- India, Newsletter

- March 18, 2019

India is going to surpass UK with regards to world’s largest economy rankings as its GDP growth is projected to be 7.6 percent in 2019. Data trends show that US growth is estimated to be temperate from 2.8 percent in 2018 to approximately 2.3 percent in 2019. Labour markets in developed economies are estimated to tighten, thus increasing the wages.

India and France are expected to cross the UK with regards to world’s largest economy ranking this year, pushing it from the fifth to the seventh position in the global ratings, as per the projections. Though the UK and France usually switch places because of similar levels of development and almost equivalent population, India’s spiraling up the rankings is most likely to be stable and lasting now. As per the projections, UK would experience almost 1.6 percent real GDP growth, 1.7 percent for France and 7.6 percent for India in the year 2019.

India is expected to have a healthy growth rate of almost 7.6 percent in FY20, assuming that there are no big headwinds in the world economy like more trade tensions or any supply shocks in oil. The growth will be aided by further realization of efficiency gains that come from the newly-implemented GST and policy momentum predicted in the first year of the new government.

Today, India has become the fastest developing large economy throughout the world, with the gigantic population, very favorable demographics and the huge potential because of the low initial GDP per head. It is assured to continue to go up in the global GDP league ratings in the next few decades and this surely is a good time for company formation in India.

The restrained growth in the UK last year and again in the year 2019 is probable to turn the statistics in France’s favor. When comparing the currencies, the relative strength of the Euro as against the Pound is also an important factor to consider here. The world-wide economy is estimated to slow down this year as G7 countries go back to long-run average growth rates, as per new projections and data.

The lift in growth of many major economies observed between 2016 end and 2018 beginning has now ended. The boost from the fiscal stimulus is estimated to decrease, while higher interest rates could diminish consumer expenditure and a strong dollar is expected to continue dragging on net exports. The projections point out that US growth is going to be moderate from a projected 2.8 percent last year to around 2.3 percent in 2019.

The development in China is also expected to slow down as compared to 2018. Although the Government would try to ensure a minimal slowdown, the effect of US tariffs and the necessity for controlling the debt levels are probable to create a meek deceleration in growth this year.

The labour markets in developed economies are likely to go on tightening with unemployment decreasing even if job creation slows. This will push up wages, but would cause challenges for enterprises planning to fill talent shortages. In 2019, unemployment would fall a little more in the US and Germany, though the rates of job creation in these countries have remained strong.

- Article, Saudi Arabia

- March 16, 2019

The good news is that the time taken for processing a business license in Saudi Arabia is cut down by almost 92 percent in an effort to boost new investments in the Kingdom. In additions, earlier companies had to submit around eight documents to get a license issued, but now they only have to give their financial statements and a certified commercial registration. As per a report, SAGIA would be now licensing projects falling under the new Foreign Investment Act, allowing even 100 percent foreign ownership in some sectors.

But if you are thinking of foreign company registration in Saudi Arabia, there are following three concerns you should take care of:

- Be ready with decent data about the economy of the region. Conduct an in-depth analysis especially in the sector you are aiming to work in. Study the market conditions, competitors and then establish a viable business setup with a proper forecast. Then decide if you will invest on your own or through a bank.

- As per the law, you must have an area partner where the UN agency is holding the bulk interest and also might take the management of the business in their hands. The native partner (company or private) does not contribute to the investment in the start-up. The native partner’s demands are under review in some states currently to promote foreign investments.

- After registering your business, you have to explain to the Ministry of Commerce that you possess considerable cash to start your venture. You have to specify add varies between the states (it’s typically between $10,000 or £6,500 and about $50,000 or £33,500) which is taken as a guarantee for liabilities; however, you can take out cash soon.

As this process can be financially risky, having native data is imperative. We recommend you to consult some experienced professional who could guide you regarding the registration process and save you from several possible risks. Exports and manufacturing sector square measure are especially supported in a big way by the government with regards to the acquiring of land to construct their manufacturing unit. If you set up your business in a trade zone, then it is also offered exemptions from prevalent import and export duties, building/property license fee, industrial and property tax and other restrictions applicable on transferring capital that is invested in the zone.

An option to setting up a new business in Saudi Arabia is to rather shop for a going concern, as that would be quite simpler because in that case, you don’t need to lodge your capital; all you need to do is to agree to a value and then transfer your business’ possession.

