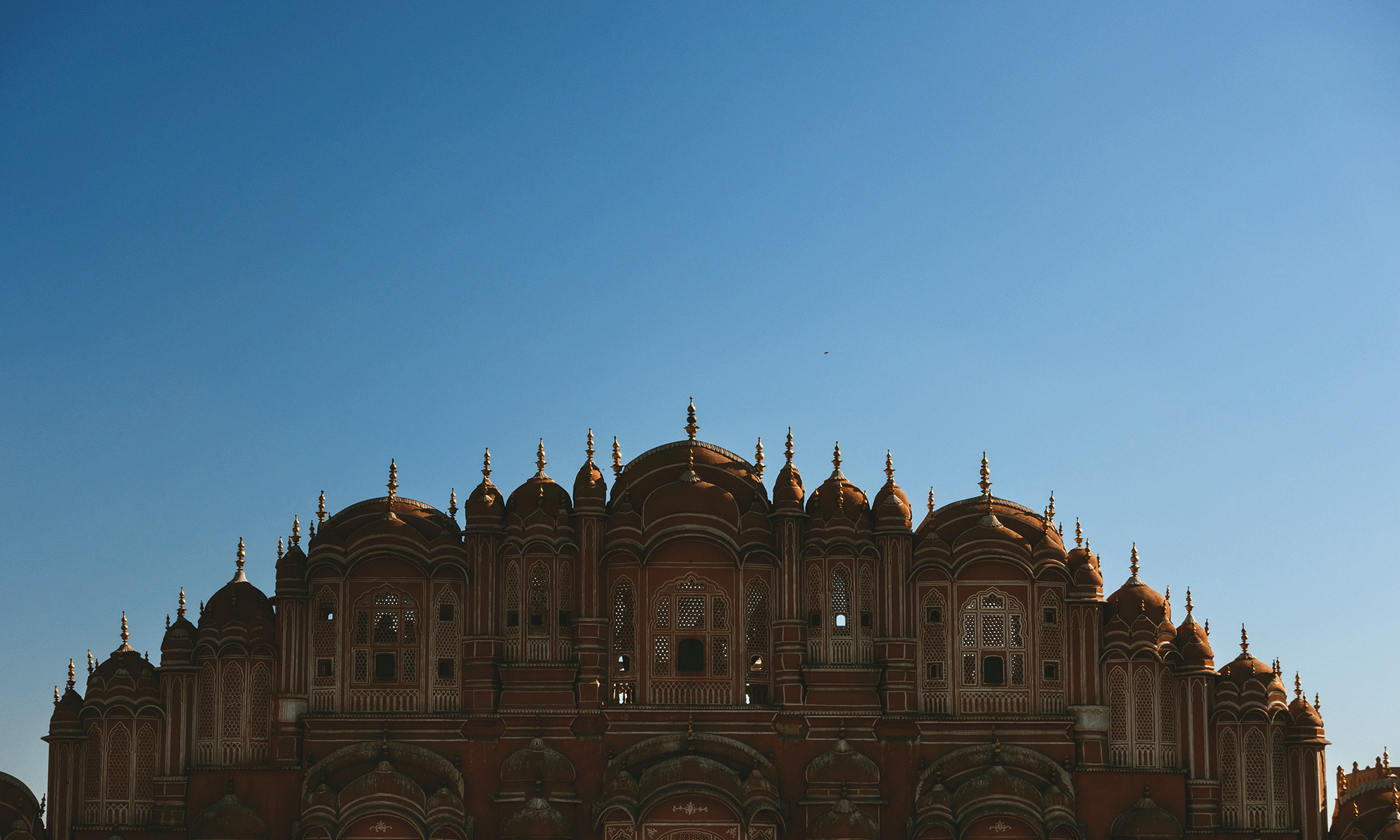

- Article, India

- November 2, 2020

The Shops and Establishment Act is authorized in every state in India and it controls most business entities in the nation. Some of the primary goals of this Act include controlling payment relating to wages, occasions, terms of employment, leaves, work conditions, over time work, maternity leave and advantages, the depiction of work, rules for work of youngsters among many other things for individuals involved in shops and other business establishments. The Shop and Establishment Act is enforced nationwide. All commercial establishments in India such as hotels, eateries, theatres, amusement parks, theatres and other entertainment houses all come under the purview of this Act.

In the act, a “commercial establishment” is defined as:

- Any business organization in the commercial sector like banking, insurance or trading establishments

- Establishments where citizens are employed or engaged to complete office work or provide professional services

- Hotels, eateries, restaurants, boarding houses, small café or refreshment houses

- Entertainment and amusement places like theatres, cinema halls or amusement parks

All the above mentioned enterprises fall under the Act and are thereby, expected to adhere to the rules, regulations and norms that are set by the Act for better treatment of their employees. The exceptions to the Shops and Establishment Act varies from state to state in India. Each state in the country submits a list of all shops and establishments that come into the Act and outlines who are the ones required to complete registrations under the Act in order to run their company in the state.

When do I need to register my business under the Shops and Establishment Act?

You must apply for registration under the Shops and Establishment law within 30 days of establishing your business, a store of any of the establishments mentioned above. This registration is important and necessary for multiple reasons, such as opening a new current account in a bank. This registration works as a basic license and a proof of your enterprise while applying for other registrations that are required to run and manage a business in India. Incorporation and online shopping forms are available for you access on the government website.

The application process for the registration

Each and every state in India has established different regulations and rules for registration under the Shops and Establishment law. However, the basic procedure is still the same. As per the law, every business has to obtain approval from the Ministry of Labour. You can obtain the registration certificate from the Chief of the Shops and Law inspector of the facility or from any other inspector who is authorized to the region in which the facility is run.

