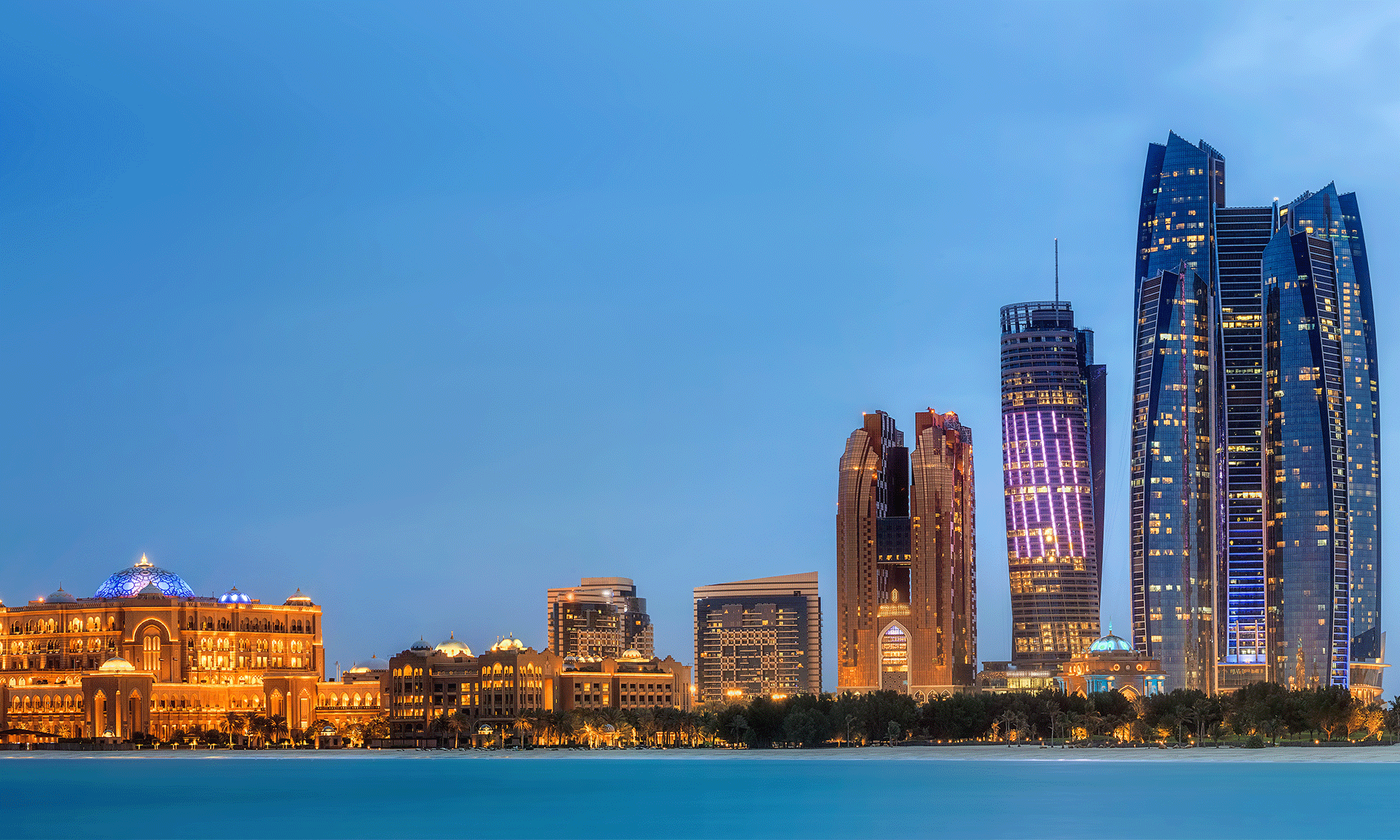

Dubai’s real estate market has experienced tremendous growth over the past decade, making it an ideal investment opportunity, according to experts in the city’s property industry. Dubai has become a sought-after destination for international investors and first-time buyers looking for investment opportunities within the UAE. Experts suggest that the sector is not showing any signs of slowing down while offering valuable advice for individuals looking to enter the market.

In 2022, Dubai’s real estate market experienced an astonishing 36% expansion, with over 88,000 transactions totalling AED240 billion completed, representing 61% growth compared to 2021. Rental prices also saw an average rise of 21% since 2021, making this an excellent time to enter the purchasing market. Rental yields can range between 5-9% with no property tax burden, enhancing its attractiveness further.

Dubai’s real estate market offers several key advantages for investors. The cost per square foot is much lower than in other highly desirable cities, providing more value for money. Furthermore, relaxed visa regulations allow investors to secure residency visas when purchasing properties of certain values.

