- Article, U.A.E

- January 3, 2022

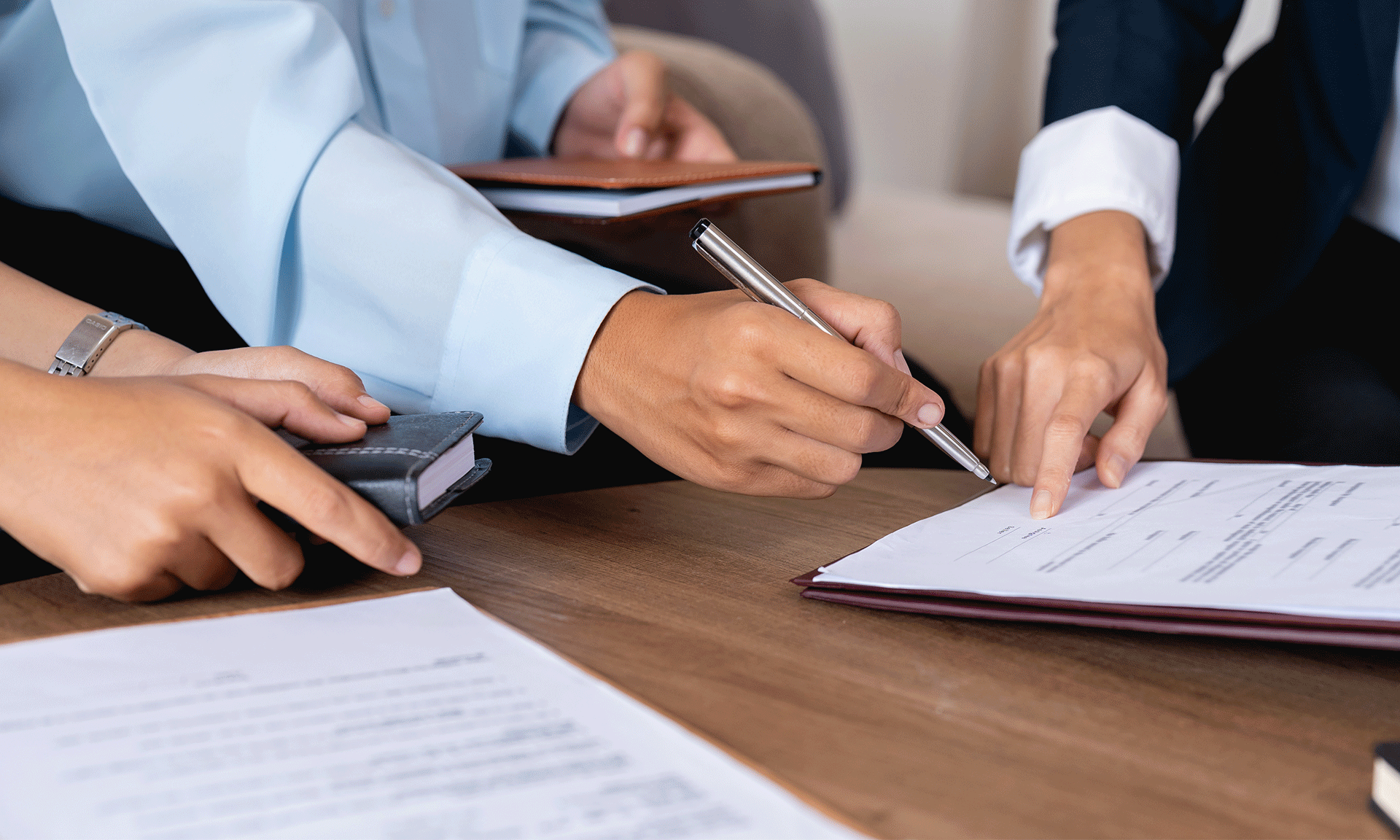

Dubai is one of the world’s most prosperous economies. As such, it is natural that business owners and entrepreneurs from around the world would like to set up shop in this flourishing city. Now, any business owner in Dubai needs the help of a professional PRO. PRO is an abbreviation for ‘public relations officer’. A PRO helps your business with all the required government approval, documentation, and legal compliance required for the business. Given the importance of a PRO, it is essential to choose nothing but the best PRO services in Dubai for your company.

A good way to find the right PRO service company is by outsourcing this requirement. However, many people wonder whether outsourcing PRO services is a good idea or not. To help you arrive at the correct conclusion, we have listed down the advantages and disadvantages of outsourcing PRO services in Dubai. Let’s take a look –

Advantages of outsourcing PRO services

Here are the advantages of outsourcing professional PRO services –

- Receive professional guidance

The biggest and most important benefit of outsourcing PRO services is that you get access to the best professional guidance. You can choose a knowledgeable PRO service provider that enjoys a good reputation in Dubai. They will help you informed of all the latest regulations so that you are always on track.

- Saves on time

As a business owner, the one thing you may be short on is time. You have meetings to attend, staff to manage, and clients to talk to. A professional PRO can help save you time on all the paperwork and regulations you need to keep up with. This can give you great peace of mind.

- End-to-end service

The best PRO service will pick up the paperwork and documentation right from your office and deliver it where it needs to go. As a business owner, you would not need to worry about making the visits yourself.

- Leaves you free to focus on work

With your PRO needs getting managed by experts, you are left free to focus on what really matters…growing your business in Dubai. You don’t need to worry about keeping track of the latest government rules, documentation, and permits for your business as you have professionals to manage all this for you. Plus, you save yourself from unnecessary fines.

Disadvantages of outsourcing PRO services

Now, let’s look at the downside of outsourcing professional PRO services –

- Costs involved

Hiring a professional PRO will cost you, no doubt. However, the advantages of hiring these professional services outweigh the costs. You receive complete assistance from professionals who know what they are doing and who will guide you every step of the way. Plus, if you had to hire a PRO on staff, you would probably have to spend a lot on salary and benefits. Outsourcing can prove to be much cheaper, especially for a startup.

- Concern about quality

When it comes to outsourcing, you may worry about the quality of the PRO service provider. However, if you choose a good service provider known for their excellence in service, you can rest assured that you are in good hands. A good PRO service provider will give you all the information and receipts you need so that you stay informed every step of the way.

As we can see, the advantages of hiring professional PRO services are definitely worth their weight in gold. To know more about PRO services in Dubai, get in touch with us at IMC Group. We provide professional services including company formation in Dubai and PRO services such as yearly license renewal, regulatory approvals and NOC letters, immigration and labour cards, corporate bank account opening, copyright and trademark, and much more.