An application, in the specified form, must be submitted to the relevant inspector along with the following documentation:

- Name of the business in question

- The name and details of the owner as well as employees (during the time of business formation)

- The address of the business facility and a copy of the bill of sale. Alternatively, the lease contract for the shop is also accepted

- The business owner’s PAN card number

All the above listed details and documentation should be submitted in the form along with the relevant fees set for the inspector in charge.

After the application is received, the allotted inspector will review the details and visit your business facility. If necessary, the inspector will provide a certificate of registration under the law. The registration certificate obtained should be displayed in a visible, significant place inside the store and should also be renewed in case any of the details provided (like the number of employees, etc.) should be changed. The certification should also be renewed upon expiration. Registering a business the Shop and Establishment Law is one of the many mandatory requirements for all businesses operating from a store or a facility. In cases of facility changes or closures, all the relevant details should be presented to the inspector within fifteen days of the planned change or closure.

Businesses that run out of stores or facilities need this licensing or registration to prove its authenticity while planning to increase investment through bank loans or from investment capital. The above described registration process can be fully completed and the formal, printed version of the license will be issued within 10 business days in most of the cities and may take a little longer elsewhere.

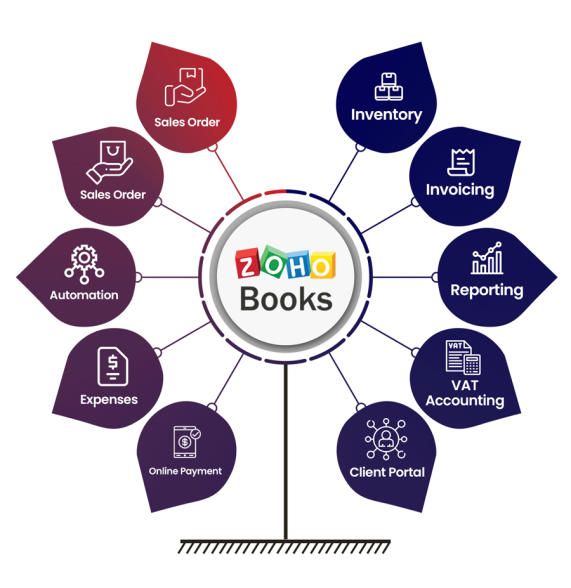

- Article, U.A.E

- October 22, 2020

The concept of online smart cloud-based accounting was first put into practice in 1998, and since then, there have been many innovative software developments to bring it to today’s maturity.

ZOHO Books is a smart cloud-based online accounting software that has become most popular amongst all accounting services in Dubai.

Features of ZOHO Books

Main features of ZOHO Books are

- End to end application covering all stages of business process stages

- Can be easily integrated with all cross-functional applications

- A collaborative software as ZOHO Books CRM can facilitate communication with customers

- Intelligent and intuitive user interface organizing tools in clear sections and interlinking pages for easy navigation and help save lots of time

- Time tracking with timesheet modules for tracking time spent in completing projects

- Contact management features instant customer support through customer query mitigation and narrowing down the gap between sales and support teams

- Once activated, the automatic bank feed fetches all banking transactions from your listed banks on a daily basis, by default

- Have an option for creating customized reports by integrating ZOHO Books reports

- Once a bank rule is created by defining transactions, all your banking transactions are automatically categorized

Advantages of ZOHO Books

ZOHO Books is always your preferred and better choice for accounting.

- The intuitive interface makes it very easy and convenient for use

- Zoho Books pricing is one of the lowest in this category, making it most lucrative and affordable for you

- It is very robust and accurate software and help prevent accounting blunders and keep you within regulations and standards

- The mobile application helps you to continuously track the financial status of your organization without a laptop and even when you are moving and can be run on both android and iOS

- All your accounting needs can be comfortably met with this software and help you save money and increase customer base. Payables & receivables, inventory, Payroll, and VAT management can be easily and comprehensively done

ZOHO Books Implementation in UAE

Whenever any new system is employed, the need for experience and expertise arises for the successful implementation and maintenance of the new system.

As ZOHO Books are gaining wide acceptance and popularity, ZOHO Analytics initiated ZOHO consulting partners program to equip the consulting partners with the necessary skills and expertise and for providing customer solutions around ZOHO Books. On successful completion of this program, all consulting partners are certified and approved as ZOHO Books consultants.

ZOHO Books consultancy services in UAE provide complete implementation through

- Analyzing customer needs and business processes and creating prototypes

- Implementation and Customization of ZOHO Books through necessary selection and integration of essential ZOHO books from forty plus products, e.g., CRM, Projects Campaign, etc.

