Overview

Though Singapore has witnessed a more than fivefold jump in the number of Family offices over the last few years, this wealth and asset management space is still in a phase of infancy with enormous potential for future growth. Most of the family offices in Singapore belong to the first or second generation of Ultra High Net Worth (UHNW) families who are planning for their wealth transfer only for the first time and will keep doing so over many future generations promising a booming market for family office services.

Traditionally, family offices have been popular with well-established structures in Western developed countries viz the US and Europe. However, as the Asian continent has put its strong footprint in the global economy with a high concentration of individual wealth and private capital, there has been a surge of this financial business model in Asia, especially in Southeast Asian Singapore. As per data available with the Monetary Authority of Singapore, there are more than 400 family offices in Singapore, and only 200 of such offices manage an estimated value of assets exceeding 20 billion dollars, a whopping sum.

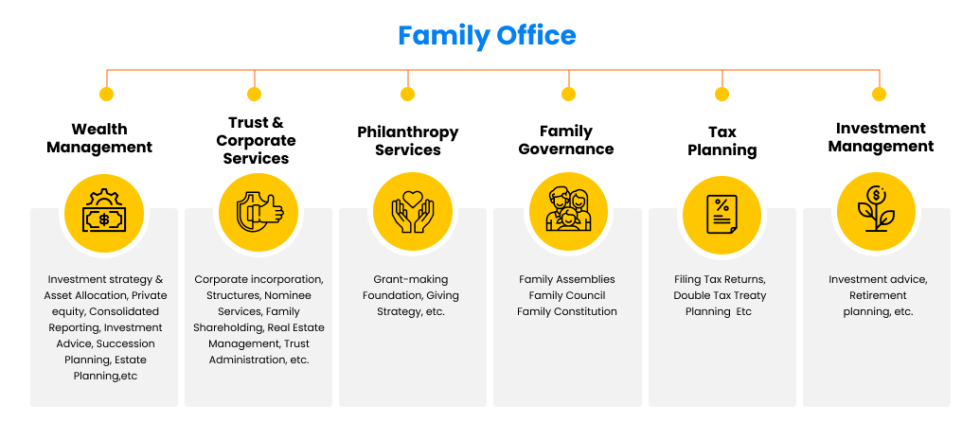

Family offices are private wealth management entities providing cost-effective financial solutions for UHNW families. Family offices employ financial advisors, investment analysts, legal and tax professionals for wealth and tax planning.

Family offices carry out financial and legal activities which are either carried out in-house or outsourced from external service providers. Activities performed by family offices include management and planning of private assets, wealth protection, succession planning, tax planning, lifestyle management, family governance, education, charities etc. While a Single family office in Singapore caters to one single family, multiple family offices can serve more than one family.

Why is Singapore considered attractive for Family Offices?

Multiple reasons are driving the ultra-rich families to flock to Singapore for establishing family offices post-pandemic. Singapore provides access to both Asian and global opportunities for investments and besides the Asian families, many US and European family offices are being attracted to the country with key family figures opting for residing and taking citizenship of Singapore. The main reasons for exponential growth can be attributed to the below-mentioned reasons.

- Reduced risks of regulatory changes ensuring the safety of assets

- A competitive corporate tax environment irrespective of residence status and tax incentives through Singapore Resident Fund Scheme, Enhanced Tier Fund Tax Exemption Scheme and Global Investor Programme

- Presence of investment and international banks planning to double their operations over next two to three years

- A Matured and Regulated financial market

- World-class Technology

- A recognized international hub for financial services and banking

- Newly introduced Variable Capital Company structures

- Easy settlement for super-rich families through Global Investor Programme

How do Global Pandemic and Geopolitical Uncertainty help flourish the Family Office Space in Singapore?

Global pandemic and geopolitical instability can be a big positive rather than negative for family offices in Singapore. The fear of morality of the pandemic has indeed made the super-wealthy families vulnerable but the uncertainties also instilled a sense of urgency amongst them. Singapore has one of the lowest death rates from the covid pandemic and many billionaires all over the world have been residing for longer in this city-state.

The pandemic has become an important wake-up call for wealthy families to mobilize resources and step up to bring in the positive changes needed in family offices for reviewing and updating protocols and practices within the family office space, investing more time and money for upgrading antiquated ineffective systems and assessing all forms of risk. The geopolitical instability has also raised safety issues of their assets and a need for relocation to a safer and more politically stable jurisdiction.

Covid pandemic has also triggered the possibility of higher tax regimes and stricter regulatory norms in the foreseeable future necessitating the need for wealthy families to explore better avenues for reducing the tax burden. Populist policies with several monetary stimuli introduced during early 2020 may not be viable for long due to inflationary pressure as already hinted by the Federal Reserve on Fed tapering.

In 2020, many billionaires across the world donated several billion dollars for vaccine development and many ultra-rich families were prompted to serve their communities in their countries of origin. This shift in social responsibility has spurred the growth of philanthropic trusts. Philanthropy helps in bringing people together and helps members of wealthy families do something meaningful by participating for a novel cause and reduce bureaucracy in organizations.

The pandemic also provided a big push in smart digital technologies and data securities providing wealthy families better comfort and safety in wealth management. As per recent surveys, more than 80% of family office respondents agree that artificial intelligence can be the biggest disruptive force in global business. More asset management and hedge fund professionals are joining family offices in Singapore and the technology stack is also growing more sophisticated.

Takeaway

The city-state has world-class technology, a transparent and non-bureaucratic regulatory system, a high standard of health infrastructure and a politically stable government and is attracting the super-wealthy families to set up a Singapore family office in preference to their home countries.

As there are plenty of alternatives available for family office structures and governance framework for addressing varying needs and circumstances, it is advisable for wealthy families to partner with a reputable and trusted partner with professional expertise and experience in providing advice on wealth management and implementing customized and appropriate family office structures.

IMC is led by a team of asset management and legal professionals and can help you set up your own family office in Singapore to provide independent and trusted advice on suitable structure, control and supervision keeping in view the long term needs for wealth management and administration.