- Newsletter

- August 16, 2018

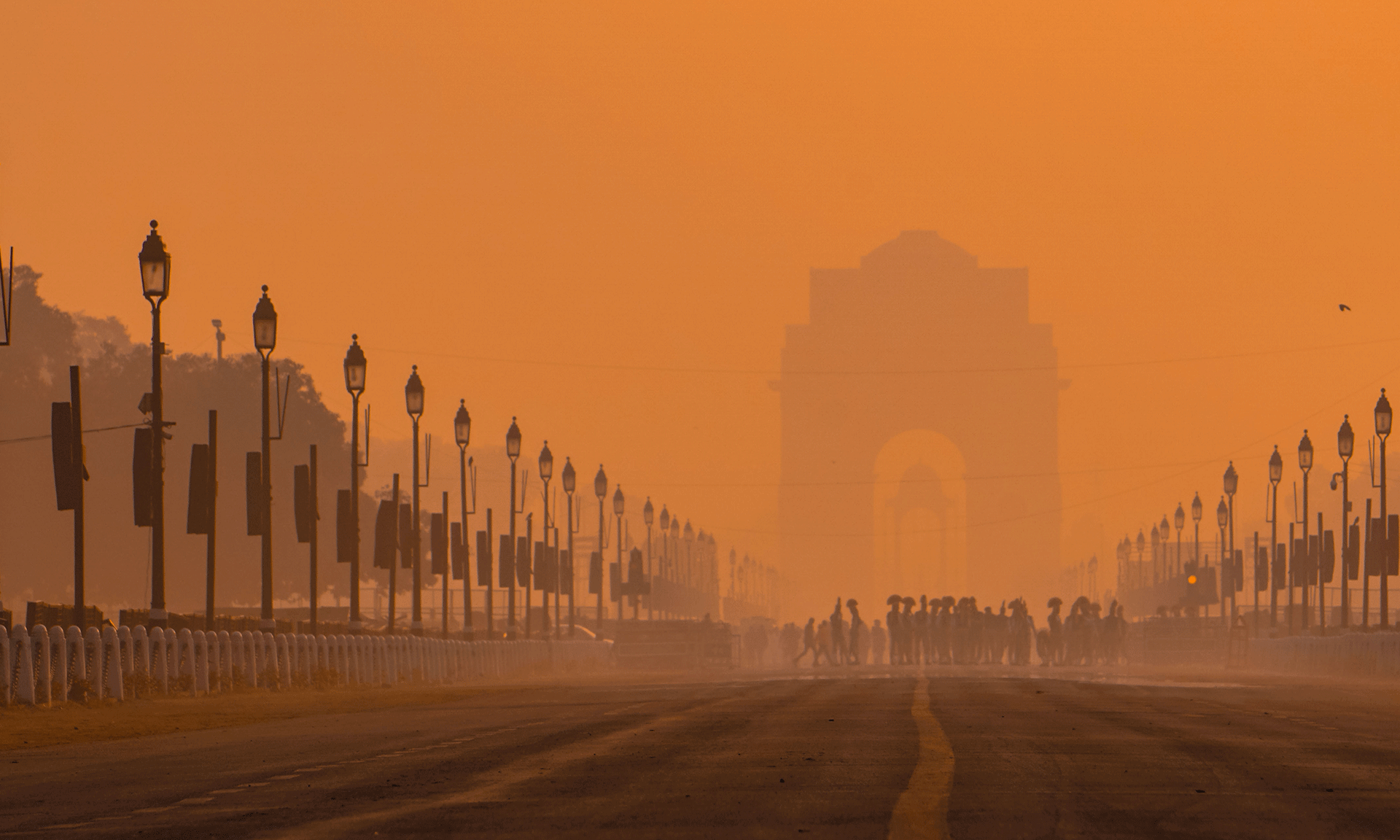

It has been a year ago, when India got to know what indirect tax was – yes, we entered the GST era. GST came out with a slogan of ‘one nation, one tax’ and has been quite a path-breaking change, which absorbed many federal as well as state taxes and also created a uniform taxation system in our country. As the cascading was removed, the goods became more reasonable and better-placed in the global market and now credit options are freely available on most products and services, which further remove defects from majority of the supply chains.

GST has opened up a new path of fiscal federalism and in this case the central and state governments exercise the powers to levy a tax all products and services. The good thing is that all decision-making in the GST Council happens by consensus and after a healthy discussion. Introduction of GST has also helped in making India stand at par with other countries in terms of global laws. This makes it easier for any country to do business in India and also increases profit margins and efficiency, therefore, attracting more foreign investments.

However, GST is a still a concept that is work in progress, and for it to be effective in the true sense, the central and state governments have to restructure the law, processes and its compliance. One of biggest challenges is that the GSTN or compliance portal of GST is not up to the mark or its best potential. It is still under automating the returns and is not able to match the invoices from the perspective of credit. Because of this, the government has now proposed to simplify the returns and, from the next year, GST will transition to a single return and the credits would be taken according to the invoice details that are uploaded by the vendor.

The current GST structure is divided five categories or rates for goods and services. These are: 0%, 5%, 12%, 18% and 28%. This needs to be simplified so that the advantages from GST could be maximized. This is also important to bring the Indian tax system at par with the global standards and also get a solution for issues regarding the interpretation and categorization of goods and services, and therefore reduce the chances of disputes. Because of the introduction of GST, the services industry went through a major transformation in its processes and functioning due to the rise in compliance procedures, which came about due to decentralized registrations.

