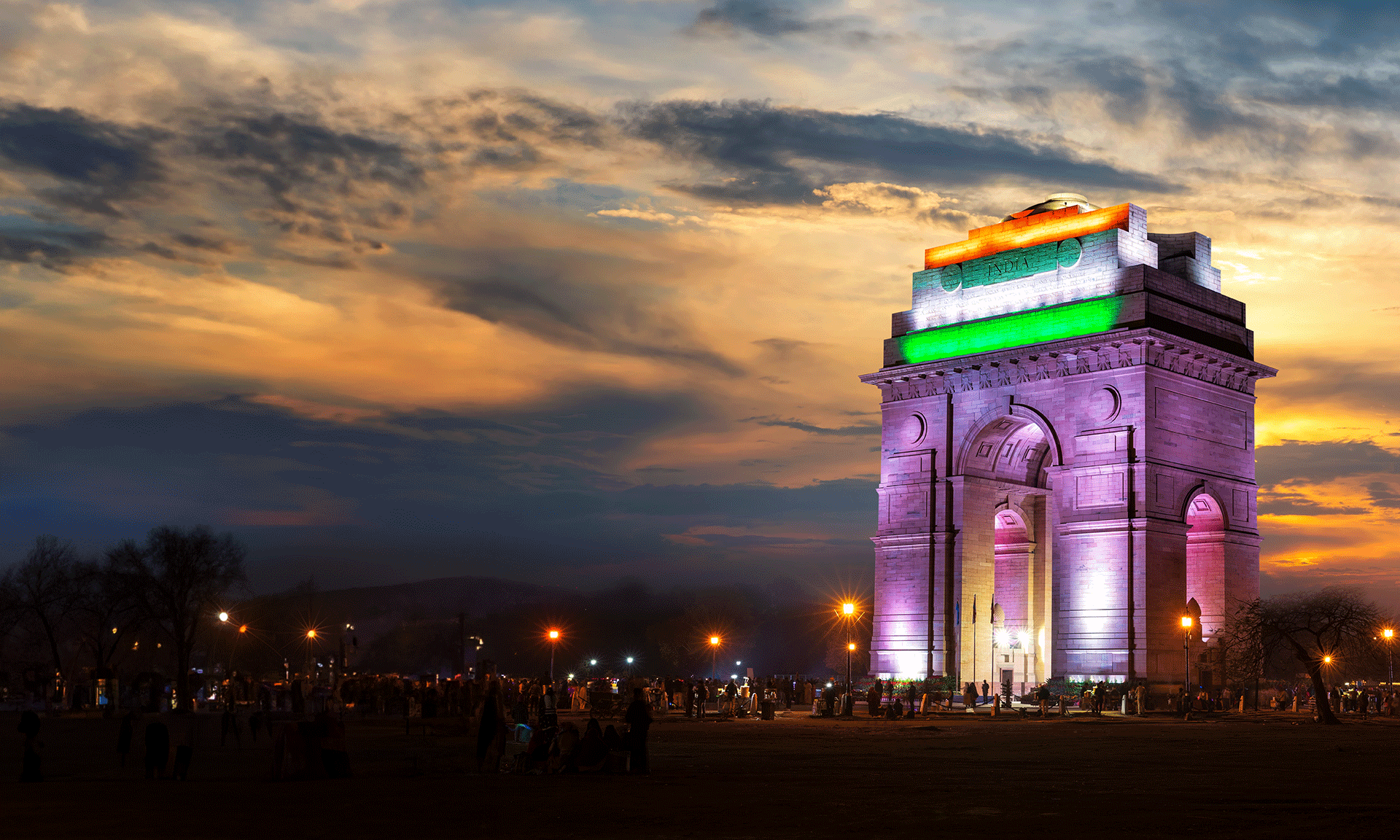

India’s currency has weakened due to a significant outflow of funds. However, its strong underlying strengths and projected growth continue to make it an appealing prospect for foreign investors.

Indian investors can invest from anywhere via several routes: Foreign Direct Investment (FDI), Foreign Portfolio Investment (FPI), Foreign Venture Capital Investment, and Alternative Investment Fund.

Today’s topic of discussion is one of the most popular investment paths – Foreign Portfolio Investment (FPI).