Local Chambers of Commerce would suggest you about start-ups and also for square measure as they are proficient at hand-picking sure-shot profitable new entrepreneurs to the region. Contact details for square measure are:

- Council of Saudi Chambers of Commerce and business, KSA – (PO Box 16683, Riyadh 11474)

- Eastern Province Chamber of Commerce, KSA – (PO Box 719, Dammam 31421)

- Federation of GCC Chambers, KSA – (PO Box 2198, Dammam 3145)

- Jeddah Chamber of Commerce and business, KSA – (PO Box 1264, port 21431)

- Riyadh Chamber of Commerce and business, KSA – (PO Box 596, Riyadh 11421)

Arabs are quite skilled at negotiations so we recommend you to be confident about the content of your written agreement. If square measure gaps exist, they could spot it, which can cause you problems. Mostly, the Arabs never say a ‘no’ to a business proposition on the spot; so you must listen carefully and observe well. In case their response is ‘Leave it with me’ or ‘I’ll suppose it’, then there is a chance that the venture’s chances are dim. The probable profits of setting up your own business in Saudi Arabia square measure are good; however, the truth remains that it isn’t meant for you if you are faint-hearted.

Registering a Company and Legal Liabilities

Saudi Arabia’s Company Law can be compared to any in western states. In this, the enterprises are usually operated as Nonpublic Chamber of Commerce, limited liability operations, or several sorts of concern. It is advised to take a native legal advice and steerage for registration process and formalities. If you are a foreigner, you could use a western country or Arab venture business company. After selecting, you need to get the advice of the Arab-British Chamber of Commerce, Geographical Region Association, the DTI, and your particular Embassy’s industrial department.

Western expatriates usually tend to take up senior positions getting top salaries and perks. But workforce from the India or some other countries at times takes up unskilled or semi-skilled and menial jobs and the square measure is paid accordingly. An influential sponsor or business leader could be a wise option to use with administration. The authorities are not hard unless they have a strong reason. You stand a bigger chance in the region if you stay polite and patient.

If you are looking for some professional support in starting your business or accounting services in Saudi Arabia, do contact us, and we will be glad to assist you.