However, the biggest plus point is that the government has taken many proactive and corrective actions like administrative simplifications and also changes in the rates. But there’s a long way to go! Besides having a better GSTN portal, a simpler return and a better law to bring it closer to an ideal GST, the current credit scheme also needs to be widened and the existing rates need to be streamlined. There is also a need for the multiple rate structure to be narrowed down to a two-rate structure. In addition, the tax base needs to be broadened to tax some particular petroleum products and property market in the coming times. The government should also re-look at the TCS and TDS provisions and also the reverse charge on the supplies from unregistered dealers. The GST refund process and mechanism should also be simplified and the exporters should be facilitated, so that it’s easier to do any business in India.

Tough the foundation stones have been laid, and the industry and revenue are moving towards a positive direction, there surely is a requirement to make amends in the law and procedures and then we can say that India is truly a model GST jurisdiction.

In case you have any questions around GST registration in India or taxation services in India, do get in touch with us. Our professional services at IMC promise you a hassle-free experience in this regard.

- Newsletter

- August 16, 2018

The new list of designated zones

Continuing the lines of the Cabinet Decision (59) of 2017 on Designated Zones, the UAE Federal Tax Authority (FTA) announced that it has granted the following free zones as designated zones last June 18, 2018:

- Al Ain International Airport Free Zone in Abu Dhabi

- Al Butain International Airport Free Zone in Abu Dhabi

- International Humanitarian City, Jebel Ali in Dubai

Businesses registered and situated within these designated zones are eligible to the special provisions for supplies of goods under the UAE VAT law.

Should you want to discuss this article in further details and you want to know the impact in your business or planning to set-up a business in a free zone, please get in touch with some of our VAT consultants in Dubai.

VAT treatment on various compensation-type payments

The Federal Tax Authority (FTA) issued a Public Clarification VATP001 in order to provide guidance on the VAT treatment of compensation-type payments such as compensation for the loss, settlement of a dispute, payment made for damaged goods, penalty or fine. The said Public Clarification states that if there is a payment for the consideration for supply, a VAT is due on such payment.

In determining whether a payment is consideration for any supply, it is necessary to consider the contractual and legal arrangements in full to determine the reason for the payment.

Eligible goods for the profit margin scheme

The Public Clarification VATP002 provides a list of goods that are eligible to the profit margin scheme. The FTA also clarified that only those particular goods which has previously been subject to VAT before the supply in question are included in the profit margin scheme.

As a result of this Public Clarification, stock on hand of the used goods that have been purchased or acquired before the effective date of Federal Decree-Law No. (8) on Value Added Tax (VAT law), or which have not previously been subject to VAT for some reasons, are not qualified to be sold under the profit margin scheme. Hence, the VAT is due on the full selling price of such goods.

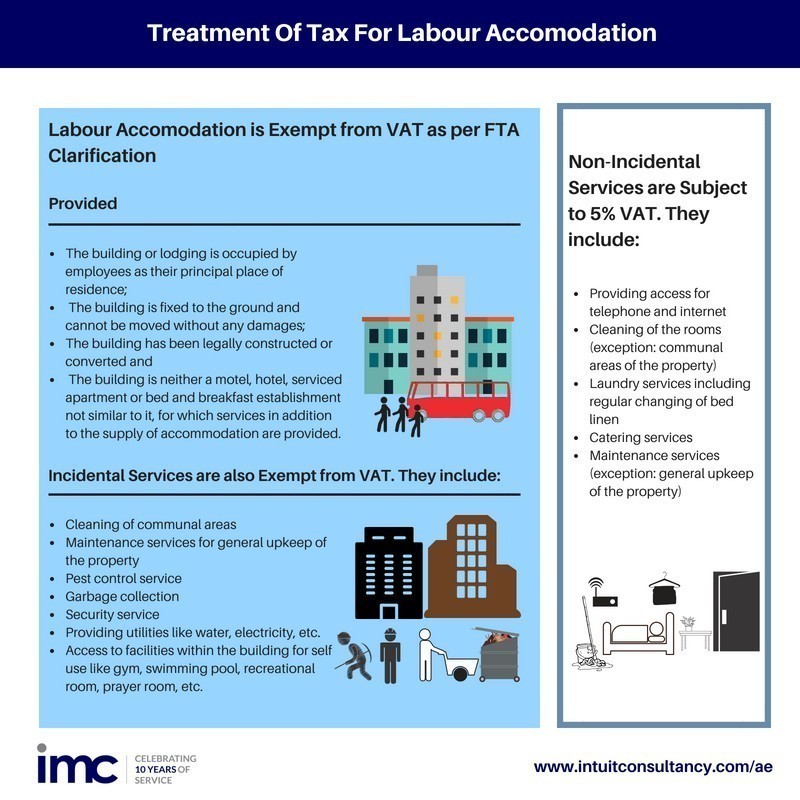

VAT treatment on labor accommodation

Based on FTA’s Public Clarification VATP003, a clear distinction is required in determining whether the labor accommodation is a supply of residential property or a serviced accommodation. VATP003 states that the services for the supply of residential property are exempt from VAT (or zero-rated if it is related to first supply of residential property). On other hand, a serviced accommodation is subject to 5% VAT.

All suppliers need to check the extent on which the additional services have been supplied related to the accommodation in order to determine the nature of the supply. Some additional services like telephone, internet access, room cleaning, catering, and laundry service could be counted as indicators for service accommodation. Whereas, if the cleaning of communal areas, maintenance services of the property, pest control, utilities or access to the facilities have been supplied, the same could be considered as supply of residential property.