- What is Foreign Portfolio Investment (FPI)?

- Can you provide information about India's main laws and regulations for a Foreign Portfolio Investor (FPI)?

- What are the different Types/Categories of Foreign Portfolio Investors in India?

- What are the advantages of registering as a Category I FPI compared to Category II?

- What are the key operational aspects to consider when making a foreign portfolio investment?

- What tax compliances must an FPI follow under the Income Tax Act of 1961?

- FPIs face several burning issues under the current tax regime

- Areas Where IMC Can Assist FPIs

What is Foreign Portfolio Investment (FPI)?

Can you provide information about India's main laws and regulations for a Foreign Portfolio Investor (FPI)?

What are the different Types/Categories of Foreign Portfolio Investors in India?

An applicant can obtain an FPI license under SEBI regulations in one of two categories below:

(a) “Category I FPI”, mainly includes:

- Investors associated with the government or government entities

- Pension funds and university funds are two separate types of financial entities

- Entities like asset managers, banks, and investment advisors should be appropriately regulated

- Entities that meet the eligibility criteria set by the Financial Action Task Force (FATF) member countries

(b) “Category II FPI” includes all investors who are not eligible under Category I:

- Funds that are appropriately regulated cannot be considered as Category-I foreign portfolio investors

- Endowments and foundations are charitable organizations supporting a specific cause or mission

- “Corporate bodies” refers to organizations or groups legally recognized as distinct entities from their members or owners

- Family offices

- Individuals

- Unregulated funds can take the form of limited partnerships and trusts.

What are the advantages of registering as a Category I FPI compared to Category II?

The main advantages of category I are listed below:

(a) Determining the eligibility to issue Offshore Derivative Instruments (ODIs);

(b) Compared to Category II FPIs, Category I FPIs enjoy easier compliance with certain KYC norms.

(c) Regarding stock and currency derivatives, the position limits have been increased.

Category I FPIs are exempt from the Indian Income-tax Act’s “Indirect Transfer” provisions. These provisions apply to overseas investors who transfer shares/interest in an overseas entity with assets in India.

What are the key operational aspects to consider when making a foreign portfolio investment?

The following are the significant operational features:

1. Appoint a legal representative:

To obtain an FPI license under SEBI regulations in India, it is necessary to appoint a legal representative to assist in the process. The application needs to be submitted in the prescribed format, along with all the required documentation. Financial institutions authorized by the Reserve Bank of India can act as legal representatives and reputable law firms.

2. Appoint a Tax advisor:

If you are an FPI working in India, complying with all tax obligations is essential. A tax advisor can help you with this by maintaining records, issuing certificates for repatriating funds out of India, handling annual tax compliances, and representing you before tax authorities. By hiring a tax advisor, you can ensure that you meet all the requirements and avoid any legal issues related to taxes in India.

3. Appoint a Domestic Custodian

Before investing in India, appointing a domestic custodian to provide custodial services such as banking and Demat operations for your securities is essential. A domestic custodian refers to any entity registered with SEBI to carry out the activity of providing custodial services for securities.

What tax compliances must an FPI follow under the Income Tax Act of 1961?