- Article, Singapore

- December 27, 2021

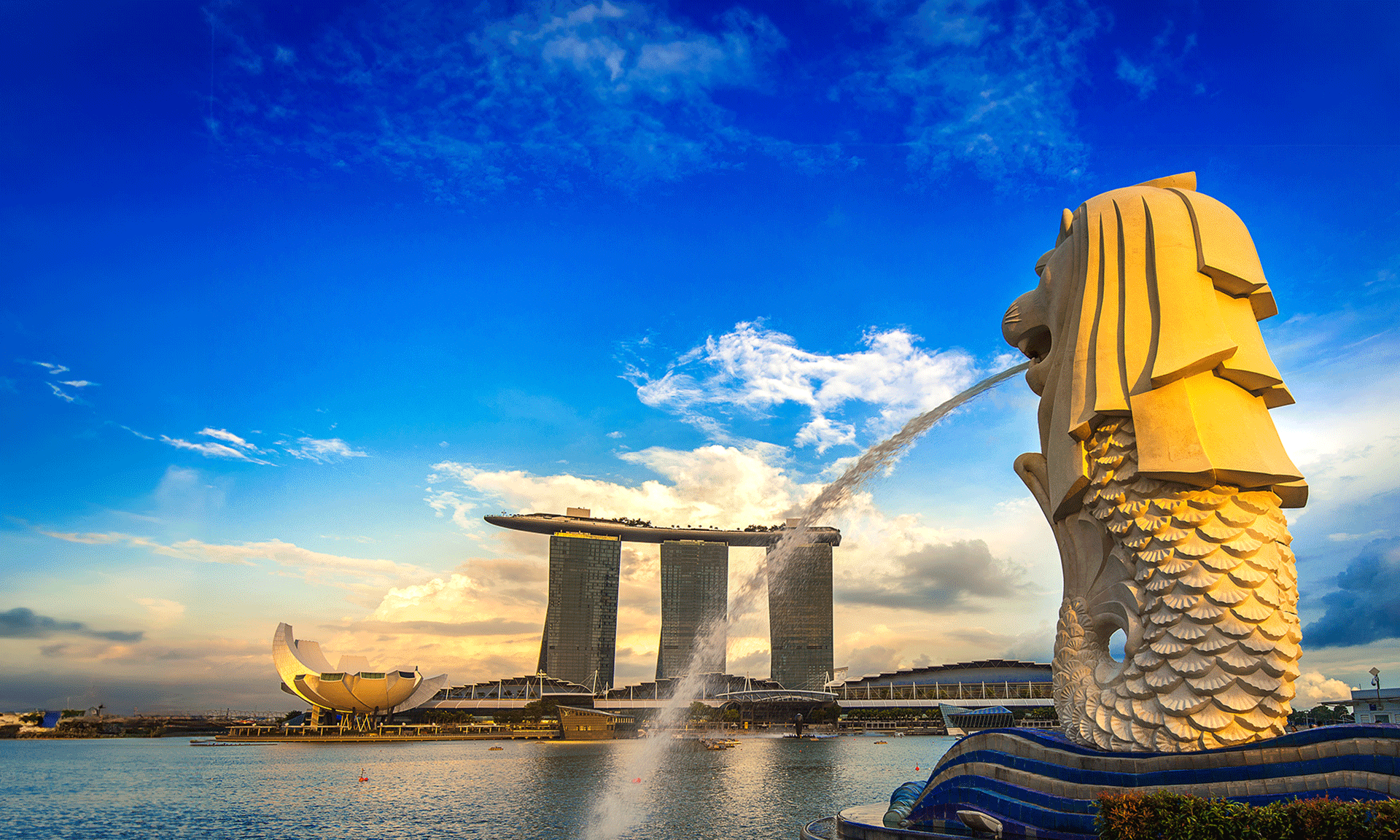

Singapore has been consistently ranked by International Organisations as one of the most preferred countries in the world for the ease of doing business and business competitiveness. In 2020, the World Bank Group rated Singapore as the second-best country in the world in its “Ease of Doing Business” survey of 190 economies and the International Institute for Management Development (IMD) placed Singapore at the top in its World Competitiveness Yearbook (WCY) after evaluating 63 countries on 338 indicators. The island city-state has been widely recognized globally for its pro-business policies such as low tax rates and no restrictions on capital and profits over the last several decades.

The sovereign nation is strategically located in maritime Southeast Asia and is considered to be the gateway to this subcontinent. It is a robust economy with a high standard of living and excellent quality of life. The country has a well-developed financial system and efficient processes for incorporating and operating a business.

Economically and politically stable, Singapore has an efficient and effective government that is free of bureaucracy and red-tapism The country also boasts world-class infrastructure facilities, a highly productive skilled workforce and a hugely developed banking and financial system including a capital market.

How is Singapore Canada business relationship?

Since the time of its independence in 1965, Singapore enjoyed very cordial and wide-ranging bilateral relations with Canada, which was one of the first countries to establish diplomatic ties with the country. Now it is one of the most important partners of Canada in Southeast Asia and enjoys strong ties in trade, education, science & technology, security & defence etc. that are mutually beneficial for economic sustainability and social progress.

Both the Countries have entered into several agreements including Trade and investment agreements, the World Trade Organization (WTO) Agreement on Trade Facilitation (TFA) Information Technology Agreement (ITA), Government Procurement Agreement ( GPA), Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), Agreement on Trade-related Investment Measures (TRIMS), General Agreement on Tariffs and Trade 1994 (GATT) and General Agreement on Trade in Services (GATS).

Canadian investors and companies regard Singapore as a strong financial hub for future economic and business growth in the Asia-Pacific region and made it their second home. Most of Canada’s top financial institutions and some 200 Canadian firms have operations in Singapore. The country has attracted Canadian businesses of all sizes and belonging to multiple sectors, from SMEs to large corporations, and especially technology-savvy start-ups in greater numbers.

Singapore-Canada Double Taxation Agreement was first signed in 1976 to improve economic cooperation and provide advantageous tax conditions to both Canadian and Singapore companies and later amended in 2011 and 2012. A tax allowance is granted against the tax paid in the other contracting state to prevent double taxation and applies to both Singaporean and Canadian individuals and companies. Any tax falling under double taxation may be levied in one of the two states as stipulated in the agreement, exception being the income from the sale of real estate, which is taxed in the country where the property is situated and employment income, which is taxed in the country where the services are rendered.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) was entered into force on December 30, 2018, between Canada and Singapore including six other countries following which trade between the two countries has improved and barriers reduced. Through the CPTPP, Canada can now preferentially access some of the world’s most dynamic and fast-growing markets, strengthening Canadian businesses and economy. The import tariffs have also been eliminated to an extent as high as 99%.

What opportunities does Singapore offer to Canadian investors?

Singapore has a simple and easy single-tier corporate tax system with one of the most attractive corporate tax rates of 17%. Besides lower rates, the country provides numerous tax incentives and cash grants to help businesses grow, thus bringing the effective tax rates even lower.

Business entities in Singapore are eligible for various business and tax incentives subject to committing to certain levels of investments, introducing leading-edge skills, technology and contributing to the growth of R&D and business innovativeness.

In Singapore, the four main government agencies are normally responsible for administering business and tax incentives for Singaporean entities and include the following: – (Details of Sector-specific incentives are available on the individual websites of these agencies).

Singapore Economic Development Board (EDB) is responsible for developing and executing strategies for attracting FDI into the country.

The Inland Revenue Authority of Singapore (IRAS) is the tax regulatory authority in the country.

Enterprise Singapore (ESG) assists Singapore based companies to expand globally and promote local exports.

The Monetary Authority of Singapore (MAS) is the central bank and financial services authority.

