- Newsletter, Oman

- August 12, 2020

According to a recent “Oman Observer” report, a $350 million investment agreement was reached between a UAE investor and Oman’s Salalah Free Zone for the building of Technology City. The planned 500,000sqm area will feature numerous support facilities including a data park and a technology academy. The $350 million funding is the most recent in a series of investments made to the Salalah Free Zone. According to Tech City CEO Ali bin Mohammed Tabouk, the signed MoU (Memorandum of Understanding) envisions a city dedicated to 4th generation and innovation technologies.

Tabouk went on to say that seven investment agreements were signed during the first half of 2020, bringing the total number of signed projects to 88. This represents a total of $8.7 billion in investments and a potential for the creation of more than 8,000 jobs. One of the contracts calls for the building of Phase Twuaeo of Al Mazaya Logistics Station, a 134,000sqm parcel of land dedicated to the development of amenities and facilities for tenants of the free zone and a storage area as well.

Governor Sayyid Mohammed bin Sultan al Busaidi of Dhofar pledged his support to development efforts. Furthermore, he welcomed the role the free zone is playing in contributing to the diversification of income sources, the economic benefit for Dhofar, and the overall growth of the regional economy. He went on to say that the success that has been achieved in the Salalah Free Zone will attract future investments as it continues to move toward becoming a regional and global business hub. This will help in the areas of company registration in Oman and Oman company incorporation. If you need assistance with registration of a company or related taxation services, call on experts.

Chairman Ahmed bin Nasser Al Mahrazi stated that the success that they have achieved with Salalah Free Zone is commendable. Additionally, he hoped that the business zone attracts global businesses and investments to further enhance the economy. The success resulted from gaining $8.7 billion in investments translates into numerous business opportunities for small and medium-sized enterprises (SME’s) as well as national companies. Overall, this equates into many economic developmental benefits. Additionally, Al Mahrazi, who is also the Minister of Tourism, stated that the investments will drive technology inflows and support the creation of new jobs for the citizens of the region.

Al Mahrazi commented that by maintaining this framework, numerous efforts to organize promotional campaigns will continue and target a number of different markets including India, Iran, South Africa, Turkey, and other countries. The focus will continue to be on attracting high-quality funding in important areas such as innovation-based technologies, logistics, and manufacturing along with other needed sectors.