- Training on ZOHO case studies and customer success stories

- All-time customer support for ensuring continued maintenance

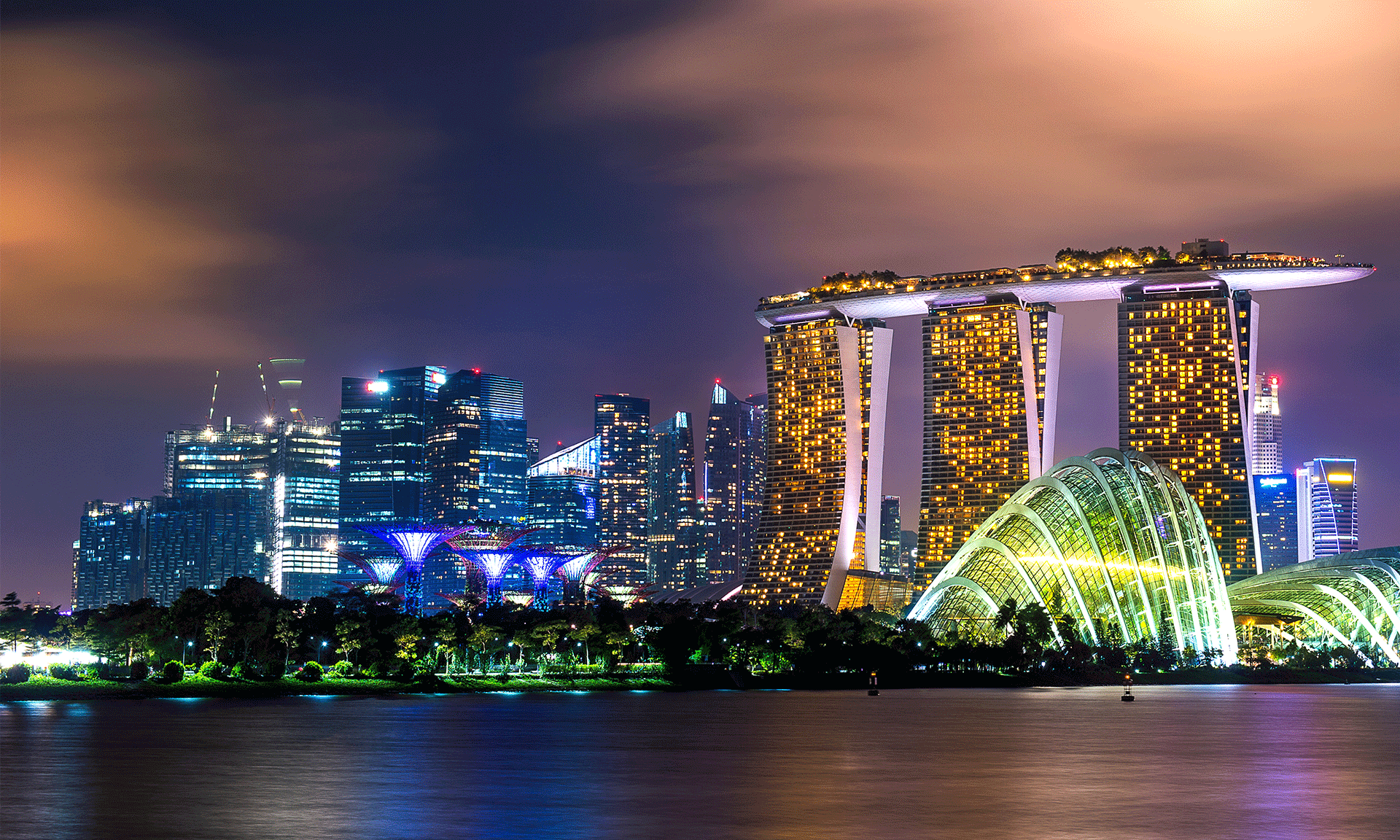

- Article, Singapore

- October 15, 2020

An employee stock options plan is an employee benefit scheme to provide them an ownership interest in the corporation. The Company’s board of management administers the ESOP process and lays down specific rules regarding the same.

A part of the total equity amount is set aside to offer this benefit to the key employees of the organization. The offer price is decided by the board of directors in advance and it remains very close to the fair market value.

The structure of ESOP is generally governed by the company’s financial needs, health, and objectives. Different issues have to be accounted for before making the final decision of setting up an ESOP.

Here is a step-by-step guide to set it up for your employees.

Drafting the rules

An efficiently drafted ESOP Agreement helps in structuring the ESOP by creating an Employee Stock Option Pool (ESOP Pool) that helps in placing an equity shareholding percentage on the side for employees.

Hence, employees can participate in the company shares because of this pool. Further, an ESOP Agreement will clarify the details of members of an ESOP committee. The ESOP committee is a committee that comprises the company’s directors and other officers.

The responsibility of managing the ESOP Pool lies with the ESOP committee and it recommends suitable actions to the Board of Directors of the company.

Approval of rules and the ESOP pool

For Singapore companies, these resolutions will be practically handled by your corporate secretary. If your company is not Singapore based, you should be confirming this step with a local law firm.

Board and Shareholder Approval

- ESOP rules approval

- The total number of ESOP pool options.

- Authorization for the board on granting options to recipients

- Authorization for issuing shares on any exercise of such options

Shareholder waivers and consents

If this is the case then those shareholders having the precautionary rights will have to sign a waiver in respect of any options granted under the ESOP. If required, you should ask your corporate secretary for preparing this shareholders’ waiver also.

Finally, your existing constitution and shareholders’ agreement should also be checked for specific consents required from any shareholder for issuing shares, grant options, or establishing an ESOP. For instance, if you have gone through external funding round, your investor might have a veto right over the issue of any new options. If that is the case then you will need that party’s written consent for granting options and issuing shares under the ESOP.

Granting your options

- Prepare your directors’ resolutions

Every time you feel like granting options, you should ask your corporate secretary for preparing a new set of directors’ resolutions in writing, approving the grant of options to a specific or a list of recipients. - Send grant letter to each recipient

Send each recipient:

- A completed & signed grant letter including the number of options granted, the exercise price along with the vesting schedule.

- An attached copy of the ESOP rules.

If the recipient is willing to accept the offer then they should counter-sign the letter of grant and send it back to you.

- Issuing the option certificate

After receiving the countersigned letter, you are allowed to issue them their option certificate.

- Updating your options register

Internally, you should also maintain an options register, containing the record of all the options the company has granted, the vesting schedules, expiry dates, and the respective exercise dates.

The Process of Checking a Registered Company in Singapore READ MORE

Important Factors to be considered while implementing ESOPs

Complicated Process

Deciding the Equity percentage

What happens when an employee exits the organization after the shares are vested?