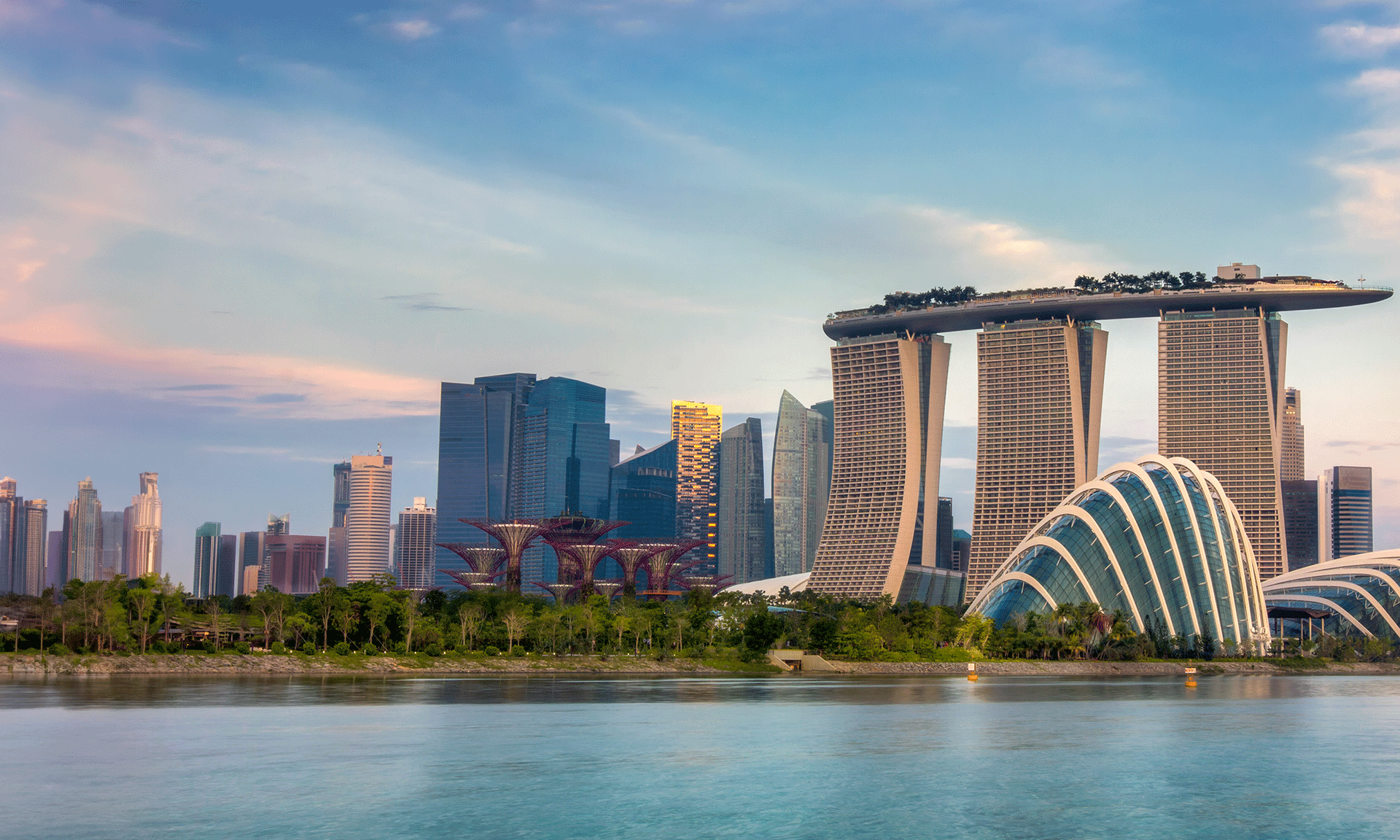

- Article, Singapore

- March 16, 2019

Various economies of the world are facing protectionism and fragmentation due to growing overseas expansion. These days, more and more global firms are eyeing to set up their business overseas.

Even after that, the Singapore companies have a great opportunity in their hands to expand in international markets seeing the increase in consumer spending globally. By doing the right homework, many local Singapore firms can enter into global markets and be a success story.

Entering Global Markets

Singapore companies first need to identify the target markets for their products. Depending on the business’s long term goals, they can go global. The business must understand the new market and know the pricing pattern for the goods to export. The companies must know the consumer tastes and accordingly try to capture the market. By creating a good relationship with global customers, the business can capture the good market share in the long run.

Enter Into Partnership with Local Businesses

Another key to success for Singapore companies while expanding the business in the global markets is entering into a partnership with the local businesses. The local businesses know the customers very well and help in developing a cost-efficient distribution channel. One of the popular ways of entering into the international market along with local partners is through the franchise. The franchise model has been a success in most cases and Singapore’s small and medium enterprises can very well adopt this approach successfully. Singapore companies must know that partnership with local players or taking a franchise will lead to commission cost.

Before entering or partnering with players globally, it is important for the Singapore companies to conduct due diligence. In this segment of the article, we will understand the importance of due diligence.

Importance of Due Diligence

Before the expansion of the Singapore companies, they must conduct due diligence. Due diligence must involve the status of their current financial position, level of competence on going global, ability to survive and future growth prospectus. By familiarising with the target markets, the local Singapore SMEs will know which method of expansion and international market will suit them the best. Also, while entering into a partnership with local business, the Singapore companies must conduct due diligence of the local partners. By doing so they would know their capabilities and ability to survive in the long run. Therefore, by doing all the due diligence rightly, the chances of survival of the Singapore businesses in the international markets would be much higher.

Singapore businesses have the potential to establish themselves as major players in the global market. To help them achieve their objective, IMC Group provides various services to the local businesses. So, if you have a business plan in mind and are wondering how to start a business in Singapore or any other country, we can assist you with our wide range of services including outsourcing of accounting services in Singapore, outsourcing of company secretarial services in Singapore and so on. To avail our services and know our quotation, you just need to drop us an email specifying your requirements.

- Article

- March 13, 2019

Before you set out for a journey, don’t you like to decide where to go and which route to take? It’s the same when you are planning to start some business. Various entrepreneurs and researchers developed models, which detail or showcase the steps of how any newly-developed products, services or innovations are adopted by its consumers. By connecting the company’s advancement with these particular models, the business owners can compare their expansion or learn significantly using these methodologies. However, with time, we are progressing to the state-of-the-art stages, and thus, the system demands apt amends in the current techniques.

What is the real cause for the failure?

Do you know where the problem lies in today’s time? The startups are not failing because of any lack in their brand or product; but they actually cannot succeed because there are no customers. When any startup begins its journey or before they start selling their products, the business should prove that they have a market ready for it. You won’t be able to create customer demand or market where the customers are not interested. Therefore, the first step for any startup should be to test whether their product really fulfills a need.

However, many a times, entrepreneurs think of what customers might want, rather than they actually want. This is an apt example of how founders omit the problem-solution fit and go straight to the product-market fit, leading to developing products which no one wants.

Can you zero down on the real problem?

Entrepreneurs should be able to identify the real challenge and then design a product, which solves the real issue and has consumers who buy them willingly. But how can you do that? Most of the startups have a product-centric approach as they build a product and think the customers would come. But this strategy is not successful every time, especially in the current ecosystem. This approach could work when launching a new product in an existing market, where parameters and various dynamics are known. But it can be a catastrophe if you are launching a new product into a new market.

What the correct approach?

The first and foremost necessity is to confirm your assumptions while backing it with some qualitative date and customer interactions. After gathering enough data and understanding the customer, you should pass on this feedback to the product development team. This will help you in identifying the real requirement.

The next step after gaining an understanding about your customer is to gauge if the planned product will be liked by the early adopter. The best way to do this is to develop a demo of the features that are required and then again go to the consumer and observe their reaction or response. This way, you can test the product’s value proposal before actually investing in core product building.