Some of the industries eligible for tax incentives are Banks & Financial services,

Shipping, R&D, International trading, Insurance, Processing services; Tourism, Headquarters activities; E- commerce and Legal firms.

The most widely availed incentive schemes include Start-Up Tax Exemption Scheme (SUTE), Pioneer Tax Incentive (PTI), Intellectual Property Development Incentive (IDI), Maritime Sector Incentive (MSI) etc. However, given the range of diverse tax incentives, Canadian investors must consult professionally qualified and well-reputed tax and accounting services in Singapore to determine the most appropriate incentives applicable for their businesses.

On top of tax incentives, Singapore provides numerous business grants and financing schemes to the Canadian companies operating in Singapore and there are more than 100 government grants available for supporting businesses.

For Startups, the following grants can be availed by Canadian businesses subject to fulfilment of certain conditions and include

Special Situation Fund for Startups (SSFS) provides financing for promising startups based in Singapore.

In the Startup SG Equity scheme, the government co-invests with qualified 3rd party investors into technology startups.

First-time entrepreneurs can avail of Startup SG Founder for receiving SGD 30,000 as mentorship and startup capital grant.

Innovative tech companies can avail of Startup SG Tech supports Proof-of-Concept (POC) and Proof-of-Value (POV) for commercialisation.

All business sectors can benefit from the below-mentioned grants.

Enterprise Development Grant (EDG) has been launched to support Singapore companies to grow and transform their businesses and grant up to 70% support for eligible costs up to a maximum of 80% till 31 March 2022.

Operation & Technology Roadmap (OTR) scheme provides up to 70% funding support to SMEs.

Productivity Solutions Grant (PSG) supports businesses in the adoption of productivity solutions and offers up to 80% funding support till 31 March 2022 for eligible costs.

Start Digital is meant for SMEs that are new to using digital technology and can take up any two digital solutions for free.

Sector-specific grants are also available in many sectors including Manufacturing & Engineering, Food and Beverage, Energy, Building & Construction, Real Estate, Financial Services, Tourism, IT, Agriculture, Aerospace and General Services.

What are the business options available for the Canadian investors?

Canadian investors and entrepreneurs looking for Singapore company incorporation can now opt for any of the five main types of business structures available. The choice of company type needs to be based on business capital, the number of business owners, liabilities and responsibilities business owners are willing to undertake etc. The business structures in Singapore include Sole Proprietorship, Partnership, Limited Partnership, Limited Liability Partnership and Company.

Businesses once incorporated can start operation after opening a bank account commonly known as a business account in Singapore.

Conclusion

The future of Singapore-Canada trade and investment outlook is bright and during March 2021, the Honourable Mary Ng, Minister of Small Business, Export Promotion and International Trade Canada initiated a week-long virtual trade mission to Singapore on e-commerce, hosted by Global Affairs Canada in collaboration with the Canadian Chamber of Commerce in Singapore and Enterprise Singapore. In her remarks, Minister Ng emphasized the importance of CPTPP in providing companies in both countries unlimited access to many dynamic and vibrant markets around the globe.

- Newsletter, U.A.E

- December 22, 2021

A new Electronic Transactions and Trust Services Law, Federal Decree-Law No. 46 of 2021 has recently been issued by the Telecommunications and Digital Government Regulatory Authority (TDRA) and ushered in a new stage of digital transformation in the UAE. The new law repeals the existing e-transactions and e-commerce law, the Federal Law No.1 of 2006. The new law comes into force on 2 January 2022 and mandates legal compliance 12 months from this date.

Rolling out of this new law is in line with the European eIDAS regulation and introduces regulatory frameworks for safe access of online services and carrying out digital transactions online. The new law aims to position UAE as a leading digital economy and enhance national business and economic indicators including the Ease of Doing Business Index, Online Services Index (OSI), the Global Entrepreneurship and Development Index, the Global Competitiveness Index and other indices.

The law outlines measures to regulate Electronic Identification and Trust Services in the country. While the issuance of controls regarding trust services will lie with the Federal Authority for Identity and Citizenship, the law will be regulated by TDRA issuing the standards and procedures of electronic identification and verification such as a digital ID in consultation with the concerned parties.

Electronic identification will enable businesses and consumers to identify and authenticate themselves online and electronic trust services will enhance security through Electronic Signatures, Electronic Seals, Electronic Time Data and Electronic Document Delivery. The law shall also regulate the validity of all documents as in the old law.

Trust services are defined as electronic services that create, verify and validate electronic or digital signatures, time stamps, seals and certificates. They may also authenticate websites and preserve the signatures, seals and certificates that are created. A person or legal entity who handles such trust services is called trust service provider (TSP).

All trust service providers must get a license from the TDRA however the details of licensing requirements have not yet been published. All the licensed trust service providers will be provided with a ‘Trust Mark’ by the TDRA as evidence of government certified trust services complying with all the legal requirements of the soil.

As per the new law, the TDRA shall prepare a ‘UAE Trust List’ to document all the certified licensees and subsequently publish the list with details of their trust services. The authority shall specify all the regulatory requirements for the service providers for being eligible for inclusion in the list.

The Chairman of the Board of Directors of the TDRA, Talal Humaid Belhoul highlighted saying “The issuance of the Electronic Transactions and Trust Services Law comes into effect at an important stage in the history of our country, as we celebrate the golden jubilee of the UAE. In this stage, we start a new chapter towards the UAE Centennial 2071 by enhancing digital transformation that impacts the economy, society, and the whole life in the UAE,”

Director-General of the TDRA, Majed Sultan Al Mesmar remarked, “The issuance of the decree-law on Electronic Transactions and Trust Services marks a start of a new stage in the process of comprehensive digital transformation in the UAE. This law deals with many details of the daily life of the various segments of society, including individuals and companies. It will have a positive impact on the higher goals of the country, in terms of promoting the digital economy and consolidating the global reputation of the UAE as an investment hub.”

UAE government, in its stride for a nationwide digital transformation, introduced the new law for improving the licensing processes of digital services that support all transactions including civil, commercial and all real estate transactions. The effectiveness of the judiciary shall be vastly improved with the easy and early settlement of all civil and commercial disputes. The law shall also enhance the acceptance and creation of records through easily accessible and retrievable electronic files.

Government procurements can be done quickly and also at a lower cost through electronic bidding and tendering. Issuance of permits and licenses shall be simple with digital signatures, electronic payment of fees and approvals accorded in the form of electronic records. All cross border transactions shall be easy, safe and secure.

- Article, U.A.E

- December 16, 2021

The recent Covid pandemic has ravaged the global economy and no wonder Dubai also suffered heavily. However, the dark pandemic had a silver lining and there has never been a more opportune time to start an online business in Dubai than post covid.

Business experts forecast retail e-commerce sales in Dubai to grow at a CAGR of more than 23% by 2022 backed by smart mobile networks, new generation high capacity electronic devices and the surging trend of online payments. As Dubai goes cashless with high digital penetration, increased numbers of business deals are going to fructify online.

Why choose Dubai for an Online Business?