Conclusion

- Newsletter, U.A.E

- October 12, 2020

“Dubai International Financial Center (DIFC) is a special economic free zone in Dubai and founded in 2004. It is the financial hub for the Middle East, Africa, and South Asia (MEASA) markets. DIFC has a large business community with its own independent regulatory framework and judicial system.”

“Dubai Future Foundation (DFF) is a government foundation established in 2016 that aims at shaping the future of the strategic sectors in cooperation with the government and private sector entities by endorsing innovative capabilities and launching Initiatives.”

DIFC signed a memorandum of understanding (MOU) with DFF in September 2020 in order to reaffirm its commitment to driving the future of finance.

The agreement between two futuristic government bodies will advance and boost the innovation agenda within Dubai and engage the financial technology community through setting the stage to enable and support growth opportunities and appropriate training activities. DIFC’s priorities and DFF’s mission aligns perfectly to collectively imagine, inspire, and design Dubai’s future.

The financial services sector is the 3rd largest contributor to Dubai’s GDP and is expected to grow steadily as DIFC becomes a major part of the Dubai future district, the region’s largest future-focused district. Companies looking to establish businesses in DIFC must apply for registration and necessary permission for DIFC company formation.

The key initiative for Dubai’s future district is DIFC’s innovation license for startups for boosting innovation, creativity, and entrepreneurship. DFF will actively support this program of the DIFC Innovation License. This shows the commitment of DFF to closely work with DIFC in furthering the future of finance in Dubai.

This will usher the combined technology acceleration program and facilitate identification and support for blockchain and AI-driven startups to put these initiatives on a high and aggressive growth path. The combined move will bolster the 10X Dubai vision enabling the Dubai government to be 10 years ahead of all other cities by adhering to disruptive innovation.

The MOU signed between DIFC and DFF also highlights the launching of technical training programs at DIFC Academy, including coding courses like Full-stack Web Development and App Development. These training programs will ultimately support DFF’s 1 million Arab coders initiative, launched by Sheikh Mohammed Bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai. Apart from training, the two forward-looking government bodies will also collaborate on Research and Development activities with leading research and technical institutions.

Arif Amiri, the CEO of DIFC Authority, described the recently signed MOU by saying, ” As the leading financial hub in the MEASA region, our eyes are firmly on the future. We are committed to driving the growth in the finance sector by embracing innovation, technology, and training.”

Arif Amiri also said, ” Investing in Human Capital initiatives with the Dubai Future Foundation is incredibly important. It underscores our long term commitment to make Dubai a leading business city of the future aligned with the national government agenda. Together, we can ensure Dubai’s sustained prosperity and accelerate the Emirate’s development journey.

“We look forward to combining forces to drive the future of finance.”

Khalfan Belhoul, Chief Executive Officer of Dubai Future Foundation, stated, ” Through our strategic partnership with DIFC, we are confident that the positive outcomes would create impact not only for the respective organizations but also for the region and its economic growth.”

Khalfan Belhoul also said, “By working closely with DIFC, we seek to accelerate business opportunities for the region, attract startups and talents, employ innovation and technology to further- enhance and generate a robust financial sector and provide the right tools and skillset to enable a future-ready generation.”

He described the MOU saying, “This partnership is a testament of our unified vision and commitment to positioning Dubai as a knowledge-based economy and to the pivotal role the UAE plays in driving its financial industry globally.”

DIFC is the largest and most advanced fintech hub in this region, transforming and diversifying the financial services industry. The continued focus on innovation in the fintech sector is acting as the backbone of Dubai’s ambitious and aggressive growth plan.

DIFC houses more than 200 fintech establishments, which enjoyed rapid growth during 2018 and 2019. DIFC focuses on and closely works with regional and international stakeholders in developing a solid digital infrastructure to mark its presence as the regional financial center.

DIFC has a global financial exchange and access to funding. It offers a dynamic business environment with a skilled workforce and vibrant business community much conducive for new business set up in Dubai.

- India, Newsletter

- October 12, 2020

Indian Foreign Secretary, Harsh Vardhan Pingla claimed that India is offering numerous business opportunities for British Companies in the post Covid period.

Indian Foreign Secretary, in his inaugural address at Confederation of Indian Industry’s 125th Annual Conference in the UK, ” A New India-UK Economic Partnership in a New World: Lives, Livelihood, and Growth” affirmed over a virtual platform on 15th of September, 2020.

Mr. Harsh Vardhan highlighted that many reforms have been initiated in India during the post Covid period and in the areas of Infrastructure, Taxation, Aadhar, Mobile connectivity, Agriculture, and JAM Trinity. The policy and structural reforms so undertaken have made India one of the most preferred foreign investment destinations attracting new companies to India.

As per the Indian Foreign Secretary, even during the Covid pandemic, India has received $20 billion foreign direct investment amidst the slowing global economy. He invited UK business houses to take advantage of the recent reforms and set up businesses in India. With reforms in place, India company formation has become an incredibly fast and easy process.

In the inaugural session, the foreign secretary described the Covid outbreak as a distinct opportunity to transform India into a manufacturing base from a passive market in the past. As per him, there are opportunities in pharmaceuticals, vaccines, services, and manufacturing where India and the UK can work together. He highlighted India and the UK’s economic synergy and claimed that products designed in the UK can be profitably manufactured in India.

Indian high commissioner to the UK, Gaitri Issar Kumar, stressed that India and UK have a long and proven trade and investment eco- system, and sought UK India partnership when global supply and value chains are in total disarray. She addressed the participants saying the UK has always been a ready partner of India and mutually cooperated in many areas, especially in generic pharma, API and medical instruments manufacturing, and building health infrastructures. She also emphasized that India and the UK can work together in other areas, including financial technology, renewable energy, defense, and electronics manufacturing, and information technology.

