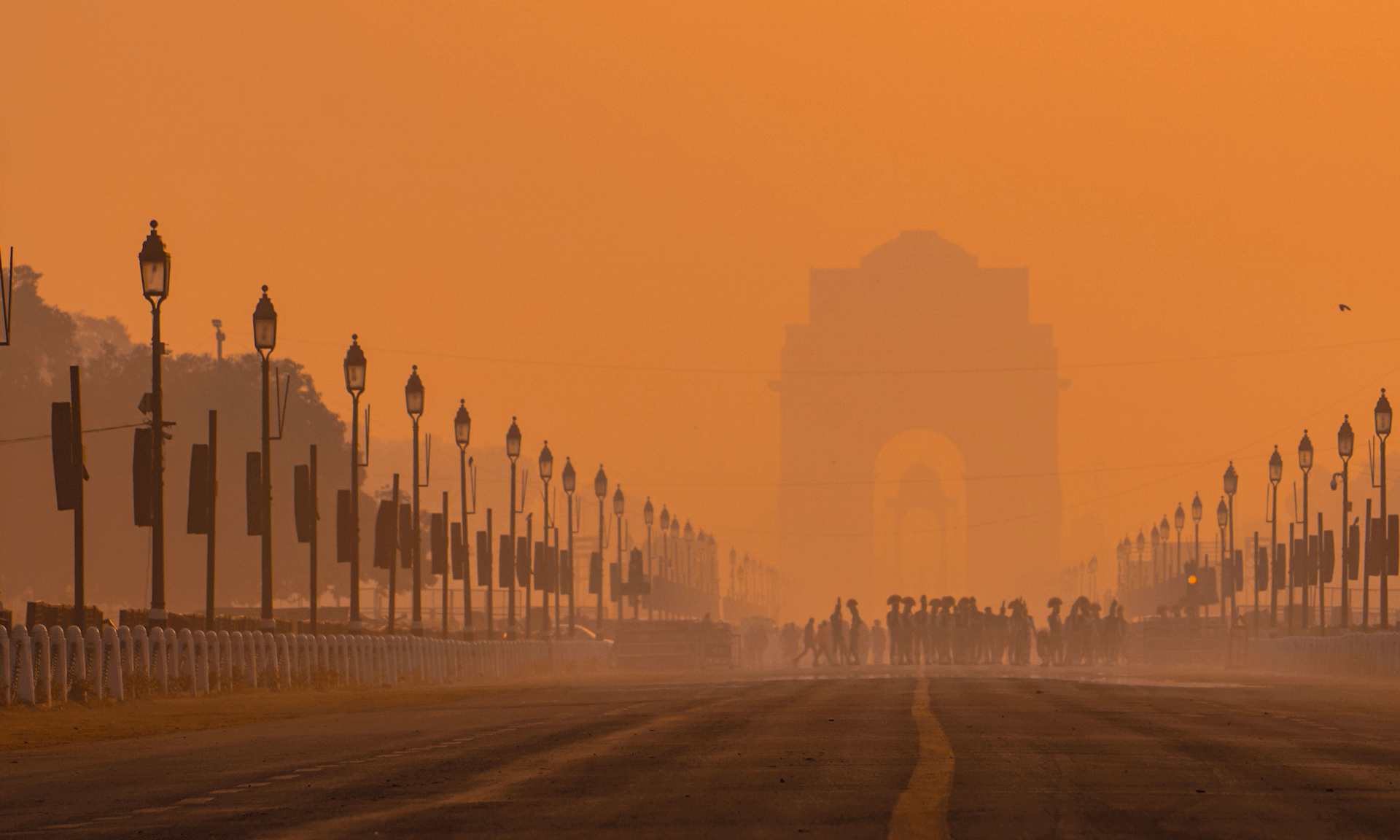

High net-worth individuals (or HNI’s as they are often called) have recently generated a surge of international investing as they urged Indian-owned family offices to develop partnerships with foreign investors in Singapore and Gulf countries. According to the Reserve Bank of India’s (RBI) liberalized remittance scheme (LRS), an Indian citizen is allowed to invest up to $250,000 abroad each year in bonds and stocks. Over the past 4 to 5 years, India has been outperformed by global markets. The fact that the Rupee has depreciated against the US dollar has made them more attractive to foreign investors.

Why should You consider investing Abroad?

