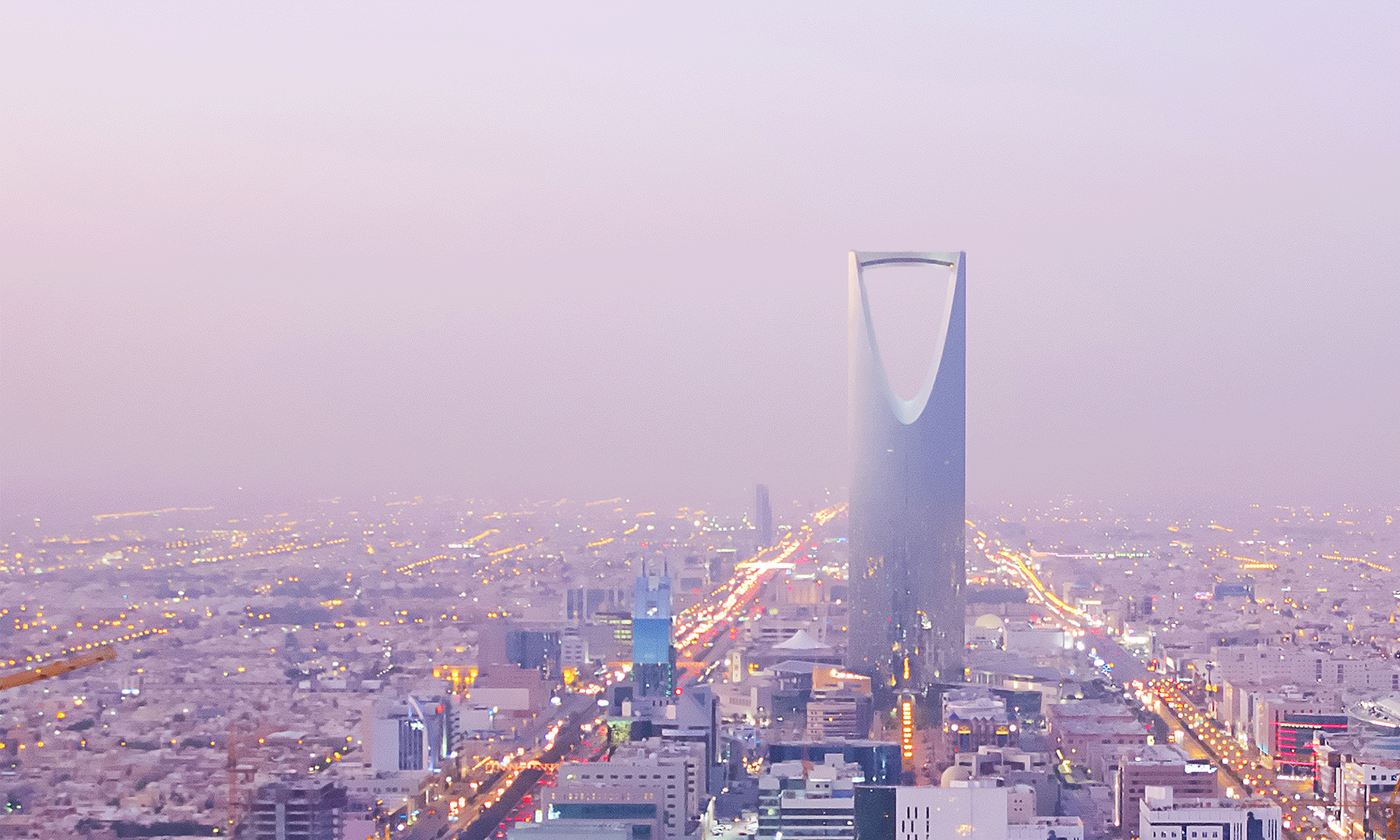

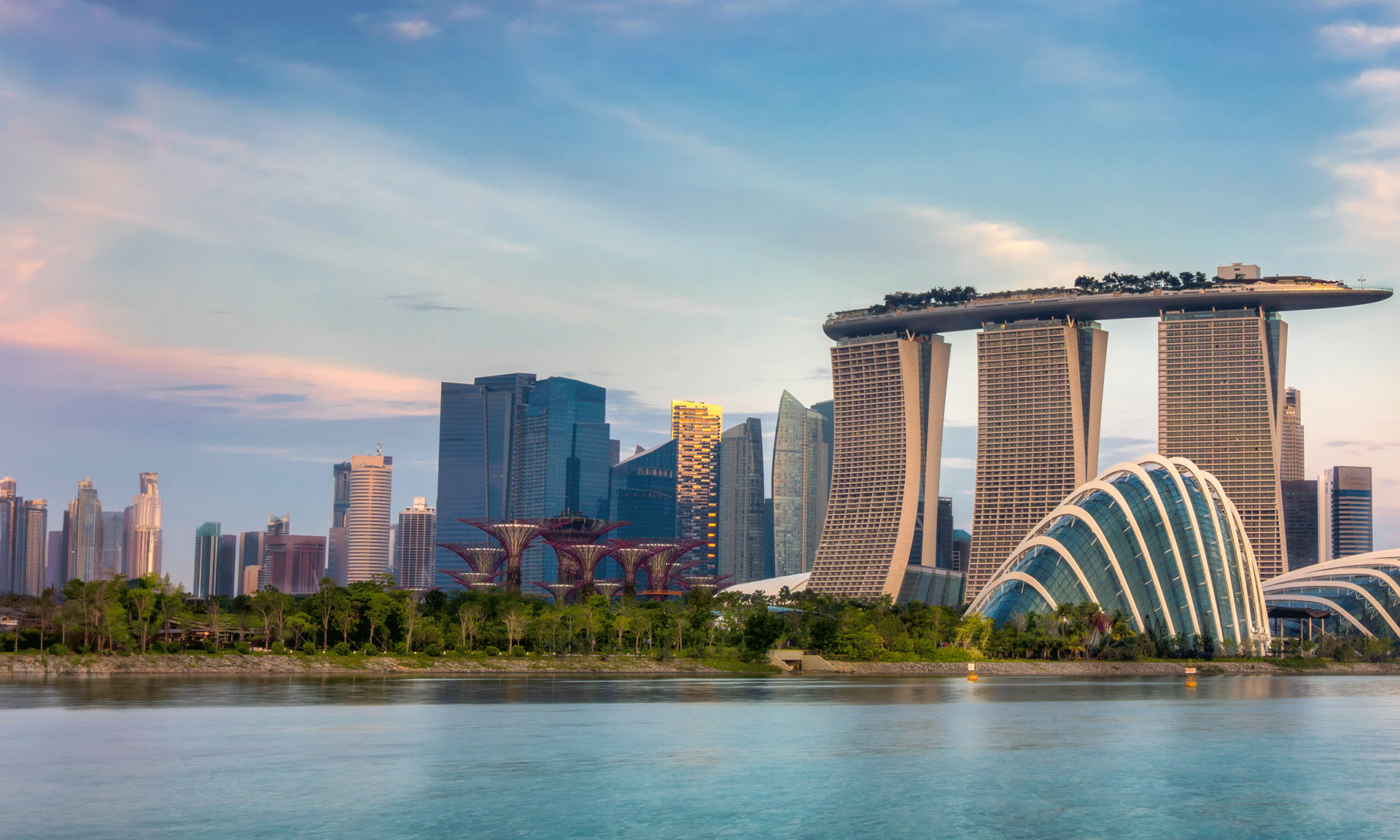

Singapore has been a preferred centre for establishing regional headquarters for carrying out business opportunities throughout Asia and ASEAN. The country got the status of a favoured investment hub and business destination in Asia mainly because of its simplified legal and tax procedures and because it’s one the most investor and business-friendly places in the world. Also, its financial system is very integrated with global financial markets, which acts as a bonus for company formation in Singapore.