Dubai stands high on the list when an investor decides over an online business in the region. Besides having the most developed e-commerce market in the entire MENA and GCC, it offers several other benefits to entrepreneurs and investors for a new business setup in Dubai including Zero Tax, Full Business Ownership, Minimal bureaucracy, Low Operating Expenses, Full Repatriation of Profits and Nil Import/Export Tariff.

What are the 12 most rewarding online small business opportunities in Dubai?

Here are 12 small business ideas in Dubai that can present huge opportunities & growth prospects and are easily operable from home.

Online Food Delivery

The online food delivery market is steadily growing in Dubai after the pandemic as people are preferring food to be delivered at their doorsteps. Recent surveys suggest that globally online food delivery segment revenue is projected to touch $151.5 billion in 2021. UAE is the second-largest market for online food delivery is estimated to touch around USD 800 million in the corresponding period.

Starting an online food delivery is straightforward in Dubai and a few steps must be initiated simultaneously including visiting the Department of Economic Development (DED) for a business license; striking deals with local restaurants, cloud kitchens and a courier service for food delivery; developing an app and applying for a residence visa in case you don’t have one.

Online Tutoring

As Dubai is witnessing a tremendous surge in the expatriate population, the demand for online private tutors is growing significantly. Online tutoring is perhaps the easiest way to start an online business where you can use your skills and knowledge on any subject in demand e.g. science, maths, arts, music etc. Besides obtaining a professional license from DED, you need to work on suitable mobile app development and liaise with the teaching community for engaging skilled tutors from their respective fields.

Social Media Advertising

As there is a continuous decline in organic social mingling and more so after the covid 19, the demand for paid social media advertising is increasing at an unprecedented rate for engaging with the targeted audience. If you have exceptional verbal and written communication skills, you can start this online business initially on a small scale by generating leads for your clients and growing with time.

Online Fitness and Yoga Training

Our present-day society is becoming more health-conscious especially after the covid pandemic and Dubai is no exception. The demand for online health and fitness trainers are continuously growing in Dubai and if you have the requisite skills and a holistic approach to fitness, starting an online fitness and yoga centre in Dubai could be a perfect opportunity.

E-Trading

As e-commerce business witnesses a sharp rise in demand, e-trading activities are growing for garments, textiles, gifts, jewellery, precious stones and household products due to the cost advantage it offers. Online trading could be a lucrative opportunity in Dubai provided you have an appropriate and valid commercial license from DED enabling you to carry out trading via an online platform for wider market access and sell a variety of products to the public over the internet e.g. Souq.com, Groupon. ae, livingsocial.com etc.

Freelance Writing

A freelance writing or SEO business is another lucrative business opportunity in Dubai. As WFH is becoming increasingly popular after covid, with good skills and vivid imagination, you can easily start a freelance writing business. You can also gradually move into the editing and copywriting side of this business.

Online Consulting

If you have expertise, skills and knowledge in any given field of necessity e.g. accounting, medicine, computer, IT etc., you can be the capital of your business and pass on your assets to others for generating huge revenue. The consultancy has long been regarded as a lucrative business. You just need a professional license most appropriate for your consulting scope and a website that your potential clients can get glued to.

Online Web Designing

The great majority of people in Dubai are computer savvy and web-inclined offering a plethora of attractive opportunities to a prospective business person. Designing web pages to help companies expand their market access is one of the best business ideas in Dubai. You can have flexible working hours and with time, can transform this business into a big company. Online web designing can also open other avenues for revenue streams by offering other technical services to your clients.

Mobile App Development

Webpreneuring is a huge and rapidly growing sector in Dubai and includes all online ventures e.g. mobile apps development, online marketing, online PR firm and many more. However, a critical and honest review of your expertise in this field is of utmost importance before you embark on this online business.

Conclusion

Last but not the least, obtaining the most appropriate business license from the DED is most critical for setting up an online business in Dubai. It is strongly recommended that an individual or group of individuals aspiring for such startups outsource the services of a Dubai company incorporation expert like IMC when setting up a new business in Dubai.

IMC is a team of seasoned and experienced company registration and business licensing professionals, credible and compassionate to bring your dreams of a successful SME to reality.

- Newsletter, U.A.E

- December 13, 2021

The Federal Decree-Law No.33 of 2021 repealing the Federal Labour Law Number 8 of 1980 and stipulating new regulations of labour relations in the private sector was issued by the UAE President His Highness Sheikh Khalifa bin Zayed Al Nahyanon. The Law will come into force from February 2, 2022.

The newly issued decree-law aims to enhance the sustainability and resilience of the UAE labour market and ensure the safeguarding of the rights of workers. Several measures have been taken to ensure a healthy, safe and friendly working environment for all private-sector employees. In a press briefing, the Minister of Human Resources and Emiratisation (MOHRE), Dr Abdulrahman Al Awar described the new Law as the UAE government’s deliberation for a competitive and flexible business and work environment over the next 50 years. The law has been documented in consultation with all interested parties and guarantees protection of interests of both employees and employers in a balanced and rightful manner, he informed.

The Minister further clarified that the new Law will help attract and retain the best talents and in turn improve the effectiveness and productivity in the labour market. The law will also help improve the competitiveness of the local Emirati workforce including women, he elaborated. The new law now complies with the requirements of international labour laws, he pointed out. He also stressed the need for workforce training. Employers from all private sectors must replace all existing employment contracts with the MOHRE with new employment contracts that must comply with the change requirements as stated in Law No. 33 of 2021, within a maximum period of one Gregorian year from the date of the law’s implementation making February 01, 2023, as the last date for making changes in the contract.

The important changes made in the new Decree-Law are summarized as under.

-

- In Article 74, the decree-law stipulates No Forced Labor and the employer may not use any means that would force the worker to work against his/her will or threaten him/her with any penalty.

- The law prohibits sexual harassment, bullying or any form of verbal, physical or psychological violence against a worker either by the employer or his/her superiors at work or colleagues.

- All forms of discrimination based on sex, race, colour, religion, national or social origin or disability are forbidden in the new law.

- The executive regulations mandate equality of pay without discrimination to women and grant women the same wage as men if they are doing the same work or work of equal value.

- The Decree-law introduced new types of work to allow employers to fulfil their labour requirements at reduced cost through part-time work, temporary work and flexy work including hiring those whose work contracts have expired but who are still in the country.

- Contrary to the earlier labour law, the new law stipulates that once a person is hired by an employer on a probationary basis, the employer is not allowed to dismiss the employee without serving a 14 days’ notice to the employee.

- The earlier provisions for end of service gratuity reduction has been withdrawn and the employees who tender their resignation are entitled to a full end of service gratuity payment subject to completing at least one full year of employment. Provisions about pension and other savings schemes are not specifically spelt out in the executive regulations.

As per the new law, a foreign worker who has worked full-time and completed one year or more of continuous service with an establishment shall be paid end-of-service benefits calculated according to the basic wage. A wage of 21 days for each of the first five years of service and 30 days for each subsequent year shall be paid. - The decree-law addresses Article 10 stipulating the ‘non-competition’ clause and allows employers to include non-competition restrictions in the employment contract forbidding an employee who has access to sensitive business information to work for a prospective employer who is in a similar line of business as that of the employer.