- Newsletter

- August 16, 2018

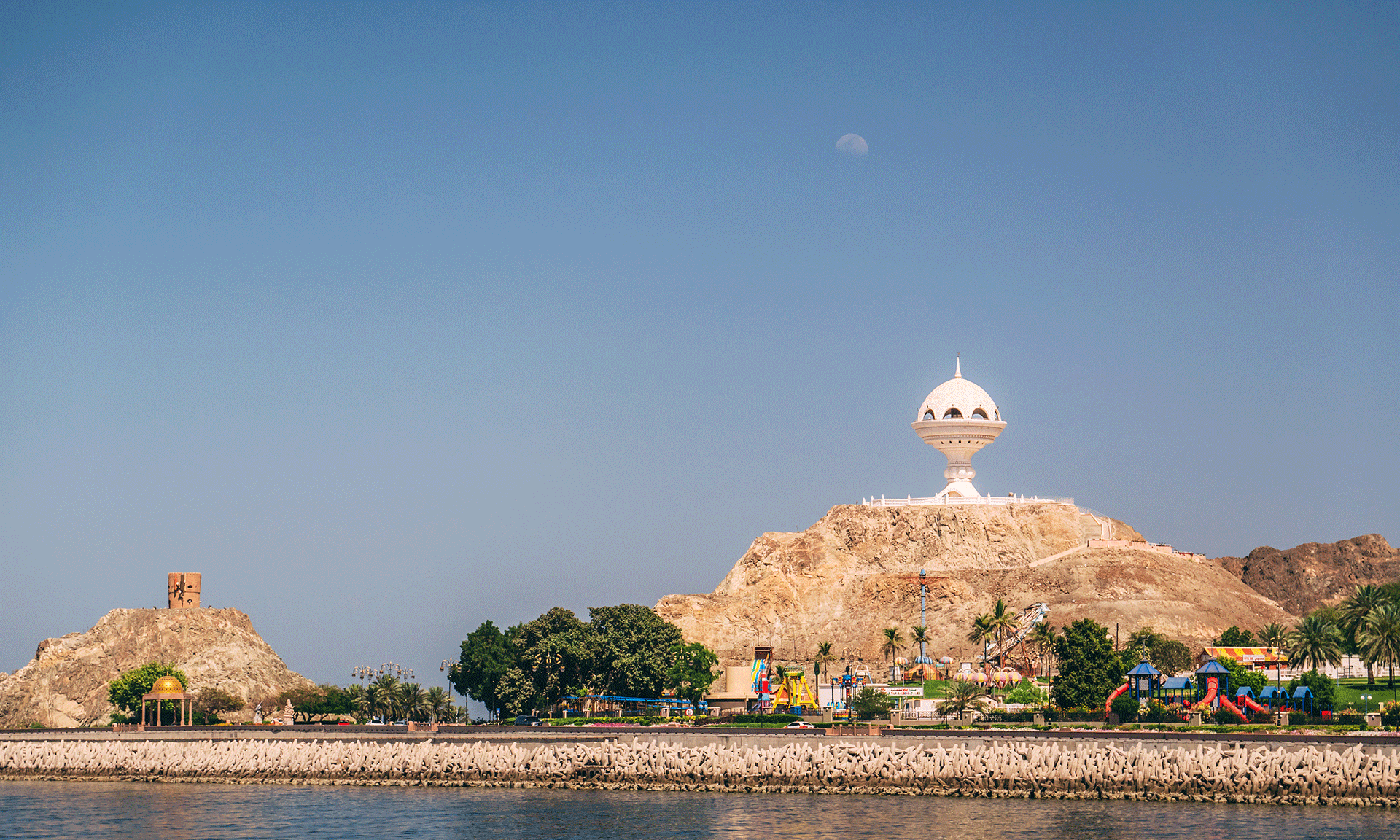

Oman is currently working on a project with South Korea with an aim to develop its first-ever ‘smart city’ which will be located in the Special Economic Zone (SEZ) in Duqm, said a report.

Oman has already taken the first step and signed and finalized a memorandum of understanding (MoU) with South Korea to start developing this smart city. A specific report on this was published by the Oman Daily Observer, which said that this new smart city will be planned in the Special Duqm SEZ and will be one of its kinds.

The South Korean entities now plan to start a comprehensive research and study focusing on finding out how the smart city principals could be developed in the SEZ of Duqm. To state the facts, South Korea has the credit of having developed the world’s first-ever smart city, which is known as the Songdo International Business District, which spreads across a huge 600 hectare area along the picturesque waterfront in Incheon Province. It will cost over $40bn to build it and the smart city would include over 100 buildings, after it is completed.

The dotted line of this MoU was signed by the relevant parties in the Oman-Korea Business Forum. This forum was attended by various high government officials both from Korea and Oman. Korea’s Prime Minister Lee Nak-Yon led the delegation and from Oman, the Minister of Commerce and Industry, Dr. Ali bin Masoud Al Sunaidy and the Minister of Oil and Gas, Dr. Mohammed bin Hamed al Rumhy, represented their country.

This MoU surely is like the first step towards a breakthrough task of applying the concept of smart city in Duqm. After this welcome step, if you are thinking of setting up your business in Oman or have any queries about company formation in Oman or accounting services in Oman, look no further. Get in touch with us and our experts at IMC will help you get a seamless experience.

- Article

- August 14, 2018

There is a growing need for PRO services in Dubai for entrepreneurs looking to set up business in the city. Dubai is one of the fastest growing economies of the world and with that, it has become a major business hub. Different business sectors like finance, logistics, business service, tourism, etc. are responsible for such quick growth of Dubai’s economy. With the booming economy, more and more businesses are eyeing to establish themselves in Dubai and this requires a lot of paperwork and formalities. Therefore, to save the valuable time of entrepreneurs and guide them on the right path to establish their businesses, PRO services in Dubai is of great significance. They look after the legal compliance, paperwork and government approvals. This lets entrepreneurs focus on their core business activities and saves their time.

