Singapore’s Digital Economy Partnership Agreement (DEPA) with New Zealand and Chile came into effect on January 7, 2021.

DEPA is a digital-only trade agreement, which aims to establish new ways and collaborations in digital trade issues, promote interoperability of different countries and address new issues caused by digitalization.

First signed in June last year, DEPA is the world’s first of its kind digital trade agreement that establishes a common set of digital trade rules and digital economy collaborations for the removal of digital barriers, fostering a new form of economic engagement especially at a time when many business activities have gone online.

Singapore has been aiming to build on its network of digital cooperation agreements and international frameworks to support businesses and SMEs engaging in cross-border digital trade and e-commerce. Additionally, DEPA will encourage greater cooperation in newly developed areas such as artificial intelligence and provide organizations the capacity to try new technologies across different countries with lower operating costs and better data protection.

Besides this year’s DEPA with New Zealand and Chile, Singapore has also signed DEPA with Australia through the Singapore-Australia Digital Economy Agreement (SADEA), in December 2020. The country is also in exploratory talks with South Korea and the UK to develop a similar bilateral Digital Partnership Agreement.

The Government of Singapore’s DEPA initiatives is in pursuit of further strengthening its footprint as a global leader in technology and e-commerce including the promotion of the country’s extensive free trade agreement (FTA) network for Singapore company formation by foreign investors.

Key Features and Benefits of DEPA

DEPA will establish new and innovative ways to digital trade issues that will help foreign business owners lower the costs of their operations and improve market access with the added advantage for Singapore company incorporation.