In a significant shift from the earlier law where the former employer didn’t need to restrain the employee by executing a ‘Non-Competition Agreement’, the new law stipulates that former employer mandatorily include this clause, if it wishes to protect its business interests, a Non-Competition Agreement in the employment contract.

The employment contract must include

– a time period not exceeding more than two years from the date of leaving his/her former employer

– the geography within which the employee is forbidden to take up employment

– the types of works that would be forbidden - The law now permits companies the flexibility to pay salaries either in UAE dirhams or in any other currency and as documented in the employment contract

- Article 8, clause 3 of the decree-law on ‘Employment contract’ specifies that the Employment Contract shall be a fixed contract and shall not exceed three years. The employment contract, however, may be renewed on the same condition with mutual consent, once or more than once, for an equal or a shorter period. The new law now abolished unlimited contracts.

- New types of leaves have been introduced in the new law specifying mourning leave, study leave and parental leave. Extending maternity leave has been proposed. The law provides details on how an employee can avail sick leave and unpaid leave. The Cabinet will decide on any other leave.

- Employers have been assigned the responsibility to pay for the fees and other associated costs of recruitment.

- The new law prohibits withholding official documents, such as passports of an employee at the end of the contract and mandates the employer to pay wages on the due date following the regulations approved by the MOHRE following the conditions and procedures as specified by the Executive Regulations.

- On the expiration of an employment contract, an employee is allowed to move to another employer. A probationary period for the worker may not exceed six months, by the executive regulations.

- The law provides for the waiver of judicial fees in all stages of litigation made by workers or their heirs, with a cap of AED100,000.

- The new law specifies the employer’s obligations of the employer in establishing labour regulations, providing adequate accommodation, protection and prevention including training and skill development of workers.

- The law provides an option for shorter work weeks, if employment contract permits, specifying that an employee may work for 40 hours in a week as against 48 hours previously.

The decree-law specifies regulations on the controls and conditions for terminating work contracts balancing the rights of both parties. The amendments strengthen the juvenile employment controls and entitlements of the deceased employee including the requirements for occupational safety.

- Newsletter, U.A.E

- December 13, 2021

The Dubai World Trade Centre Authority (DWTCA) rolled out new license rules on Sunday, 10 October 2021 to encourage and attract family businesses to establish Single and Multiple Family Offices (SFO & MFO) licenses within its designated free zone.

Vide Circular No. (12) dated 30 September 2021 on the Rules and Regulations regarding Single Family Office & Multi-Family Office activities within the DWTCA free zone, the centre announced the addition of a new license category for ‘Family Office Management’, under which two new activities were included including Single Family Office and Multi-Family Office.

The centre, founded in 1979 has opened Dubai to the global exhibitions and conferences industry and has become the heart of Dubai and continually grows as a platform for opportunities, creativity and communication. As the centre identifies the growing needs of family-run businesses, it introduces a new platform for wealthy families to establish offshore holding companies within its free zone to manage their private family wealth, assets and investments globally from Dubai, one of the world’s top financial hubs and the financial services capital of MENA region.

The first six months of 2021 witnessed more than 2000 high net worth individuals relocating to Dubai which has become one of the most sought after destinations for ultra-wealthy families. The population of HNWIs in the city has grown markedly, rising almost 4 % over the last year. Political stability, world-class health care facilities and a business-friendly tax-free environment have given Dubai an edge over other cities in attracting HNWIs for establishing Single and Multiple Family Offices, Foundations and Trusts.

His Excellency Helal Saeed Almarri, the Director-General of Dubai World Trade Centre Authority (DWTCA) briefed the media saying, “Family businesses are a highly significant segment within today’s global economic landscape and are integral to the wider international investment community. Following an exceptionally challenging year, family businesses worldwide have shown extraordinary resilience and agility, and are eager to diversify and expand into new markets. DWTC Authority recognises the need for a specialized legal and regulatory framework that offers distinct flexibility and fundamental benefits for setting up Single and Multiple Family Offices in Dubai, providing an attractive environment that supports Family Offices to operate successfully”.

DWTC SFO is a regular Free Zone Establishment (FZE) or Free Zone Company (FZCO) allowed to carry out Management of Professional Services including wealth, assets, investment, succession, governance, financial and/or legal affairs of a Single Family only.

While Professional Services include Consulting, Investment Advisory, Asset/Portfolio Management, ESG and CSR Management, Succession/Inheritance Advisory, the Administrational services include Compliance and Record-Keeping, Administrative/Office Affairs, Secretarial Management, Concierge Services. SFOs must be set up as an independent parent entity and not a Branch office with a physical presence in DWTC.

Incorporation of DWTC SFO is very much affordable and flexible as only a minimum of USD 136,000 in proven liquid assets, held by a single family is needed and for Professional and Administrational Services requirements, non-family member professionals may be appointed. DWTC also allows up to 49% of SFO’s control with non-family members and can have 100% Foreign Ownership with full repatriation benefits of capital and profits.

DWTC MFO is a professional FZE or FZCO that provides specialized services to growing family offices that are expanding to multiple geographies, industries and operations and often need professional support services. This business structure primarily represents a growing number of international consultants, professional service providers and business advisory firms who are looking for increased presence and expanding operations and portfolio management in the MEASA region.

Firms willing to provide professional and administrational services to wealthy families on wealth-related matters can now opt for a DWTC MFO license and render their expert services to multiple families as their customers.

DWTC MFO structure is flexible as it allows professionals to advise multiple families, their members, trusts and foundations under a single license with 100% foreign ownership and 100% repatriation of capital and profits.

The new Family Office licensing regime reaffirms the planned strategy of DWTC towards enhancing family office businesses in the free zone as it has already agreed with the Securities and Commodities Authority (SCA) to support the regulation, offering, issuance, listing and trading of crypto assets and related financial activities within DWTCA’s free zone. The agreement outlines a framework that permits the DWTCA to issue the necessary approvals and licenses for carrying out financial activities relating to crypto assets

DWTC is a unique and highly developed ecosystem for businesses aspiring for both local and international opportunities and the free zone offers the most conducive environment for startups, SMEs and large corporations to conduct operations locally and simultaneously access international markets.

“DWTC Authority has made strong progress this year as a free zone of choice for the investor community. With Dubai’s business-friendly environment, best in class regulatory options and comprehensive judicial ecosystems, we are confident of maintaining this momentum. DWTC Authority will continue to review and update regulatory and licensing offerings to ensure we always present unique investment opportunities to the international business community,” highlighted H.E.Helal Saeed Almarri.

As Dubai witnesses a fast recovery from the virus and registers strong growth in the first half of 2021, the global business and investing communities started recognizing DWTC as the most preferred business destination. New company registrations grew by almost 300% year-on-year with 427 new companies registering in 2021.

DWTCA has long played a major role in diversifying the economy of Dubai and has always strived to create a bigger economic impact by attracting FDI through business setup in Dubai free zone.