- Newsletter, U.A.E

- August 12, 2020

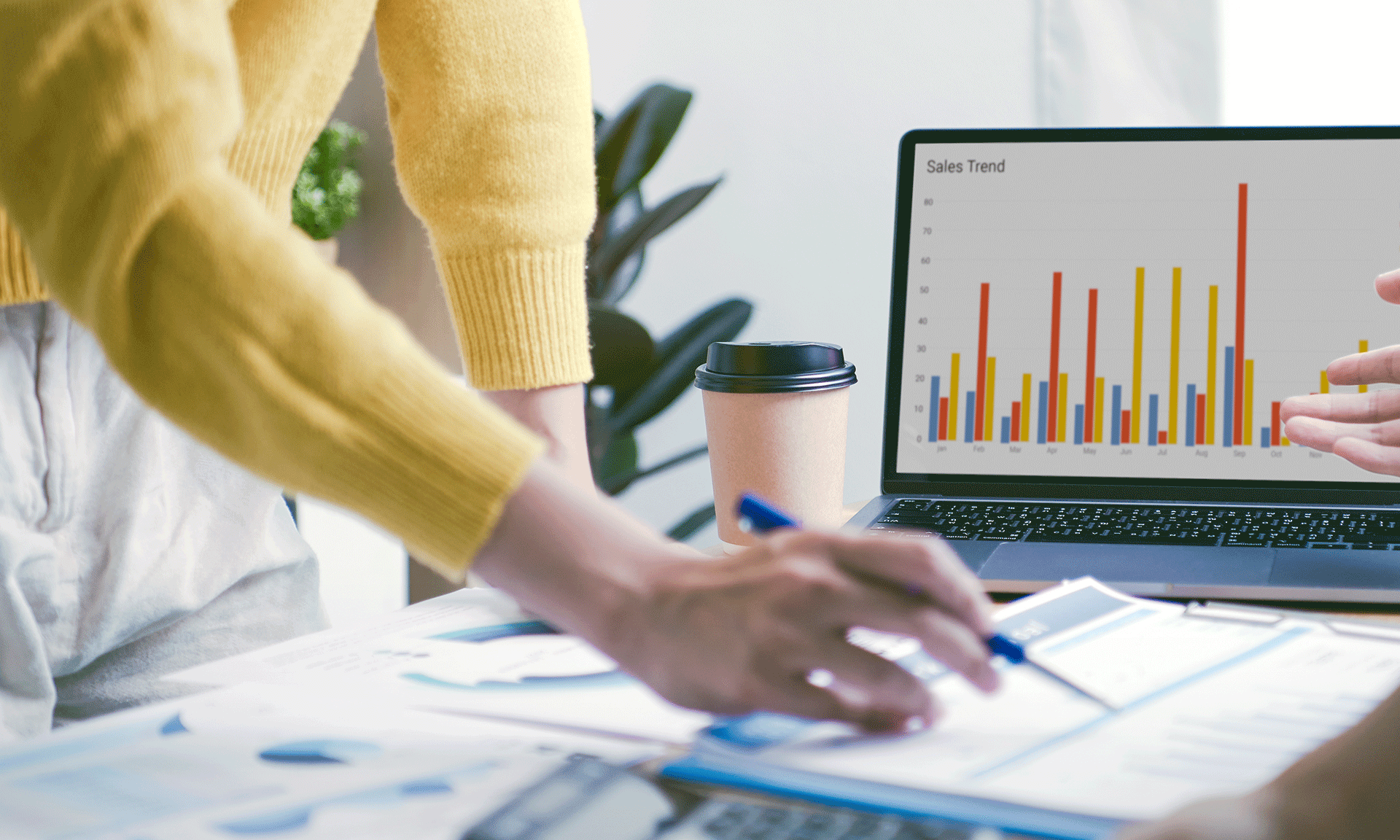

Even though there have been disruptions to the global trading landscape caused by the COVID-19 pandemic, this cloud really has a silver lining. By utilizing digital formats, nearly a quarter of a million members of the Dubai chamber of commerce have been exploring new market opportunities on a global scale. According to Omar Khan, current Director of the Dubai Chamber’s International Offices, a series of virtual meetings and webinars were organized and joined by UAE businessmen and their African, Eurasian, and Latin American counterparts.

Khan went on to say that this digital platform has enabled Chamber members to explore newer, attractive investment and trade opportunities internationally. Furthermore, this has encouraged new company formation in Dubai while at the same time promoting the area as a hub for global business. The increasing confidence in Dubai among foreign investors is attributed to their higher levels of participation. Additionally, that growth is expected to continue in the ensuing months as companies are preparing for the post-COVID-19 recovery period.

One of the more recent virtual events hosted by the Dubai Chamber was an online mission to the Canton Fair (a.k.a. the China Import and Export Fair). The purpose of the virtual visit was to discuss food trade between Dubai and Russia and explore new opportunities in Mozambique’s gas and oil sectors. This event was attended by many businesses that are eagerly looking to tap into new market opportunities. According to Khan, Dubai businesses can leverage the Chamber’s network of international offices in order to:

- access valuable market intelligence

- benefit from local support when expanding into new markets

- make well-informed business decisions

- network with prospective partners

The Chamber is also supporting those high-potential companies who desire entry into the Dubai market and use the UAE as a strategic trading hub to expand their reach in this area of the world.

This digital platform should also benefit the Dubai Multi Commodities Centre and DMCC company formation. Established by Dubai’s government in 2002, the DMCC provides the financial, market, and physical infrastructure require for the establishment of global commodities trading. It should benefit JAFZA company formation as well. The Jebel Ali Free Zone began its operations in 1985 and is located in the Jebel Ali area at Dubai’s westernmost end near Abu Dhabi. It was established to provide ready-built facilities such as standard size offices and warehouses for clients or customers.

One of the Dubai businesses that have taken advantage of the Chamber’s initiatives to assist other companies in reaching out to promising market opportunities is a company named Tradeling. Tradeling, which launched its entrepreneurial debut in February, is a digital marketplace that has been showcasing products from more than 25 countries and nearly 300 suppliers. It is a B2B (business-to-business) digital marketplace that connects with global as well as regional suppliers to meet local company demands.

As a part of their operation, Tradeling requires companies to align its plans for expansion with the way in which the business environment is evolving. For example, when Tradeling witnessed the hit from COVID-19 to its beverages, food, and office supplies (its “verticals”), they knew their e-commerce startup had to adapt to this. Consequently, they took control of the situation and immediately developed a vertical in the area of health and wellness, which wasn’t a part of their original launch phase.

Muhammad Chbib, Tradeling’s CEO, stated those businesses who want to survive the pandemic’s economic hit will have to adapt using these types of tactics. Chbib also stated that by launching a new vertical in the midst of an economic crisis has made Tradeling even stronger. It has provided the company with a sharper focus on adapting to crisis-related economic circumstances.

