In a bid to boost bilateral trade and investment, India and Oman during the ninth session of India -Oman joint commission meeting (JCM) reviewed the recent developments in businesses and trades and reaffirmed their commitment to expand bilateral trades and encourage businesses to invest in each other’s country to realize untapped potentials in commercial and economic relationships.

The ninth India-Oman CM was held in October 2020 through a virtual platform and was co-chaired by Hardeep Singh Puri, Minister of State for Commerce and Industry and H.E. Mr.Quis bin Mohammed Al Yousef, Minister of Commerce, Industry and Investment Promotion of the Sultanate of Oman.

Bilateral trade between the two countries has increased to USD 5.93 billion in 2019-20 registering a growth of 8.5%. India -Oman agreed to cooperate in the areas of Agriculture and Food Security, Standards and Metrology, Tourism, Information Technology, Health and Pharmaceuticals, MSMEs, Space and Civil Aviation, Renewable Energy, Mining, Culture and Higher Education.

Indian companies are already invested in Oman and in Steel, Cement, Fertilizers, Textile, Cables, Chemicals and Automotive Sectors. There are already more than 4000 Indian business establishments in Oman with an estimated investment of 7.5 billion USD.

Company formation in Oman has been encouraged by the Oman Ministry of Commerce, Industry and Investment promotion and assured liberal benefits for Indian companies.

As per a press release, “Both sides also agreed to expedite their internal procedures for signing ratification of the protocol amending India-Oman Double Taxation Agreement and conclusion of the India-Oman Bilateral Investment Treaty.”

India and Oman reviewed and assessed the progress of the proposed MOUs in different sectors and mutually agreed to conclude them promptly. Indian representatives appreciated Oman for signing the International Solar Alliance Framework Agreement.

India has long been associated in business and trade with Oman and has enjoyed a friendly diplomatic relationship. Increasing bilateral trade and investment between the two countries and a strategic partnership reinforced a need to review and expedite the double taxation treaty and procedural amendments as appropriate.

The India Oman business ties have been robust and expanding for quite some time now and India is Oman’s one of the top trading partners. For Oman, India has been its third-largest source of imports and also the third-largest export market for its non-oil products.

Mr. Hardeep Singh Puri highlighted recent initiatives undertaken by the Indian Government for enhancing the ease of doing business in India and promoting business through Product Linked Incentive (PLI) schemes in various sectors. He also invited Oman business enterprises and Omani Sovereign Wealth Funds to invest in India.