- Newsletter, Singapore

- December 13, 2021

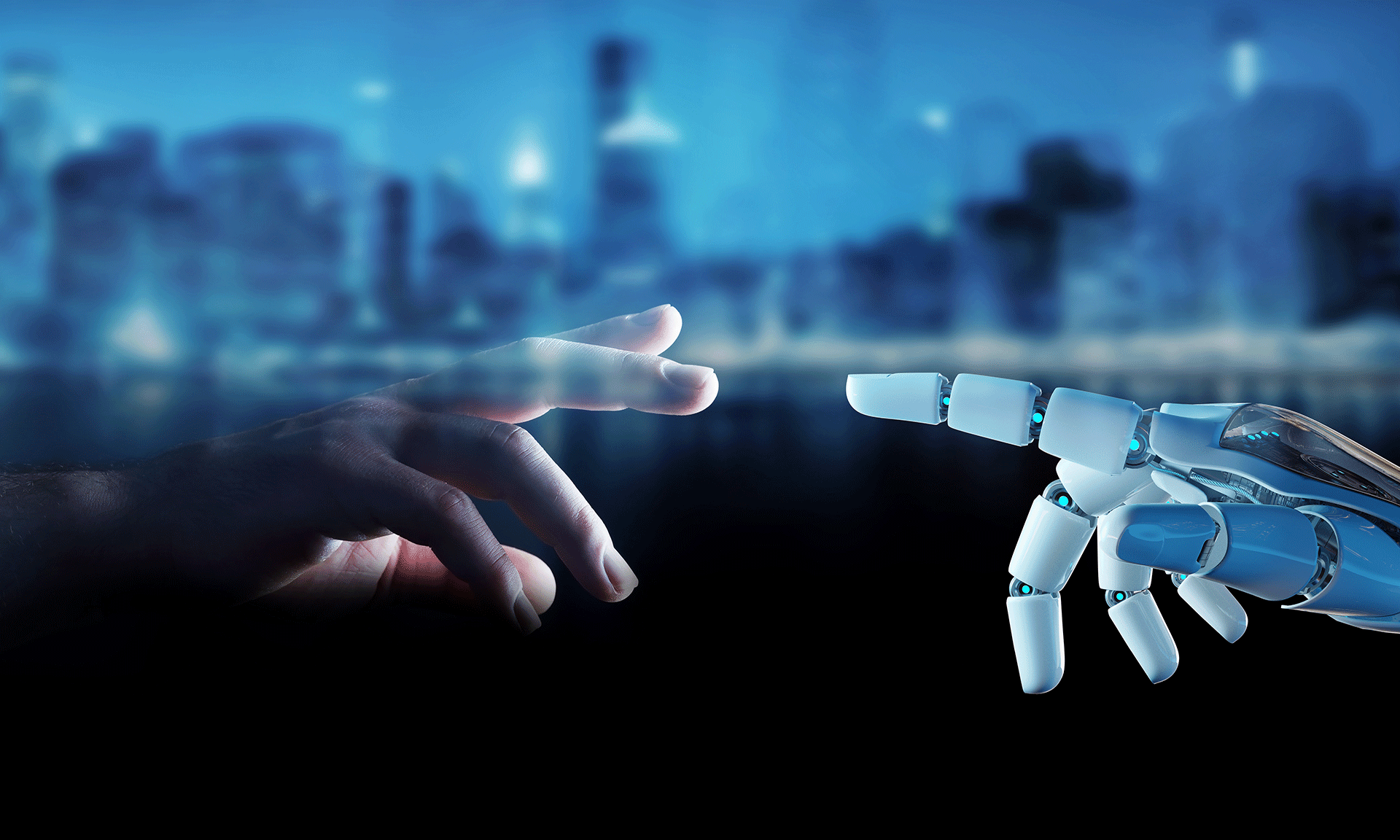

An SGD180 million has been additionally planned on top of the already budgeted SGD 500 million committed for artificial intelligence (AI) research, informed Deputy Prime Minister, Heng Swee Keat while addressing at the Singapore Fintech Festival (SFF) and Singapore Week of Innovation and Technology (SWITCH) 2021.

On November 8, 2021, Mr Heng, in an opening speech announced that the SGD180 million would be only spent towards accelerating fundamental and translational research on AI. While fundamental research involves the advancement of new and novel applications for AI, translational research refers to its application in translating data into meaningful insights.

The Deputy Prime Minister of Singapore, the new silicon valley in Asia also announced that two new national programmes on AI would be initiated for the finance industry and government sector including the ‘National AI Programme in Finance’ and the ‘National AI Programme in Government’.

These two national programmes have been introduced as part of the Singapore government’s strategy to effectively utilize AI technology for economic and social good.

The first programme in Finance includes an industry-wide AI platform and will generate insights about financial risks. The second programme in Government will improve the delivery of public sector services through greater use of AI in planning and policymaking for providing more responsive and personalized services and optimizing governing processes for the benefit of the citizens.

The first programme, NovA! is an AI platform and in its initial phase will focus on helping financial institutions rightly evaluate the environmental impact of companies and identify associated environmental risks. This is a collaboration between Singapore-based banks and local fintech firms. Sustainability related investments and the risks involved can also be better assessed by the financial institutions with this initiative. Building solid and sound AI capabilities within the Singaporean financial sector and enhancing customer service, risk management and business competitiveness is the primary purpose of this initiative.

The second AI programme, besides improving the delivery of public sector services through AI text analytics, will also focus on exploiting AI technology to improve job-matching on the national jobs portal, MyCareersFuture and improve job placements through better and more effective use of personalized jobs and skills recommendations.

These nationwide programmes come as a strategic plan of the Government for large scale adoption of AI across the nation and position the country as a global platform for AI applications and testing. The new initiative aims to leverage AI technology for economic value creation and train Singapore’s workforce on AI technology know-how.

In its efforts to become a smart nation, the Singapore government emphasized the necessity of AI for resource identification and allocation for the key focus areas through increased collaboration between government agencies and researchers.

The national AI strategy has been developed by the Smart Nation and Digital Government Office (SNDGO), under the Prime Minister’s Office (PMO) to position Singapore in a global leadership position for the development and deployment of “scalable, impactful AI solutions’ in key areas by 2030.

The government spearheaded the national strategy to make its citizens aware of the implications and benefits of AI in their lives and promote usage of this technology. Developing AI capabilities has also been on the government’s agenda to support an AI-driven digital economy by 2030. Plans and priorities are made by SNDGO so that Singaporean entrepreneurs and engineers can develop new and innovative AI products and services for both indigenous usage and exports.

“Domestically, our private and public sectors will use AI decisively to generate economic gains and improve lives. Internationally, Singapore will be recognised as a global hub in innovating, piloting, test-bedding, deploying and scaling AI solutions for impact,” emphasized the SNDGO.

Four focus areas have been identified for increased AI deployment including finance, manufacturing, government and cybersecurity. The nationwide projects that have been earmarked are management in healthcare, intelligent freight planning in transportation and logistics, and border clearance operations in national safety and security.

“The national AI strategy is a key step in our smart nation journey. It spells out our plans to deepen our use of AI technologies to transform our economy, going beyond just adopting technology, to fundamentally rethinking business models and making deep changes to reap productivity gains and create new areas of growth,” noted Lee Hsien Loong, the Prime Minister of Singapore.

