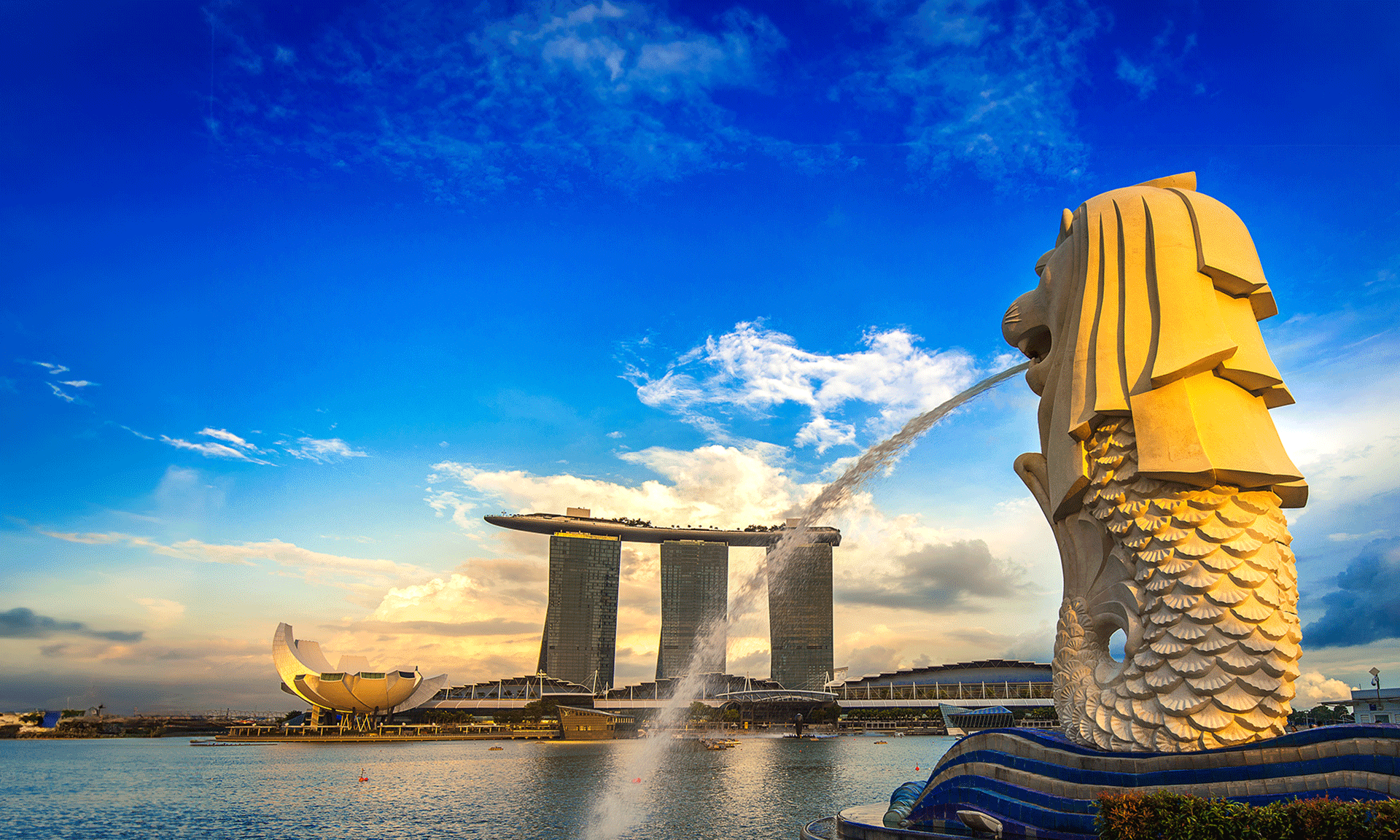

Singapore has been consistently ranked by International Organisations as one of the most preferred countries in the world for the ease of doing business and business competitiveness. In 2020, the World Bank Group rated Singapore as the second-best country in the world in its “Ease of Doing Business” survey of 190 economies and the International Institute for Management Development (IMD) placed Singapore at the top in its World Competitiveness Yearbook (WCY) after evaluating 63 countries on 338 indicators. The island city-state has been widely recognized globally for its pro-business policies such as low tax rates and no restrictions on capital and profits over the last several decades.

The sovereign nation is strategically located in maritime Southeast Asia and is considered to be the gateway to this subcontinent. It is a robust economy with a high standard of living and excellent quality of life. The country has a well-developed financial system and efficient processes for incorporating and operating a business.

Economically and politically stable, Singapore has an efficient and effective government that is free of bureaucracy and red-tapism The country also boasts world-class infrastructure facilities, a highly productive skilled workforce and a hugely developed banking and financial system including a capital market.

How is Singapore Canada business relationship?

Since the time of its independence in 1965, Singapore enjoyed very cordial and wide-ranging bilateral relations with Canada, which was one of the first countries to establish diplomatic ties with the country. Now it is one of the most important partners of Canada in Southeast Asia and enjoys strong ties in trade, education, science & technology, security & defence etc. that are mutually beneficial for economic sustainability and social progress.

Both the Countries have entered into several agreements including Trade and investment agreements, the World Trade Organization (WTO) Agreement on Trade Facilitation (TFA) Information Technology Agreement (ITA), Government Procurement Agreement ( GPA), Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), Agreement on Trade-related Investment Measures (TRIMS), General Agreement on Tariffs and Trade 1994 (GATT) and General Agreement on Trade in Services (GATS).