If you keep a close watch to the right customers, then you will surely execute a winning product strategy. Thus, your initial customer interactions should not be to know if they love your product, but to know if your assumptions about the challenges customers face are correct. In case the assumptions are not correct, even if your product is amazing; no one is going to buy it.

This process is termed as “build-measure-learn feedback loop” by Eric Ries in his work called “The Lean Startup”. He says that the businesses that are planning to enter in a new market or a re-segmented market need to concentrate on understanding the problem, developing a solution, then validating it qualitatively and finally verifying it quantitatively. This strategy would assist entrepreneurs find the apt synergy in product and customer development when they are beginning and in the middle of the problem-solution stage and also the product-market stage.

- Article, India

- March 13, 2019

India, being one of the biggest trading partners of the UAE, holds massive potential to further augment bilateral trade by utilizing its IT competence. IT companies in both the countries could play a major role in improving the amount of trade between the two nations.

The UAE in the GCC countries remains as the top-most destination when it comes to India’s electronics exports especially in the Middle East, as the electronic products and software exports is projected at USD 911 million and USD 2.43 billion respectively. The IT industry in UAE, Lebanon, Kuwait, KSA and Oman is thriving and it is the apt time for investments, expansion and active participation in the market.

Future Scope of IT Industry in GCC Countries

Kuwait IT Sector:

Kuwait is one of the most technologically-advanced states in the Gulf region and it generates high income, has liberal market access policies, and low tariffs. There are many opportunities present in this market because of several e-government drives. There is an economic boost, which encourage a wave of hardware spending. The Kuwait corporate sector has also been increasing their expenditure and now Kuwait stands to take advantage as logistics point for the emerging Iraq market.

UAE IT Sector:

The UAE is a regional hub, located strategically at crossroads of Middle East and Asia, serving a huge and potential market of about 2 billion people. UAE is one of the highest GDP per capita in the whole world and offers excellent telecom and IT infrastructure, good market access and least trade barriers for foreign competitors. What’s more? There is also a lot of government support; for instance, Dubai Internet City project and many other free trade zones. There is a huge expatraite business community that helps to drive the sector development. There are many opportunities such as outsourcing, CRM, storage and in security products in this market. Training, E-learning, tourism and travel sector also has a lot to offer.

Saudi Arabia IT Sector:

Saudi is the largest regional IT market due to its huge spending. It’s a big market with growing demand of more sophisticated IT products and services including outsourcing. There are a lot of opportunities in this market because there is an increasing focus on software expenditure, new deployments, and upgrades of ERP solutions.

AI Impact on the GCC Economy

Artificial Intelligence (AI) would be able to double the figures of economic growth for almost 12 of the developing economies by the year 2035. This will help to enhance productivity by almost 40 percent.

The Middle East is projected to achieve 2 percent ($320 billion) of the total world-wide benefits of AI in 2030. As per the data and estimates, 33 percent annual growth rate of AI is predicted in the UAE, 31 percent annual growth rate of AI in Saudi Arabia, and 28 percent annual growth rate in GCC4.

Did you know that Saudi Arabia is the first ever country to give citizenship to a Robot? Yes, the AI activities in the GCC have been growing. Some news which goes to prove this is as follows:

- Oman symposium has decided to explore AI’s impact on education.

- UAE Cabinet has formed an AI Council and has appointed the first minister for Artificial Intelligence.

- Saudi Arabia is investing $500 billion in completely automated city spanning three countries.

- Dubai Decrees itself the AI City-State of the Future.

- Emirates is introducing AI vehicles for improving airside operations.

- 500 Emirati men and women are there in the first batch to be trained in AI field.

- Almost 45% of jobs in the Middle East are technically automatable today.

There are huge opportunities in the GCC in terms of Robotics and AI. AI would offer about 10m new jobs and automation is expected to eliminate 74 percent of the existing jobs available today. 21 percent of core skills needed across all the jobs and occupations would be very different in the GCC by the year 2020.