He also added saying, “As a small country, Singapore lacks the scale of large markets and R&D ecosystems, but we can make up for this by building up AI research, and working together cohesively across government, industry, and research, to develop and deploy AI solutions in key sectors,” Lee added. “At the same time, we must also anticipate the social challenges that AI will create by maintaining public trust and building capabilities to manage and govern AI technologies, and guarding against cybersecurity attacks and breaches to data privacy.”

The Monetary Authority of Singapore (MAS) has already developed the first phase of Veritas, an AI governance framework and Toolkit to ensure that financial institutions use AI responsibly. The framework will focus on three main areas including customer marketing, risk scoring, and fraud detection.

“AI has the potential to transform financial services, but it must be used safely and responsibly. Good governance is essential to AI adoption in the financial industry,” the special AI advisor for MAS David Hardoon emphasized.

As part of the national AI strategy and to develop and manage smart estates, Mr Heng also deliberated a new partnership between the Infocomm Media Development Authority (IMDA) and Singapore University of Technology and Design (SUTD) for enhancing AI technological capabilities.

The rollout of a national AI strategy will empower Singapore to emerge as one of the smartest nations in the world and increasingly attract foreign innovative and tech-savvy SMEs and startups for the best Singapore company incorporation.

- Newsletter, U.A.E

- December 13, 2021

The recently released data by the Dubai Department of Economy and Tourism revealed a 69% jump in the issuance of new business licences in the first 10 months of 2021 signifying the return of investors’ confidence back to Dubai.

As investors and entrepreneurs identify high growth momentum and future investment opportunities across different sectors, they look for instant licensing for Dubai company incorporation.

The UAE department of Economy and Tourism issues instant licenses to business persons who are willing to set up and operate their businesses on the same day after applying for a new business license in a single step simple and easy 5 minutes process through the online portal ‘Invest in Dubai’.

While 32,626 new business licenses were issued during October 2020, the same month in 2021 witnessed 55,194 licenses registering huge growth over one year period on the back of increased confidence and trust of Investors in the economic resilience of Dubai.

“The growth in the number of licences issued also reflects the strength of the economy, Dubai’s success in managing the impact of Covid-19, the government’s agility in amending economic policies to drive economic growth, the low cost of doing business, and the easy procedures for starting businesses, all of which contributed to enhancing investor confidence in Dubai’s diversified economy,” emphasized Dubai department of Economy and Tourism.

The growing number of businesses set up confirms that Dubai’s economy is back in action after the pandemic and started firing in all cylinders after the launch of the historic international trade fair of EXPO 2020.

IHS Markit Dubai Purchasing Managers’ (PMI) index showed last month that the non-oil economy maintained its growth momentum in October 2021 and clocked almost a V-shaped recovery after attaining the largest gain in two years. The demand environment has radically improved with a rebound in new orders and is also attributed to EXPO 2020 which have revived the tourism, realty and banking sector.

The e-commerce space witnessed high growth during the first two quarters where new licenses increased almost 63%, from 1989 last year to 3243 nos in the corresponding period this year. In August 2021, Dubai witnessed a more than 50% rise in the number of new licenses issued. As per the report, the professional category new business licenses remained the front runner with almost 59% share closely followed by the commercial category one at around 40%.

While companies in the sole proprietary category topped the list of new license legal forms with 38% share, limited liability companies and civil companies secured the 2nd and 3rd positions with 28% and 24% shares of legal forms respectively.

One-person LLCs, branches of companies based in other emirates, branches of foreign companies, branches of free zone companies, branches of GCC companies, general partnership companies, public shareholding companies and private joint-stock companies also opted for legal forms.

Fully completed registration and licensing transactions in the first 10 months increased by 17% year on year and transaction volume for renewal of licenses saw up by 3%. A huge increase was witnessed in the initial approval of new business licenses growing more than 40% in October 2021 on a year on year basis.

Dubai International Financial Centre (DIFC) and Dubai Multi Commodity Centre (DMCC) are the two flag bearers of Dubai’s recognition as one of the best financial hubs in the world and played the most pivotal role in bringing Dubai’s economy back in the high growth path after covid 19 pandemic.

DMCC has been recently awarded ‘Global Free Zone of The Year’ by Financial Times amongst 70 Free Zones across the world and 7th consecutive time in a row. As the economy gets back on track, more investors are likely to opt for a DMCC company formation and benefit from the world-class business facilities from this free zone.

DIFC opens up to all startups and SMEs with the DIFC Innovation License that serves as a springboard for young tech-savvy entrepreneurial minds for future disruptive businesses. With the recent announcement of ‘Supersonic Speed Technology’, DIFC will undoubtedly attract more young business talents who would be tempted for DIFC company formation.

- Newsletter, U.A.E

- December 13, 2021

The hosting of a first-of-its-kind business conference on Israeli technology and innovation in Jaffa, Tel Aviv on Wednesday 24 November by the UAE embassy in Israel marks the first state-sponsored business delegation from the UAE to Israel.

Government officials, business leaders and entrepreneurs were present at the conference and discussed the advancement of technology and innovation and promotion of business ties between the two countries.

The event came more than a year after the first anniversary of the U.S negotiated historic Abraham Peace Accords, signed on 13 August 2020 at the South Lawn of the White House in Washington between the UAE and Israel.

The event was held in partnership with the Israeli NGO Start-Up Nation Central, a not-for-profit organization that keeps a close tab on the technological ecosystem and the Ministry of Economy of Israel.

Start-Up Nation Central was founded in 2013 by philanthropy and a one-stop destination for governments, corporations and investors to connect with the Israeli tech ecosystem. It runs an online platform, Start-Up Nation Finder where one can identify potential Israeli technology companies based on one’s interest.

Around 200 dignitaries attended the summit and among them were members of a UAE state-sponsored business delegation led by the UAE Minister of State for Entrepreneurship and SMEs, Ahmad Belhoul Al Falasi and the Minister of State for Foreign Trade Thani Al Zeyoudi.

Mohamed Al Khaja, the UAE Ambassador to Israel initiated this conference earlier this year as the new delegation sought to collaborate on innovation and entrepreneurship ventures between the two countries.

The agenda of the conference revolved around technological innovation driven by multinational corporations, the creation of an innovative technological ecosystem and collaboration in achieving mutually beneficial economic progress.

The UAE Ambassador to Israel, Al Khaja said “As people of the region, in order to advance our own societies and our economies, it is imperative for all actors in this room, and our counterparts to find ways to ‘lean in’ to this relationship and work together to open doors and correctly navigate and fuse together the respective strengths of our societies and economies.”

“We are proud and excited to host Israeli startups, corporations and joint ventures aiming to capitalize on the language, cultural and global connections of the dynamic Emirati marketplace, and to allow you to tap into the diverse talent pool and global business acumen of the UAE,” he remarked.

The leader of the UAE envoy, Dr Al Falasi highlighted, “Everywhere I look I see alignments, both in our strengths and our challenges, when it comes to small and medium businesses, startups, and tourism. There are a lot of ways that we can work together and enable our respective businesses to expand from the UAE to Israel and the other way around.”