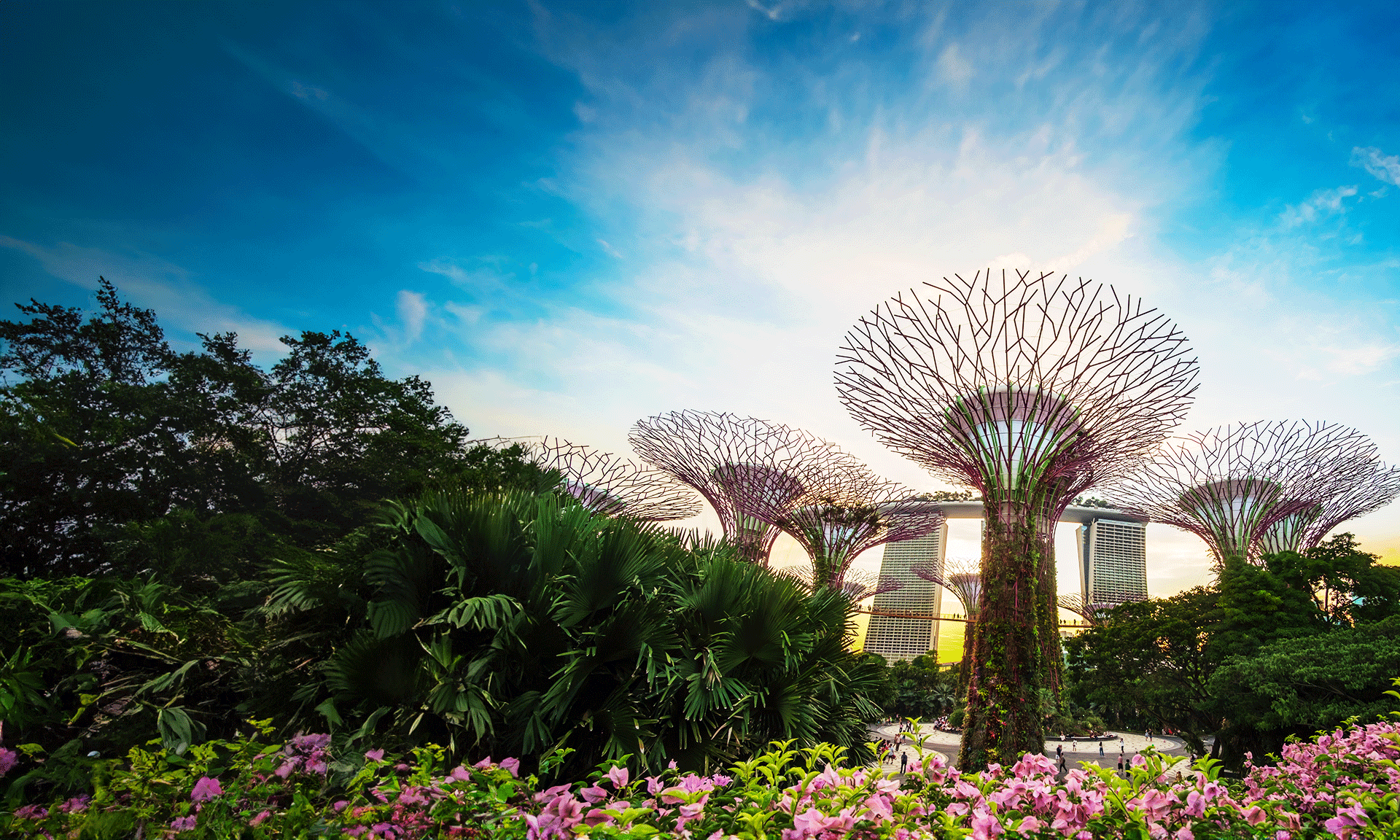

- Article, Singapore

- August 7, 2020

BizFile was introduced in Singapore over 15 years ago and it was considered as a serious innovation in government communication with the business. Presently, ACRA is being utilized to make online data management simple, swift, and efficient.

In this article, we are sharing a detailed insight into ACRA BizFile and how it works.

Anyone who intends to start a business in Singapore is required to register all the business’ relevant information with the Accounting and Corporate Regulatory Authority (ACRA). To improve this process of Singapore company incorporation, ACRA introduced BizFile which is an online web directory system to file and retrieve corporate data. In 2016, ACRA made a major update to improve the speed and efficiency of the portal and renamed it BizFile+, which is currently providing more than 400 services electronically to the businesses of Singapore.

What Can One Do with ACRA BizFile?

As an entrepreneur in Singapore, you or your corporate secretary will be interacting with the portal regularly. Here are the major activities (including but not limited to) that you can perform using BizFile.

- Company’s online registration

- Cessation of your company

- Making changes in information like the company’s address or hierarchy

- Annual return filings

- Getting industry reports

- Approval investigations with referral professionals

- Accessing the central directory of UEN

Filing of the Company’s annual returns; Change the Company’s particular

The entire the interface of the portal is completely user-friendly and provides you with direct payment methods and you also get confirmation emails and SMS after every transaction.

How can one register a company with ACRA BizFile?

For registration, you need to log in to the portal of BizFile+. If you are doing it for the first time, you will need a SignPass. This is the Singapore Personal Access Password which is available only to Singapore Residents. It serves as a digital signature to verify your identity. Foreigners, willing to start a business, will have to hire Corporate Service Providers, who will grant access on their behalf. After login, you need to fill in the required information about your business and adhere to the mentioned instructions. Once the setup gets completed, you will need a CorpPass to make transactions for your entity. CorpPass has the same rules as SignPass and is granted only to Singapore Residents or some work pass holders.

Details to be submitted for incorporation

You need to provide the following details online for registration purposes.

- Type of company

- Approved intended company name

- Key activities of the company

- Details of directors (Every the company should at least have one Singapore citizen or employment pass-holder as a director)

- Details of shareholder or contributors

- Details of share capital

- Registered address details (locally registered address only)

You should fill all these details with complete attention because making changes, later on, is quite extensive and boring.

How to File Annual Returns with ACRA BizFile?

For this, you need documents like the company’s financial statements and the latest necessary information about the shareholders and directors of your company. The following steps are helpful to file the annual returns easily.

- After the financial year-end, prepare and complete all financial statements that are generally made by in-house or outsourced financial staff.

- Schedule an AGM where all the directors and secretaries present the above financial statements to the shareholders.

- After the approval by shareholders, all the information can be uploaded on the BizFile portal easily along with other required details.

Certain companies can submit the return even without conducting an AGM and are exempted from some provisions. However, the submission for others needs to be completed within 30-days after the AGM to avoid any kind of penalties and fines.

Benefits of using ACRA Bizfile

The following are the major notable benefits of ACRA’s BizFile platform.

- Convenient for businesses

- Easy management along with data accuracy

- Faster and cost-efficient as no paperwork exists

- Better operational performance

- Provides direct payment gateways

- Better compliance with regulatory requirements

- Reliable information is available in industries.

Conclusion

ACRA’s BizFile is a complete and intelligently designed portal to take care of all processes of business registrations in Singapore. The interface is user-friendly and accessible to all for any kind of business services like making changes, renewing information, purchasing information, and checking transactions directly. There are many company secretarial services in Singapore who can take care of all your necessary work on the portal. All foreign citizens or businesses require the support of such services because of unique rules by ACRA. BizFile is helping Singapore citizens since 2004 and is constantly improved for better usage by everyone.