President of Confederation of Indian Industry (CII), Uday Kotak, discussed India’s foreign direct investment and said India is the second-largest FDI contributor to the UK. He also informed that the UK is the 6th largest FDI contributor for India. Mr. Kotak also reiterated the need for the hour through a focus on managing growth, lives, and livelihoods while considering the challenges associated with life after a pandemic.

Chandrajit Banerjee, Director General of CII, highlighted that Brexit is around the corner, and there is an immediate need to discuss the business partnership between India and the UK. He emphasized on free trade and comprehensive economic agreements. The Director-General also mentioned a trade war and growing tensions between America and China, and its deadly impact on global supply chain necessitates strong business ties with the UK for mutual growth and economic recovery and development.

- Newsletter, U.A.E

- October 12, 2020

A high-level meeting through video conferencing was convened between the Canadian consul general in Dubai and the Dubai chamber of commerce and Industries on 7th of September, 2020 towards post covid economic recovery through collaborative efforts in digitalization, logistics, e-commerce, life sciences, and sustainable technologies.

H.E. Hamad Buamin represented the Dubai chamber of commerce and industries as President and CEO, and H.E. Jean-Philippe was present as Canadian Consulate General in Northern UAE.

Both leaders reflected upon the rapidly growing trade and business relationship between UAE and Canada, emphasizing Dnata launching ground handling operations in Vancouver Airport and D.P. world’s $ 8.2 billion co-investment platform with Canada’s pension fund, Caisse de depot et Placement du Quebec for expanding its global port and terminal operations.

H.E.Buamin, on behalf of the Dubai Chamber of commerce and industries, reiterated Dubai’s huge incentives offering a great competitive advantage to foreign companies and investors for their Dubai Company Incorporation and enhancing Dubai’s credibility in value proposition in recent times. He also praised the Dubai government’s rapid and proactive response in addressing post covid challenges and speeding up digital transformations to facilitate businesses smoothly sail through post covid situations.

H.E. Buamin described Canada as the UAE’s strategic business partner. He also highlighted Dubai as one of the most preferred global investment and business destinations, frequently leveraged by Canadian business enterprises.

Canadian Consulate General, H.E. Jean- Phillippe Linteau heavily admired the Dubai chamber of commerce and industries for its leadership role in promoting Dubai as the most sought-after global business center, especially during post covid period. He also highlighted that increased digitalization in Dubai certainly helped in post covid period and narrowed down the geographical distance between Dubai and Canada. He also clarified that Dubai has already been regional headquarters for many Candian business houses as one of the most lucrative business destinations in the world and the numbers of such regional Canadian business headquarters with business set up in Dubai would only grow in recent future owing to the strong and ever-increasing business ties and bilateral relations between the two countries.

The Consulate General of Canada, H.E. Jean- Phillippe Linteau, also expressed his desire and put his hopes for increased Dubai-Canada bilateral and business ties in more strategic areas of energy, infrastructure, and life sciences. As per him, the two countries Dubai and Canada, are truly committed and should work together during the post covid era for establishing a robust, more resilient global economy.

H.E. Hamad Buamin seen equally enthusiastic who put his entire trust on the great potential of Canadian business entrepreneurs and their Dubai based business counterparts to focus and innovate on high and smart technology areas very rewarding for both countries and ultimately for the entire globe.

Dubai UAE has always enjoyed a great relationship with Canada since 1974, the year UAE got independence and strived towards improving business and bilateral relationships with Canada. UAE and Canada have deep business, and bilateral relationships mainly focused on building upon the prosperity of two societies, strengthening global and regional security, and effectively contributing to the economic and social development of third world countries and empowering women.

- Newsletter, Singapore

- October 12, 2020

Singapore, a tiny nation and the city-state in Southeast Asia, has become one of the world’s most promising economies today. The economic policies and structures implemented during the middle of the 20th century have started delivering results in the 21st century. A nation almost without any natural resources and ranked 171st in area wise global ranking, Singapore is considered as the most attractive place for work and business with a high standard of living.

The Singapore economy is mainly dependent on manufacturing industries and the export of electronic products. However, financial technology and tourism space are also fast progressing and attracting lots of foreign investments.

Singapore is the economic center in the Asia Pacific region and is ranked as one of the leading nations in economic freedom. It is also recognized as the second most investor-friendly state by the World Bank. Company formation in Singapore is easy and free of bureaucratic hassles.

Factors responsible for the highest growth and investment in Singapore’s Fintech Industry are as follows.

Low Taxes

Singapore has very low tax rates and offers several tax incentives and tax exemptions to the investors. It also follows a forward-looking diplomatic foreign policy and has entered into a Double Taxation Treaty with more than 90 countries, further offering tax reliefs on foreign income sources. It is one of the primary reasons that fintech investors are attracted to Singapore as a tax haven.

Large Mobile Base

Digitalization is the future and has become more so post coronavirus pandemic. Singapore has a huge mobile base, with more than 82% of the population as mobile subscribers. As most fintech businesses are heavily dependent on mobile phones, a large mobile subscriber base helps attract more fintech investments in Singapore.

Success Stories of Local Startups

Successful local startups are also inspiring potential fintech investors to come and establish companies in Singapore. In addition to providing e-transactions platforms to their consumers, local startups offer solutions for lowering the cost of money transfers, digitalization of documents, and cryptocurrency transactions, including digital money-raising platforms. Many more fintech startups are looking for their Singapore company incorporation.

