- NEWSLETTER,U.A.E

- May 15, 2023

Dubai’s real estate market has experienced tremendous growth over the past decade, making it an ideal investment opportunity, according to experts in the city’s property industry. Dubai has become a sought-after destination for international investors and first-time buyers looking for investment opportunities within the UAE. Experts suggest that the sector is not showing any signs of slowing down while offering valuable advice for individuals looking to enter the market.

In 2022, Dubai’s real estate market experienced an astonishing 36% expansion, with over 88,000 transactions totalling AED240 billion completed, representing 61% growth compared to 2021. Rental prices also saw an average rise of 21% since 2021, making this an excellent time to enter the purchasing market. Rental yields can range between 5-9% with no property tax burden, enhancing its attractiveness further.

Dubai’s real estate market offers several key advantages for investors. The cost per square foot is much lower than in other highly desirable cities, providing more value for money. Furthermore, relaxed visa regulations allow investors to secure residency visas when purchasing properties of certain values.

When investing, it is imperative to conduct thorough research. Carefully consider a variety of factors, such as the developer’s track record, location, and potential return on investment (ROI). Location plays an instrumental role in ROI. When selecting prime locations to invest in, it is vital to consider amenities available such as retail stores, dining options, transport links, recreational activities, healthcare facilities, and schools in their evaluation. Also, familiarize yourself with local laws and regulations related to investment and real estate ownership to avoid legal complications.

When purchasing, also consider and compare all financing options available, taking into account maintenance and additional costs such as RERA service charges.

Partnering with an agent who specialises in the area or community you are researching is invaluable, providing answers to queries and up-to-date information on its location. These representatives can answer your questions quickly while offering valuable insight. If you’re considering a new business setup in Dubai, IMC Group can provide expert guidance and tailored solutions to help you navigate the process. With their extensive knowledge and experience, IMC Group ensures a seamless transition into the thriving Dubai market.

- NEWSLETTER,U.A.E

- May 15, 2023

The United Arab Emirates (UAE) Ministry of Finance has announced a new initiative to reduce the corporate tax burden and compliance costs of small and micro-businesses, including startups. Small Business Relief Ministerial Decision No. 73 of 2023 will be applicable to periods beginning after the 1st of June 2023 and ending on the 31st of December 2026. The relief is intended to promote the expansion and diversification of the UAE’s economy, as well as an environment conducive to investment and entrepreneurship.

Lower Tax Burden on Small Businesses

According to the Ministerial Decision, taxable persons with revenues of less than AED 3 million during the relevant tax period and all preceding tax periods will not be considered to have generated any taxable income. The revenue calculations will adhere to the UAE’s accepted accounting standards. However, Qualifying Free Zone Persons and members of Multinational Enterprise Groups (MNE Groups), which are groups of companies with operations in more than one country and consolidated group revenues exceeding AED 3.15 billion, will not be eligible for Small Business Relief.

The government of the UAE has announced a nine per cent tax on profits exceeding AED 375,000. When planning their finances and ensuring compliance with UAE tax laws, it is crucial for businesses to understand how to calculate their taxable corporate income.

Before calculating their corporate tax liability, businesses must determine their revenue according to the UAE’s accepted accounting standards. The Small Business Relief will apply to eligible small businesses with revenues below AED 3 million, and no corporate tax will be due. Profits exceeding AED 375,000 will be taxed at a rate of nine per cent for businesses with revenues exceeding AED 3 million.

Protecting Against Artificial Business Separation

The Ministerial Decision emphasizes that if the Federal Tax Authority (FTA) determines that taxable persons artificially separated their business or business activity to exceed the AED 3 million thresholds, such electing persons will be considered to have engaged in an arrangement to obtain a Corporate Tax advantage under Clause (1) of Article 50 of the Corporate Tax Law’s general anti-abuse rules.

Conclusion

The Small Business Relief is a significant step towards assisting SMEs and new businesses in the UAE. To make the most of this tax relief, it is highly recommended that businesses seek the expertise of a corporate tax advisory in Dubai. IMC Group, with years of experience handling tax matters for numerous businesses in Dubai, offers exceptional advisory services tailored to the unique needs of each client.