- Article, Saudi Arabia

- July 31, 2020

Company registration in Saudi Arabia is expected to get a whole lot easier now. To become an ambitious country, Saudi Arabia will be focusing on transparency, accountability and effectiveness in its governing strategy. Only through solid foundations can sustainable success can be achieved.

Saudi’s vision 2030 plan includes strategic objectives cascading down to the nation’s public sector entities and vision realization programs, 12 of which have already been rolled out. With all these ambitious programs, Saudi Arabia plans to overcome its oil dependency with a well-diversified, dynamic and modern economy. Since vision 2030’s conception in 2016, Saudi Arabia had made progress towards diversifying its economy and decreasing its dependence on oil revenues. The large scale reforms, which included a fiscal balance program, had been supported by decisions which improved the overall quality of life in Saudi Arabia by benefitting residents and attracting domestic and foreign investments. Growth has opened up new jobs for Saudi Arabian citizens in main areas through the partial privatization of sectors such as healthcare and housing. The nation had also prompted business setup in Saudi Arabia. In 2019, Saudi Arabia had jumped 30 spots in the World Bank’s Ease of Doing Business 2020 index – the biggest improvement and highest jump worldwide.

In 2020, Saudi Arabia decided to evaluate the vision 2030’s goals after four years of its launch. However, with the dramatic shock to the oil prices, the coronavirus pandemic has hit Saudi Arabia’s economy hard. Dropping oil prices, disruption of global trade and financial markets, an indefinite pause on industries like tourism, and huge lost productivity in the government and private sector has cast an uncertain spell for the future of the Saudi plan. Notably, even before the outbreak of the pandemic, the nation was facing some challenges like the murder of journalist Jamal Khashoggi in Istanbul, increasing tensions with Iran, which had taken focus off Saudi’s economic reform efforts.

According to a study report by the University of Bath, the main obstacles or challenges with Saudi Arabia’s Vision 2030 are the uncertainties surrounding its launch and potential for success. This originates from its stated objectives that can only be described as ambitious because of the scope and magnitude of the undertaking – not to mention that only 15 years (relatively short period of time) has been set to achieve the aforementioned objectives.

Furthermore, there is a shortage of information about the detailed plans that will help in realizing the intended macroeconomic and socio-political renovation. Apart from this, the seemingly slow response from a number of governmental and quasi-governmental institutions in announcing their detailed plans and programs has added to this existing uncertainty.

According to Atlantic Council data, Saudi Arabian government has invested a significant amount of money, energy and effort in the Vision 2030 reforms and it has yielded some noteworthy achievements to date. This broadly includes fiscal stabilization and macroeconomic management, the development of capital markets and the banking system, the digitization of government services, and transformed social reforms. However, in several other areas, reform efforts have not proven themselves successful with respect to their intended objectives. This can notably be seen most in creating jobs and reforming the private sector into an engine of growth.

Doing business in Saudi Arabia may be easier and more efficient with some external professional help. The good news is that Saudi Arabia has already recognized the fundamental reforms required for the nation’s long-term economic growth, and it has started the work of implementing many of them.

- Article, Singapore

- July 22, 2020

Singapore is widely recognized for its highly-efficient and competitive tax system, which lets companies, partnership firms, sole proprietor and entrepreneurs (individuals) enjoy low tax rates and several types of tax relief. The Inland Revenue Authority of Singapore (IRAS) is the central tax administrator of the country. It falls under the Ministry of Finance’s authority and operates as a chief tax advisor to the Singaporean government. The IRAS is mainly in charge of collecting taxes. It collects taxes, which account for around 70% of the government’s operating revenue that supports the nation’s economic and social programs. These programs are aimed at achieving an inclusive society and quality growth. All in all, the two main functions of the IRAS is to collect all types of taxes and act as a tax advisor to the state.

As a part of its public engagement, IRAS works with tax agents as partners in administering the Singapore tax system and in facilitating tax compliance. As the main tax authority under the Ministry of Finance, IRAS plays a crucial role in tax policy creation by providing policy inputs in addition to the technical and administrative implications of each policy. IRAS also actively monitors developments in external economic and tax environment to spot areas for policy review and changes. It aims to create a competitive tax environment, which fosters the growth of enterprises in the nation. Other non-revenue operations carried out by IRAS include representing the state in tax treaty negotiations, offering advice on property valuation and drafting of tax legislation.

Types of taxes that the IRAS deals with

Let’s take a look at some of the taxes that the Inland Revenue Authority of Singapore deals with.

Please note that capital gains, inheritance and dividends are not taxed.

Some taxes such as Customs and Excise Duties and Water Conservation Tax are administered by other ministries and not the IRAS.

History of the Inland Revenue Authority of Singapore

To manage the Income Tax Ordinance that was enacted earlier, the Singapore Income Tax Department was unveiled in 1947. The overall tax collected from 1 January 1948 to 31 December 1949 amounted to $33.2 million. Inland Revenue Department was created in 1960 when multiple revenues collected by multiple separate agencies were unified in one centralized place. This paved way for the creation of the Inland Revenue Authority of Singapore.

In 1992, the IRAS was created by legislation as a statutory board under the authority of the Ministry of Finance. It look over the operations that were previously carried out by the Inland Revenue Department.

Structure of the Inland Revenue Authority of Singapore

How to deal with the Inland Revenue Authority of Singapore?