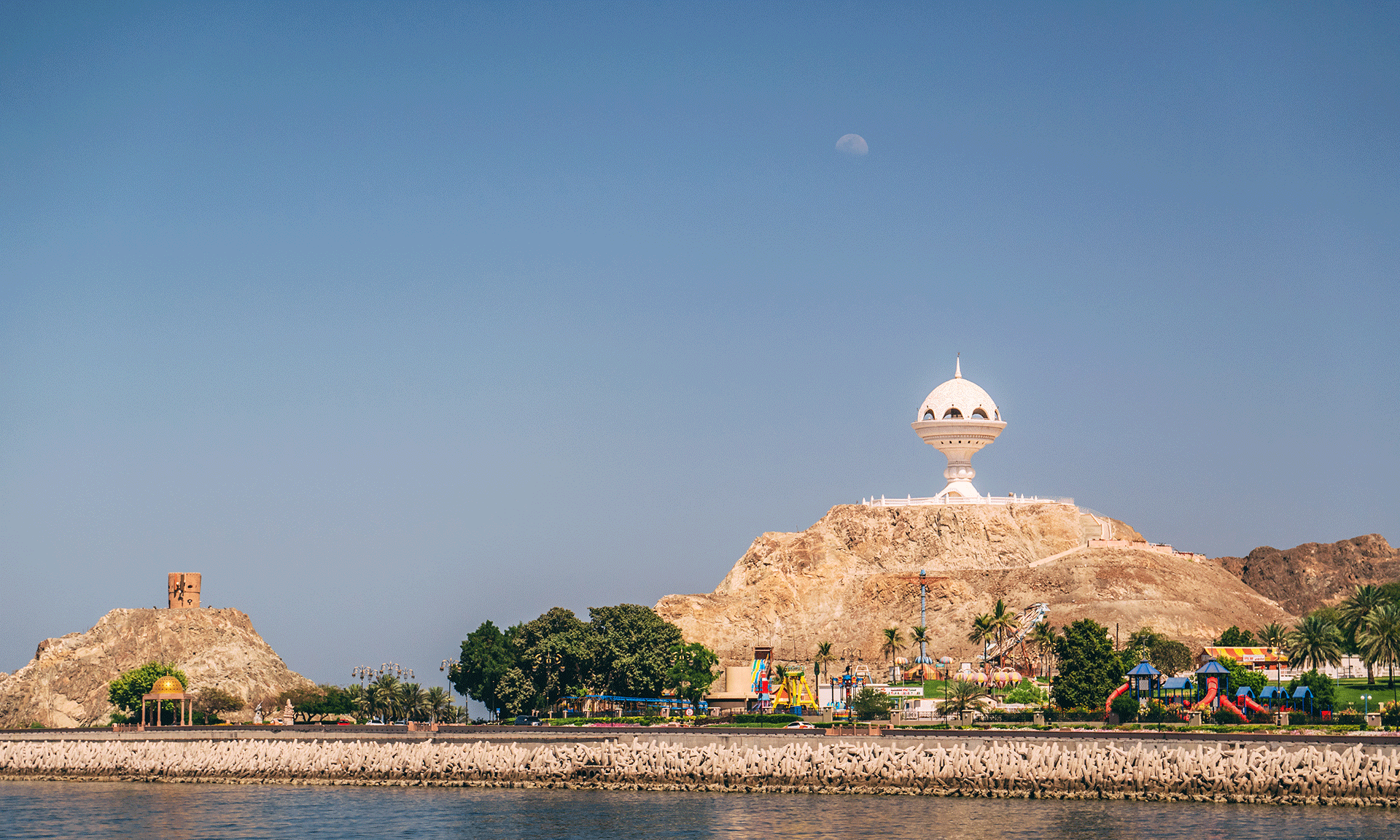

- Article, Oman

- March 12, 2019

Oman’s current Sultan is making remarkable efforts to modernize the country and make it more open. Though oil and gas remain as the most prominent sector, Oman’s economy is definitely diversifying to a large extent taking into account various industries to protect the economic composition of the nation. Oman now ranks as one of the most developed countries of Arab, which attracts a lot of global investors. It is forecasted that its GDP growth would go up to 3.5% this year. If you are planning to start your business or register a foreign company in Oman it is an ideal time to do so. You can set up different entities in Oman, be it an LLC company or a Sole Proprietorship. But before establishing your business in Oman, you must know about its economy and the benefits you would derive.

Opportunities of Business in Oman

The following are some of the most lucrative enterprise opportunities available in Oman:

- Travel and Tourism

- Fuel Station

- Haulage

- Perfume

- Electronics/Other Home Appliances

- Facility Maintenance

- Restaurants

- Daily Commodities Store

Advantages of Setting up a Business Entity in Oman in 2019

Oman has been successfully attracting many international investors. Usually, investors take into account various parameters and then move towards foreign company registration in Oman. Some of the advantages that an investor would get on starting their business in Oman are as follows:

1. Oman’s Economy

The economic condition of any nation can be gauged by its economic freedom index. Oman’s economic freedom score was at 61.0, which took its economy to the rank of 93rd freest economy as per the 2018 Index. It was also ranked as number 8 among the 14 nations in the MENA region.

2. Strategic Location

Being at a distance of less than 2 hours from any key business centers of Europe, Asia, and North America, Oman prime location is a very big advantage. Because of its strategic location, the non-oil exports are reaching to almost 176 countries. Oman has now become the gateway to the Arabian Gulf and is a meeting place of the African and Asian continents, thus, opening the path for an array of business opportunities.