Networking Platforms

Singapore is a great place for networking, and good networking is the essence of innovation and growth of the fintech industry business. Singapore Fintech Festival is a venue where participants from all over the world come and share their experiences and innovative ideas related to financial technology and business. The recent Fintech Festival attracted more than 40,000 participants from over 100 countries who used it as their deal-making platform for future fintech businesses and investments.

Accessibility to testing and implementation

Singapore, the financial hub in Southeast Asia, is surrounded by countries that are not as developed as Singapore. These surrounding developing countries often serve as a testing and implementation grounds for Singapore in innovative financial solutions. The neighboring countries indirectly help Singapore in developing new technologies related to financial services or fintech industries.

High standard of living

Singapore is a rich nation with an average per capita GDP of $ 64,000. Most of its residents are well off and educated. It is thus imperative that an economy with so much money available in the system and aided by high technology and digitalization can propel the fintech business.

B2B business climate

B2B transactions involve two companies rather than a company and an individual. The B2B sector is highly developed in Singapore that handles corporate to corporate transactions. Compared to B2C, B2B transactions are more complex and involve more paperwork, e.g., digital signature. Lots of new fintech startups are offering B2B transactions and choosing Singapore as the most logical destination.

Government Policies and Support

Fintech is one of the smart strategies of the Singapore Government. Sector-specific strategies are being incorporated in Singapore to boost sectoral fintech businesses and investments. “Fintech Fast Track Initiative ” and ” Smart Financial Center ” are part of this wider strategy of propelling sector-specific fintech business. Singapore Fintech Association, a non- profit platform facilitating fintech collaboration, and Singapore Fintech Festival, a widely recognized event, is also the Singapore government’s brainchild. With so much government support complemented by simple and transparent government business policies, Singapore is rapidly climbing up the global fintech investments.

Key Takeaways

Singapore, known as the Financial capital of Southeast Asia, has developed high technological capabilities; strong, simple, and investor-friendly regulatory framework and, highly skilled and educated workforce. These three attributes are mainly responsible for fintech business growth in Singapore, providing innovative solutions to both consumers and financial services industries.

Many reports and rankings worldwide showcase Singapore as a nation with the highest potential for growth in the fintech sector. Singapore ranked 6th in the latest Global Financial Centres Index and rapidly advancing forward to catch up with the UK and USA.

A finer balance and closer alignment between innovation and regulation will surely take Singapore’s fintech business to the next level.

- India, Newsletter

- October 12, 2020

Ever since the 1918 Spanish Flu pandemic, the human race has experienced such a profound public health crisis in the recent past due to coronavirus.

Every challenge throws an equal opportunity, and India is no exception. Great opportunities are rising in India’s economic horizon and mainly because of technological and geopolitical changes, new laws, and changing climates.

In addition to direct contributions, these five mega opportunities will also help expand additional manufacturing ecosystems through expansion and new company formation in India relating engineering service providers and ancillaries.

Data Center Business:

As Post covid social distancing measures keeping us indoors, the demand for web-enabled services has risen dramatically.

The emergence of 5G technology, likely to be launched by the end of 2021, will further increase IoT (Internet of Things) enabled products in the Indian market. The ever increasing demand for more data center capacity is all set to continue the exponential growth curve.

The digital transformation programs were undertaken in India across all businesses for staying viable and competitive, and individual domestic users staying more and more online will also propel the demand for more data centers.

The present data center market in India is pegged around $2 billion, and the projected growth rate is approximately 25% taking the figure to $5 billion by the year 2024.

The 8 major cities in India have around 7.5 million square feet of space, accommodating various data centers. As per industry estimates, some 10 million square feet additional space is likely to be added over the next three years. The adoption of IaaS (Infrastructure as a Service), SaaS (Software as a Service), and PaaS (Platform as a Service) will receive further impetus once 5G is rolled out and will invariably increase the physical presence of cloud service providers requiring more space and increasing data centers revenue.

The data localization proposition by the government mandating personal data storage within the country will further increase the demand for more data centers in India. Reserve Bank of India (RBI, the regulatory body of the Indian Banking System) has already made local data storage compulsory for all financial institutions.

Big business houses and technology firms, e.g., Microsoft, Reliance, Oracle, Hiranandani, and Adani have already committed more than $ 15 billion investment over the next 5 years to set up new data parks across the country well as expanding the existing ones. CtrlS, Nxtgen NTT, the other players in this market are equally optimistic. Hiranandani group has set up Asia’s largest data center in Navi Mumbai with 0.82 million square feet of space.

The Indian government has already launched a Big Data management policy through CAG. Though in the nascent stage, Big Data can be the strongest driver of data center investment in the Indian market offering New business opportunities in India.

Electronics Manufacturing:

Presently, India’s domestic electronics manufacturing market stands at $70 billion, only 3.3% globally, with export of $ 11.28 billion in FY20. Like America, Japan, and South Korea are planning to shift their manufacturing base from China, India could be a major beneficiary with a potential of $180 billion in exports by 2025.

As the digital revolution sweeping across India, with more and more people acquiring new products and technologies powered by IoT, AI, ML, and Big Data, the Indian Electronics manufacturing sector is all set for unprecedented growth. Apart from smartphones, laptops, and other electronic gadgets, there is also increased use of electronic products and components in automotive, lighting, and communications.

An incentive scheme of $ 6.65 billion has been launched this year for five global smartphone manufacturers to boost domestic electronics manufacturing. India also plans for product linked incentives for the top five domestic smartphone companies for producing $ 133 billion smartphones and components by 2025.

Lured by the incentive schemes, some 22 Indian and global firms, including Samsung, Lava, and Dixon, have proposed 11 lakh crore worth of mobile production in the next five years. Bajaj Electronics, BHEL, ITI are also planning for increased investment in this sector. Taiwanese manufacturer for Apple iPhones Foxconn wants to incest $1 billion for expanding the Chennai unit, and Wistron, another Taiwanese firm, plans an additional $ 155 million investment in Bangalore.