In order to find out your tax status, one (individuals and business organizations) must sign in to the IRAS personal account called as myTax Portal. Individuals logging in will need their SingPass ID, whereas business/companies accounts will require a CorpPass ID to log in.

It is also possible to connect your accounting software tool to the Inland Revenue Authority of Singapore. To do this, however, the accounting software you use should meet the technical requirements IRAS has set and must make it to this list of approved software meet the technical requirements that the IRAS has established. The software must also make it to this list of approved software applications. There are also other easy ways to manage accounting services in Singapore.

Functions of IRAS

Tax Collection Responsibilities

The IRAS is responsible for:

- Income Tax: Applied to individuals and companies based on their earnings.

- Goods and Services Tax (GST): This tax is levied on all goods and services, including imports.

- Property Tax: Charged to property owners according to the estimated rental values of their properties.

- Stamp Duty: Imposed on real estate transactions, property-holding entities, and shareholder transactions.

- Withholding Taxes: Applied to estates held in trust.

- Duties on Betting and Lotteries: Applied to private lotteries and gaming activities.

- Casino Taxes: Relevant to clubs and associations operating casinos.

- Charity Exemptions: Charities are exempt from certain taxes.

- Tax Exemptions: Dividends, capital gains, and inheritance are generally not taxed.

Tax Advisory Role

As Singapore’s main tax advisor, IRAS:

- Develops Tax Policy: Creates and updates tax policies and works closely with the Ministry of Finance (MOF) to draft relevant tax legislation.

- Manages Tax Treaties: Facilitates international tax agreements, with approximately one hundred double taxation treaties in place to prevent dual taxation on income.

How to reach out to and connect with the Inland Revenue Authority of Singapore?

- You can visit the IRAS’ website at https://www.iras.gov.sg/irashome/default.aspx

- Following that, log in: https://mytax.iras.gov.sg/ESVWeb/default.aspx

Alternatively, you can also call the IRAS hotline number, email them or visit the office. The helpline operating hours are from Mondays to Fridays – from 8 am to 5 pm (for all enquiries).

If you are looking to speak to a tax officer, then you can find all the relevant helpline numbers by clicking here. https://www.iras.gov.sg/irashome/Contact-Us/Call-us/

Individuals who want to enquire on business registration and business advisory matters can call the below listed numbers:

- ACRA Helpdesk: 6248 6028

- Enterprise Infoline: 6898 1800

- CorpPass Helpdesk: 6643 0577

In conclusion

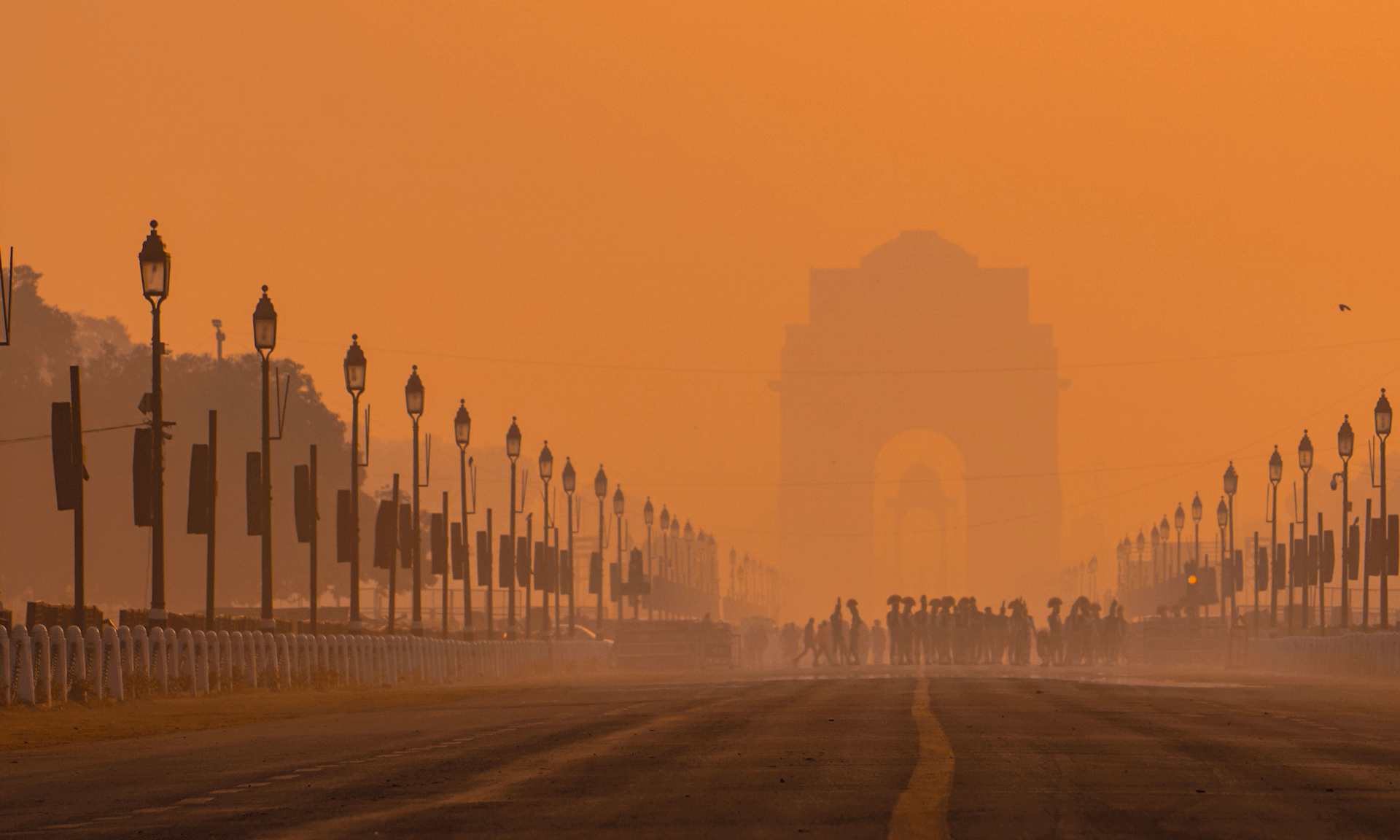

- India, Newsletter

- July 15, 2020

India will be a much more investment-friendly nation post COVID-19 thanks to reforms introduced by the Centre. Indian Prime Minister Narendra Modi approved the formation of a cabinet of empowered government officials whose main mission is to attract investment.

Company formation in India will become much easier post COVID-19. This is largely because of measures initiated by Indian Prime Minister Narendra Modi. He approved the establishment of a group of empowered secretaries. This group is to be led by cabinet secretary Rajiv Gauba. Its goal is to make India a more appealing place to invest by FDI as many large companies are looking to mitigate risks by diversifying the investments in new geographical areas.

Many entrepreneurs are finding that India Company Incorporation is much easier post-COVID-19. They are looking at other less risky parts of the world to invest in and to do business in. They see India as being strategic because it is a gateway to lucrative markets in the US, EU, China, and other strategic geographic regions. The newly formed empowered group’s task is to exploit these opportunities and transform India into one of the major players in the global value chain.

Industries want to diversify by migrating to different geographic locations. Officials know that this is large because of COVID-19. The empowered group of secretaries will ensure that as much of this new investment money will end up in India as possible. The Indian government has established Project Development Cells (PDC) in every ministry. This is according to information and broadcasting minister Prakash Javadekar in a press briefing after the meeting. He said that this will support new industries in the initial stages and fill in the gap within the domestic industries.

Entrepreneurs will be encouraged to enter into emerging and new industries. The measure is expected to dramatically boost and encourage the Indian industry. India envisions itself as becoming a $5 trillion economy by 2025. These measures are designed to ensure that this happens. Different ministries and departments in state governments and the national government will be integrated to work together strategically in terms of investment and similar incentive policies. This will facilitate India reaching its 2025 economic goal.

CEO Niti Ayog, Amitabh Kant and the commerce, revenue, and economic affairs secretaries would also be participating members. The secretary for the department that promotes industry and internal trade (DPIT) would be the convenor. Secretaries of any concerned departments would co-opt in this role. In the post-COVID 19 world, India stands to gain by better economic and tax policies, handholding new domestic industries in the initial stages and streamlining the policies for more FDIs.

The empowered group will evaluate investors and investments through a number of parameters that included project creation and actual investments. Government departments would be given deadlines for the completion of certain projects. The Kolkata port, Shyama Prasad Mookherjee Port was renamed. He was an academician, thinker and a prominent BJP icon. The renaming was approved by the cabinet.

Another major decision taken by the cabinet was to re-establish Pharmacopoeia Commission for Indian Medicine & Homoeopathy (PCIM&H) under AYUSH ministry. The merger will promote the better use of ancient knowledge, infrastructural facilities and financial resources available.

- Newsletter, U.A.E

- July 15, 2020

Economic activities in Dubai and throughout the UAE appear to be returning to near normal levels. As one of the UAE’s largest trading hubs, JAFZA (the Jebel Ali Free Zone) announced the introduction of numerous incentives to support consumers and promote new Dubai company formation and JAFZA company formation. As a result, many companies will be able to resume their operations and have renewed confidence in this significantly different post-pandemic economic landscape.

According to a recent JAFZA announcement, the easing up of COVID-19 related restrictions in the UAE will enable current and new customers to short-term lease warehouse space without having to pay for custom duties or VAT. Warehouses ranging from 300 to 15,000 sqm., including FREE electricity and water, will be available. JAFZA also introduced more flexible terms such as monthly rental payments for new tenants and offered current tenants deferred payments when leasing warehouse space.

The extensive range of a more targeted focus and support also includes the addition of cost-effective shipping services that have enhanced accessibility, increased cost savings, and speedier services. Other solutions for improved in-house logistics include:

- 24/7 lease issuance

- facilitating product movement and trade efficiency

- fast-track EHS approvals that have been designed to help companies manage the cost of supplies

With times being as challenging as they are, highly competitive business solutions are required in order to see businesses resume their operations and be more profitable in the long term. The new set of economic incentives are an addition to the 70% reduced

Fees for the licensing, registration and administrative fee/levies that were announced in March, before the lockdown began due to the pandemic. Not just UAE, but the pandemic has had far-reaching effects globally.

According to DP World, UAE Region CEO and current managing director Mohammed Al Muallem (he is also JAFZA’s chief executive), customized post-pandemic solutions for the trade sector are being developed for customers. These solutions will enable them to pay less for increased value-added services and support straight across the board. He went on to say that newer businesses as well as existing companies that we are promoting a back-to-business, investor-friendly environment.

By developing this environment around a market’s emerging needs, it will promote a stronger economic climate for improved business growth in all sectors. As it currently stands, JAFZA accounts for nearly 24% of the total direct foreign investments and the employment of over 135,000 individuals. As a result, JAFZA had generated $93 billion in trade as of the end of 2018. As of this past March (2020), the free zone has reduced all business-related fees by as much as 70% for those businesses operating within it.