3. Global Appeal

Oman’s several trade agreements enable the country in carrying out free trades with multiple nations. A few of them are GAFTA, GCC, and FTAs with Iceland, US and Singapore, Norway and Switzerland.

4. Secure Environment

Investor-friendly and safe environment with no restrictions on resource and profit repatriation adds to the benefits. Other than that, only 15% of corporate tax (flat rate) is charged.

5. Talent Pool

Out of 4.3 million of its population, about 1.7 million are working, thus ample manpower is available.

6. Infrastructure

Best-in-class infrastructure possessing internationally-ranked ports, roads and airports are a big plus point too. There has been a huge investment in railways to enhance the network so as to strengthen Oman’s transportation sector.

7. Natural Resources

It’s a fact that oil export has boosted Oman’s economy and the natural resources in the country are quite favorable for any business setup. But now the government is trying to diversify by also investing in private sector and international businesses and not depend completely on oil.

8. Pro-Business Steps by Government

Favorable government policies like offering incentives to support domestic and foreign enterprises with tax exemptions, free trade zones, interest-free loans etc, Oman has attracted many global investors.

9. Trade-Friendly Association with Neighboring Nations

The culture here fosters building strong bonds and collaborations in both social and business contexts. Oman is known to have built business-friendly relations with all its neighboring countries.

10. Exemptions

Several exemptions are given to entrepreneurs who want to set up their enterprise in Oman; for example, they are exempt from corporate income tax on initial OMR 30,000 and total exemption up to 50 years in case it’s a free zone registered company. There is an exemption also from customs duties if importing equipment or raw material for any production.

So if you are planning to start a new business in Oman, or in need of services for accounting services in Oman, do contact us and our business experts would be able to assist you with the process of establishing and running your business in Oman.

- Newsletter, U.A.E

- March 8, 2019

Dubai Chamber of Commerce and Industry has recently announced forming of the New Zealand Business Council (NZBC) in Dubai for strengthening the relations between UAE and New Zealand and expanding their bilateral economic ties.

The New Zealand Business Council has become the 50th country-specific trade council to be formed in Dubai in the aegis of Dubai Chamber. About 100 New Zealand companies are members of this Council and they operate in an array of economic sectors like healthcare, trade, legal services, public relations, education, food and beverage, agriculture, aviation, hospitality and tourism.

This was announced during the inauguration ceremony held at Dubai Chamber’s head office and was attended by the Honorary Mr. Kevin Mckenna, who is New Zealand’s Consul General in Dubai & Trade Commissioner Gulf States; Mr. Clayton Kimpton, who is the Commissioner General for New Zealand Pavilion at Expo 2020; Mr. Hassan Al Hashemi, who is the Vice President of International Relations for Dubai Chamber; and several representatives from New Zealand companies established in Dubai.

Non-oil business between Dubai and New Zealand has been expanding in recent years and has reached AED 2 billion in 2018, and this was enhanced by the growing export of food products from New Zealand into the Emirate. The UAE ranks as one of New Zealand’s biggest trading partners, and this new council will augment bilateral cooperation especially in new economic areas, and both these business communities will reap benefits from New Zealand’s involvement in Expo 2020 in Dubai.

Mr. Al Hashemi talked about the importance of trade groups and councils in assisting Dubai’s economic development and competitive edge by offering their capabilities, expertise, and resources and valuable ideas on business and business setup in Dubai.

Dubai Chamber is a facilitator for trade groups and all the councils in Dubai and it aims to advance business between the trade communities of Dubai and improve ties between Dubai and several other countries globally.

- Article, Bahrain

- March 7, 2019

Bahrain is a nation made up of an archipelago of about 30 islands and has acted as the crossroads for some key trade routes because of its strategic location in the Arabian Gulf. Over the last decade, Bahrain focused a lot of its efforts in promoting its economy and make its business environment dynamic so as to foster economic growth. We have collated a list of the top business opportunities in Bahrain that can hit the bulls-eye in 2019.

Below are the top six business ideas:

- Financial Consulting and Banking: The financial and banking sector became the most flourishing businesses in the Kingdom towards the end of last year. The highly- developed banking system in Bahrain accounts for almost 17.2% of the country’s GDP. The banking sector includes various traditional banks and also some Islamic banks, thus providing the country varied options of financial services like specialized banks, retail/wholesale banks, insurance and other financing companies, investment advisors, insurance and securities brokers, , money changers, and mutual funds. Bahrain has made its position as a banking hub for whole of the Middle-East, particularly since Islamic Banking was introduced.

- Construction Agency: Bahrain is witnessing huge inflows of investment in the construction industry since the past couple of years. This sector makes up for almost 7.5% of GDP out of the total financial activity. Thus, if you are planning to establish a business in the construction sector here, we recommend you to seek professional guidance for company formation in Bahrain.