- NEWSLETTER,U.A.E

- May 5, 2023

The United Arab Emirates (UAE) Ministry of Finance has recently introduced several measures aimed at reducing the compliance burden for small businesses, government entities, and non-residents. These initiatives include Small Business Relief (SBR) under Article 21 of the Corporate Tax Law, Single Taxable Person (STP) treatment for government entities, and exemptions from tax registration for specific entities under Decision No. 43 of 2023. While a corporate tax advisory in Dubai can help you get the best out of the relief measures, below are the important points you need to understand.

Small Business Relief for Corporate Tax

To support small businesses and startups, the UAE Ministry of Finance has introduced SBR under Decision No. 68 of 2023, allowing eligible resident taxpayers to be treated as having no taxable income if their revenue falls below a specified threshold. To qualify for SBR, businesses must have revenues equal to or less than AED 3 million in the current and the previous tax period. The threshold applies to tax periods from June 1, 2023, to December 31, 2026. However, if a business’s revenue exceeds AED 3 million in any given tax period, SBR won’t be applicable.

Notably, certain businesses are excluded from SBR, such as qualifying free zone persons, non-resident branches of foreign companies, and group companies of MNE groups with consolidated revenues above AED 3.15 billion.

Businesses not utilizing SBR can carry forward tax losses and disallowed net interest expenses for future tax periods without SBR. Despite the relief, small businesses must still register for corporate tax with the Federal Tax Authority (FTA) and file corporate tax returns. SBR exempts eligible small businesses from Transfer Pricing Documentation requirements under Article 55.

Single Taxable Person Treatment for Government Entities

Decision No. 68 of 2023 allows government entities to treat all businesses and business activities they undertake as a Single Taxable Person (STP), reducing the compliance burden and administrative formalities. To qualify for STP status, the businesses and business activities must be conducted under a license issued by a Licensing Authority and should operate within the same Emirate for local governments.

When adding new businesses or business activities to an STP, they are directly treated as STP if the prescribed conditions are met. Notification to the FTA is required within 20 business days from the date of occurrence of such an event.

What is Corporate Tax? Why does the UAE introduce CT? When will the UAE CT regime become effective?

The Ministry of Finance has issued Decision No. 43 of 2023, providing exemptions from tax registration for specific entities under the Taxation of Corporations and Businesses (CT Law), Federal Decree-Law No. 47 of 2022. Entities exempt from corporate tax registration include:

- Government entities

- Government-controlled entities

- Persons engaged in extractive businesses or non-extractive natural resource businesses that meet the specified conditions under the CT Law

- Non-residents deriving only state-sourced income and not having a permanent establishment (PE) in the UAE

These exemptions relieve eligible organizations from the responsibility of tax registration and filing of corporate tax returns. Non-resident entities without a PE in the UAE are neither required to obtain corporate tax registration nor file a corporate tax return if they solely earn UAE-sourced income. This decision significantly reduces the compliance burden for non-residents.

How to Calculate the Payable Corporate Tax in the UAE?

In the UAE, corporate tax is calculated at 9% of net profit after all deductions and adjustments are made for exempted income. Foreign taxes will be deducted from the profit in the financial statements. Taxable income is the net profit after all deductions. Only if your taxable value is greater than AED 375,000 will you be charged the 9% corporate tax.

Conclusion

The introduction of SBR, STP treatment for government entities, and tax registration exemptions under Decision No. 43 of 2023 are positive steps for the UAE, as they reduce compliance burdens and support the growth of businesses in the region. Businesses should carefully consider whether to opt in or opt out of the relief schemes based on their specific circumstances and consult with corporate tax advisory professionals in Dubai for guidance. Moreover, organizations should assess their eligibility for these exemptions, maintain appropriate records, and stay updated on any future changes in the CT Law and related regulations to ensure continued compliance with UAE tax laws.

- Article, U.A.E

- April 25, 2023

Gulf SWFs and PE firms have substantial financial resources to support significant M&A activity.

The Middle East’s M&A sector experienced a deceleration in 2022, with both corporate and financial investors adopting a cautious stance due to surging interest rates and growing economic unease. Although M&A transactions sustained their robustness during the initial months of 2022, they lost momentum as the macroeconomic situation progressively worsened throughout the year.

The year 2022 has presented several economic and financial challenges that have made dealmaking a complex task on a global scale. Among the main obstacles has been the constricting credit environment, with banks limiting their funding for leveraged buyouts due to increasing interest rates and an overall aversion to risk. As a result, the issuance of leveraged loans to support private equity (PE) acquisitions have mostly come to a halt in Europe and the Middle East.