- Newsletter

- July 15, 2020

The GCC or Gulf Cooperation Council is the economic and political alliance of 6 countries – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE, the economies of which were shocked by the advent of the COVID-19 pandemic during the aftermath of lower oil prices. Family businesses in the GCC were already in dire financial straits as they were dealing with high leverage, lower profits, and restricted liquidity. Thus, combination of the two economic hits has severely stressed all 6 country’s economies.

Fortunately for most of these businesses, they have taken action and implemented measures to help counteract the economic crisis with new company formation in Saudi Arabia and new company formation in UAE. However, these family businesses are now faced with adapting to a dramatically different post-pandemic landscape. Most of them are retaining the existing staff that is important for long term success of the business apart from coordinating actions with suppliers and main clients to enhance business continuity. It is our belief that these businesses must adopt the following 4 strategies in order to attain a better position over the long term:

Digitize core operations and invest in a “stay-at-home” economy – prior to the pandemic, shopping and working online was on the rise. Now it will likely be the new of conducting business for businesses and consumers alike. Therefore, family owned companies in the financial and retail sectors will have to adopt their business models and core operations to this newer, “stay-at-home” economy.

Diversify their financial portfolios – with sharper financial crises and shortened economic cycles becoming more frequent and more globally based, the traditional focus of risk management is failing to protect their financial portfolios. Consequently, family businesses must pursue a more encompassing approach to risk when managing their portfolios. They should incorporate cash flow threat assessments with the valuation drivers of demand and price.

Pursue opportunities in the private sector – as a result of decreased oil revenues, GCC government’s deficits are growing. Consequently, they will need these family businesses to drive their economy more than ever. It’s important for these businesses to take on more PSP (private sector participation) projects such as opportunities in the infrastructure by developing partnerships between multi-family companies in order to combine their talents and minimize risk.

Take advantage of more local opportunities – by closing their national borders, GCC businesses were forced to re-examine their supply chains and increase their localization efforts. By investing in local production and new chains of supply, businesses can protect themselves from supply chain disruptions while at the same time reducing their reliance on imports. Given the stable performance of the manufacturing sector during Saudi Arabian oil cycles, increased opportunities in this sector will be more attractive.

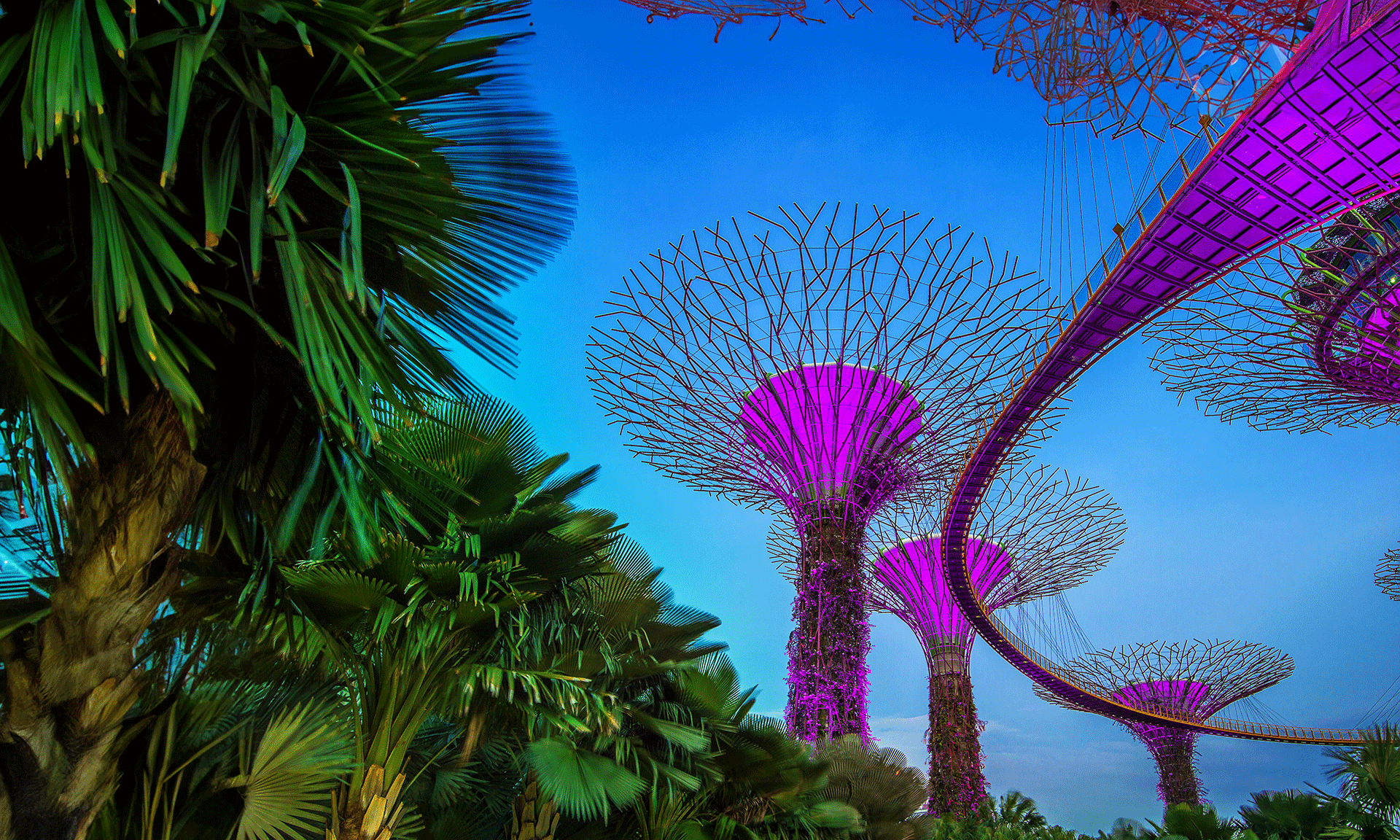

- Newsletter, Singapore

- July 15, 2020

For the forecast period of 2019-24, it is estimated that Singapore’s ready-to-eat food (RTE) market will achieve a CAGR (Compound Annual Growth Rate) of 2.6%. Due to the increased exposure to numerous cultures, Singapore’s citizens are experimenting with new and different foods. This has given RTE foods an opportunity for growth in conjunction with this recent culinary trend of experimenting with people’s diets.