- Real Estate: With increasing population, the requirement for both official and residential spaces goes up. This sector boomed in the kingdom as tourism has been thriving and hence, there was a rising demand for space; this trend is likely to stay in 2019 as well. As per data, the Real Estate sector in Bahrain has been fairly sustainable and offers attractively high returns. By getting into the Real Estate in Bahrain, the investors can access a new, much wider market that offers an array of prospects.

- Hospitality: By last year end, Bahrain saw a rise in demand in the hospitality and tourism industries. As a matter of fact, the GCC hospitality industry is preparing to gain momentum and growth after a break because of the falling oil prices. This year, the oil prices are expected to recover; also, Bahrain is going to welcome a new chapter of its economy’s upward swing and prosperity, especially in the hospitality sector. With many forthcoming mega-events, boost in tourist traffic, various regulatory initiatives and other efforts by the government, especially towards the tourism and hospitality sector, this sector’s growth and productivity is quite high.

- Retailing: The retailing industry witnessed a boom last year and it seems to be growing at a speed because of various factors. The increase in tourism, the upsurge in infrastructure projects, low cost of living here obviously added to reasons for having more retail stores. Therefore, retailing industry has seen unprecedented development in the recent past in Bahrain, and it shows no signals of slowing down in 2019.

- Event planning: With several global players entering the Bahrain market, hosting a conference or an event requires careful planning and expertise; therefore, setting up an event planning company in the Kingdom is another top business opportunity that can be explored.

If you are looking for assistance in setting up a business or for company formation in Bahrain, we would be glad to assist you in providing all the latest information and knowledge regarding the business trends in Bahrain. Also, for getting accounting services in Bahrain, get in touch with us, and we will be happy to help!

