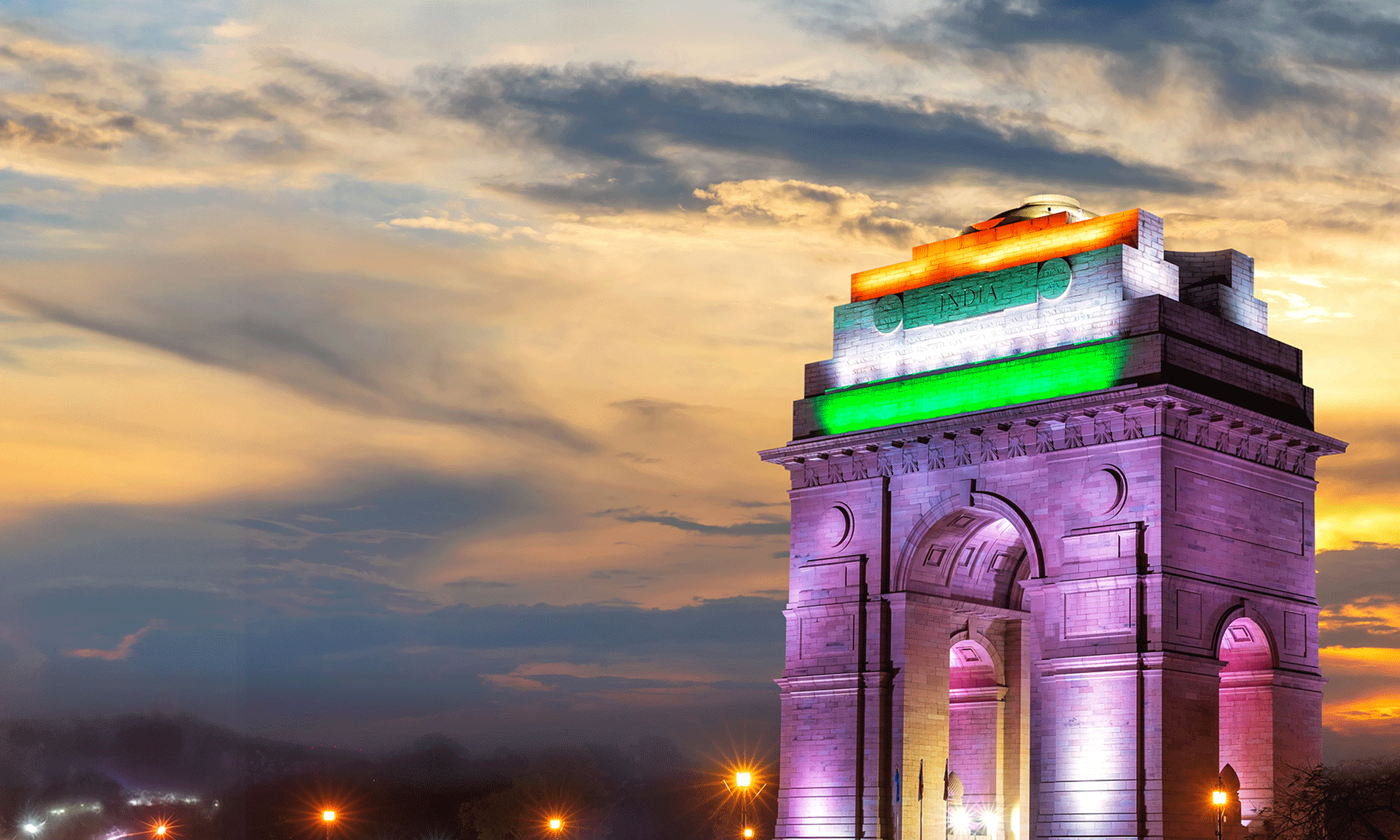

Dubai is one of the fastest growing economies and is an ideal hub to trade from all the corners of the world. One of the major businesses is the import export business in Dubai. During the past few years, Dubai import export business has been one of the most profitable businesses.

Great infrastructure along with the UAE’s position makes Dubai highly popular for import export business. Moreover, the Dubai government has stated providing eservices to the import and export companies in Dubai in order to help them function smoothly and efficiently. Guidelines for setting up an import-export business in Dubai can be found in this link.

Reasons for Setting up an Import Export Business in Dubai

An Import Export Business in Dubai can be hugely successful due to its Strategic Location as it is the gateway between the east and the west.