Meaning of PRO Services?

PRO means Public Relations Officer; they assist companies in business setup in Dubai free zone or other areas. Some of the services provided by PRO include managing the documentation requirements of the ministries to set up business, acquiring trade licenses, assisting with the visa application, etc.

However, in the recent years, the documentation process for the business set up in Dubai has eased a lot but compiling all the documents at once can be tedious. PRO services can help in overcoming this issue and coordinate with different government departments like the Chamber of Commerce and Industry, Department of Economic Development (DED), etc. Therefore, with PRO’s assistance, businesses can expect smooth business set up in Dubai.

Services Provided by PRO

The PRO provides services such as:

- Labour and immigration cards

- Resident and employee visa

- Trademark and copyright

- Approval and renewal of trade license

- Regulatory approvals and NOC letters

- Opening a corporate bank account

- Company and branch formation

- Annual license renewals and updates

- Emirate ID card

Advantages of Using PRO Services in Dubai

The advantages of using PRO services in Dubai are as follows:

- Cost Saving

PRO services in Dubai helps in reducing the cost involving document processing and its clearance. It further helps in eliminating the cost of having a separate department for doing such work.

- Time Saving

With the help of PRO services, businesses save a lot of time in compiling the documents and standing in long queues at the government departments. Instead, the business can focus on its core areas.

- Transparent

The services provided by PRO are transparent in nature. The billing and government charges are supported with proper receipts and copies of bills. This transparency ensures businesses that they are not overcharged for the services.

- Keep a Track

PRO service providers keep a track of the documents and proceedings at the government offices. They maintain proper track of even smallest of things like when the visa of employees will expire, any compliances to be made, etc. and remind the business management regarding the same. They ensure that the company is duly complying with the rules and regulations of the government.

- Hassle Free

PRO services are completely hassle-free. They provide door to door services to the business i.e. they collect the documents from the office and deliver them to the right place. They also take the onus of monitoring the progress of any job assigned to them.

With numerous benefits, PRO services are an asset for businesses. IMC Group provides PRO services in Dubai. We have the requisite experience and expertise to help the business set up in Dubai and deal with legal compliances that follow. To know more about our PRO services, get in touch with us now!

- Article

- August 11, 2018

India’s market size is the biggest advantage for any successful enterprise. There is no dearth of customers or consumers and therefore, higher revenues. Considering this factor, opting to do your own business is any day a better choice than getting a job. You may think that getting the initial capital would be tough, but there are many such businesses in which you don’t need huge investments.

Your idea for a business doesn’t necessarily need to be a unique one. Even a small-scale business could be a good business if it’s does well on revenues and profits, along with bringing you goodwill and keeping up with some social obligations. So, we have collated a list of 10 business ideas which you could consider and begin your journey as an entrepreneur.

1. Desserts or Sweets Store:

Investment needed: Rs 50,000 – 60,000

ROI: 8-9 months

Who isn’t addicted to sweets? Especially in India, be it celebrating some special days like birthdays and anniversaries, festivals or victories in life, sweets are an important part of all Indian and South Asian culture. This makes getting into sweets business a great idea. Though it’s a mature market, if you think of a niche of specialty of desserts or sweets, there is a minimal chance of failure. What’s more? This business needs very small amount of capital and a small area to start with.

2. Gaming Center:

Investment: Rs 40,000-Rs 70,000

ROI: 6-7 Months

There’s a child hidden in all of us; and who doesn’t like playing video games, and other indoor and outdoor games? Yes, you can think of starting a gaming center. This surely will attract both children and adults. You could include video games, snooker, etc and if you don’t mind investing a bit more, then try virtual games, bowling alley etc.

3. Daily needs store:

Investment- Rs 100,000 – 150,000

ROI: 12 months

How about a all-in-one store where you get daily needs groceries, basic cosmetics and personal care products, household utilities and much more. You could strat such a store in a small space and with a small investment and may be think of expanding later after you start reaping profits. To expand your customer base, you could run festival discounts and other attractions.

4. Office Assistant:

Investment: Rs 30,000- 40,000

ROI: 4-5 months

Most of the MNCs and organizations usually have assistants who handle their day to day tasks and operations. But wouldn’t that be a job? No, you could also have a consultancy service where you could serve as an assistant to some organization; or may be even serve multiple organizations in their daily tasks. These tasks include simple operations like fixing meetings, arranging and co-ordinating events, travel etc. This business requires good networking and communication skills and doesn’t need much investment.

5. Home Tuitions:

Investment: Rs- 20,000-25,000

ROI: 3-4 months

If you want to utilize your skills and education while not investing a big amount, then you could think of starting home tuitions. May be you start with just one or two students, but if you do well, the word of mouth will be a good form of advertising for you and within no time you will have a big group of students. Here too, you could focus on any one or two subjects that you have expertise on. If you have good networking skills, after some time, you can expand your business into a tuition institute. Then, you can hire good teachers and other administration staff and reap the benefits.

6. Yoga Classes:

Investment: Rs 10,000-15,000

ROI: 2-3 Months

The ancient art of Yoga is one of the most sought after practices in today’s times. This is one of the business ideas that needs minimal investment and can be started in your home or garden. Just start a yoga class with a few people in the morning or evening. When you have enough number of clients, you could think of hiring a hall or a bigger space for your classes.