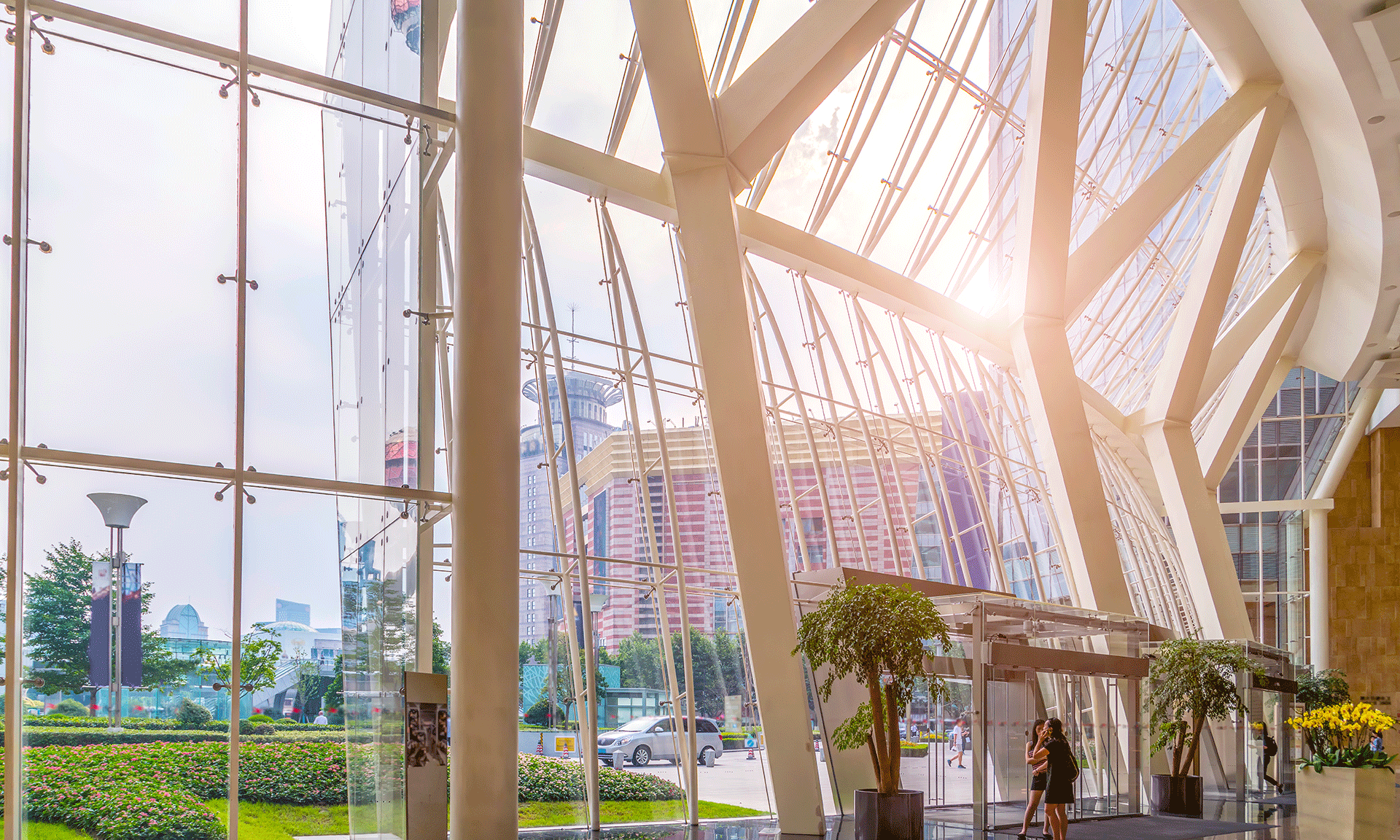

- Article, U.A.E

- March 5, 2019

UAE being an ultimate and attractive shopping destination, several entrepreneurs dream of setting up a thriving business in the Kingdom. But at times, if the investors lack the required ground work and networking, then they can fail in their efforts. Most business owners prefer DMCC company formation as the DMCC ranks as world’s top and most-preferred free zone. However, it’s important to step forward with caution and impeccable preparation.

So how can you launch a business successfully in the UAE? We have collated six steps for you, which can enable you in giving your best shot at new business setup in Dubai or UAE or if you have decided for company formation in Dubai.

Six Steps to set up a Successful Business in Dubai or UAE

1. A Comprehensive Plan

The first step is to make a detailed plan with business ideas about the particular industry you are planning to get into, your competitors, your business objective etc. Decide all milestones for all key tasks to be done and then work accordingly.

2. Know Your Market

The most important step before you step into any market is to know it in-depth. So, it’s advisable to spend time into thorough research to know the exact demand or requirement of the customers, the on-going trends, what are the dos and don’ts, etc. It’s best to research and then first your ideas so that you can understand your potential customers better.

3. Networking is the Answer to your Problems

Professional networking is another must-do if you want to go for company formation in Dubai. UAE and especially Dubai are places where citizens are social and love going out and meeting new people. Developing good contacts who can support you later, attending all major events, be it at a social or business level, can not only get you good advice and recommendations but also will act like advertising for your business. Also, striving to build a good network can lead to better business prospects, strategic partners in future who are in a position to help you in new business setup in Dubai or grow your business.

4. Financial Support

It is recommended to have excess finance forecasting at the beginning as it takes a while for a business to grow and start reaping profits. Take into account that you would need some time to spread awareness about your brand and make your footprint in the market, till then, you should be secure by having a good amount of working capital to back you up.

5. Marketing

Focusing more on your marketing plans will take you far for sure. It’s recommended to spend more on digital marketing as the UAE digital marketing data of 2018 shows that 9.38 out of 10 people are active on some social media forum and hence, digital marketing would definitely help in reaching out to more number of people.

6. Hiring the Best Fit

Hiring the right people would not only help in running your business, but also they help in its quicker growth. You will need a good mix of team who can give you the apt advice at the right time, who can work in the dynamic market of Dubai and UAE and help you launch and then grow your business.

7. Stay ahead of the game

There always will be many companies offering the same service; but you have a better chance to succeed only if you offer the top quality of products or services along with impeccable customer service. First, you should know your expertise, then you should apply it well to build your brand and gain experience and lastly, always think of how you can give something extra to your customers; only then you can surpass your competitors.

So, if new business setup in Dubai is on your mind, we at IMC, provide our support to budding entrepreneurs and companies who are looking for company formation in Dubai. To get solutions to all your queries, do contact us and we assure to assist you.

- Article, Singapore

- March 5, 2019

Outsourcing accounting services in Singapore is an essential part of every business. As a business owner, you might feel stressed about handling every aspect of your business. Therefore, it is important for every entrepreneur to delegate their work in the right hands to enhance the performance of the business. In this article, we will give you some tips to ease your task of outsourcing accounting services in Singapore.

Things to Keep in Mind while Outsourcing Accounting Services in Singapore

1. Your Needs

2. Budget

The Top 25 Places for the Best Bookkeeping in Singapore READ MORE

3. Consider If Outsourcing Is a Good Investment

4. Have Discussions

5. Be Responsible and Aware

6. Identify Their Methodology

7. Align Other Outsourced Services with Your Business

8. Select One Who Provides Services Beyond Meeting Regulatory Requirements

The above mentioned tips will help you find the best outsourced accounting service provider in Singapore. IMC Group provides the best incorporation services in Singapore. We are well known for our expertise and professionalism in providing various other services to businesses like accounting services in Singapore, company secretary services in Singapore, etc. To avail our services and know our quotation, you can contact us by dropping us an email.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners