As Dubai Expo 2020 kicked off its inaugural ceremony with much splendour on 1st October 2021, the global business community became upbeat about a sustainable economic future with increased collaboration, innovation and opportunities in trade and investment. The six-month-long event with 192 participating countries, thousands of corporations and millions of visitors will indeed rekindle business interactions for putting the growth engine on track after widespread economic devastation due to the covid pandemic. Industry experts are also confident in the huge inflow of foreign investments in the UAE and several new business set up in Dubai.

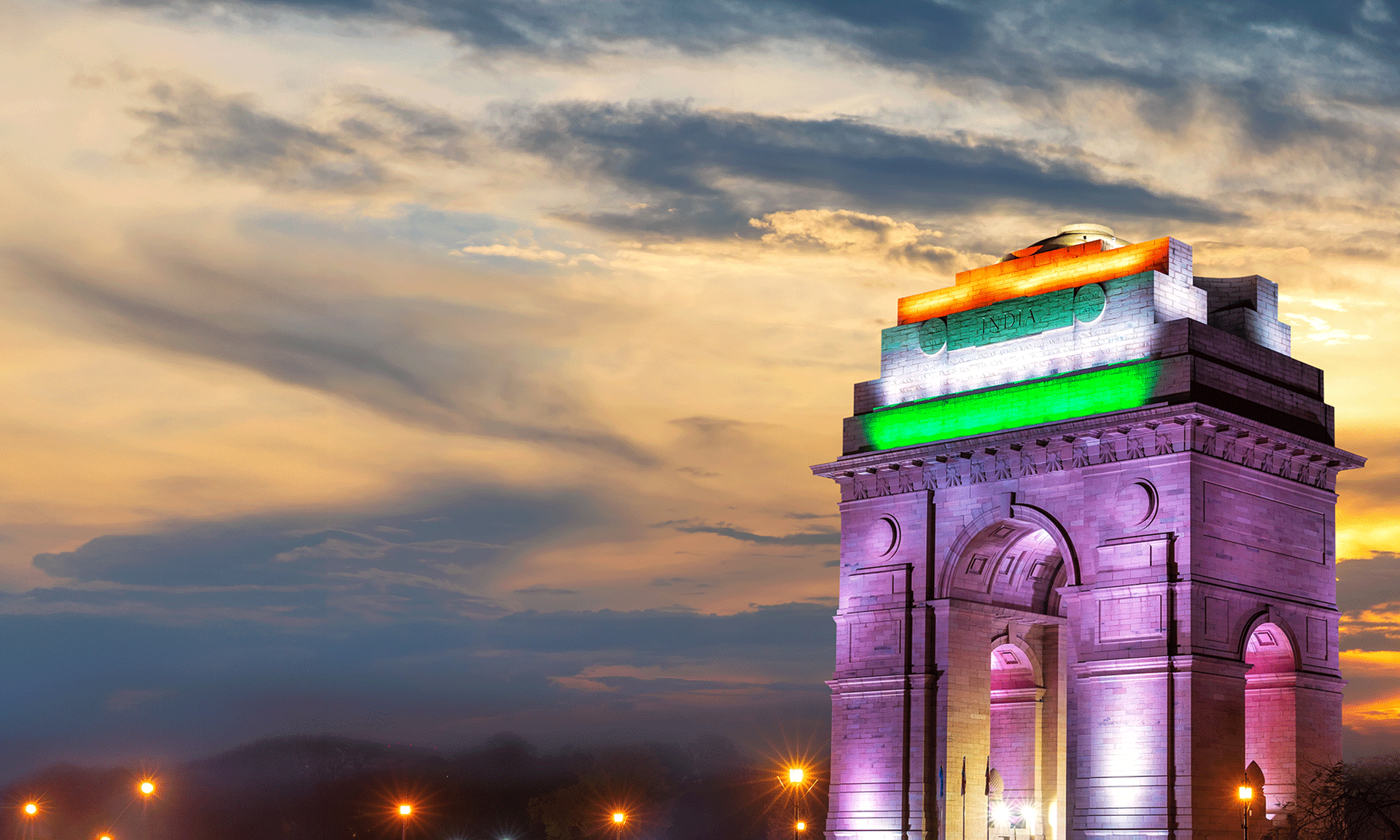

The world fair, first in the Middle East coincides with the 75th year of Indian independence and will be the perfect venue for displaying its vibrant culture, innovative core and technological prowess over the coming six months.