Despite the global challenges, the Middle East has experienced a modest decrease in the number of deals, from 366 in the first nine months of 2021 to 343 in the same period in 2022. The UAE, Saudi Arabia, and Israel were the most sought-after countries by buyers, with companies headquartered in these locations representing 20.7%, 9%, and 54.2% of the total deals in the region, respectively.

Amid the increasingly challenging economic climate, most M&A transactions in the Middle East were focused on recession-proof sectors, such as non-discretionary consumer goods and healthcare, while technology, media, and entertainment remained popular. Additionally, infrastructure deals proved to be a highlight in the region’s M&A activity.

Looking ahead to 2023, we anticipate a new dealmaking environment characterized by the same challenges that affected the market in the latter part of 2022. As a result, we expect the M&A sector to remain sluggish, particularly in the first half of the year. Despite this, the performance outlook, potential public-to-private opportunities, distressed situations, and lower valuations could present new avenues for dealmaking and unlock previously pent-up deals.

Nevertheless, in this increasingly complex environment, the timelines for completing deals are likely to be longer, and the risk of executing transactions successfully is higher.

Here are some potential trends that could shape the M&A market in the coming months:

Undeployed Reserves:

In the short-term, powerful corporate buyers may hold an edge, but the M&A market will still depend on sovereign wealth funds (SWFs) and financial sponsors, who have ample dry powder available for investment. As economic conditions shift, these funds will likely become more selective and focus on opportunities that enhance their existing portfolios or offer cash-generating potential. Despite a slowing fundraising pace, we anticipate that SWFs and financial sponsors will remain key players in the M&A market.

Small-scale acquisitions:

While financing options remain limited and large-scale opportunities are scarce, private equity firms and sovereign wealth funds may shift their focus towards smaller-scale bolt-on acquisitions. These types of acquisitions can add value to portfolios of SWFs and PEs, particularly when traditional growth channels are no longer viable, and exit routes become limited. During times of uncertainty, investing in familiar businesses and platforms may also prove to be a more sensible strategy for SWFs and PEs.

Mergers and acquisitions in distressed companies:

It is worth noting that, contrary to expectations, we did not observe a substantial increase in mergers and acquisitions involving financially troubled companies thus far in 2022. However, we anticipate this may change in 2023 as worsening economic conditions begin to pressure company balance sheets. This could lead to asset sales and operational restructuring, ultimately creating potential opportunities for mergers and acquisitions in distressed companies.

Divestitures:

We anticipate increased divestiture opportunities as economic conditions become more uncertain, causing larger companies and conglomerates to re-evaluate their strategies and shed non-essential assets. Moreover, activism investment remains a potent catalyst, with many investors able to establish positions at reduced prices during a downturn in the stock market. For SWFs and PEs, divesting non-core business units from their portfolio companies, while more intricate, may yield superior returns.

Environmental, Social, and Governance:

ESG factors are becoming an increasingly important consideration for both corporate and financial buyers in their M&A activities. This trend is expected to continue and gain momentum in 2023. Investors closely scrutinise targets’ ESG practices, including their impact on the environment, diversity and inclusion policies, and supply chain management. These factors are now essential components of investment decision-making and can have a significant impact on deal outcomes. They can also influence the availability and cost of financing, giving sponsors an advantage in securing debt funding.

In 2023, M&A buyers are expected to shift towards more resilient sectors in the face of economic headwinds, including non-discretionary consumer, healthcare, infrastructure, and specific sub-sectors within technology, media, and entertainment. These sectors are better positioned to withstand economic uncertainties due to strong demand, recurring revenue models, and the ability to mitigate rising operating costs arising from inflation. Moreover, the ongoing trend of digitalization across businesses will provide impetus to technology-related sectors. Infrastructure assets will also be a key focus, given their asset-heavy nature and ability to generate stable cash flows, thus providing downside protection.