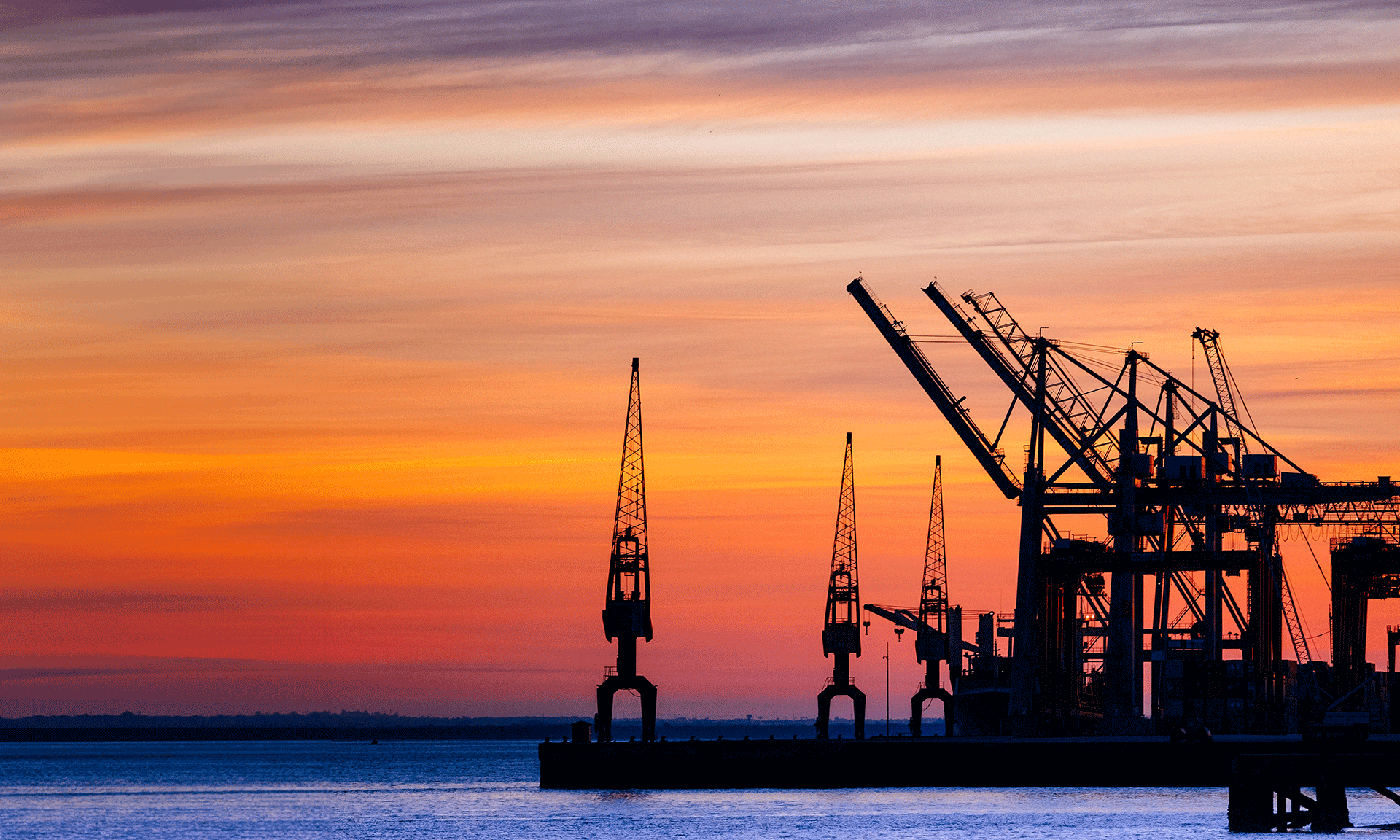

The Airports & Seaports of UAE are strategically located to access the international trade route and have world-class infrastructural and logistics facilities. The UAE is directly connected to more than 170 countries by Air, Land, and Sea routes.

The high level of supply and demand augurs well with the flourishing international trade in Dubai and other parts of Emirates. The UAE is rich in petrochemical and natural gas contributing to the majority of exports. There are huge requirements for global products in these regions constituting imports.

The diversified economy of the UAE government with many incentives for foreign investments attracted a large pool of investors across the globe and boosted infrastructure support, real estate, technology, fintech, and many other businesses and money flow.

So, let’s have a look at the procedure for setting up an import export business in Dubai.

Import Export License

Dubai import export business requires an import export license to function. The process to obtain a license is very simple and can be done online. However, if you are exporting or importing special or restricted goods then you need to acquire a special license from the Customs Office.

Import License is required to purchase or get commodities from outside the borders of UAE or from the foreign country or form any other province of Emirates by meeting all legal procedures, documentation, permissions, and terms of licensing. Anyone can become an importer by availing this license from the UAE license authority.

Export License is required when you want to trade in goods or services produced locally in some other country or among the free trade zone of UAE. If the goods are exported to any of the Free Trade Zones of the UAE, they are not subject to pay any customs duty. Although the Free Trade Zone is an integral part of UAE, it doesn’t come under the UAE Customs Territory.

Registration with Customs

Apart from getting the import export license, you also need to register with the Customs Department. An import code from UAE customs is required to bring goods into UAE by sea or air. Commodities which pass through customs from a free zone to local market are liable for duty. Registering in Dubai Customs is unambiguous and can be done online although you will require a bunch of documents. Mirsal – 2 is the online declaration and clearing system of Dubai Custom. Therefore, all commodities imported or exported should pass through Customs office and will be checked whether they fall under the prohibited list or not.