This business setting has helped global investors to take benefit of Singapore’s approach to some of the biggest combined free trade sectors through ASEAN, including ASEAN-Hong Kong, ASEAN-China, and ASEAN-India free trade agreements (FTAs).

However, there are several other factors that help in making Singapore one of the best places for firms that want to start their business operations in the region.

Easy and well-organised set up process

If you are wondering on how to start a business in Singapore, you must know that the business processes and legal regulations in the country are quite easy and transparent, which means that most of the information that any business might require is usually available online. Hence, it becomes easier for global decision-makers to know more about the domestic market when they decide to enter it.

Businesses who have decided to set up their office here can use Bizfile, which is an electronic filing system combining all the tax and business needs in a single form, thus lessening the need to spend extra time and effort at various service centres. Bizfile is handled by the Accounting and Corporate Regulatory Authority (ACRA), which is the statutory body accountable for the supervising new companies getting formed in Singapore.

Another benefit is that the effort, cost and time spent in setting up in Singapore is comparatively lesser. Foreign entrepreneurs can pay US$254 (S$300) to register a company through Bizfile and it costs about US$10 (S$15) for registering the company’s name. The good part is that usually the applications are processed on the same business day; but, the process can also take anywhere between 14 days to two months if they are to be reviewed by any government agencies.

The well-organised and cost-effective nature of corporate set up in Singapore has amounted to over 37,000 global companies and almost 7,000 multinationals working in the country. This is also one of the reasons why the city-state is always positioned among the top three economies world-wide and in the Ease of Doing Business report.

Favourable tax environment

Singapore’s positive tax regime is globally recognized for permitting entrepreneurs and businesses to enjoy low tax rates and various types of tax relief – via incentives, exemptions from specific incomes and comprehensive tax treaty networks.

Singapore’s corporate tax regime is supposedly one of the most attractive and best in Asia. Entrepreneurs can take benefit of the flat 17 percent corporate income tax rate for any profits they make over S$300,000 (US$217,000) and it is 8.5 percent for profits that go up to S$300,000 (US$217,000).

Additionally, as the Singaporean tax system functions on a territorial basis, businesses are not taxed on most of the globally-sourced incomes (like incomes from dividends or from branch profits) that are sent into Singapore; as long as they are paying tax in the source country at a rate of minimum 15 percent. Another benefit is that there is no capital gains tax in the country.

Robust DTA and FTA networks

One of the major advantages of setting up a holding company in Singapore is the country’s network of 24 FTAs and 85 double taxation agreements (DTAs).

There are mainly two types of DTAs operational in Singapore – comprehensive and limited. Comprehensive DTAs include all income types and permit exchanging of tax information; however, restricted DTAs cover income which is derived from shipping and air transport.

These DTAs also comprise treaties done with ASEAN’s 10 member states, which are, Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam; thus offering companies with a better competitive edge while entering this market.

Besides, this country also boasts of exclusive access to the biggest combined free trade sectors due to its multiple agreements with ASEAN and its FTAs with countries such as China, India, Hong Kong, and the EU. Singapore is also in the process of negotiating new FTAs in collaboration with the Eurasian Economic Union (EAEU) and Pacific Alliance-Singapore.

Singapore – an easy entry into ASEAN

Singapore is well-positioned to assist the investors to steer through the challenges and newer opportunities offered by ASEAN markets. For example, its effective setup processes, integrated supply chains and competitive tax environment have enabled Singapore to move ahead of conventional holding locations in the region, like Malaysia, and give competition to well-established international investment centres such as Hong Kong.

But there are many softer factors that place Singapore as one of the best and ideal places for companies that want their regional headquarters to grow and expand into ASEAN and Asia.

People of this country share multiple cultural and linguistic connections along with ASEAN members, while English is their main working language. Its highly-skilled and professional workforce is armed to act as an intermediary for investments coming in Asia while communicating to the best of their ability with global investors.

Singapore’s significance as a management hub for getting into the ASEAN markets is now growing in importance, more than ever.

IMC Group

IMC Group