- NEWSLETTER,SINGAPORE

- April 11, 2023

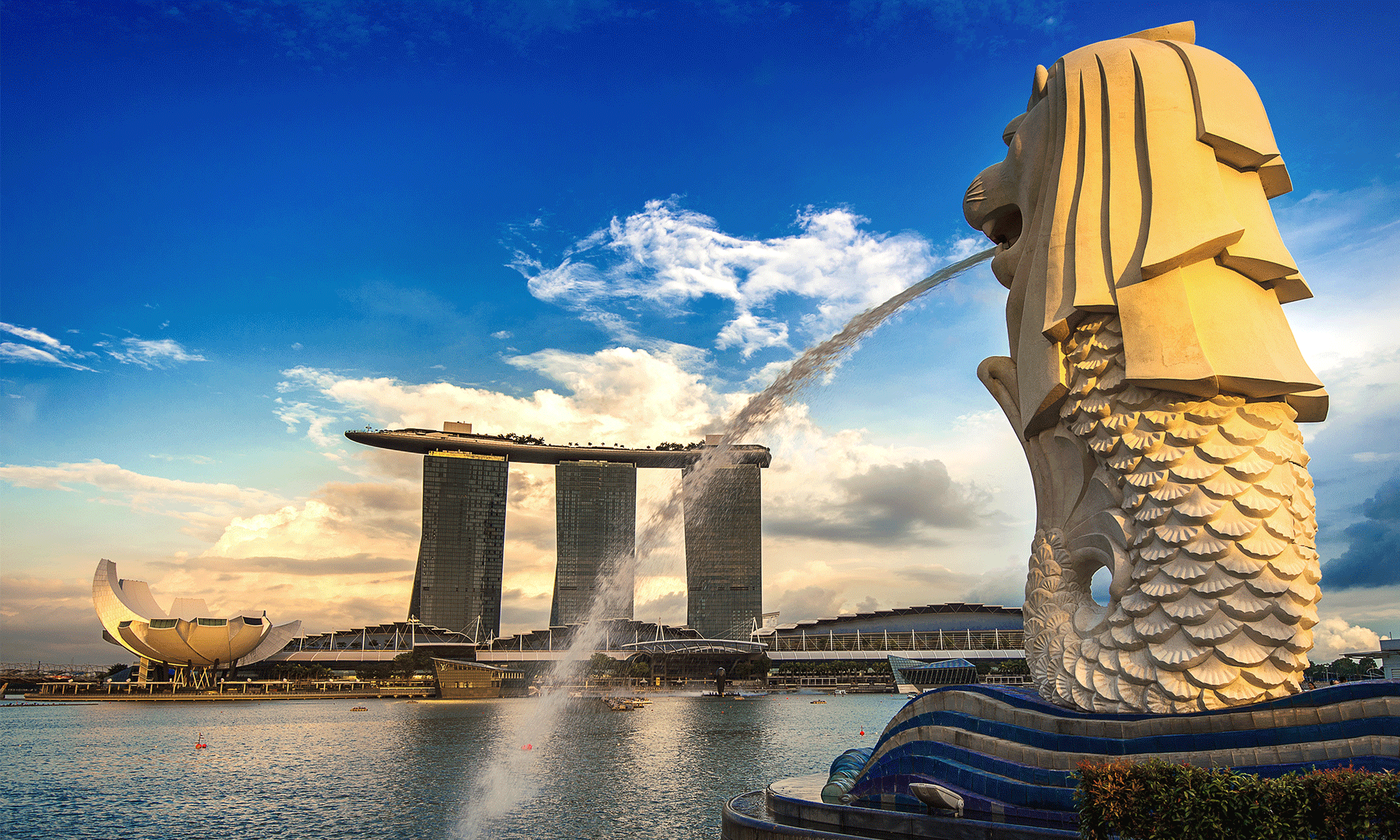

Singapore warmly welcomed Britain’s recent decision to become the first European country and the 12th member to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

As Britain sets its sights on bolstering its global alliances post-Brexit, the decision to ease company formation in Singapore is a clear signal of intent. With its reputation as a business-friendly destination, Singapore is a natural choice for British firms seeking to expand their global reach. This move is a crucial step towards that end, paving the way for closer ties between the two nations and a bright future for cross-border commerce.

Trade and Industry Minister Gan Kim Yong posted on LinkedIn to congratulate Britain on achieving a “significant milestone” after nearly two years of negotiations, expressing his joy over the country’s inclusion in the trade pact.

Mr Gan added, “The UK’s accession to the CPTPP will provide more business opportunities and make it easier for Singapore companies to navigate the UK market”.

He further stated that this move would enhance the robust bilateral economic partnership between the two nations, supported by multiple agreements such as the UK-Singapore Free Trade Agreement, the UK-Singapore Digital Economy Agreement, and the UK-Singapore Green Economy Framework.

Minister-in-charge of Trade Relations, Mr S. Iswaran, shared a similar view on LinkedIn.