Water Management:

India needs a reliable and robust water management system to meet drinking water, agricultural and industrial requirements and needs approximately $ 100 billion investment in the next five years as part of India’s ” Nal Se Jaal” scheme and intelligent and innovative water management tools and applications.

Application of SCADA (Supervisory control and data acquisition) and Smart Water meters are to be used for smart integrated decision-making and automated water management control.

The market size for smart water management will be approximately $ 21 billion by 2024 from $12 billion as of now, and India, with its huge water resource, can be a major beneficiary in this sector.

Thermax, Siemens, GE, Toshiba, Voltas, and L&T are major players in this market, offering smart water management solutions for both the demand and supply side.

Defence Manufacturing:

India happened to be the 2nd largest importer of defence equipment after Saudi Arabia from 2015 to 2019 is all geared up for indigenous defence equipment manufacturing. Under the ” Atmanirbhar Bharat” initiative, India plans to suspend 101 weapons and platforms over the next 7 years, accounting for $ 53.4 billion foreign imports.

With this huge import ban, local high-end technology-driven manufacturing companies e.g. Bharat Forge, L&T HAL, and BHEL, will be the major beneficiaries.

EV Charging:

The introduction of Electric Vehicles (EV) is a major policy decision of the Indian government. As more and more EVs are introduced in the market, India will be needing around 400 000 EV charging stations by 2025, requiring approximately $ 20 billion investment.

Initially, one EV charging kiosk will be installed at every 69,000 petrol pumps in the country and will be expanded afterward. Charging stations at remote areas will further require complete energy back up meaning more investment requirements. Tesla, ABB, Siemens, Schneider, Bosch, and EESL ( Energy efficiency services limited) will be the major beneficiaries as major players in this segment.

Key Takeaway

India can very well become the global manufacturing hub in the recent future and create huge employment opportunities in the country with the right government initiatives and sustainable business policies in the global market.

- Newsletter, U.A.E

- October 12, 2020

To establish stronger ties with Israel; Dubai state owned D. P. World, a global company providing end to end smart logistics solutions, and Dubai Customs is in a continuous quest for bilateral business opportunities between the two countries and already signed a series of MOUs in this regard.

DP World Chairman and CEO, Sultan Ahmed Bin Sulayem has already signed the memorandum of understanding with Dover Tower owner Shlomi Fogel, an Israeli businessman, for partnering on joint development of Israel port Haifa in the Mediterranean and also opening a direct shipping line between UAE and Israel port Eilat in the Red Sea. The Newly planned trade route helps develop Dubai Multi Commodities Center (DMCC) and DMCC company formation.

Dover Tower is an Israeli company engaged in developing ports and shipyards and also owns Israel shipyards and port of Eilat. DP World, UAE, operates a number of ports in varied locations from Hong Kong to Bunes Aires and is keen on exploring joint investment opportunities in areas of infrastructural development of two countries. The engagement also aims for sustainable peace and stability in the middle east.

Three main areas of cooperation between the two countries are covered under MOUs. Firstly DP World will engage in the development of Israeli ports and free zones and assess the potential for establishing a shipping line from Eilat to Jebel Ali; Second, Dubai customs will assist in promoting private trade and businesses by adhering to customs best practices and continuous innovative processes; and third, the Drydocks World, Dubai with its largest ship repair facility in the middle east will explore business opportunities with Israeli shipyards and develop, manufacture and market International Shipping and Logistics (ISL) products in partnership with Israel.

As per Chairman and CEO of DP World, Sultan Ahmed bin Sulayem the MOUs would help in tapping trade and economic cooperation opportunities and promote development focussed ties between UAE and Israel. He also stated that the DP world’s mission is global trade between UAE, Israel, and other countries and invited business enterprises from other countries to come and participate in Dubai company incorporation.

Shlomi Fogel, Chairman, and owner of the Dover Tower group, a shareholder of Haifa shipyard and also the owner of Eilat port, described his company’s collaboration with DP world as a matter of great honor. He also took pride in the mutual vision and friendship of the two companies and expressed his desire for a strategic partnership that would impact global trade and economy and strengthen the business relationship between Israel and UAE. He described this agreement as a beginning and envisioned many more agreements between the DP world and Dover Towers across different industries.

Chairman and CEO of Dover Tower also officially announced the partnership agreement between Israel shipyard and DP world to jointly participate in the tender for the privatization of Haifa port.

Jebel Ali, the only port in the Arabian gulf connected to the Far East, has the ability to accommodate mega vessels and recently decided to dock HMM GDANSK, one of the world’s largest cargo vessels, on her return Europe Far East voyage. HMM GDANSK is 400 meters long with a capacity of 24,000 TEUs, Twenty feet Equivalent container Units.

Jebel Ali is one of the few ports in the gulf which can handle 10 mega vessels at one time. It has a handling capacity of 22.4 million TEUs and is considered as the region’s premier gateway port on the Asia- Europe sea trade route. As per Mohammed Al Muallem, CEO and MD of DP world UAE region, the visit of HMM GDANSK bears the real testimony of Jebel Ali’s real strength and capacity.

Jebel Ali is one of the most technically developed ports employing robotics, IoT, Big Data, Virtual reality and cybersecurity, and complete automation.

Collaborative efforts between DP world and Dover Port, the two world-class companies, will help expand businesses between UAE and Israel and other middle east countries.