Union Minister of Commerce and Industry, Piyush Goyal inaugurated the India Pavilion on October 1, Friday and said in a press briefing, “It is an outreach to the whole world to showcase a new India, an emerging technologically driven self-confident India. Dubai Expo 2020 is an opportunity to showcase India’s potential.”

The India Pavilion, located at Al Forsan Park next to the Opportunity District is one of the largest at the Dubai Expo and features an innovative moving facade with more than 600 rotating screens symbolizing ‘India on the Move’ and displays 75 stories of 75 years of Indian independence with an engrossing stimulus of “constant change” and “timeless endurance” at the front.

In line with Dubai Expo 2020 theme “Connecting Minds, Creating the Future”, India Pavilion is created on “Openness, Opportunity, Growth” and is centred on 11 primary themes including Climate and Biodiversity, Rural and Urban Development, Tolerance and Inclusivity, space, Golden Jubilee, Knowledge and Learning, Travel and Connectivity, Global Goals, Health and Wellness, Food & Agriculture, Livelihoods, and Water; and each having a dedicated zone under one high tech gigantic structure.

The India pavilion consists of four floors and displays its past, present and future powered by the latest technologies of Augmented Reality and Projection Mapping. The massive and captivating pavilion is an innovative combination of the Space program, Ayurveda, Yoga and a rapidly growing USD 3.5 trillion economy and also displays enormous opportunities rendered by its vast 1.3 billion population. The Pavilion also hosts an amphitheatre, conference halls, state pavilions, restaurants, and many other facilities.

While the first floor displays India’s cultural vibrancy, the second floor exhibits enormous opportunities to be derived from the India-UAE partnerships. The third floor is dedicated to corporate India and its growing strength and credibility in various sectors.

The Pavilion is designed to provide the visitors with an unforgettable experience of India’s unity in diversity, treasures and traditions, spectacular achievements, technological breakthroughs and myriad business opportunities. It is meant to inject a feeling of futuristic, modern and digitally strong India while simultaneously showcasing the beauty of Indian art, cuisine and culture.

India pavilion has planned to organize lots of conferences, B2B meets, cultural events, food festivals, online workshops, cinemas, debates, and competitions and will be visited by many social and political celebrities including business leaders and corporate heavyweights.

Fifteen Indian states and Union Territories including nine ministries from the Centre are taking part in this expo, which will be continuing till March 31, 2022.

The participating States and Union Territories at the India Pavilion are Gujarat, Karnataka, Ladakh, Telangana, Rajasthan, Maharashtra, Uttar Pradesh, Kerala, Jammu and Kashmir, Goa, Andhra Pradesh, Chhattisgarh, Jharkhand, Himachal Pradesh and Haryana and display respective region’s business advantages and growth opportunities.

Large Indian companies are also participating such as Tatas, Reliance, Vedanta, Hinduja Group, Adani, L&T, ITC, Hindustan Unilever Limited, Ease My Trip, Oyo, Standard Chartered Bank, Trident Group, Baidyanath, Apollo Hospital, Daawat Rice, Bank of Baroda, Patanjali, Dabur etc. and some leading UAE based business houses such as KEF Holdings, IFFCO, Aster, Lulu Group.

India put a brave front in its fight against the Covid pandemic and could successfully mitigate the adverse economic effects through the huge vaccination drive. The roll-out of several economic packages including the introduction of reform policies by the government has prepared the stage for a sustainable and robust economic growth phase to make the country a USD 5 trillion economy by 2025.

India has forged strong ties with the UAE and the proposed FTA between the two sides is likely to be signed during March next year. In a press meet during Expo 2020, Piyush Goyal remarked that the FTA holds tremendous potential for both the countries to enhance trade and investment and many investors in India are keen on Dubai company incorporation.

The Expo has presented India with a unique and strategic advantage and the country has planned to exploit it fully by focussing on countless opportunities that the country can provide to the global business and investing community. Addressing the nation on its 75th Independence Day, PM Modi said that no force on earth can stop India to realize her dreams and invited the citizens to be the flag bearers for global peace and safety. “The world’s economic revival is linked to the growth of India. The country is ready to do whatever it can to further global good and prosperity. This is an India that is reforming, performing and transforming,” Modi emphasized in his speech on Dubai Expo 2020.

IMC Group

IMC Group