“Singapore remains strongly committed to ensuring that CPTPP remains high-standard, robust and relevant so that it continues to bring benefits to our people and businesses”, Mr Iswaran stated. “I look forward to the UK’s accession to the CPTPP.”

Mr Gan stated that all members of the CPTPP will collaborate towards finalising the accession protocol.

Other members of the CPTPP are Brunei, Canada, Chile, Malaysia, Mexico, New Zealand, Peru and Vietnam.

In a joint ministerial statement, member countries said the CPTPP is “one of the most comprehensive and ambitious trade deals ever concluded”.

“The CPTPP members and the UK are committed to further promoting free trade, open and competitive markets, the rules-based trading system and economic integration in the region and beyond,” they said.

By joining the CPTPP, Britain will enhance its current bilateral free trade agreements with most member countries, providing businesses with additional options for trade terms.

According to British Prime Minister Rishi Sunak’s office, the agreement is the largest trade deal since Brexit, with a combined GDP of £11 trillion (S$18.1 trillion) once Britain becomes a member, which accounts for 15% of the global GDP.

Natalie Black, Britain’s Trade Commissioner for Asia-Pacific, highlighted that as the second-largest member of the CPTPP, Britain’s participation would increase the trade bloc’s combined GDP from its current £9 trillion and offer improved access to 67 million UK consumers.

“CPTPP is one of the world’s most progressive trade agreements, and the UK’s accession will take it from a Pacific agreement to a truly global one,” said Ms Black.

According to a statement released by the British High Commission in Singapore, Kemi Badenoch, the Secretary of State for Business and Trade, expressed the following: “Our accession to CPTPP sends a powerful signal that the UK is open for business and using our post-Brexit freedoms to reach out to new markets, including in the Asia-Pacific region, and grow our economy.

“Joining this influential trade bloc will help us to shape the rules of global trade with like-minded nations and work even closer together on our shared priorities of prosperity, security and free and fair trade.”

Kara Owen, the British High Commissioner to Singapore, reported that trade between Britain and Singapore increased by 24.8% from the previous year, with a total value of £20 billion during the 12 months leading up to September 2022.

“We continue to see very strong interest from UK companies in Singapore and the broader Asia-Pacific region,” said Ms Owen.

“Joining the CPTPP will further strengthen our existing agreements with Singapore to grow trade and investment. We look forward to supporting UK and Singapore companies as they take advantage of all it offers.”