Dubai Export Procedure

The exporter needs to go through the below steps:

-

The exporter has to submit the documents required at the Customs Office.

-

Export declaration registration fee is to be paid at the Customs Office.

-

Later, Customs declaration certificate is issued.

Documents Required for Export

-

The licensing agency in the country should give the company an approved Export Declaration Certificate or the Instructions of the Declaration of Goods Application (IDG). This is required for airport customs point of entry.

-

If commodity exported falls in the restricted list, the exporter should have a permit from the competent agencies.

-

A Sales invoice is required from the company which should provide the description of goods, quantity, and value of each item.An invoice should be addressed to the company outside UAE.

Dubai Import Procedure

The importer needs to go through the below steps:

-

Submit the original Bill of Lading and pay dues (if any) to the shipping agent as the vessel arrives. After this, the shipping agent will issue a Delivery Order.

-

All cargo clearance formalities should be completed before the expiry date of Delivery order. So keeping this in mind, the shipping agent will issue the Delivery order 3-4 days prior to the arrival of the vessel.

-

Now comes the time for Customs Clearance. The Import Declaration application is to be submitted online by logging in to Dubai Trade. The importer should make payment of customs duties and other fees online. The importer should procure consent if the commodities imported are restricted or have an exempt duty before filing the Customs Import Declaration.

-

Dubai Customs will authenticate the documents and may inspect goods before giving the possession of cargo to the importer.

-

After the container is discharged, the importer can then appoint a transport company to receive delivery of container/commodities.

-

As per the Customs Import Declaration, if any inspection is required then the container will be taken to the inspection area of the competent authority and only after getting the inspection clearance, the container will exit.

Documents Required for Import

-

Invoice mentioning the total quantity, goods description and total value of each item addressed to the importer.

-

Certificate of Origin stating the origin of goods approved by the country of origin’s Chamber of Commerce.

-

A document mentioning the detailed weight of each product in a container, method of how it is packed and the HS Code for all items is required.

-

Import Permit from the competent agencies if importer in importing restricted goods or duty exempted goods.

Dubai Import Export Business In a Free Zone

Dubai Import Export Business has a huge scope and you can avail the services of IMC Group if you are willing to set up an import export business in Dubai.

Though all UAE free zones are areas within the territory of the UAE but are considered outside the scope of the UAE customs territory. They have to follow certain conditions and requirements in order to conduct import export business in UAE free zone.

For Import Export Business between Free Zone and a Local Company – Importer should have an importer code and goods should be the same that is mentioned in the license of import export business in Dubai. Goods should reach the destination within 72 hours of the customs declaration. Goods have to be checked before entering the free trade zone.

For Import Export Business between Free Zone and a Foreign Company–Free zone license is free from the expenses of custom duties.

Free Zones are the ideal and most attractive locations to set up import-export business in Dubai providing several benefits as under

- Fast and Easy Approval

- Nil Customs Duty

- Zero Tax

- World-class Infrastructure100% Foreign Investment

- Fast Business Setup

- Customs Inspection on-premises

- Warehousing Facilities

- Easy access to Airports and Seaports

Products in Import Export Business in Dubai

The list of products allowed in the import-export business in Dubai are as follows-

- Crude and refined petroleum is the most widely exported commodity

- Diamonds, Gold, and other types of jewelry

- Automobile and different types of transport equipment

- Broadcasting and media equipment

UAE Trade Promotion Organizations

Dubai Export Development Corporation (EDC)

Established to provide exporters with the services they need to enter or expand into foreign markets, EDC is the promotional arm of the Dubai Economic Department. It aims to widen Dubai’s exporter base into unexplored or high-potential markets by supporting businesses that produce internationally competitive goods.

Export Credit Insurance Company of the Emirates (ECIE)

ECIE helps companies to increase their export businesses safely and securely. It provides trading organizations with the necessary protection against trade credit risks, allowing them to manage their commercial and political risks better, safe-guard their balance sheets and increase their profitability. ECIE offers short-term trade credit insurance policies to UAE firms engaged in manufacturing, value-added trading, and the export of services. These are tailored to protect against the risk of payment defaults by importing customers. Its partnerships with well-reputed organizations include Coface, the global expert in credit risk analysis and trade receivables management, Saudi Arabia-based Islamic Corporation for the Insurance of Investment and Export Credit; and Kuwait-based Arab Investment and Export Credit Guarantee Corporation.

UAE Trade Laws

- Certificate of origin rules Draft Law

- Competition Draft Law

- Arbitration Draft Law

Conclusion

International trading or import-export Business in Dubai is the most lucrative avenue with all the available business infrastructure, import-export facilities, and logistics support in place.

The transport links to the international market, safe and secure shipment handling in large volume and efficient online customs clearance are promoting Dubai as the most preferred choice for opening a trading company in the Arabian Peninsula.