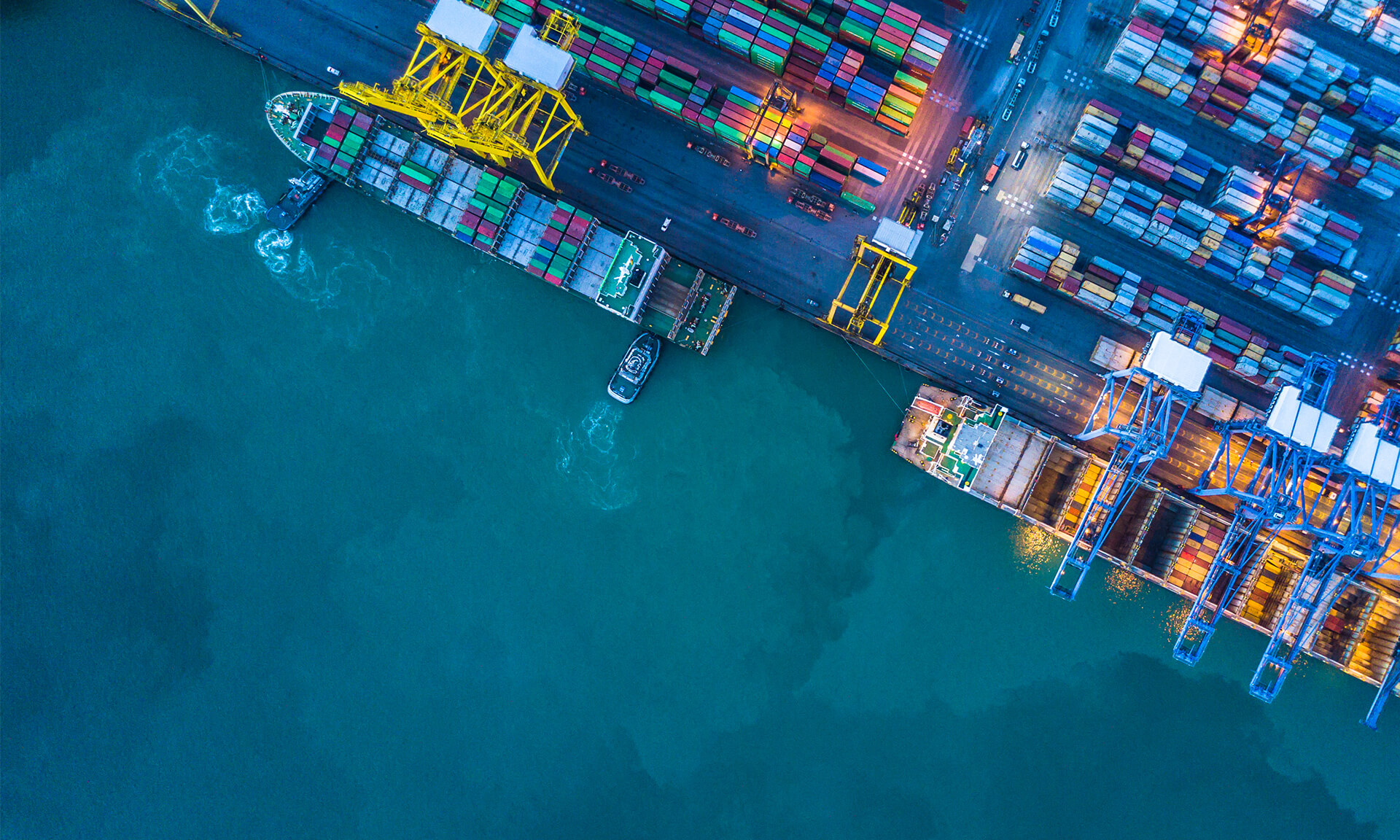

Paperless trade

A key feature of DEPA is that it will encourage paperless trade and reduce document transit and cargo clearance time improving business effectiveness.

An exporter in Singapore can easily apply for an e-certificate of origin with an electronic SPS certification for onward transfer to the customs of the destination country.

Paper trades drastically reduce the cost competitiveness and operational efficiency due to the cost of papers and higher waiting time.

Fintech and e-payments

DEPA advocates greater acceptance of payments due to increased interoperability between different payment systems enabling cross-border payments much easier for NBFCs such as fintech firms.

It was in early December last year when Singapore issued its first digital banking license enabling non-bank entities to offer similar services as conventional banks.