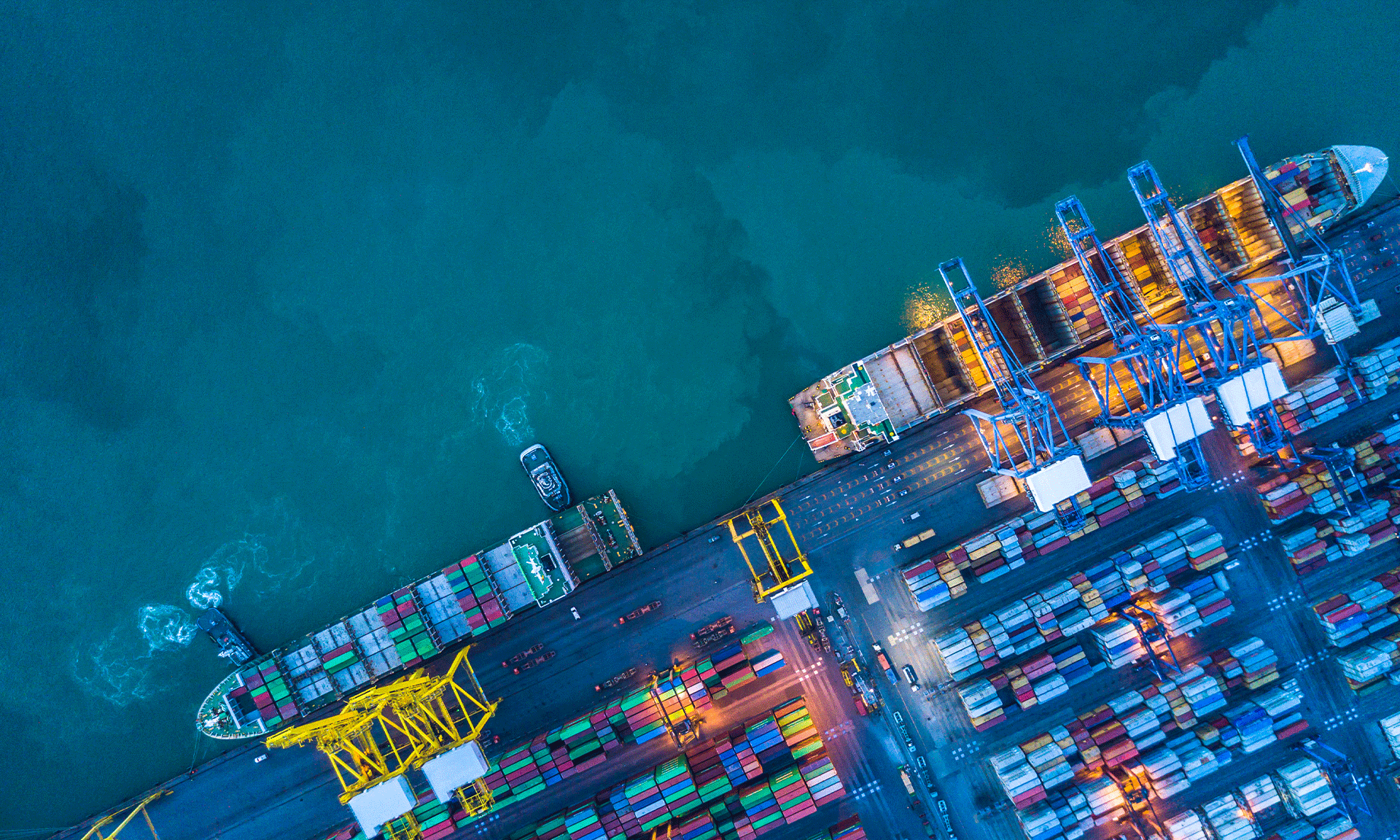

Foreign Portfolio Investors invest in securities such as shares, bonds, debentures, and units of business trust, earning income in the form of dividends, interest, and capital gains. They must remit this income and capital investment out of India regularly.

To remit funds, deposit the applicable income tax with the government treasury. Taxes depend on the nature of the income and can be paid through withholding or self-assessment. Also, the banker must have a tax advisor’s certificate to remit the funds.

FPIs must file an annual tax return electronically at the end of each Indian financial year. If requested, tax authorities may scrutinize the return.

FPIs face several burning issues under the current tax regime

Many Foreign Portfolio Investors (FPIs) structured as non-corporates have to pay a higher surcharge rate on their income from capital gains. As a result, several FPIs are contemplating converting their structure from non-corporate to corporate. However, this conversion may attract General Anti Avoidance Rules (GAAR) under Indian tax laws.

FPIs with fund managers in India with potential business connections must satisfy prescribed conditions.

Areas Where IMC Can Assist FPIs:

- Assisted in guidance and helped with organizing the FPI route

- Support setting up the structure under the FPI route

- Obtain transaction information from the custodian and maintain records

- Computation of tax liability on securities per the Indian Income Tax Act, Double Taxation Avoidance Agreement, and Multilateral Instrument

- Issuance of certificate for repatriation of funds as per Income-tax Act and RBI guidelines

- Organising and filing Annual Income Tax Returns

- Assisting in responding to and managing notices or letters issued by tax authorities and providing related advisory services

- During tax proceedings, one can review assessment orders

- Communication with the tax authorities

IMC Group

IMC Group