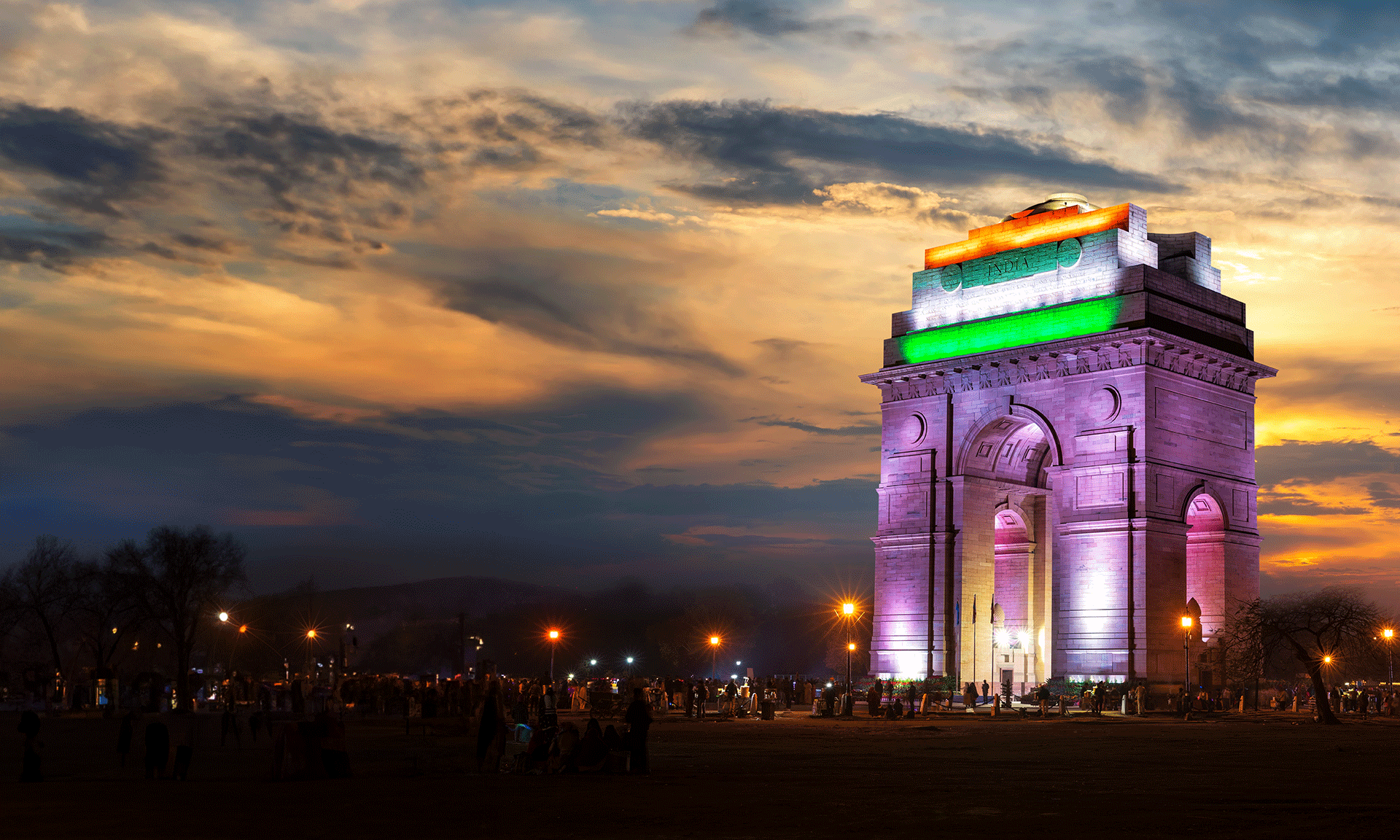

- NEWSLETTER, INDIA

- April 11, 2023

India’s digital prowess is a global inspiration! The International Monetary Fund (IMF) confirms India’s “world-class digital public infrastructure” as a blueprint for digital transformation worldwide. In a recent working paper, the IMF praises India’s innovative approach and focus on building blocks, making its digital journey a resounding success.

“Build smart: Find the core, solve more!” – In India’s diverse land, the building block approach unlocks custom solutions with essential tools.

“Boosting India’s digital ecosystem with competition and compatibility! Open standards power the India Stack, enabling anyone to leverage its functions.”

India’s guiding principles in education and healthcare have transcended to other domains, like the ground breaking CoWIN platform for COVID-19 vaccination. Thanks to its digitally-driven approach, India effortlessly surged ahead in the race to administer vaccines, defying daunting hurdles such as mass-scale internal migration.

CoWIN’s innovative technology has been implemented in various countries like Indonesia, the Philippines, Sri Lanka, and Jamaica, enabling them to streamline their vaccination initiatives.

India realized IT’s pivotal role in shaping its identity layer. Earlier, numerous identity cards and databases existed, but none had the potential to serve over a billion citizens. Enter Aadhaar – the game-changer.

The government brought in a tech-savvy entrepreneur as the founder chairman to craft the ID system and empowered UIDAI to recruit top-skilled professionals for the project.

India’s digital revolution thrives on innovation! Its building block approach unlocks multiple solutions per block, while a vibrant ecosystem fosters competition and tailors solutions to local needs.

India Stack’s design sparks competition, breaks silos, and overcomes barriers to empower innovation and progress.

In a tweet, Louis E. Breuer, IMF’s Senior Resident Representative in India, commended India’s digital public infrastructure, citing its transformative impact on people’s lives. The paper concludes that other countries undergoing digital transformation can learn from India’s journey.

- NEWSLETTER,SINGAPORE

- April 11, 2023

By October 1, 2023, corporate finance (CF) advisers in Singapore are required to adopt new due diligence requirements. The objective behind implementing these new requirements is to enhance the quality and standards of corporate finance advisers in the city-state.

Deployment Plan

From October 1, 2023, all corporate advisory engagements in Singapore must comply with the due diligence requirements. In anticipation of this, MAS has advised CF advisers to begin formulating and executing policies that align with these new requirements.

To whom do the new requirements for business conduct apply?

The following are subject to the new conduct requirements:

- Banks that have obtained licenses, merchant banks, and finance companies are not required to hold a capital market services (CMS) license

- Individuals or entities who possess a CMS license and provide advice on corporate finance; or

- Persons who provide advice on corporate finance, including those who are representatives of options a) and b)

Requirements are related to the overall conduct of business activities

Under Notice SFA o4-N21, one of the newly introduced requirements for business conduct is this.