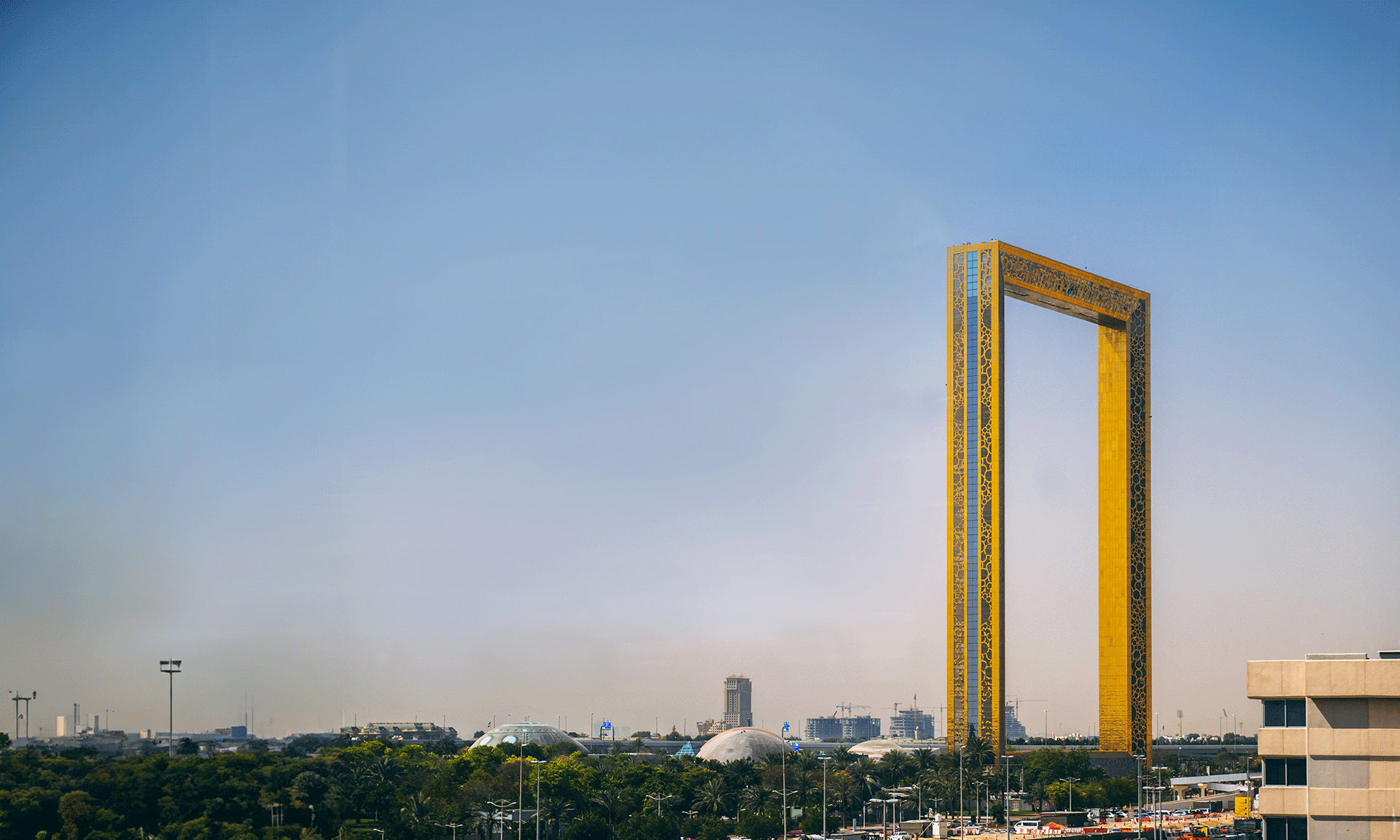

When investing, it is imperative to conduct thorough research. Carefully consider a variety of factors, such as the developer’s track record, location, and potential return on investment (ROI). Location plays an instrumental role in ROI. When selecting prime locations to invest in, it is vital to consider amenities available such as retail stores, dining options, transport links, recreational activities, healthcare facilities, and schools in their evaluation. Also, familiarize yourself with local laws and regulations related to investment and real estate ownership to avoid legal complications.

When purchasing, also consider and compare all financing options available, taking into account maintenance and additional costs such as RERA service charges.

Partnering with an agent who specialises in the area or community you are researching is invaluable, providing answers to queries and up-to-date information on its location. These representatives can answer your questions quickly while offering valuable insight. If you’re considering a new business setup in Dubai, IMC Group can provide expert guidance and tailored solutions to help you navigate the process. With their extensive knowledge and experience, IMC Group ensures a seamless transition into the thriving Dubai market.

IMC Group

IMC Group