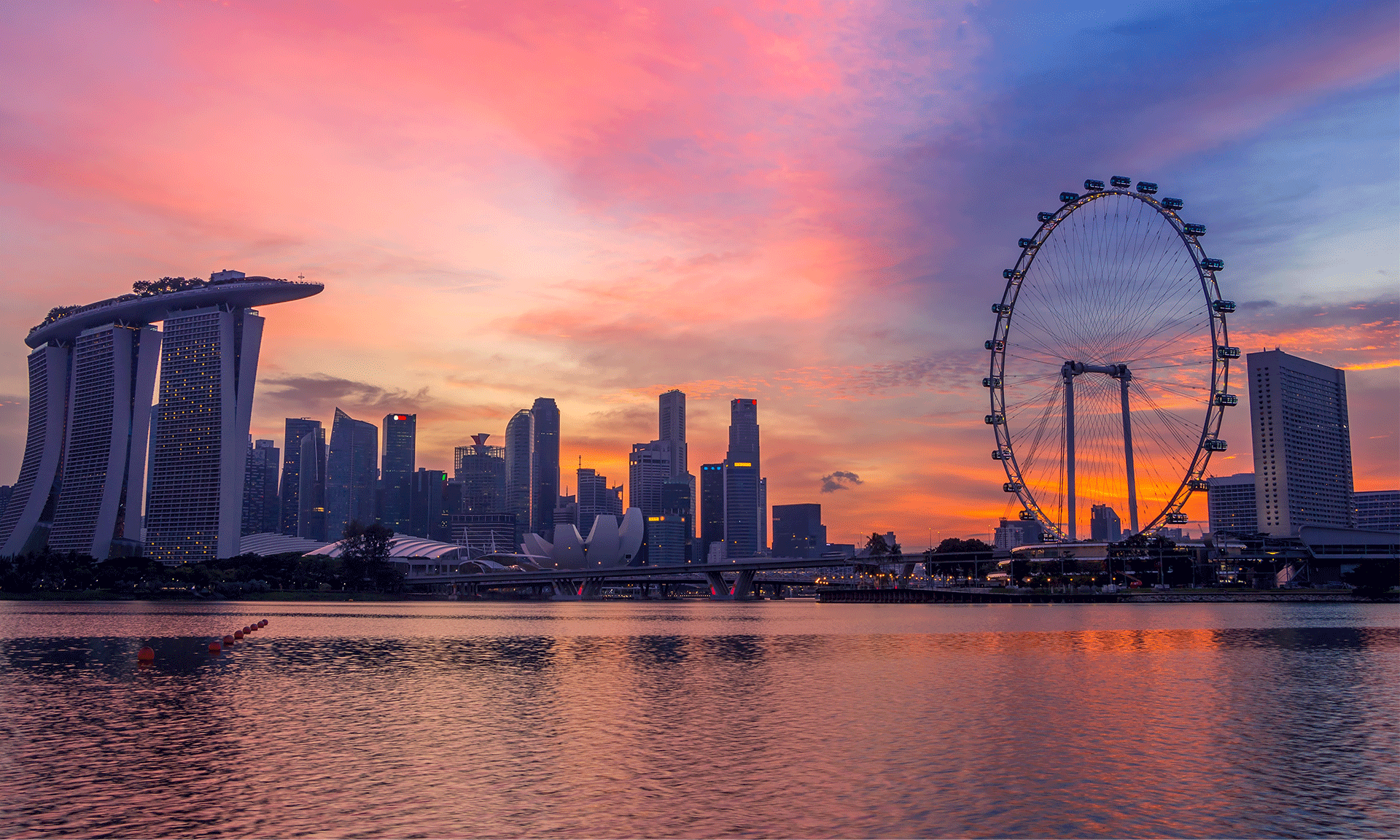

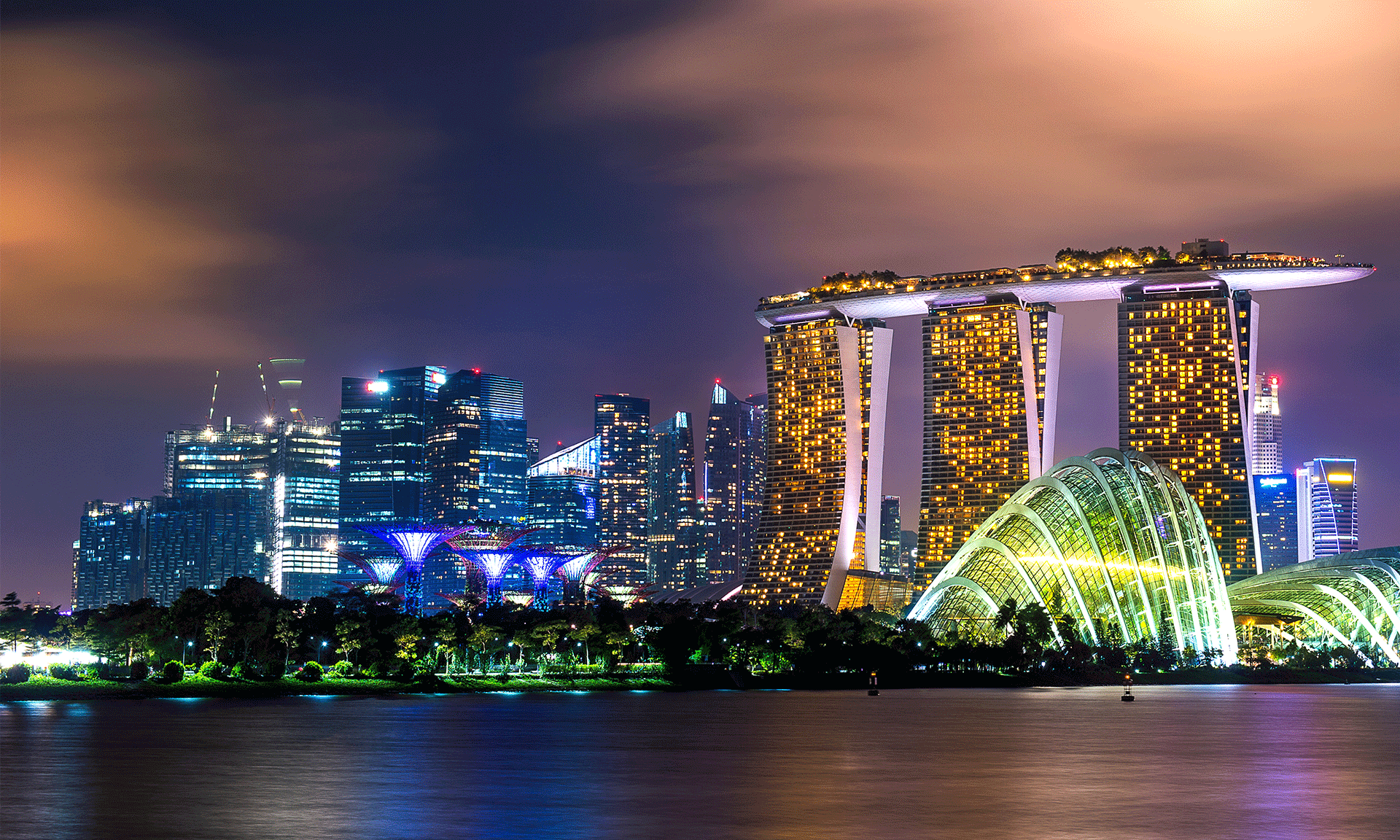

Company formation in India has now become much simpler, transparent and less bureaucratic. IMC, a professionally managed and well-experienced business service consultancy group can help Oman business enterprises to set up companies in India and provide all necessary support from the start to end. IMC is based in one of the Indian metropolitan cities and also has well established operational setups in Dubai and Singapore.

IMC Group

IMC Group