Dealing with conflicts of interests

Corporate finance advisers must avoid conflicts of interest with their clients. If they can’t mitigate material disputes, they must stop advising on that transaction or decline new projects.

To protect price-sensitive information its directors or personnel receive, a CF adviser should implement policies, controls, and procedures, including limited access to sensitive information and separating roles of those involved in corporate finance.

Policies, controls, and procedures must be implemented by a CF adviser to protect sensitive information received by its personnel, including limited access based on necessity and separating corporate finance advice from other roles.

The CF adviser should have policies, controls, and procedures to prevent insider trading and clear reporting lines for issue escalation with representative oversight.

Requirements for due diligence in general

The CF advisor is responsible for performing due diligence with reasonable care, which involves verifying the accuracy and completeness of statements and confirmations made by customers or others involved in the transaction.

The corporate finance advisor should also oversee any new information during the transaction that may question the credibility of the initial information received.

Providing guidance to listing applicants regarding their regulatory obligations

The CF advisor must inform listing applicants about their responsibilities under Singapore’s Securities and Futures Act, as well as their obligations upon admission to the Singapore Stock Exchange.

The corporate finance adviser must conduct background checks on listing applicant’s key personnel, directors, group entities, and controlling shareholders as per the notice.

Corporate finance advisers in Singapore must examine the physical assets of listing applicants and conduct interviews with significant stakeholders such as creditors and key suppliers. In the case of material issues, the adviser must scrutinize supporting documents such as invoices, contracts, and title deeds. They may also gather information from public record databases or delegate the relevant checks and reviews to a third party.

When appointing a third-party service provider, the corporate finance adviser must ensure that the third party’s due diligence meets satisfactory standards and quality.

The corporate finance advisor’s foremost responsibility is to ensure the Singapore Stock Exchange’s suitability of the listing applicant. This includes verifying the completeness of the listing application information and assessing the qualifications of the applicant’s directors in managing the business. The CF advisor plays a vital role in upholding due diligence requirements.

- India, NEWSLETTER,SINGAPORE

- April 11, 2023

The future of small businesses in Singapore and India is looking brighter than ever! The SICCI has hailed India’s SME-friendly budget for 2023-24, paving the way for exciting new collaborations and growth opportunities. Joining forces for company formation in Singapore and India, the possibilities are endless for both nations’ dynamic small business sectors.

Which sectors in India are expected to benefit the most from the budget?

The sectors that are expected to benefit the most from India’s SME-friendly budget are infrastructure, healthcare, education, and agriculture. These sectors have been given significant attention in the budget, with a considerable amount of funds allocated to their development.

Neil Parekh, the Chairman of SICCI, expressed his optimism about the target of Saptarishi announced by India’s Finance Minister Nirmala Sitharaman. He highlighted the potential for green growth, leveraging youth power, and promoting the development of the financial sector.

He stated that our team looks forward to collaborating closely with our counterparts in India to drive growth and innovation in the SME sectors of both countries.

He praised the SME-friendly budget and stated that the first step would be to reach out to the leadership of ASSOCHAM (The Associated Chambers of Commerce and Industry of India), with whom they have already signed an MoU, to expand further their areas of cooperation outlined in the Indian Budget 2023-2024.

He noted that the proposed 30 international skill centres would be set up across various states to provide skill training for youth to pursue global opportunities.

The SICCI sees excellent potential in collaborating with our Indian counterparts to transfer technology, expertise, and talent to equip the younger generation in India with the skills and knowledge to seize global opportunities. The proposed international skill centres, especially in sectors such as green technology, IT and digital technology, and healthcare, where skilled professionals are in high demand, present excellent opportunities for cooperation.

He also expressed his interest in tourism development in India, stating that SICCI is keen to connect state governments with officials from the Singapore Tourism Board and Enterprise Singapore to exchange the best practices for developing the sector. This collaboration will bring benefits to the citizens of India and global tourists.

With India’s economy projected to grow by 7% in 2023, the SICCI and its members are poised to seize many exciting opportunities, including forming companies in India and collaborating with Singapore for business growth. The 99-year-old Indian business group with over 550 members eagerly anticipates the potential for innovation and expansion highlighted by Parekh, the group’s leader.

- NEWSLETTER,U.A.E

- April 11, 2023

Ministry of Finance announced Decision (no.27 of 2023), adding clarity to determine tax residency as per UAE Cabinet Decision no. 85 of 2022.