7. Book Store:

Investment: Rs 50,000-70,000

ROI: 12 months

Reading is a hobby and passion for many people these days. Be it newspapers, magazines, books or novels, starting a book store is a good idea. You could stock up books as per the city and the taste, literacy rate etc of people dwelling there. It’s also a good idea to keep books as per the age group of your customers. You could advertise about your book store through various schools, colleges and universities.

8. Fast Food Joint:

Investment: Rs 40,000- 50,000

ROI: 4-5 months

Indians have special love for spicy and street food. You could think of starting your own fast food restaurant or small joint in some market where you would get lot of customers. If you choose the correct location, your fast food joint can cater to hundreds of consumers every day. This business is hence a good idea because you can break even within a few months and then start reaping benefits provided you maintain a good quality.

9. Human Resource Consultant:

Investment: Rs 20,000- 25,000

ROI: 4-5 Months

Many big manufacturing companies require a mix of laborers, people for management and also other skilled manpower. But finding and appointing employees of various profiles is not at all easy. So how about starting a recruitment or Human resources consultancy business? You need good networking skills to do well in this business as you need to deal with both job seekers and job providers or organizations.

10. Budgeting Manager:

Investment: Rs 30,000- 40,000

ROI: 4-5 Months

Mostly, people start some enterprise in the area of their expertise, but they do not have the know-how of investments and how to procure funds etc. If you think you have knowledge of finance, you can think of starting your business or consultancy service as a budgeting manager. Even if you start with one big client, you can expand your business later with experience. In this business, you assist the clients in making decisions regarding their capital structure and how they can invest in securities.

You can choose any of these ideas depending on your skill-set; but remember that all businesses need commitment, hard work and passion. Just add your special touch, create your niche and you are good to go.

- Article, U.A.E

- August 11, 2018

One of the economical start-up is a cleaning company in UAE. Dubai has a prospective market for cleaning companies and has issued high number of cleaning company licenses. The volume of the business has increased nearly by 35% to 45%. To commence the business of cleaning, one needs to have a cleaning company license which is really low cost and a clear idea on how to set up a new company in Dubai.

So, let’s have a look at how as an entrepreneur, you can commence a cleaning company in the UAE.

Steps on How to Open a Cleaning Company in UAE

The first step to open any company is to know the market for it and to procure the required cleaning company license in Dubai. There are three primary sectors in the cleaning sector

- Industrial Cleaning Company License– this sector is mainly concerned on big office obstructs, a big team would be required to open in this sector.

- Residential Cleaning Company License– as the name suggest, this sector entails cleaning houses. It can be initiated with a little team associated with house cleaners and could progressively increase with time.

- Commercial Cleaning Company License– this sector requires a skilled cleaning service which knows how to deal with particular places. It is a bit difficult but once you find the right market it is potentially the most rewarding sector out of all.

2. Market Investigation

Any business requires market for it to run. In order to run a profitable business, researching the market to commence the cleaning service is within the demand. It is important to understand the local demographic as well as the potential marketplace before making a business plan.There are not much economical changes in the field of cleaning; it still requires an entrepreneur to be constantly updated with the latest government and environmental policy, customer preferences and technological developments.

Doing Business in the UAE

Having a system which is consistent and efficient allows your business to run well even in absence of the owners and makes sure to align all the employees to a common goal. Consistency in a system helps to develop efficiency.

Dubai is a multicultural country and there are two or three main languages (Arabic, English and Hindi). Having a customer relationship manager who is able to communicate well with different customers and is able to speak two to three languages (that are used in UAE) is important for the cleaning business to bloom. A standard training should be given to the staff in order to excel in the business. Staff should be able to conduct cleaning at various places with the same quality. Therefore, for the cleaning company to be thriving, it is better to have a standard training for all the staff members. A cleaning company is nothing without its equipment and staff. Cost of the equipment depends on the field selected by the company. For example, the household cleaning company might not need equipment as it has access to household items whereas the commercial cleaning company will need costly equipments. Purchasing equipments is an important step and therefore all the factors should be considered. Advertising and Marketing the company services is the core step which will bring clients. Use the 4P’s from the Marketing Blend i.e. Place, Product, Price and Promotion which will help to assess the marketing strategy. For residential cleaning companies, advertisement can be done through Internet, newspaper ads. For commercial cleaning company, best way is to make sales calls, drop off sample price list and follow up calls. Apart from these old methods, making use of social networks and blogs will help to reach a larger mass.

Dubai has a wide range of websites and portals wherein the business can be placed. This helps to reach out to larger base of customers. It is important to use all possible resources in order to run a flourishing business.

UAE Economic Substance Regulations: Compliance & Filing Guidance

Cleaning services in Dubai are charged as per hour rates. Procuring a cleaning company license in Dubai is easy and low cost and therefore the cleaning sector is in bloom in UAE. The second step is to know the location as to where the company should be set up. Depending on the location, business can be classified as under:-

- Mainland Business Set Up – A local sponsor owning 51% shares of the company is required to set up a Dubai Mainland Company. The foreign investor will own 49% shares in the company.

- Business Set Up in Dubai Free Zone–Setting up a business in Dubai Free Zone is much more beneficial as it gives the entrepreneur 100% ownership of the business. Adding to it, there are no taxes, grant of visa for 3 years for investors, staff and family members. Staff can be employed easily as there are no mainland labour rules.

You can register as a professional or as a cleaning company in Dubai. In both the cases, the registration process will be managed by Department of Economic Development (DED). We at IMCGroup, provide services to businesses in Dubai for the past several years. You can contact us to setup your cleaning company in Dubai. As the business volume has rapidly increased by a margin of 35 percent to approximately 45 percent in the past decade as mentioned before, the surging cleaning business aims to provide better quality and more reliable services for both individuals and corporations to get a stronger foothold realizing that cleaning is not a job preferred and loved by everyone.