- Article, Singapore

- October 1, 2020

Getting a PR in Singapore will fetch you almost all the same benefits as an originated Singapore citizen. The only key differentiator would be you’ll not be getting any voting rights. To look for corporate or professional penetration in Singapore, you need to have a Permanent Residency pass. Getting a PR will also help you with Singapore Company Incorporation. In other words, if you are looking forward to professional penetration in Singapore, getting a permanent residency will solve all the problems of yours and will ease up the process.

The process to apply for a PR in Singapore is quite complex and involves a lot of steps. Let’s understand each one of them in brief –

1. Decide when to apply for PR

The very first question that pops up is when to apply for a PR in Singapore. Generally one can apply for the PR from the day he or she starts working in that country on an employment pass. However, one of the basic requirements that need to be met before applying for a PR is to have pay slips from a Singaporean Employer for 6 consecutive months. So it eventually means that one should have to wait for six months from the date he or she has started working in a Singaporean company.

2. Calculate your chances of approval

Apart from the type of employment pass, you are holding, and the duration of your employment in Singapore, many other factors need to be kept in mind while thinking about the approval of your PR application.

They are as follows:

- The academic background has a role to play here. The academic degree you hold and from which university or board it is accredited with is considered.

- Your physical presence in Singapore. The chances of getting a PR application approved are directly proportionate to the duration of your presence in Singapore.

- The stability of your employment and a job profile is also taken into consideration for calculating your chances of getting a PR in Singapore.

- Your financial soundness and salary also play an important role.

- Your background will also be checked.

3. Reviewing the requirement for the application

Once you meet all the basic eligibility criteria, you are all set to fill in the application form and proceed with the future course of action. You can download the PR application form very conveniently. You need to download two forms, one is form 4A and the other one is accompanying notes to form 4A. Form 4A comprises of two parts, the first one is the PR application form and the other one is Annexe A. the first one is to be completed by you while Annexe A is to be filled by your employer. The second document contains explanatory notes. The whole applications along with supporting documents can be now submitted online through ICA portal via Sing Pass.

4. File Supporting Documents

The most crucial step in filling an application to get the Permanent Residency of Singapore includes properly filling the supporting documents. In case if you commit even the slightest of the error, your application will be rejected then and there. The list of supporting documents is mentioned in the explanatory document which was downloaded in the fourth step. Let’s lookout for some important guidelines that you need to take into account before filing the documents –

- At the time of submitting the PR application online, you will need to upload the scanned copies of the original documents.

- In case if you have any official document that is in your native language, you need to get it officially translated into English.

- Having any previous experience or recommendation letters are useful. You can even contact your previous employers for any sort of help.

- If you owe any property in Singapore, attaching the documents that state the same will work as a cherry on the cake.

- Attaching a most recent copy of your resume is useful

- Preparing a cover-letter beforehand that articulates your entire journey with Singapore will work for you to get the brownie points.

Documents needed to file your PR application

- Employment Proof.

- Letter of recommendations.

- Education Proof – Degree, Diplomas, and certificates from your high school or universities.

- Proof of your income – salary sleep, your bank passbooks.

- Your most recent CV.

- If you have any property in Singapore- Documents supporting your ownership.

- Documents of your spouse or children.

How Long Does it Take?

What is the cost involved in applying to get a Permanent Residency Pass?

The cost involved in the procedure of filing a PR application is $100 which is non-refundable for each application. In case your application gets approved, you have to pay a sum of $120 which includes the fees of your entry permit, 5 years of re-entry, and an identity card issue.

There are various types of PR schemes for varied classes of individuals. Let’s consider each one of them in brief along with the requirements they have to fulfill.

1. Singapore PR Scheme for Individual Employees

This is the most legit way of getting a PR in Singapore because a lot many skilled workers come to the land to work for the country and directly contribute towards the economical growth. The first step in initiating a PR application process is to relocate to Singapore either with an employment pass or entrepreneurial pass, or a personalized employment pass. After you relocate to Singapore and stay in the country for a minimum of 6 months, you can apply for a PR.

2. Singapore PR Schemes for Investors

One can also apply for a PR through investing in the Global Investor Programme. You can take the benefits of this in two different ways either you or your immediate family members can plan for company formation in Singapore or invest in an established business in the country.

3. Singapore PR Schemes for Artistic Talent

If you are blessed with an artistic eye and are inclined toward curating new art in the form of paintings, music, literature, photography, dance, or a film, then the value of your talent will be appreciated in the Singaporean geographies. The scope of new and modern art has increased rapidly over the year in Singapore. The citizens and the government value the individual talent from other geographies that have that hunger to create something new and something different. Individuals who have a concrete plan to involve and grow Singaporean art and culture with a track record of local engagements to showcase on a global platform are more than welcomed and offered a PR.

After having an insight into the brief procedure of applying for a Singaporean PR, there are a few basic things that need to be catered from the legal and political point of view. These include anyone with a minimum 21 years of age, at least before two to six years from the date of applying for a PR, is even eligible to make the application. The government of Singapore welcomes the arrival of people with “want to create something big and out of the box” to contribute towards the overall growth of the country.

| Stage | Action | Key Requirements / Documents | Approx. Time |

1. Eligibility & Timing | Decide when to apply — you must have held an Employment Pass with 6 consecutive months’ salary slips from a Singapore employer. |

| 6 months (minimum) |

| 2. Self-Assessment | Calculate your chances based on:

|

| – |

| 3. Application Preparation | Download & complete Form 4A (Parts A + Annexe A) and accompanying notes; submit online via ICA/SingPass. |

| – |

| 4. Supporting-Docs Upload | Scan & upload originals (with English translations if needed):

|

| – |

| 5. Processing & Outcome | ICA reviews all materials, conducts background checks, then notifies of outcome. |

| 4–6 months |

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group