“It is truly remarkable how only a year after the Abraham Accords, we have already established strong relationships in the form of business and commercial agreements. This is more than simply a foundation to build on. It is a solid partnership of real significance, not just for our nations, but for the region and the world as a whole,” commented the UAE Minister of State for Foreign Trade.

Israel’s Minister of Economy and Industry Orna Barbivai welcomed the arrival of UAE delegates in Israel saying the visit “enables us to expose the visiting Emirati industry and business leaders to Israel’s wealth of innovation, technology, entrepreneurship, and research.”

After the conference, the UAE Minister of State for Entrepreneurship and SMEs and Minister of State for Foreign Trade also visited Start-Up Nation Central Headquarters to meet with entrepreneurs from leading technology companies of Israel and explore potential Israeli investors interested in company formation in Dubai.

The following day, 25 November, the UAE delegation team members held a series of one-to-one and group meetings with their Israeli equivalents.

The UAE believes that economic activity with Israel will exceed $1 trillion over the next decade and will open floodgates of business opportunities for the investors of both countries. In all likelihood, the Jebel Ali Free Zone (Jafza) in Dubai, one of the biggest trade hubs in the region will be a major beneficiary and a growing number of Israeli investors will look for Jafza company formation to utilize the developed facilities in Jafza which has entered into a “strategic agreement” with the Federation of Israeli Chambers of Commerce (FICC) to promote businesses and trade.

Israeli Central Bureau of Statistics (CBS) data revealed bilateral trade between Israel and the UAE between January and June 2021 was approximately USD 610 million and more than half of which were from diamonds.

The Dubai Multi Commodities Center Authority (DMCC), home to the Dubai Diamond Exchange has already started a representative office in Tel Aviv inside the Israel Diamond Exchange (IDE) to extend support to Israeli businesses, across all industries and sectors who are interested in setting up a presence in Dubai through a DMCC company formation.

- Bahrain, Newsletter, U.A.E

- December 12, 2021

The recently agreed MOUs reached between the UAE and Bahrain are intended to promote bilateral cooperation between the two countries in many important areas and pave the way for the effective realization of economic growth plans of both countries. A new executive programme has also been launched encompassing some key areas including investment and trade, higher education, teacher training and human resources.

The MOUs were signed during the official visit of His Royal Highness Prince Salman bin Hamad Al Khalifa, Crown Prince and Prime Minister of Bahrain to UAE in November 2021. Prince Salman met His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, during his visit.

HRH Prince Salman and HH Sheikh Mohammed were present during the signing of several agreements and MoUs including the new executive programme that spans over several areas such as climate change, higher education, teacher training, human resources, trade and investment, advanced technology, economic integration, food security, health care, artificial intelligence in oil and gas, transportation, technical support for upstream industries, cyber security, cyberspace technical cooperation, logistics, combating crime, and stock markets.

At the end of the visit, a joint statement was issued by the governments of the UAE and Bahrain wherein the two countries agreed to promote bilateral cooperation in key areas to attain mutual benefits and joint objectives of both countries. Each country agreed to encourage ministries and government authorities to cooperate and transform cooperation objectives into joint ventures.

Both the countries committed to addressing the pandemic and exchanging best practices and reinforcing scientific cooperation in medical research. Abdul Rahman bin Mohammed bin Nasser Al Owais, UAE Minister of Health and Prevention, and Faeqa bint Saeed AlSaleh, Bahraini Minister of Health, exchanged an MoU on health cooperation.

The two countries also committed to cooperating in employment, labour and localisation and exchange expertise and best practices in these areas. An MoU on labour and HRD was signed between Dr Abdulrahman Al Awar, UAE Minister of Human Resources and Emiratisation, and Jameel bin Mohammed Ali Humaidan, Bahraini Minister of Labour and Social Development.

An MOU on Cybersecurity Cooperation was exchanged between Mohamed Hamad Ak Kuwaiti, the Head of Cybersecurity of the UAE government and Sheikh Salman bin Mohammed Al Khalifa, CEO of National Cybersecurity Strategy of Bahrain.

The two countries agreed to work jointly to address the burning issue of climate change and an MoU on climate change and environmental cooperation were exchanged by Dr Sultan bin Ahmed Al Jaber, UAE Minister of Industry and Advanced Technology and UAE Special Envoy for Climate Change, and Dr Mohammed Mubarak bin Dainah, Chief Executive Officer of the Supreme Council for Environment of Bahrain.

Technological advancement was also on the agenda of two countries and an MoU on industry and advanced technology was exchanged between Dr Sultan bin Ahmed Al Jaber, UAE Minister of Industry and Advanced Technology, and Zayed bin Rashid AlZayani, Bahraini Minister of Industry, Commerce and Tourism.

Two MoUs, one each on higher education and executive programme for cooperation in education for three years; 2021, 2022 and 2023 were exchanged between Sarah bint Yousif Al Amiri, UAE Minister of State for Advanced Technology, and Abdullatif bin Rashid Al Zayani, Minister of Foreign Affairs of Bahrain.

The two countries agreed on cooperation in trade and investment and an MoU was signed between Abdullah bin Touq Al Marri, UAE Minister of Economy and Zayed bin Rashid AlZayani, Bahraini Minister of Industry, Commerce and Tourism. Advancing the tourism industry was also the focus of both countries.

To recognize UAE as a partner in Bahrain Global Sea-Air Logistics Hub, an MoU was exchanged between Dr Thani bin Ahmed Al Zeyoudi, UAE Minister of State for Foreign Trade, and Zayed bin Rashid AlZayani, Bahraini Minister of Industry, Commerce and Tourism to restore the aviation sector to the pre-pandemic level.

An MoU was reached between Abu Dhabi National Oil Company (ADNOC) and Gas Holding Company of Bahrain. Dr Sultan bin Ahmed Al Jaber, Minister of Industry and Advanced Technology and Managing Director and Group CEO of ADNOC, and Dr Mohammed Mubarak bin Dinah, Chief Executive Officer of the Supreme Council for Environment of Bahrain, also exchanged an MoU between Adnoc and Tatweer Petroleum.

UAE Minister of Energy and Infrastructure, Suhail bin Mohammed Al Mazrouei, and Kamal bin Ahmed Mohammed, Bahraini Minister of Transportation and Telecommunications, signed an MoU on transportation and communications.

An MoU was signed between Abu Dhabi Securities Exchange (ADX) and Bahrain Bourse and was represented by Saeed Hamad Al Dhaheri, ADX CEO, and Khalifa Ibrahim Al Khalifa, CEO of Bahrain Bourse.

Export promotion has already been an area of cooperation between the two countries as Export Bahrain and Dubai Industries and Exports signed an agreement in October 2021 to support Bahraini investors exploring the UAE market and Dubai company incorporation.

It was agreed that relevant national organisations from both countries will reinforce their economic ties. A centre will be established for UAE nationals looking for a company formation in Bahrain that would connect commercial registries in the two countries.

The Crown Princes of both the countries expressed their common and sincere desire to support bilateral relations moving forward for mutual development and progress of the two countries and contribute to building a prosperous future for their citizens.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group