Legal entities must be established or recognized within the country to be UAE tax residents. This excludes branches of foreign entities. Companies outside the UAE can qualify if their management and control are in the UAE.

Physical presence in the UAE is a determining factor for tax residency of natural persons.

Individuals with personal and financial ties in the UAE who stay for at least 183 days within 12 consecutive months are deemed tax residents.

For UAE citizens, residents, and GCC nationals, the 90-day rule applies when they are physically present in the UAE for 90 days (or part of them) for 12 months. The latest decision clarified that owning a permanent residence is unnecessary as long as it is accessible.

The latest Ministerial decisions clarify the UAE’s 183-day rule for tax residency. Both financial and personal interests are now considered when determining tax residency. Even if a natural person stays for only 90 days, significant connections with the UAE could lead to tax residency status.

Another small detail added to determining one’s tax residency is that parts of the days will also count towards the 90-day and 183-day rules. This part significantly affects all professionals based in Dubai whose professions require substantial travel outside the Emirates.

For professionals based in Dubai who travel extensively outside the Emirates, it’s worth noting that partial days count towards the 90-day and 183-day rules. This can have a significant impact on determining their tax residency.

- NEWSLETTER,U.A.E

- April 11, 2023

The United Arab Emirates (UAE) will introduce a Corporate Tax regime in June this year, in line with global trends for a minimum corporate tax rate. Before the new law commences, businesses must determine if they are subject to the tax and qualify for an exemption. The UAE declared its plans to establish a new Corporate Tax (CT) regime in January 2022. Subsequently, in December, Federal Decree-Law No. 47 was issued to provide a legislative framework for introducing the Federal Corporate Tax in the country.

The UAE will adopt the global minimum tax rate envisioned by the OECD, effective June 1, 2023, to enhance its appeal to businesses. The Corporate Tax regime will apply to all activities and interactions, except natural resource extraction, which will remain subject to Emirate-level corporation tax. The UAE’s new CT regime taxes businesses on their accounting net profit adjusted for specific items, with a 9% tax rate applied to taxable profits instead of gross revenue. Small businesses will receive a tax exemption on earnings up to AED 375,000 (approx. US$100,000).

Categorizations: Taxable, Exempt or Qualifying Free Zone Person?

Under the new system, businesses will be classified as Taxable, Exempt, or Qualifying Free Zone Persons (QFZP) and must determine their category and register accordingly. Some exempt entities may also need to apply for approval.

In the following section, we will examine the impact of the new CT regime on each of the three categories: Taxable, Exempt, and Qualifying Free Zone Persons (QFZP).

Taxable Person

For tax purposes, a person can be classified as either a resident or a non-resident taxable individual.

Resident person:

- A resident individual is a legal entity incorporated or recognized in the state, including free zone persons or foreign entities managed and controlled within the state.

- An individual who engages in a business or business activity within the state is considered a natural person for tax purposes.

Non-resident person:

- Non-resident individuals have a nexus in the state, derive income from sources, or have a permanent establishment as per Cabinet Decision

- For taxation purposes, a branch within the state will be considered a single taxable entity with its parent company

Exempt Person

Certain exemptions are granted automatically by a cabinet decision, while others require an application, as outlined below:

Automatically exempt:

- The list of government entities and government-controlled entities will be specified in a cabinet decision that has not yet been published

- Natural resource businesses are exempt from taxation by notifying UAE Ministry of Finance

- Entities may be exempt from taxation if they are included in a Cabinet Decision (which has not yet been published) as Qualifying Public Benefit organizations

Approved by the Federal Tax Authority, an entity can be exempted:

- Pension and social security funds that are either public or private

- Eligible investment funds

- UAE subsidiaries that are entirely owned and controlled by exempt entities

Qualifying free zone person (QFZP)

To be eligible for the 0% CT rate, a Qualifying Free Zone Person (QFZP) must fulfil the following requirements:

- Ensure sufficient presence in the UAE

- Calculates the qualifying income based on criteria defined in a forthcoming cabinet decision

- The individual has not chosen to be liable for a 9% CT

- Adheres to relevant transfer pricing regulations (if any)

The tax rates applicable to Qualifying Free Zone Persons meeting the specified conditions shall be as follows:

- 0% on income that Qualifies

- A tax rate of 9% applies to taxable income that falls outside the scope of the qualifying income definition

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group