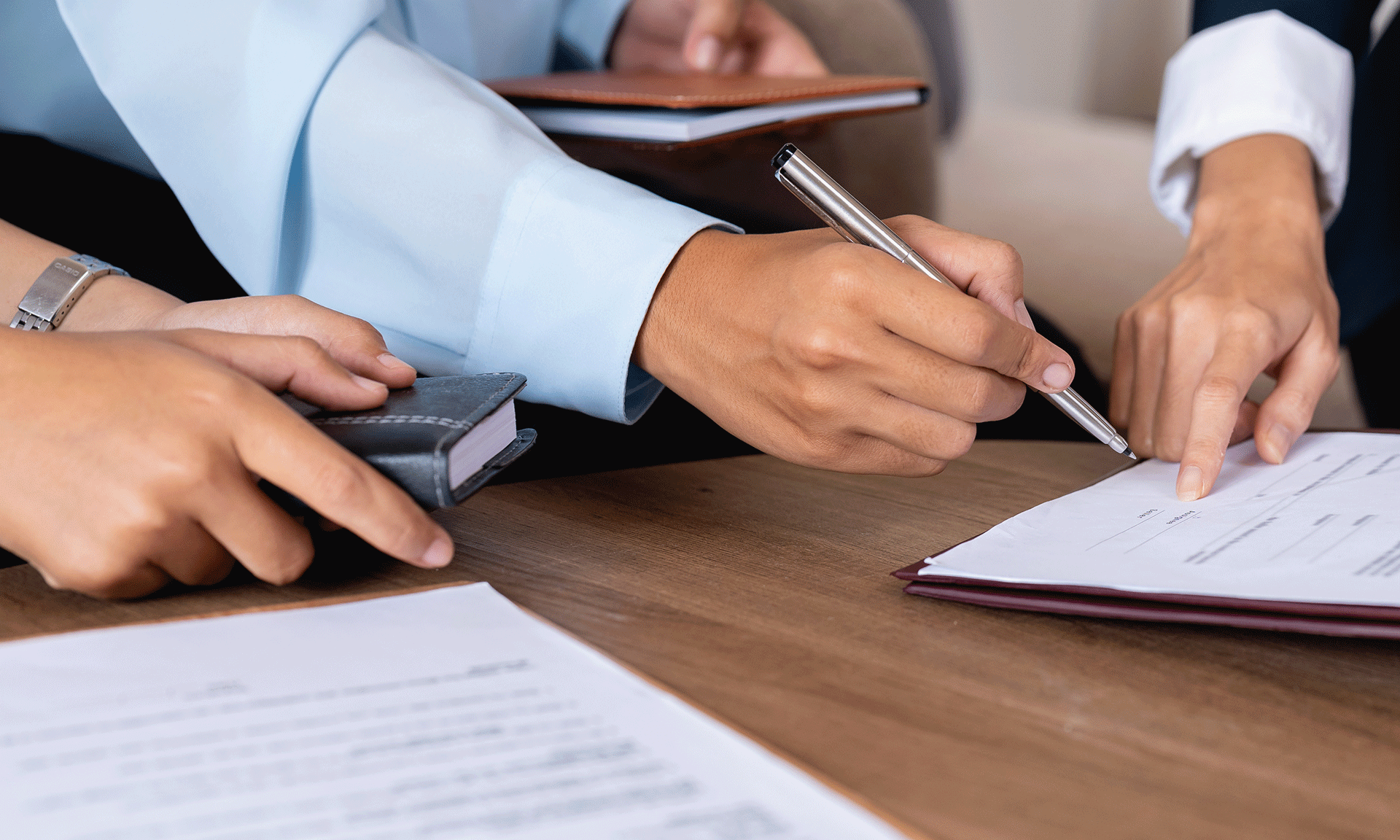

Electronic invoicing

DEPA will ensure e-invoices in Singapore are recognized in Chile and New Zealand for shorter invoice processing time, faster payments, and cost savings by embracing similar e-invoicing standards.

Pan-European Public Procurement On-Line (PEPPOL) e-invoicing solutions will also be available in Singapore SMEs.

Digital identities

DEPA will enable countries to develop safe and secure mutually recognizable digital identities that can streamline many business processes such as opening a bank account, registering a company, etc.

Partners within DEPA can facilitate initiatives that promote the compatibility of different digital identity regimes. In doing so, procedures such as Know-Your-Client (KYC) checks by banks can be done more efficiently and in any DEPA partner country, since the bank only requires the company’s digital identity. This due diligence process currently can take over three months to complete.

Data innovation and artificial intelligence

Parties in DEPA will allow data to flow freely across borders which, in turn, facilitates a conducive environment for businesses to develop new products and services from data-driven innovations.

This includes the use of AI for which there will be the adoption of an ethical AI governance framework. This will ensure that DEPA partner countries responsibly harness AI.

Furthermore, this digital agreement means businesses can pilot and commercialize their data-driven products and services with overseas counterparts from DEPA, therefore accelerating cross-border innovation.

Personal data protection

DEPA will ensure greater personal data protection during the transfer of data across borders by developing mechanisms based on international frameworks.

Business organizations in Singapore can now opt for Asia Pacific Economic Cooperation Cross Border Privacy Rules (APEC CBPR) certification and once certified, can demonstrate the company’s strong data protection and security policies consistent with the APEC Privacy norms.

Besides, the CBPR certified companies can exchange data with other certified companies in Singapore’s DEA network, as well as with other regimes which are already certified as per APEC CBPR System.

DEPA will build trust in digital systems facilitating opportunities for participation in the digital economy and promoting the adoption of AI governance framework and responsibly utilizing AI.

IMC Group

IMC Group