If you are planning to get a cleaning company license in Dubai, there are external consultancy services who can assist you out in setting up a cleaning company in Dubai for taking care of the many legalities involved. Setting up a cleaning company can come very cheap provided you can find and get the necessary help from experienced and expert sources. A Cleaning company license in Dubai is a low-cost license. You can obtain a cleaning service license under Dubai Mainland in approx. AED 35000 to 45000 and makes a cleaning company set up very easy to initiate. This cost will cover the fee for Trade name reservation, initial approval of the business activity, License fee, your local sponsor annual fees, including registration fee towards Immigration and Labor department clearance, and that too in a demanding and competitive cleaning business market.

As evident, there are several steps to be followed before you receive a cleaning company license in Dubai and for succeeding in your endeavor, must plan for appropriate conventional and digital marketing strategies. There are three most important sectors for starting a cleaning company in Dubai and every sector needs a particular set of skills for optimized cleaning operation and business success. This cleaning company license in Dubai enables you to mainly focus on big office blocks requiring a big team to wash every floor including an administration wing to handle overall cleaning operation from the back office. This cleaning license entails cleaning household properties e.g. houses, apartments, residential blocks, and such work is usually undertaken once the house owners leave for work. It can be done with a small team consisting of cleaners and the number you can scale based on the quantum of work. This license is usually for contractual cleaning. This particular operation of cleaning requires well-equipped and skilled manpower that knows how to handle the commercial place. It is usually not that easy to secure contracts at first however when you establish yourself in this cleaning business it could be a very lucrative one. Dubai Cleaning services license has a broad variety of Sub Business Activities that can be added to your Business License and are as follows.

Activity Group: Motor vehicle repairing

License Type: Professional

Activity Description: Car cleaning license Dubai allows you to engage in car washing and cleaning services; through immovable automatic or manual washing stations.The UAE including Dubai is a huge and growing market for all the Cleaning Businesses. Almost 60% of the population in Dubai are expatriates who are basically busy with their huge workloads and day to day schedule and don’t find time for cleaning activities.

There have been issuance of a high number of cleaning company licenses in Dubai in the recent past and grew remarkably over the last few years reflecting the rapidly growing demand for cleaning activity.

- Article

- August 11, 2018

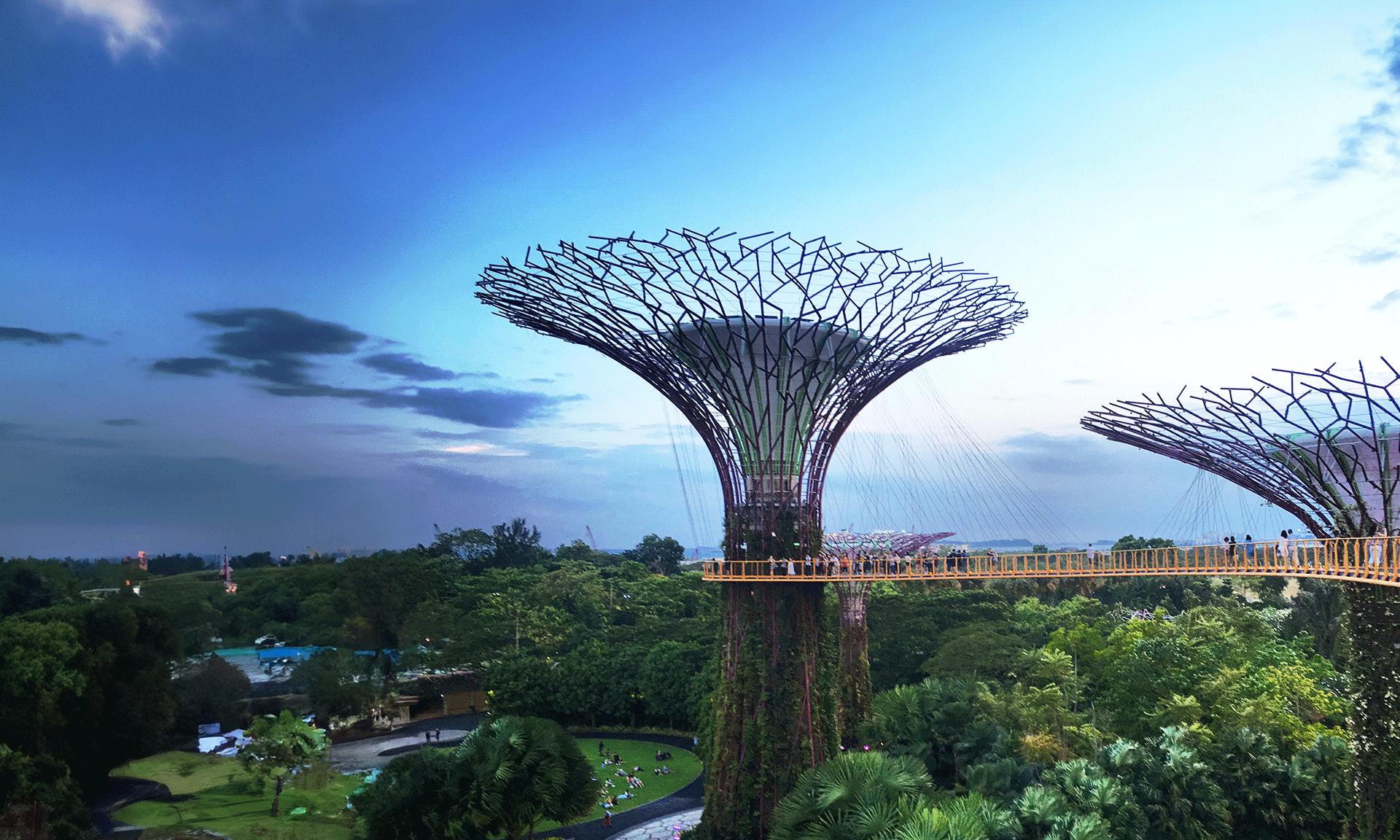

Singapore attracts companies, startups and entrepreneurs from all the corners of the world owing to its robust business environment and trade-friendly policies. If you are looking to set up your business here, we present to you a guide on the types of licences, the licences applicable for your business and the permits required from the Singaporean government before the conduct of your business. Let’s read on.