Consequently, the country’s food supply chain is undergoing continual organization and has witnessed an increase in product circulation across applicable retail channels. As a result, this has led to increased Ready-To-Eat food sales throughout the consumer marketplace. Furthermore, regulatory authorities have introduced initiatives that are driving the food market where this is concerned which includes checks on quality and safety standards. This includes efforts on behalf of the Singapore Health Promotional Board to increase awareness of fish products and frozen foods.

Industry Analysis

One of the major Asian trade destinations, Singapore is seeing the growing prevalence with an increase in the use of instant foods. Recent analytical statistics show the RTE foods are gaining increased popularity based on convenience among Singapore’s dual income families. This means that these busy families prefer the convenience of RTE foods due to the constraints of their daily lives and schedules. RTE foods were developed to save people time in the kitchen while reducing the costs related to spoilage. Due to increased family incomes, individuals are now purchasing prepared foods regardless of the price.

Additionally, as the number of dual income families continues to increase in Singapore, more females are entering what used to be a male-dominated workforce. According to statistics presented by the World Bank labor force, the percentage of women in the job market has increased from 43.5% to 45.13% during the period of 2010 to 2018. As more females enter the workforce, they will be spending less time in their kitchens. So, RTE food sales should continue to increase during the forecast period of 2019-24. During the pandemic, interest in self-sufficient soared and the impetus on quick instant foods has seen a spike. There has been an increase in the RTE sale across the consumers along with the ease of product circulation in retail channels.

Fastest Growth Segment

Singapore has emerged as one of Asia’s major trade destinations and continues at an exponential pace. As people’s lifestyles have become increasingly hectic in recent years, the prevalence of instant foods has grown in similar fashion. Since RTE foods are so convenient, fewer Singaporeans are using their kitchens. This has not only led to an increase in the number of brands that are producing RTE noodles, it is the fastest growing food sector in the marketplace. Some of the leading brands include Nestle Maggie and Nissin foods that are targeting the Singapore market that is evolving with changing consumption patterns. Other market members are now being more innovative with their product portfolios as a result, thereby causing a significant shift in the competitive landscape.

- Newsletter

- July 15, 2020

On June 8th, Vietnam’s National Assembly ratified two important economic agreements, namely the EVFTA (European Union-Vietnam Free Trade and EVIPA (European Union-Vietnam Investment Protection Agreements. Both received unanimous approval with nearly 95% of the country’s lawmakers voting in favor of the EVFTA and nearly 96% voting in favor of the EVIPA. These developments followed European Parliament’s ratification of the FTA in February.

About the EVFTA

The EVFTA paved the way for increased trade between Vietnam and the European Union and was signed into law on the last day of June. This aggressive pact provides for the elimination of nearly 99% of custom duties between the two governments. In so many words, the MPI (Ministry of Planning and Investment) stated that the agreement would increase the country’s GDP by nearly 5% and result in nearly a 43% increase in exports to the EU by 2025.

Furthermore, the European Commission is estimating a $29.5 billion increase in their GDP by 2035. The agreement calls for the elimination of 65% of all EU export duties while the remaining 35% will be eliminated over the next 10 years. On the other side of the coin, the agreement calls for the elimination of 71% of the duties on exports to the EU from Vietnam with the remaining 29% being eliminated over the next 7 years. As a new generation agreement, the EVFTA contains important provisions for:

- investment liberalization

- IP or intellectual property rights

- sustainable developments

Additionally, the agreement will include the implementation of standards for the ILO or International Labor Organization and the UN’s Convention for Climate Change. By the end of 2018, EU investors were responsible for investing nearly $24 billion in over 2,000 Vietnamese projects. On a regional scale among ASEAN members, Vietnam is the 2nd most important trading partner to the EU, thereby surpassing Indonesia and Thailand.

Industry Expansion Projections

At its core, the EVFTA removes restrictive non-tariff and tariff barriers for the primary imports from each government over the ensuing 10-year period. The primary export industries that will benefit include:

- Electronic products – the EVFTA will provide the country with a chance to take a lead in electronic production such as smartphones and electronic manufacturing.

- Pharmaceuticals– This sector is attractive to the investors in EU as with the new FTA, more than half of the imports by EU will be duty-free immediately and the rest will become duty free after 7 years. Pharmaceutical companies of EU will be allowed to import authorized medicines to be sold in Vietnam.

- Textiles and Footwear– FTA could significantly increase the volume of trade in textiles and footwear as it is the major export to the EU. In 2018, this export sector contributed nearly US$9 billion.

Recent changes to the EU, such as the exit of the UK or Brexit, could no doubt impact the importance and outcome of the EVFTA. For now, the FTA will go into effect in the UK through year’s end. However, it may be extended for 2 more years based on the agreement between the EU and the UK.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group