Canadian investors and companies regard Singapore as a strong financial hub for future economic and business growth in the Asia-Pacific region and made it their second home. Most of Canada’s top financial institutions and some 200 Canadian firms have operations in Singapore. The country has attracted Canadian businesses of all sizes and belonging to multiple sectors, from SMEs to large corporations, and especially technology-savvy start-ups in greater numbers.

Singapore-Canada Double Taxation Agreement was first signed in 1976 to improve economic cooperation and provide advantageous tax conditions to both Canadian and Singapore companies and later amended in 2011 and 2012. A tax allowance is granted against the tax paid in the other contracting state to prevent double taxation and applies to both Singaporean and Canadian individuals and companies. Any tax falling under double taxation may be levied in one of the two states as stipulated in the agreement, exception being the income from the sale of real estate, which is taxed in the country where the property is situated and employment income, which is taxed in the country where the services are rendered.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) was entered into force on December 30, 2018, between Canada and Singapore including six other countries following which trade between the two countries has improved and barriers reduced. Through the CPTPP, Canada can now preferentially access some of the world’s most dynamic and fast-growing markets, strengthening Canadian businesses and economy. The import tariffs have also been eliminated to an extent as high as 99%.

What opportunities does Singapore offer to Canadian investors?

Singapore has a simple and easy single-tier corporate tax system with one of the most attractive corporate tax rates of 17%. Besides lower rates, the country provides numerous tax incentives and cash grants to help businesses grow, thus bringing the effective tax rates even lower.

Business entities in Singapore are eligible for various business and tax incentives subject to committing to certain levels of investments, introducing leading-edge skills, technology and contributing to the growth of R&D and business innovativeness.

In Singapore, the four main government agencies are normally responsible for administering business and tax incentives for Singaporean entities and include the following: – (Details of Sector-specific incentives are available on the individual websites of these agencies).

Singapore Economic Development Board (EDB) is responsible for developing and executing strategies for attracting FDI into the country.

The Inland Revenue Authority of Singapore (IRAS) is the tax regulatory authority in the country.

Enterprise Singapore (ESG) assists Singapore based companies to expand globally and promote local exports.

The Monetary Authority of Singapore (MAS) is the central bank and financial services authority.

Some of the industries eligible for tax incentives are Banks & Financial services,

Shipping, R&D, International trading, Insurance, Processing services; Tourism, Headquarters activities; E- commerce and Legal firms.

The most widely availed incentive schemes include Start-Up Tax Exemption Scheme (SUTE), Pioneer Tax Incentive (PTI), Intellectual Property Development Incentive (IDI), Maritime Sector Incentive (MSI) etc. However, given the range of diverse tax incentives, Canadian investors must consult professionally qualified and well-reputed tax and accounting services in Singapore to determine the most appropriate incentives applicable for their businesses.

On top of tax incentives, Singapore provides numerous business grants and financing schemes to the Canadian companies operating in Singapore and there are more than 100 government grants available for supporting businesses.

For Startups, the following grants can be availed by Canadian businesses subject to fulfilment of certain conditions and include

Special Situation Fund for Startups (SSFS) provides financing for promising startups based in Singapore.

In the Startup SG Equity scheme, the government co-invests with qualified 3rd party investors into technology startups.

First-time entrepreneurs can avail of Startup SG Founder for receiving SGD 30,000 as mentorship and startup capital grant.

Innovative tech companies can avail of Startup SG Tech supports Proof-of-Concept (POC) and Proof-of-Value (POV) for commercialisation.

All business sectors can benefit from the below-mentioned grants.

Enterprise Development Grant (EDG) has been launched to support Singapore companies to grow and transform their businesses and grant up to 70% support for eligible costs up to a maximum of 80% till 31 March 2022.

Operation & Technology Roadmap (OTR) scheme provides up to 70% funding support to SMEs.

Productivity Solutions Grant (PSG) supports businesses in the adoption of productivity solutions and offers up to 80% funding support till 31 March 2022 for eligible costs.

Start Digital is meant for SMEs that are new to using digital technology and can take up any two digital solutions for free.

Sector-specific grants are also available in many sectors including Manufacturing & Engineering, Food and Beverage, Energy, Building & Construction, Real Estate, Financial Services, Tourism, IT, Agriculture, Aerospace and General Services.

What are the business options available for the Canadian investors?

Canadian investors and entrepreneurs looking for Singapore company incorporation can now opt for any of the five main types of business structures available. The choice of company type needs to be based on business capital, the number of business owners, liabilities and responsibilities business owners are willing to undertake etc. The business structures in Singapore include Sole Proprietorship, Partnership, Limited Partnership, Limited Liability Partnership and Company.

Businesses once incorporated can start operation after opening a bank account commonly known as a business account in Singapore.

Conclusion

The future of Singapore-Canada trade and investment outlook is bright and during March 2021, the Honourable Mary Ng, Minister of Small Business, Export Promotion and International Trade Canada initiated a week-long virtual trade mission to Singapore on e-commerce, hosted by Global Affairs Canada in collaboration with the Canadian Chamber of Commerce in Singapore and Enterprise Singapore. In her remarks, Minister Ng emphasized the importance of CPTPP in providing companies in both countries unlimited access to many dynamic and vibrant markets around the globe.