What Are The Different Types of Licences?

Depending on your business type, there are three different types of licences.

- Compulsory Licences

As the name suggests, this licence is mandatory and must be obtained even before you can begin conducting your business operations. For example, if you plan to set up a child care establishment, you need to first obtain a child care centre licence before you can commence any operations.

- Occupational Licences

This licence is to be procured by professionals such as doctors, lawyers, architects and accountants. One cannot begin with their practice if they have not procured such occupational licence beforehand.

- Business Activity Based Licences

These licences are business-specific and not required by all types of business corporations. For example, if you are setting up a convenience store, you first need to obtain a liquor licence if you intend to sell liquor in your store.

Which Business Licence Is Applicable For My Business?

In Singapore, most of the business enterprises do not need to obtain permits from governmental agencies or a business licence. However, for that, their company registration must have been filed and approved by the Accounting and Corporate Regulatory Authority (ACRA). ACRA is Singapore’s Registrar of Companies. There are certain entities that require State approval before they can commence their business operations. They fall under more stringent rules and have to obtain prior permits and licences to function effectively.

Following are some industry-specific licences for which you need to take special permits from the government of Singapore before you can begin your business operations:

- Retail Business

As far as Retail Business is concerned, the licence requirements depend on the products or services being sold to the public.

- Supermarket retailers require a supermarket licence as per the Environmental Public Health Act. This licence ensures that raw as well as cooked food supplies confirm with the food hygiene standards set as per the act.

- Telecommunication retailers are required to procure a Dealer’s Class licence from the Infocommunications Development Authority of Singapore (IDA) and notify them about the intended retail outlets and their location.

- Chinese Proprietary Medicine retailers need to procure from the Health Sciences Authority of Singapore (HAS) a Wholesale Dealer’s Licence for Chinese Proprietary Medicine (CPM).

- A certificate of registration from the Health Sciences Authority of Singapore (HSA) is mandatory for retailers of drugstores or pharmacy.

- A cosmetic products notification is required to be procured by retailers of cosmetic products from the Health Sciences Authority of Singapore.

- A liquor licence is required to be procured from Liquors Licensing Board by the liquor retailers.

- Food and Beverage Business

If you are interested in setting up your own restaurant or any enterprise related to food and beverages, following are some licences that you may require:

- A food shop licence must be procured from the National Environment Agency (NEA) for retail of food and beverage products. This is a mandatory requirement under the Environmental Public Health Act.

- You require a registration number with the Agri-Food & Veterinary Authority of Singapore (AVA) if you wish to import processed food products or food appliances.

- If you sell liquor and tobacco as part of your F & B business, then you will require additional liquor and tobacco licences for their retail sale.

- Travel Agency

If your business is covered under Section 4 of the Travel Agents Act, you must procure a Travel Agent’s licence with the Singapore Tourism Board. Section 4 basically covers the sale or arranging of tour packages and selling of tickets.

- Child Care Centre

Those looking to establish a child care centre must file their application for a child care licence with the Early Childhood Development Agency (ECDA).

- Educational Institution

Registration with the Ministry of Education and Council for Private Education is required if you wish to set up an academic school. Other recommended certifications include EduTrust and Singapore Quality Class (SQC) certifications.

- Employment Agency

You must obtain a licence from Employment Agency License from the Ministry of Manpower (MOM) if you are seeking to set up a job placement organization or recruit labourers.

Get in touch with us if you are interested in Singapore company formation and our team of experts would be happy to assist you.

- Newsletter, U.A.E

- August 7, 2018

UAE Federal Tax Authority has published a clarification on the Value Added Tax (VAT) treatment for labour accommodation. As per the clarification, labour accommodation is exempt from the VAT. Incidental services which are basic and considered necessary are also exempt. While non-incidental services which are beyond the basic provision are subject to 5% VAT.

- Article, U.A.E

- August 4, 2018

Dubai has one of the fastest growing economies and therefore a perfect place to expand one’s sphere and even to earn well. The diversity of people, highly established structures, good infrastructure, fastest growing economy and economic stability have attracted a lot of small businesses in Dubai. The establishment of small businesses is the key to Dubai’s future growth, although the licensing and new company registration is a bit complex.

So, let’s have a look at how as an entrepreneur, you can open a small business, a retail shop or a grocery shop in the UAE.

Steps on How to Open a Small Business / Retail Shop / Grocery Shop in UAE

- Know Your Business

The first step to commence any business is to know the demand for it in the market. It is important to have sound knowledge of the local region, demandfor the product or service and a thorough research into viability of the business. Choosing a legal entity (example, sole proprietorship, partnership, limited liability partnership) is a deciding factor as to how much you want to grow in the future.

- Business Plan

After knowing the demand for the business, the next step is to have a business plan. A business plan is required to secure a source of funding. A credible plan might attract local support as well as government support.