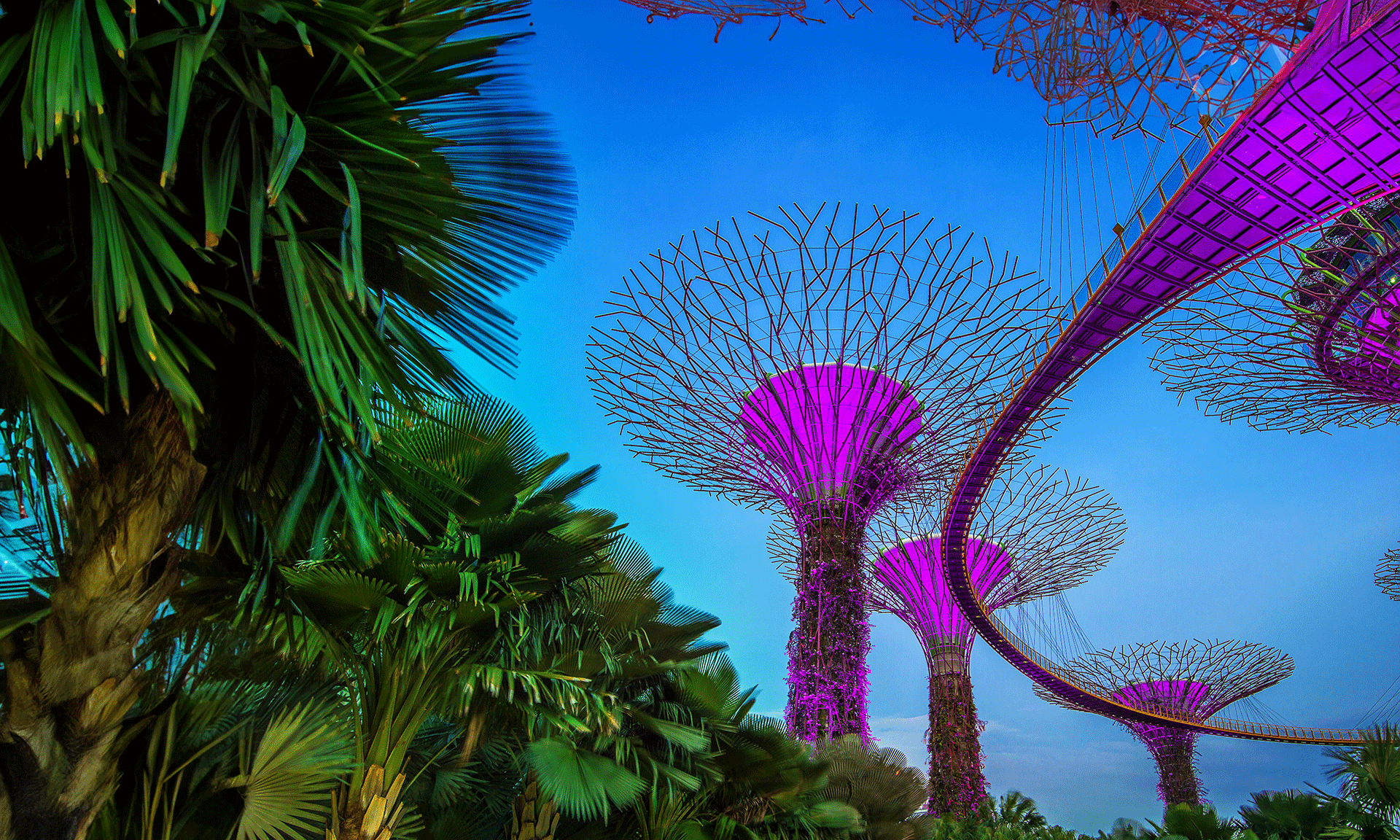

Singapore has been putting its marketing efforts into attracting foreign investors from around the world. As a foreign investor, establishing a business is relatively easy. Singapore and UAE are cosmopolitan, multicultural sovereign countries that are well connected globally. Furthermore, their business environment is conducive to creative and knowledge-driven companies. Most importantly, these countries are strategically located at the main intersection of Europe and Southeast Asia and have excellent infrastructure.

Currently, even in the pandemic the governments of the Gulf Corporation have given rebates on taxes and other levies have been removed to ensure that family business in Gulf Cooperation with restricted liquidity and lower profits are able to maintain and thrive during these difficult times.

Compared to other countries, Singapore’s attractive tax system, sophisticated banking system, and strong legal framework have given it the competitive edge. Other positive factors that have helped this city-state attract foreign investors include:

- An educated workforce

- Ease of Singapore company incorporation

- Lower corporate taxes

- Numerous investment opportunities and incentives

- Strict enforcement of intellectual property laws

In addition to the above, Gulf countries and Singapore is an excellent place to live, learn, and work. These countries have long been recognized as some of the most competitive entities globally and are a frontrunner in several industry areas including:

- asset and wealth management

- insurance treasury operations

- international banking

- maritime finance

- trade finance

As a result, many international companies have established a base in Singapore and in the Middle Eastern countries and have taken advantage of what it has to offer foreign investors. They have utilized its diverse capital markets and their state-of-the-art financial investment services. The basic incentive for HNIs to invest in Gulf countries and Singapore is the tax advantage and investment policies that offer better growth prospects for their businesses.

What else makes Singapore attractive to foreign investors?

In recent years, Singapore has gained prominence as a favorable destination for the centralization of certain activities such as finance, IT, and logistics. This provides companies with certain benefits including enhanced productivity, lower operating costs, and superior customer service. Compared to other countries, company formation in Singapore is relatively easy. The city-state offers certain incentives that are targeted towards foreign investors from specific industries who can apply directly to the city-state government for them. For the foreign investor, Singapore offers one of the highest rated communications infrastructures when compared to Hong Kong and Malaysia.