- Know your Location

The selection of location plays an important role in setting up a business in Dubai. A businessman should be aware of whether he wants to set up business in Mainland or in Free Zones. He should be aware of the benefits so as to decide the location of the business. For example, a grocery shop should preferably be set up in or near a shopping centre, restaurant, bookstore or coffee store.

- Local Partner

If the business is set up in Free Zones, the company can be owned 100% by you. But the business set up outside Free Zones require local business partners holding a majority interest in the company. A local partner can be an individual or a company.

- Equipments for the Store

The type of equipments you will require depends on what you plan to sell. For example, a grocery store would require freezers, refrigerators, carts, baskets, shelves. Having good and all necessary equipments can help in smooth functioning of the business.

- Financial Viability

A business requires funds to start and to grow. Having a good financial viability will attract more and more investors and hence will help the business to grow. Even the Ministry of Commerce will require the owners to show records of financial investment once the business is registered.

- Inventory Management

This is one of the most important aspects after opening a retail or small shop. Improper inventory management can make you lose money. For example – if there is excess inventory, then the groceries can run bad before they are put for sale.

- Advertising

Once the shop is set up, getting new suppliers and promoting the business in order to attract customers is the key requirement. You can promote the shop by flyers, banners and even via social media, blogs, etc. Promotion technique these days include putting huge sales, attractive decorations in the shop, releasing coupons, etc.

- Friendly Staff

These small shops/retail shops require staff that can communicate properly and is friendly. Staff who can go above and beyond for the customers should be appointed.

- VAT

Setting up a small shop, retail shop or a grocery shop has benefit in VAT Registration in Dubai. Any shop having a turnover of less than Dh 187,500 does not require registration under the VAT law in Dubai.

The registration process might get on your nerves and therefore it is advised to seek the expertise of a business consultant in order to save your valuable time. We at IMC Group, provide services to businesses in Dubai for the past several years. Get in touch with us if you are looking to set up a small shop or a retail shop in Dubai.

- Article, Singapore

- August 4, 2018

The Singapore government has offered a wide range of startup schemes and grants to promote the growth and expansion of businesses in Singapore. In fact, to get ahead of the fierce competition, the Government of Singapore recently rolled out Startup SG in March 2017. The aim of this launch was to provide an enhanced and innovative business environment to gather fresh startup talent from all the corners of the world. Such measures taken by the government are proving beneficial in propelling the country towards a thriving start-up ecosystem.

Why Does Singapore Appeal to Global Entrepreneurs?

The primary factors that contribute to the flourishing state of Singapore’s microbusiness ecosystem are its political and macroeconomic stability. In addition to these, a strong judicial system, corruption-free bureaucracy, and robust regulatory institutions have provided a thriving business environment in the nation. Other factors include state-of-the-art infrastructure, financing schemes and cash grants by the government, and tax incentives, among others.

Startup SG in Singapore

Startup SG is an umbrella branding that brings together all the support schemes for startups in Singapore. It is basically a launch pad for all the global entrepreneurs that offers them a platform to connect with the global entrepreneurial network and also gain access to the local support initiatives.

The six pillars of support include the following:

- Startup SG Founder

This scheme was developed for new entrepreneurs with an innovative business. It provides up to $30,000 by matching $3 to every $1 raised by the entrepreneur. Along with the funding, mentorship and business guidance will also be provided to such entrepreneurs from Singapore-based incubators. This scheme can be applied only through an Accredited Mentor Partner (AMP).

- Startup SG Tech

The grant offers project funding to local Singapore companies to develop a breakthrough technology. With this grant, such companies will receive funding for POC (Proof-of-Concept) and POV (Proof-of-Viability) projects. POC projects are designed to test the technical and scientific viability of a new technology. POV projects are designed to test the commercial viability of a lab proven technology. POC projects can receive funding up to S$250,000 whereas POV projects can receive up to S$500,000.

- Startup SG Equity

Startup SG Equity is an investment fund managed by SPRING Seeds Capital and SGInnovate for funding startups that require higher capital expenditure and take longer to become commercially viable.

The eligibility criteria for the startups include the following:

- The company must be a private limited company incorporated in Singapore having a paid-up capital of S$50,000 minimum.

- The company must not be a joint venture or a subsidiary.

- The company must not have been in existence for more than 5 years.

- The core activities of the company must be carried out in Singapore.

- A third party investor ready to invest in the company must be identified by it.

- The company must have high growth prospects and international scalability.

- The company must demonstrate that its applications have substantial intellectual content and are highly innovative.

- Startup SG Accelerator

Startup SG Accelerator provides funding for incubators that assist in developing and mentoring new startups in high growth industries. Some of the sectors in the list of accelerators and incubators include the following:

- Cybersecurity

- Smart Logistics

- FinTech

- MedTech

- Robotics

- Data Analytics

- Artificial Intelligence

- Internet of Things

- Startup SG Loan

These are government-backed loans that are offered through Participating Financial Institutions which can provide startups with the much-needed working capital. Trade financing and equipment/factory financing are also covered by such loans. Startup SG Loans include SME Micro Loans that are applicable for companies with less than 10 employees to support their day-to-day business needs with financing up to S$100,000.

- Startup SG Talent

This pillar includes schemes such as the EntrePass, T-UP and SME Talen Programme (STP) for startups. EntrePass is a work pass scheme that eases the entry and the stay of global entrepreneurs in Singapore so they can contribute their skills to the local skill-sets and make for a more vibrant start-up ecosystem.

If you are looking for company registration in Singapore, get in touch with us. We can assist you with Immigration and Visa services and also offer taxation services once your company has been established.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group